A.M. Best Assigns Rating to Horace Mann Educators' New Senior Notes; Affirms Financial Strength, Issuer Credit and Debt Ratings

20 April 2006 - 4:14AM

Business Wire

A.M. Best Co. has assigned a rating of "bbb-" to the $125 million

6.85% 10-year senior unsecured notes issued by Horace Mann

Educators Corporation (HMEC) (NYSE: HMN). Concurrently, A.M. Best

has affirmed the financial strength rating (FSR) of A- (Excellent)

and issuer credit ratings (ICR) of "a-" of Horace Mann Insurance

Group (Horace Mann) and its property/casualty subsidiaries.

Additionally, A.M. Best has affirmed the FSR of A- (Excellent) and

ICR of "a-"of HMEC's life/health insurance subsidiary, Horace Mann

Life Insurance Company (Horace Mann Life), as well as HMEC's ICR of

"bbb-"and the debt ratings on HMEC's outstanding securities. All

the above companies are domiciled in Springfield, IL. All ratings

have a stable outlook. (See below for a detailed list of ratings.)

Proceeds from the notes will be used to pay off the $74 million

balance of HMEC's bank facility, which was borrowed to repurchase a

portion of its outstanding senior convertible notes due in 2032.

A.M. Best believes the approximately $50 million remaining will

likely be utilized to further reduce existing corporate debt in the

near term. HMEC's pro forma financial leverage, including the new

$125 million senior notes, is approximately 29%. Interest coverage

is well within parameters for the current rating level. The ratings

reflect the revitalization of the property/casualty group's

capitalization driven by the corrective measures management has

taken in recent years. The 2005 operating results--although

affected by roughly $37 million in net catastrophe losses due to

hurricanes Katrina, Rita, and Wilma--have been driven by positive

underwriting results led by the private passenger auto liability

and private passenger auto physical damage lines. Performance of

Horace Mann's property book, although dampened by catastrophe

losses, has improved markedly as rate increases and continued

improvements in underwriting terms have begun to produce earning

results. The capital position of the property/casualty operations

has been strengthened by its 2005 year-end results and is

supportive of the A- (Excellent) rating level. Horace Mann also

benefits from its expertise in personal line products for the

educator market, which has enabled it to obtain numerous

endorsements from local, state and national educational

associations. In addition, distribution through exclusive agents,

many of whom are former educators, affords strong ties to local

education communities. The ratings also reflect Horace Mann's

strict expense management and strengthened underwriting standards,

as well as its adequate loss reserve position, which experienced

little development throughout 2005 after the corrections made in

2003. Horace Mann continues to operate through a corporate

structure that affords financial flexibility as a publicly-traded

holding company with access to the capital markets, moderate

financial leverage and historically solid fixed-charge coverage.

Horace Mann Life's rating reflects its significant presence within

HMEC, its sound risk-adjusted capitalization on a stand-alone

basis, its overall positive statutory operating performance,

increased agent productivity and the development of an independent

field force, which complements its captive agency field force for

the company's 403(b) tax-qualified annuity products. Partially

offsetting these strengths is the impact of the persistent low

interest rate environment on Horace Mann Life's fixed annuity

block--which has experienced considerable spread compression--stock

market volatility and its impact on fee income from its variable

annuity business and declining life insurance sales trends. The

rating also considers the continuing demand on Horace Mann Life's

financial resources to support stockholder dividends to HMEC. The

FSR of A- (Excellent) and ICRs of "a-" have been affirmed for

Horace Mann Insurance Group and its following property/casualty

subsidiaries: -- Horace Mann Insurance Company -- Horace Mann

Property & Casualty Insurance Company -- Teachers Insurance

Company -- Horace Mann Lloyds The FSR of A- (Excellent) and ICR of

"a-" have been affirmed for Horace Mann Life Insurance Company. The

ICR of "bbb-" has been affirmed for Horace Mann Educators

Corporation. The following debt rating has been assigned: Horace

Mann Educators Corporation-- -- "bbb-" on $125 million 6.85% senior

unsecured notes, due 2016 The following debt ratings have been

affirmed: Horace Mann Educators Corporation-- -- "bbb-" on $75

million 6.05% senior unsecured notes, due 2015 -- "bbb-" on $353.5

million senior unsecured convertible notes, due 2032 The following

indicative debt ratings have been affirmed on securities available

under the $300 million shelf registration: Horace Mann Educators

Corporation-- -- "bbb-" on senior unsecured debt -- "bb+" on

subordinated debt -- "bb" on preferred stock A.M. Best Co.,

established in 1899, is the world's oldest and most authoritative

insurance rating and information source. For more information,

visit A.M. Best's Web site at www.ambest.com.

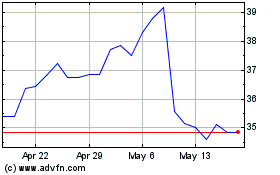

Horace Mann Educators (NYSE:HMN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Horace Mann Educators (NYSE:HMN)

Historical Stock Chart

From Jul 2023 to Jul 2024