00010960562023Q2falseUnited Kingdom00010960562023-04-032023-07-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 11, 2023

Luxfer Holdings PLC

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| | | | | |

| England and Wales | | 001-35370 | | 98-1024030 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | |

8989 North Port Washington Road, Suite 211,

Milwaukee, WI, 53217

(Address of principal executive offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: +1 414-269-2419

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Ordinary Shares, nominal value £0.50 each | LXFR | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐

| Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

☐ Emerging growth company

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Section 2 Financial Information

Item 2.02 Results of Operations and Financial Condition.

On October 11, 2023, Luxfer Holdings PLC (the “Company”) issued a press release announcing preliminary results for its third quarter ended October 1, 2023.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in any such filing.

Section 9 Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Luxfer Holdings PLC

(Registrant)

Date: October 11, 2023

By: /s/ Megan Glise

Megan Glise

Authorized Signatory for and on behalf of

Luxfer Holdings PLC

Luxfer Announces Preliminary Third Quarter Results

MILWAUKEE, Wisconsin, October 11, 2023 – (BUSINESS WIRE) – Luxfer Holdings PLC (NYSE: LXFR) (“Luxfer” or the “Company”), a global industrial company innovating niche applications in materials engineering, today announced preliminary results for its third quarter ended October 1, 2023.

“When reporting our second quarter 2023 results and providing updated full year 2023 guidance in late July, we noted specific areas where our businesses were facing challenges with either waning demand or supply chain issues,” said Luxfer Chief Executive Officer, Andy Butcher. “These challenges persisted during the third quarter and our third quarter results fell well below our expectations. As a result, our full year 2023 results are now tracking meaningfully lower than the previously provided adjusted earnings per share guidance.

“On the demand side, we saw lower customer order rates driven primarily by increasing macroeconomic headwinds and uncertainty. In our supply chain, previously described challenges caused by the disruption in our domestic magnesium supply continued, and overall competitive cost pressures persisted. These issues have been particularly acute in our Graphic Arts business, where the ability to pass through higher costs to our customers has proved to be constrained. We are executing a turnaround plan in Graphic Arts to reduce costs, including a headcount reduction program. We are also pursuing further actions to improve margins and maintain strong cash flow across the business. We have a solid balance sheet with ample liquidity. Despite near-term challenges, we remain optimistic regarding our long-term value creation prospects.”

The Company currently expects Q3 net sales of $97 million and adjusted earnings per share of approximately $0.04. Management will provide additional details on third quarter results and the fourth quarter outlook on the Company’s third quarter earnings call scheduled for Thursday, October 26, 2023.

Butcher concluded, “While the combination of macroeconomic headwinds, customer inventory management, and competitive pressures from low-cost sources has impacted our ability to achieve previously anticipated results in 2023, we continue to take proactive action. We are focused on delivering on our customers’ needs while controlling what we can to mitigate these factors, achieve improved financial results, and keep our operations ready for demand recovery. We have accelerated and expanded our annual strategic review process to quicken our path towards outcome trajectories that meet the high standards we expect of ourselves and that our stakeholders deserve.”

The Company’s preliminary results for its third quarter ended October 1, 2023 are an estimate, based on information available to management as of the date of this release, and are subject to further changes upon completion of the Company’s standard quarter-end closing procedures.

Non-GAAP Financial Measures

Luxfer Holdings PLC prepares its financial statements using U.S. Generally Accepted Accounting Principles (GAAP). When a company discloses material information containing non-GAAP

financial measures, SEC regulations require that the disclosure include a presentation of the most directly comparable GAAP measure and a reconciliation of the GAAP and non-GAAP financial measures. Management’s inclusion of non-GAAP financial measures in this release is intended to supplement, not replace, the presentation of the financial results in accordance with GAAP. Luxfer management believes that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any period. Management also believes that these non-GAAP financial measures enhance the ability of investors to analyze the Company’s business trends and understand the Company’s performance. In addition, management may utilize non-GAAP financial measures as a guide in the Company’s forecasting, budgeting, and long-term planning process. Non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures presented in accordance with GAAP.

With respect to the Company’s 2023 adjusted earnings per share guidance, the Company is not able to provide a reconciliation of the non-GAAP financial measure to GAAP because it does not provide specific guidance for the various extraordinary, nonrecurring, or unusual charges and other certain items. These items have not yet occurred, are out of the Company’s control, and/or cannot be reasonably predicted. As a result, reconciliation of the non-GAAP guidance measure to GAAP is not available without unreasonable effort, and the Company is unable to address the probable significance of the unavailable information.

Forward-Looking Statements

This release contains certain forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those projected in the forward-looking statements. Examples of such forward-looking statements include but are not limited to: (i) statements regarding the Company’s results of operations and financial condition; (ii) statements of plans, objectives or goals of the Company or its management, including those related to financing, products, services, and strategic planning; (iii) statements of future economic performance; and (iv) statements of assumptions underlying such statements. Words such as “believes,” “anticipates,” “expects,” “intends,” “forecasts,” “goals,” “outlook,” and “plans,” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that the predictions, forecasts, projections, and other forward-looking statements will not be achieved. The Company cautions that several important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates, and intentions expressed in such forward-looking statements. These factors include but are not limited to: (a) lower than expected future sales, including as a result of decreasing demand and customer inventory management; (b) increasing competitive industry pressures; (c) general economic conditions or conditions affecting demand for the products and services it offers, both domestically and internationally, including as a result of post-Brexit regulation, being less favorable than expected; (d) worldwide economic and business conditions and conditions in the industries in which the Company operates, including impacts on its supply chain; (e) fluctuations in the cost of raw materials, utilities, and other inputs; (f) currency fluctuations and hedging risks; (g) the Company’s ability to protect its intellectual property; (h) the significant amount of indebtedness the Company has incurred and may incur and the obligations to service such indebtedness and to comply with the covenants contained therein; and (i) continuing risks related to the impact of the global COVID-19 pandemic, such as the scope and duration of the outbreak, government actions, and restrictive measures implemented in response thereto, supply chain disruptions and other impacts to the business, and the Company’s ability to execute business continuity plans, as a result of the COVID-19 pandemic or otherwise. The Company cautions that the foregoing list of important factors is not exhaustive. These factors are more fully discussed in the sections entitled “Forward-Looking Statements” and “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the U.S. Securities and Exchange Commission on March 1, 2023. When relying on forward-looking statements to make

decisions with respect to the Company, investors and others should carefully consider the foregoing factors and other uncertainties and events. Forward-looking statements speak only as of the date on which they are made, and the Company does not undertake any obligation to update or revise any such statement, whether because of new information, future events, or otherwise.

About Luxfer Holdings PLC

Luxfer is a global industrial company innovating niche applications in materials engineering. Using its broad array of proprietary technologies, Luxfer focuses on value creation, customer satisfaction, and demanding applications where technical know-how and manufacturing expertise combine to deliver a superior product. Luxfer’s high-performance materials, components, and high-pressure gas containment devices are used in defense and emergency response, clean energy, healthcare, transportation, and general industrial applications. For more information, please visit www.luxfer.com.

Luxfer is listed on the New York Stock Exchange and its ordinary shares trade under the symbol LXFR.

Contact Information

Steve Webster

Chief Financial Officer

Investor.Relations@luxfer.com

v3.23.3

Cover

|

3 Months Ended |

Jul. 02, 2023 |

|---|

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 11, 2023

|

| Entity Registrant Name |

Luxfer Holdings PLC

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity File Number |

001-35370

|

| Entity Tax Identification Number |

98-1024030

|

| Entity Address, Address Line One |

8989 North Port Washington Road, Suite 211

|

| Entity Address, City or Town |

Milwaukee

|

| Entity Address, Postal Zip Code |

WI, 53217

|

| Country Region |

+1

|

| City Area Code |

414

|

| Local Phone Number |

269-2419

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary Shares, nominal value £0.50 each

|

| Trading Symbol |

LXFR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001096056

|

| Document Fiscal Year Focus |

2023

|

| Document Fiscal Period Focus |

Q2

|

| Amendment Flag |

false

|

| Entity Address, Country |

GB

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

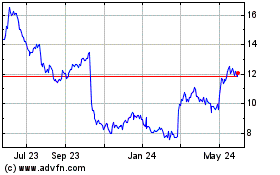

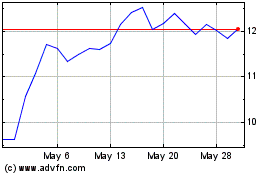

Luxfer (NYSE:LXFR)

Historical Stock Chart

From Apr 2024 to May 2024

Luxfer (NYSE:LXFR)

Historical Stock Chart

From May 2023 to May 2024