Nuveen Global High Income Fund Announces Update to Portfolio Management Team

22 March 2023 - 12:00AM

Business Wire

Effective immediately, portfolio manager responsibilities for

Nuveen Global High Income Fund (NYSE: JGH) have been updated. John

Espinosa, Brenda Langenfeld, and Katherine Renfrew are being added

as portfolio managers and Anders Persson will no longer be a

portfolio manager of this fund. Mr. Persson will continue in his

role at Nuveen as Chief Investment Officer of Nuveen Global Fixed

Income. Kevin Lorenz and Jacob Fitzpatrick will continue in their

roles as portfolio managers of this fund. There will be no impact

on the investment approach, investment strategy, or any of the

fund’s investment objectives or policies.

The following provides information about each new portfolio

manager’s experience.

John Espinosa oversees all investment research across Nuveen’s

global fixed income team. He is also a portfolio manager across the

firm’s emerging markets debt and international bond strategies and

specializes in sovereign credit, rates and foreign currency. John

is a member of the Investment Committee, which establishes

investment policy for all global fixed income products. John has

nearly two decades of Fixed Income investment industry experience

and previously managed the organization’s global sovereign and

emerging markets debt research teams. John joined the firm in 2004

as a quantitative analyst and associate portfolio manager for the

CREF Bond Total Return group and entered the financial services

industry in 2001. He was selected for The Asset Magazine’s “Most

Astute Asian G3 Bond Investors” list from 2008-2015, ranking number

one in the U.S. in 2011, and also recognized as 2019’s top manager

for risk-adjusted returns within international fixed income by

Citywire Professional Buyer magazine. John graduated with a B.B.A.

in Economics and International Business from Manhattan College, an

M.A. in Economics from Fordham University, and holds a Certificate

in Advanced Risk and Investment Management from the Yale School of

Management.

Brenda Langenfeld is a portfolio manager for Nuveen’s global

fixed income team and a member of the preferred securities sector

team. She is the lead manager for Nuveen’s preferred and

income-focused closed-end funds and portfolio manager of the

Preferred Securities and Income strategy. Brenda is also co-manager

for the Real Asset Income strategy since 2015, which invests in

income generating debt and equity securities from both the real

estate and infrastructure segments, and in 2020 she became

co-manager of the Credit Income strategy. Brenda joined the

preferred securities sector team in 2011. Prior to her portfolio

management roles, Brenda was a member of the high-grade credit

sector team, responsible for trading corporate bonds. Previously,

she was a member of the securitized debt sector team, trading

mortgage-backed securities, asset-backed securities and commercial

mortgage-backed securities. Brenda graduated with a B.B.A. in

Finance and International Business from the University of

Wisconsin-Madison. She also holds the CFA designation and is a

member of the CFA Society of Chicago and the CFA Institute.

Katherine Renfrew is a portfolio manager for Nuveen’s global

fixed income team and the sector lead for emerging markets

corporates and quasi-sovereigns and all developed markets

quasi-sovereigns. She is the longest-tenured member of Nuveen’s

International and Emerging Markets Debt team and serves as a

portfolio manager for Nuveen’s suite of emerging markets debt

strategies. Katherine joined the firm in 1997 and has held several

roles relating to emerging markets debt including South American

regional analyst, trader, manager for the firm’s investments in

Eastern Europe, Middle East and Africa (EMEA) regions, and Asian

and EMEA regional analyst. Prior to joining the firm, she was a

fixed income securities analyst at MONY Capital Management and a

financial analyst at Mattel Toys. She was ranked as one of the Top

20 female portfolio managers in the United States by Citywire

Professional Buyer magazine in 2019 and 2018. Katherine graduated

with a B.S. in Economics and a B.S. in Engineering from the

University of Michigan and an M.B.A. in Finance and Accounting from

the Columbia Business School at Columbia University.

Nuveen is a leading sponsor of closed-end funds (CEFs) with $54

billion of assets under management across 55 CEFs as of 31 Dec

2022. The funds offer exposure to a broad range of asset classes

and are designed for income-focused investors seeking regular

distributions. Nuveen has more than 35 years of experience managing

CEFs.

For more information, please visit Nuveen’s CEF homepage

www.nuveen.com/closed-end-funds or contact:

Financial Professionals: 800-752-8700

Investors: 800-257-8787

Media: media-inquiries@nuveen.com

About Nuveen

Nuveen, the investment manager of TIAA, offers a comprehensive

range of outcome-focused investment solutions designed to secure

the long-term financial goals of institutional and individual

investors. Nuveen has $1.1 trillion in assets under management as

of 31 Dec 2022 and operations in 27 countries. Its investment

specialists offer deep expertise across a comprehensive range of

traditional and alternative investments through a wide array of

vehicles and customized strategies. For more information, please

visit www.nuveen.com.

Nuveen Securities, LLC, member FINRA and SIPC.

The information contained on the Nuveen website is not a part of

this press release.

EPS-2802274PR-E0323W

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230321005672/en/

Financial Professionals: 800-752-8700 Investors: 800-257-8787

Media: media-inquiries@nuveen.com

Nuveen Global High Income (NYSE:JGH)

Historical Stock Chart

From Jan 2025 to Feb 2025

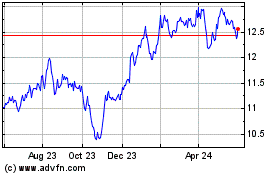

Nuveen Global High Income (NYSE:JGH)

Historical Stock Chart

From Feb 2024 to Feb 2025