UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐Definitive Proxy Statement

☒Definitive Additional Materials

☐Soliciting Material Pursuant to § 240.14a-12

Hersha Hospitality Trust

(Name of Registrant as Specified In Its Charter)

_____________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total Fee Paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Supplemental Information for 2023 Annual Meeting of Shareholders

Introduction

Dear Fellow Hersha Shareholder:

We are writing to ask you for your support by voting in accordance with the recommendations of our Board of Trustees on all of the proposals and election of all Trustees included in our 2023 Proxy Statement, which was filed on April 13, 2023. In particular, we are requesting your vote FOR Proposal 4, to amend our 2012 Equity Incentive Plan (“Equity Incentive Plan”) which has been depleted (see our “Equity Incentive Plan is Depleted” on page 4). A vote FOR Proposal 4 will allow the continued use of the Company’s equity as an essential part of our compensation programs, a key tool in promoting further alignment with our shareholders.

We are pleased that Institutional Shareholder Services (“ISS”) has recognized the enhancements we have made to our compensation programs, which were the result of conversations with our investors (see “We are Engaging with Investors and Enhancing our Compensation Practices” on page 7), and has recommended a vote FOR proposal 2, the annual vote on compensation paid to our Named Executive Officers (“NEOs”). However, we are disappointed that ISS recommended a vote AGAINST the amendment to our Equity Incentive Plan in Proposal 4. We maintain a compensation program that is more equity-focused than the majority of our peers and each of our NEOs have elected to receive ALL of their cash incentive compensation in the form of equity for the past 6 consecutive years. We have demonstrated an appropriate and effective use of equity and it is a cornerstone of our compensation program (see “Use of Equity Aligns Compensation and Performance” on pages 5).

Thank you for your continued support,

COMPENSATION COMMITTEE OF THE BOARD OF TRUSTEES OF HERSHA HOSPITALITY TRUST

Thomas J. Hutchinson (Chair), Jackson Hsieh, Michael A. Leven, Dianna F. Morgan, and John M. Sabin

Compensation Plan Designed to Create Value

Our Equity Incentive Plan is Depleted

■As of March 31, 2023 there are only 24,160 common shares available under the 2012 Plan. Unless the plan amendment is approved by shareholders, the company will only be able to compensate its CEO and other NEOs with cash, which is not in the long-term interest of the Company

■The Board of Trustees believes that the 2012 Equity Incentive Plan (the “2012 Plan”) is instrumental in recruiting and retaining the services of highly talented individuals by enabling such individuals to participate in the future success of the Company

■The Board of Trustees also believes that Equity Awards have strongly aligned the interests of those individuals with the interests of the Company and its shareholders

■On April 13, 2023, the Board of Trustees amended the 2012 Equity Incentive Plan, subject to the approval of shareholders, in order to continue the Company’s ability to grant Awards under the 2012 Plan. If approved by shareholders, the Amendment will

◦Increase the aggregate number of common shares that may be issued by 3,000,000 shares (thereby increasing the aggregate share authorization to 11,875,000 shares)

◦Extend the expiration date from April 16, 2031 to April 16, 2033

◦Update the effective date of the 2012 Equity Incentive Plan

Use of Equity Aligns Compensation and Performance

■Shareholder alignment has always been and continues to be an important cornerstone of the Company’s compensation philosophy

◦For the 6th CONSECUTIVE YEAR, 100% of our NEOs elected to take 100% of their cash bonuses in equity, subject to additional two-year vesting

◦84% of CEO potential target compensation and 81% of all other NEO potential target compensation is settled in equity

–If shareholders do not approve the plan amendment, virtually all CEO and NEO compensation for 2023 will be in cash and not subject to longer-term risk

Our Executive Alignment is Delivering Results

We are Engaging with Investors and Enhancing our Compensation Practices

■Entering 2021 and like that of nearly all hotel REITs, the COVID-19 pandemic had lingered, which resulted in very low visibility and outlook for the year; consequently, establishing rigorous quantitative goals was not feasible

■In 2022 as the recovery continued we reverted back to our pre-covid compensation plan and set about rigorous quantitative metrics for over 80% of the compensation plan

■The Compensation Committee Chair and other members of the Compensation Committee engaged in stockholder outreach.

2023 Executive Transition and Lowered Target Compensation

■On January 1, 2023, upon the retirement and resignation of Mr. Hasu P. Shah from his position as Chairman of the Board, the Board of Trustees:

■Appointed Mr. Jay H. Shah as Executive Chairman of the Board and he departed his position as Chief Executive Officer.

■Promoted Mr. Neil Shah to President and Chief Executive Officer. Mr. Neil Shah will continue to serve as the Company’s Chief Investment Officer and Head of the Company’s Asset Management function.

■Eliminated role of Chief Operating Officer in an effort to reduce the Company’s general and administrative expense.

■As a result of this transition, 2023 target compensation was reduced by $3.5 million, or 33%.

The Board of Trustees Recommends You Vote:

Appendix

Equity Compensation Plan Information: Updated

Equity Compensation Plan Information

As of March 31, 2023, no options or warrants to acquire our securities pursuant to equity compensation plans were outstanding. The following table sets forth the number of securities to be issued upon exercise of outstanding options, warrants and rights; weighted average exercise price of outstanding options, warrants and rights; and the number of securities remaining available for future issuance under our equity compensation plans as of March 31, 2023:

As of March 31, 2023, there were 2,158,995 unvested LTIP Unit Awards outstanding and 165,647 unvested Restricted Share Awards outstanding.

11

11

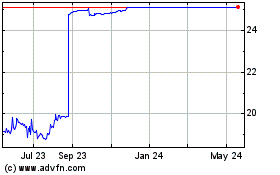

Hersha Hospitality (NYSE:HT-D)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hersha Hospitality (NYSE:HT-D)

Historical Stock Chart

From Nov 2023 to Nov 2024