UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2023

Commission File Number: 001-37877

The Bank of N.T. Butterfield & Son Limited

(Translation of registrant’s name into English)

65 Front Street

Hamilton, HM 12

Bermuda

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ý Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

DOCUMENTS INCLUDED AS PART OF THIS FORM 6-K

Attached hereto (i) as Exhibit 99.1 is the earnings release, (ii) as Exhibit 99.2 is the financial statements, and (iii) as Exhibit 99.3 is the earnings call presentation, all for The Bank of N.T. Butterfield & Son Limited for the three months ended September 30, 2023.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| Date: October 24, 2023 | THE BANK OF N.T. BUTTERFIELD & SON LIMITED |

| | |

| | |

| | By: | /s/ Shaun Morris |

| | Name: | Shaun Morris |

| | Title: | General Counsel and Group Chief Legal Officer |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | Description |

| | | |

| | Earnings release - Third quarter 2023 results |

| | Financial Statements - Third quarter 2023 results |

| | Earnings call presentation - Third quarter 2023 results |

Butterfield Reports Third Quarter 2023 Results

Financial highlights for the third quarter of 2023:

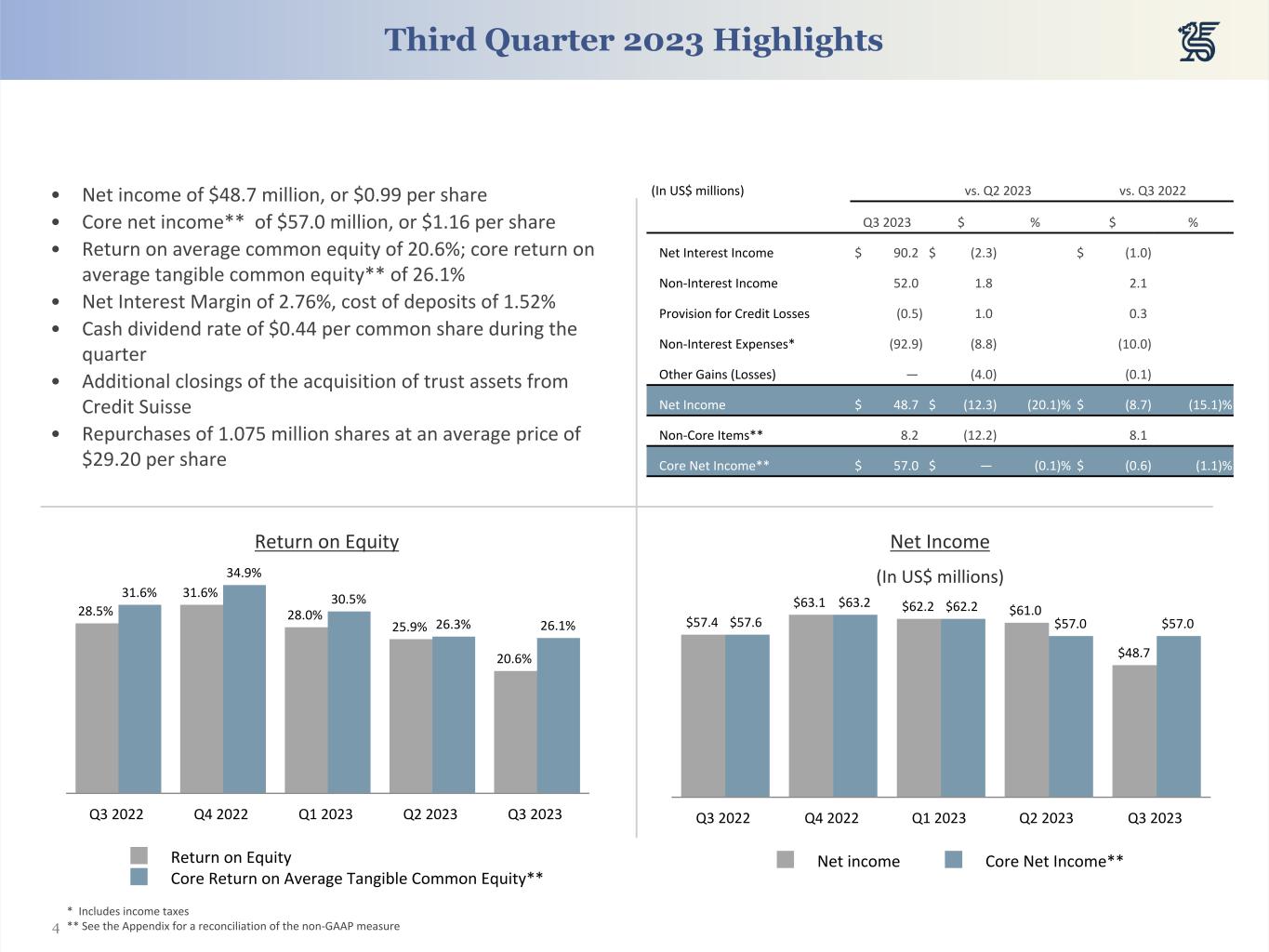

•Net income of $48.7 million, or $0.99 per share, and core net income1 of $57.0 million, or $1.16 per share

•Return on average common equity of 20.6% and core return on average tangible common equity1 of 26.1%

•Net interest margin of 2.76%, cost of deposits of 1.52%

•Board declares dividend for the quarter ended September 30, 2023 of $0.44 per share

Hamilton, Bermuda - October 24, 2023: The Bank of N.T. Butterfield & Son Limited ("Butterfield" or the "Bank") (BSX: NTB.BH; NYSE: NTB) today announced financial results for the quarter ended September 30, 2023.

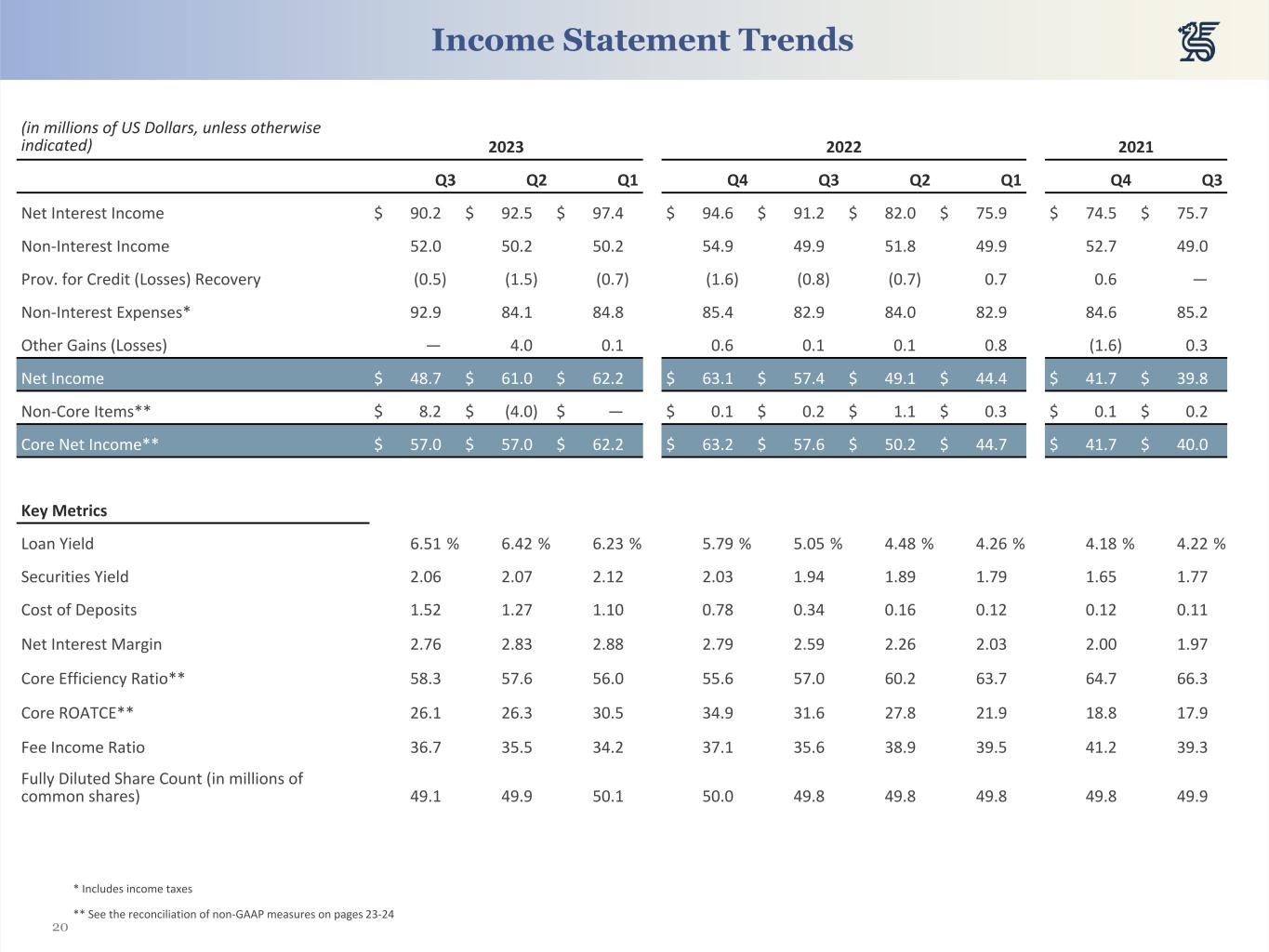

Net income for the third quarter of 2023 was $48.7 million, or $0.99 per diluted common share, compared to net income of $61.0 million, or $1.22 per diluted common share, for the previous quarter and $57.4 million, or $1.15 per diluted common share, for the third quarter of 2022. Core net income1 for the third quarter of 2023 was $57.0 million, or $1.16 per diluted common share, compared to $57.0 million, or $1.14 per diluted common share, for the previous quarter and $57.6 million, or $1.16 per diluted common share, for the third quarter of 2022.

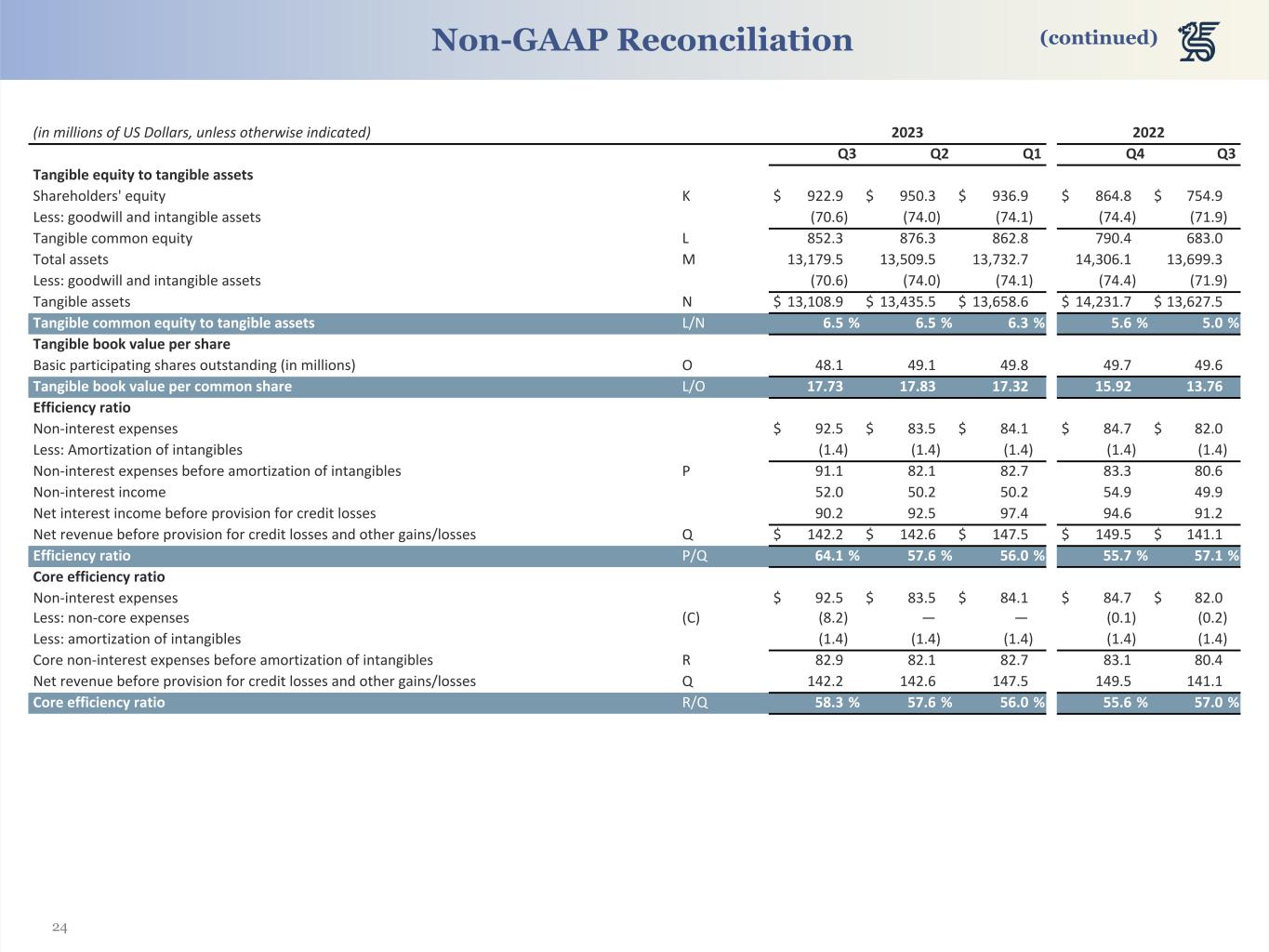

The return on average common equity for the third quarter of 2023 was 20.6% compared to 25.9% for the previous quarter and 28.5% for the third quarter of 2022. The core return on average tangible common equity1 for the third quarter of 2023 was 26.1%, compared to 26.3% for the previous quarter and 31.6% for the third quarter of 2022. The efficiency ratio for the third quarter of 2023 was 64.1%, compared to 57.6% for the previous quarter and 57.1% for the third quarter of 2022. The core efficiency ratio1 for the third quarter of 2023 was 58.3% compared with 57.6% in the previous quarter and 57.0% for the third quarter of 2022.

Michael Collins, Butterfield's Chairman and Chief Executive Officer, commented, “The Bank continues to produce earnings and a return on equity that reflect its overall financial strength and operational effectiveness. Our strong results demonstrate the continued focus on low risk density asset classes, while delivering consistent non-interest income and controlling expenses. As higher-for-longer interest rates have developed as the most likely scenario in the near term, competition for deposits has increased across our island jurisdictions, particularly in the Channel Islands. We continue to work closely with clients on both the loan and deposit product sets to ensure their financial services needs are met and that each relationship is appropriately managed.

"Reducing compensation-related expense is one of the key levers available to us as we navigate the current interest rate cycle, increasing competition, and inflation. In the third quarter, we made the difficult decision to initiate a group-wide restructuring program, which will reduce Butterfield’s global workforce by 9% in several phases. We expect annual cost savings of approximately $13 million once the restructuring is fully implemented in the first half of 2024, and we will continue to operate across all of our jurisdictions without changes to our products and services.

(1) See table "Reconciliation of US GAAP Results to Core Earnings" below for reconciliation of US GAAP results to non-GAAP measures. 1

Our efforts remain focused on navigating the various economic cycles for the success of the Bank and for the long-term benefit of all stakeholders.”

Net income was down in the third quarter of 2023 versus the prior quarter primarily due to $8.2 million of non-core costs associated with the group-wide restructuring program that was implemented in the quarter and resulted in the recognition of redundancy expenses. Core net income1 was flat compared to the prior quarter as lower net interest income comprised of increasing interest income offset by higher interest-bearing deposit costs, and increased core expenses, were moderated by higher non-interest income and a lower provision for credit losses.

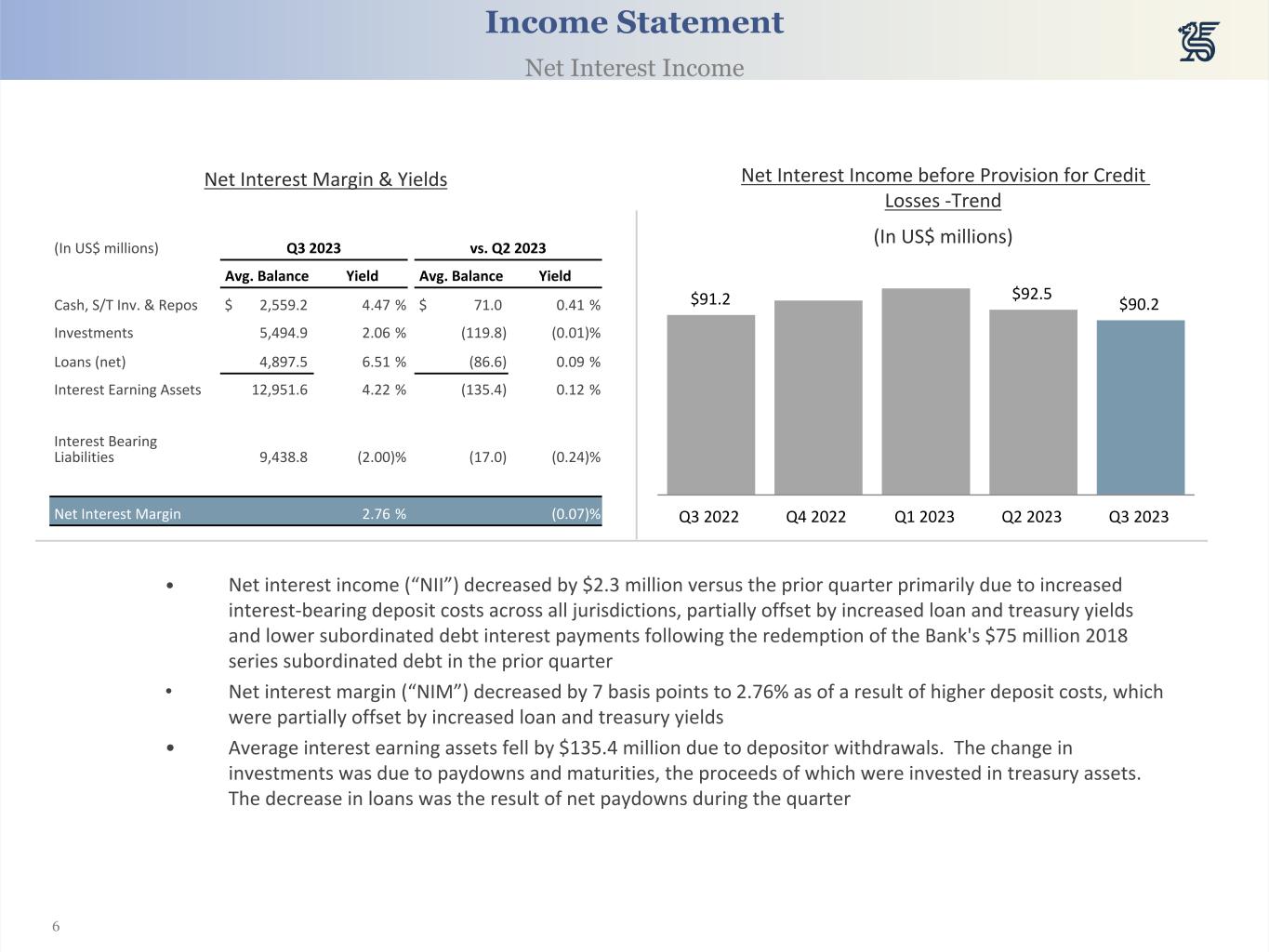

Net interest income (“NII”) for the third quarter of 2023 was $90.2 million, a decrease of $2.3 million, compared with NII of $92.5 million in the previous quarter and down $1.0 million from $91.2 million in the third quarter of 2022. NII decreased during the third quarter of 2023 compared to the prior quarter, primarily due to increased interest-bearing deposit costs in all three banking jurisdictions, partially offset by increased loan and treasury margins and lower subordinated debt interest payments following the redemption of the Bank's $75 million 2018 series subordinated debt in the second quarter of 2023. Compared to the third quarter of 2022, NII was down due to a decrease in the size of the Bank's balance sheet following post-Covid normalization, which offset improved net asset margins.

Net interest margin (“NIM”) for the third quarter of 2023 was 2.76%, a decrease of 7 basis points from 2.83% in the previous quarter and up 17 basis points from 2.59% in the third quarter of 2022. NIM in the third quarter of 2023 was lower than the prior quarter due to increased deposit costs, which were partially offset by higher loan yields and treasury margins. Compared to the third quarter of 2022, NIM improved primarily due to higher yields on treasury assets and loans, partially offset by increased deposit costs.

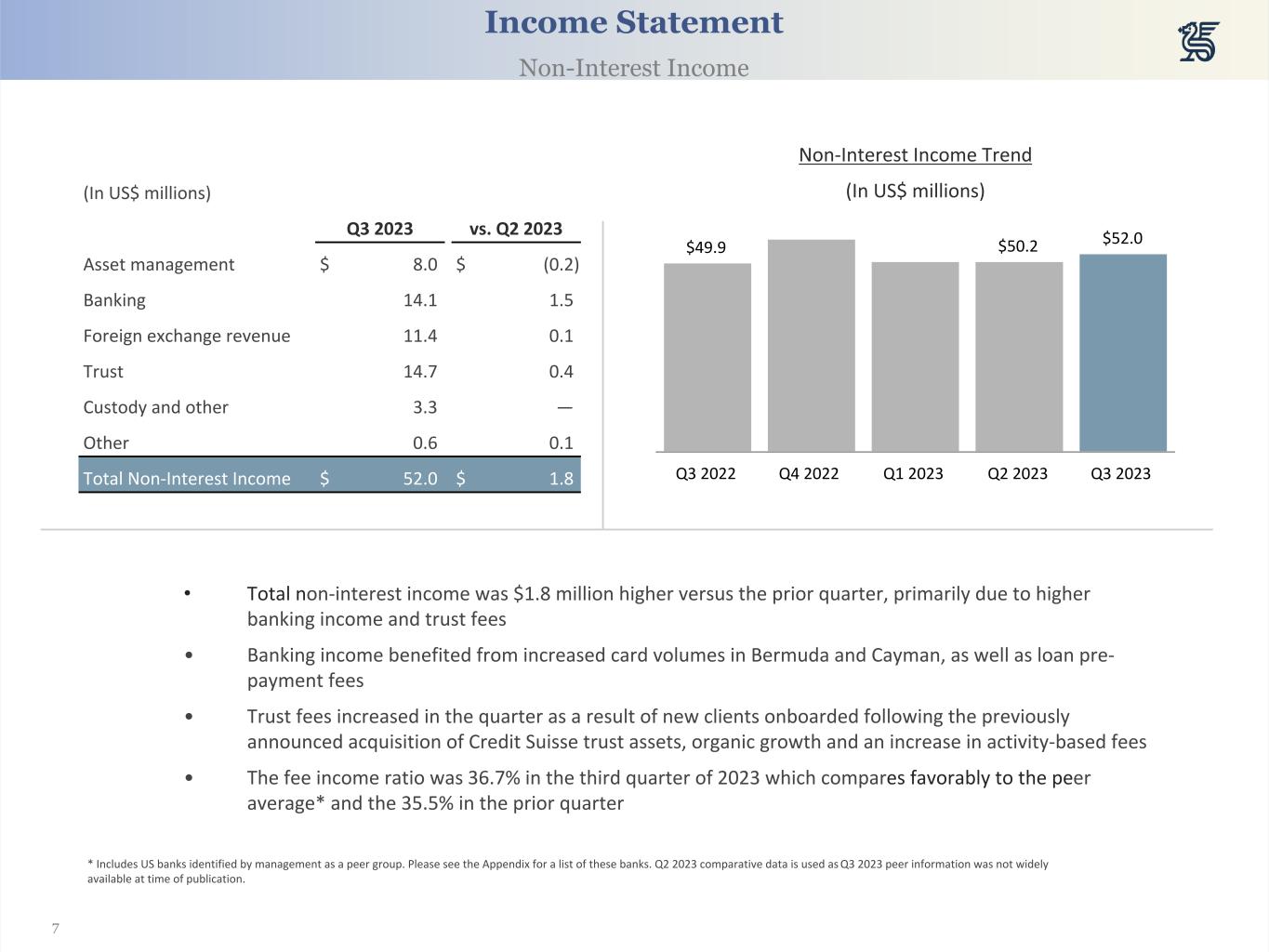

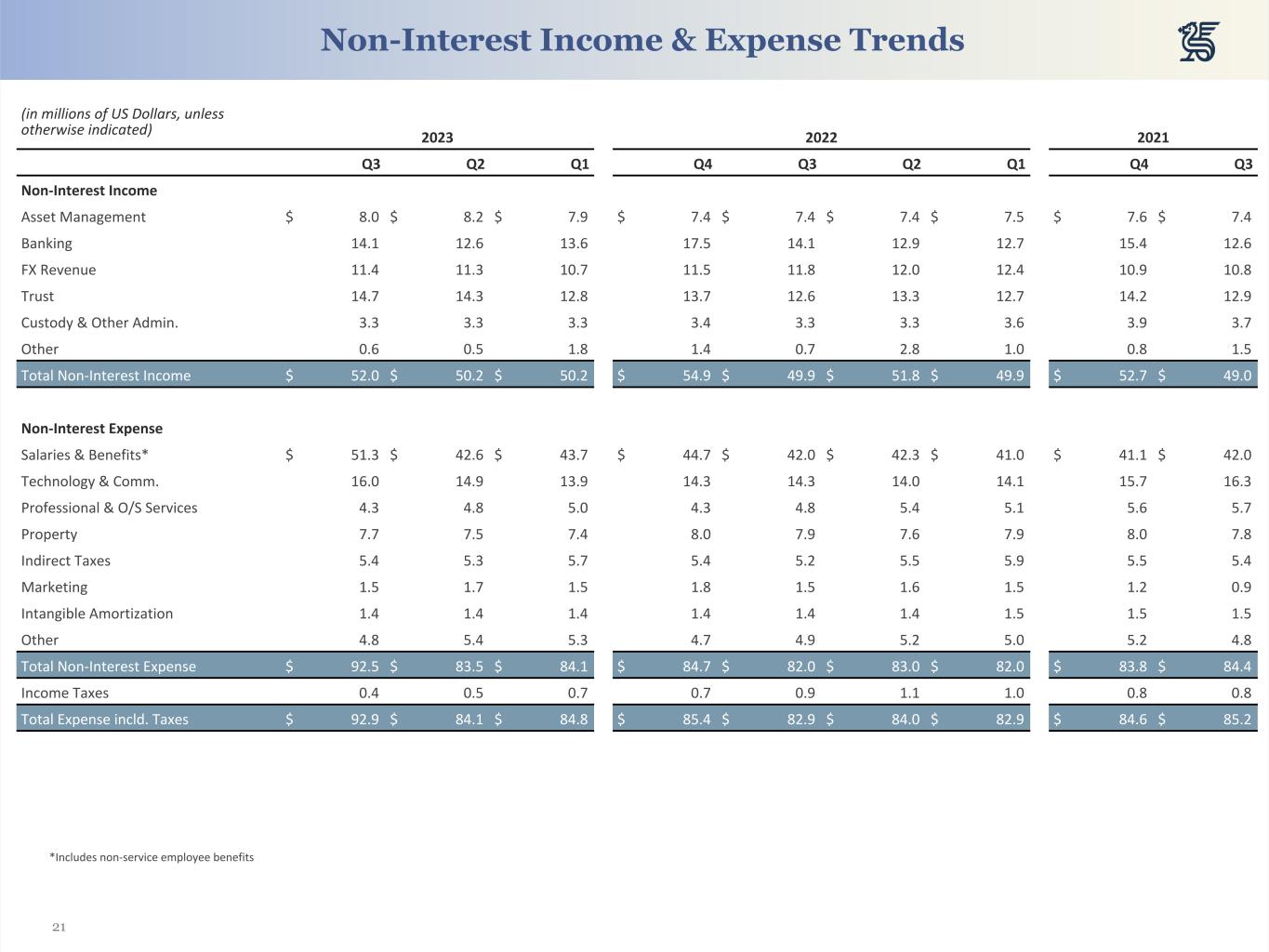

Non-interest income for the third quarter of 2023 of $52.0 million, an increase of $1.8 million against the previous quarter of $50.2 million and $2.1 million higher than $49.9 million in the third quarter of 2022. Non-interest income for the third quarter of 2023 increased compared to the prior quarter due to higher banking income that benefited from increased card volumes in Bermuda and Cayman, as well as loan pre-payment fees. Trust fees also increased in the third quarter of 2023 following the onboarding of new clients from the previously announced acquisition of Credit Suisse trust assets. Non-interest income in the third quarter of 2023 was higher than the third quarter of 2022 primarily due to increased trust income mostly attributable to new clients, including organic growth, and additional activity-based fees.

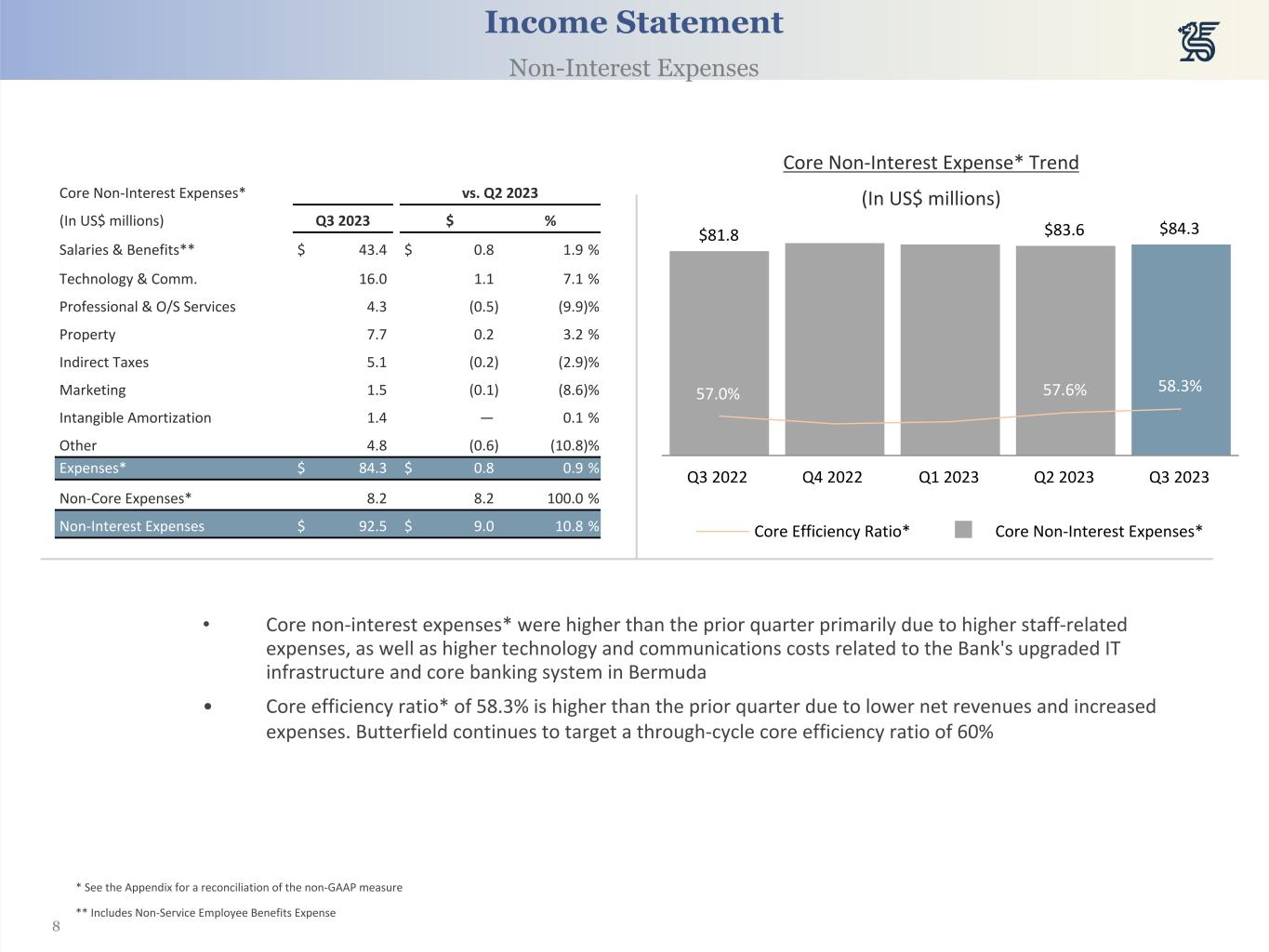

Non-interest expenses were $92.5 million in the third quarter of 2023, compared to $83.5 million in the previous quarter and $82.0 million in the third quarter of 2022. Core non-interest expenses1 of $84.3 million in the third quarter of 2023 were higher than the $83.6 million incurred in the previous quarter, primarily due to higher staff-related expenses as well as higher technology and communications costs related to the Bank's upgraded core banking system in Bermuda. Core non-interest expenses1 in the third quarter of 2023 were higher than the $81.8 million incurred in the third quarter of 2022 due to inflationary increases in salaries and benefits, as well as the increased technology and communications costs associated with the core banking system and IT infrastructure investments.

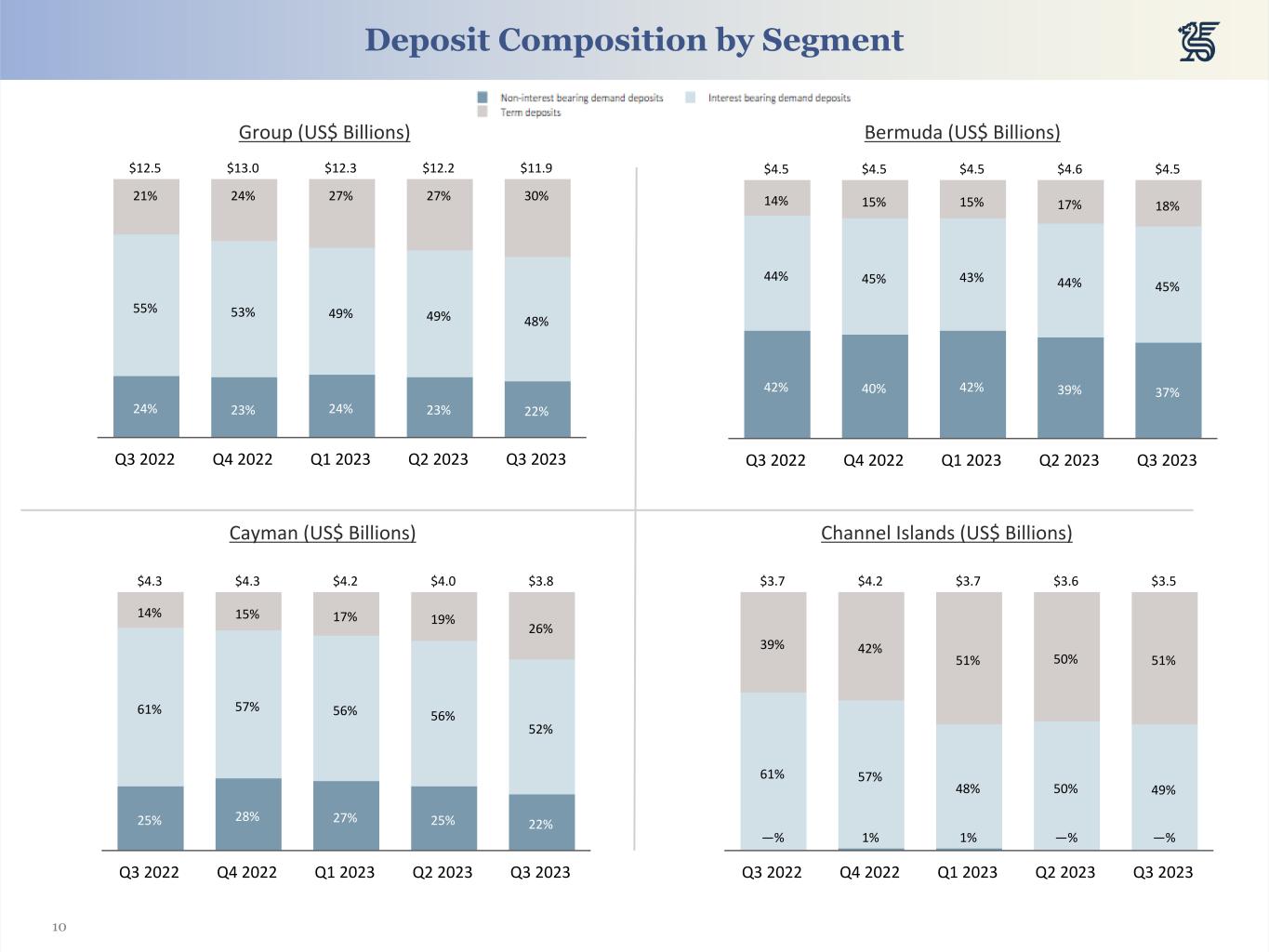

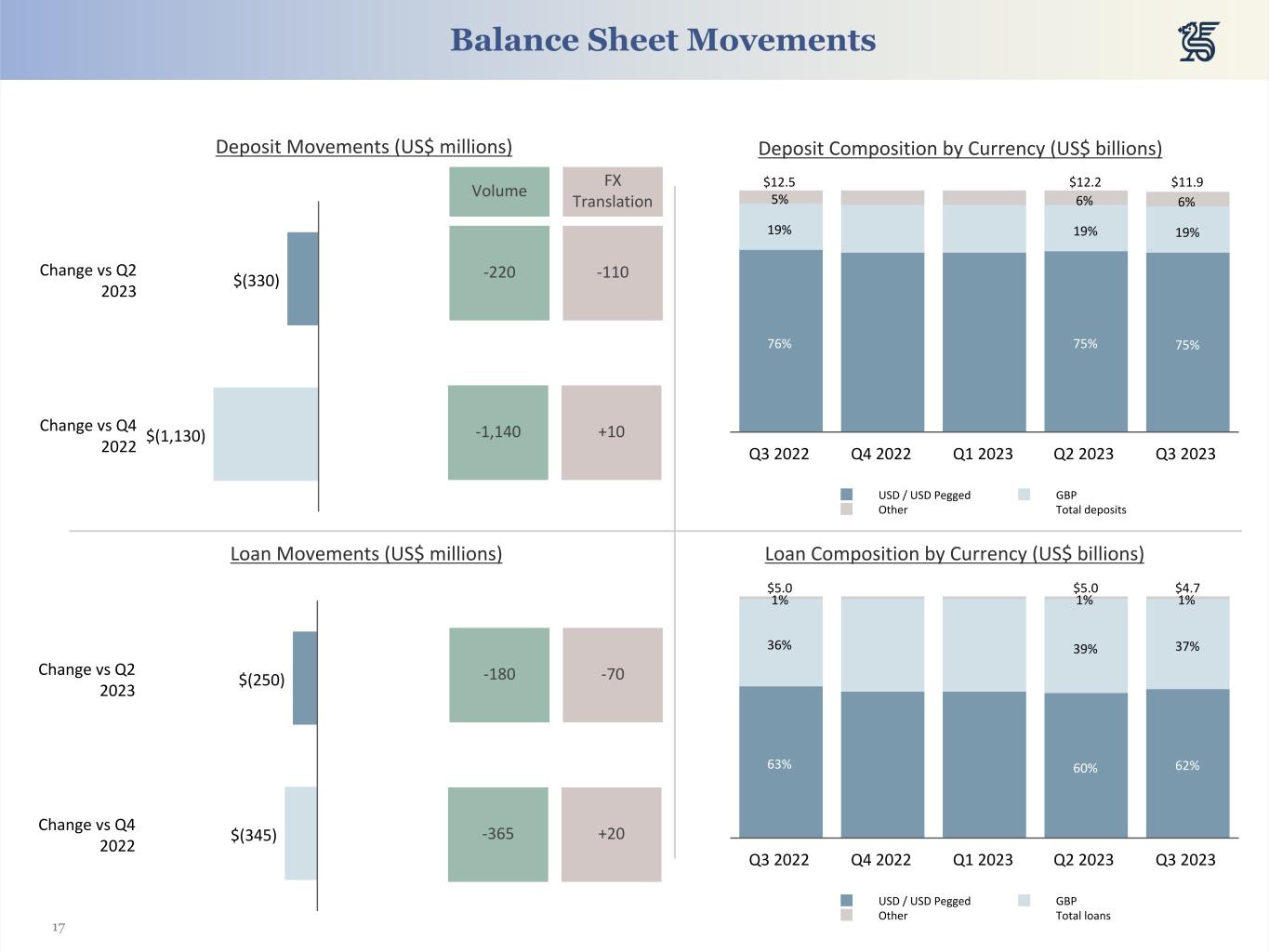

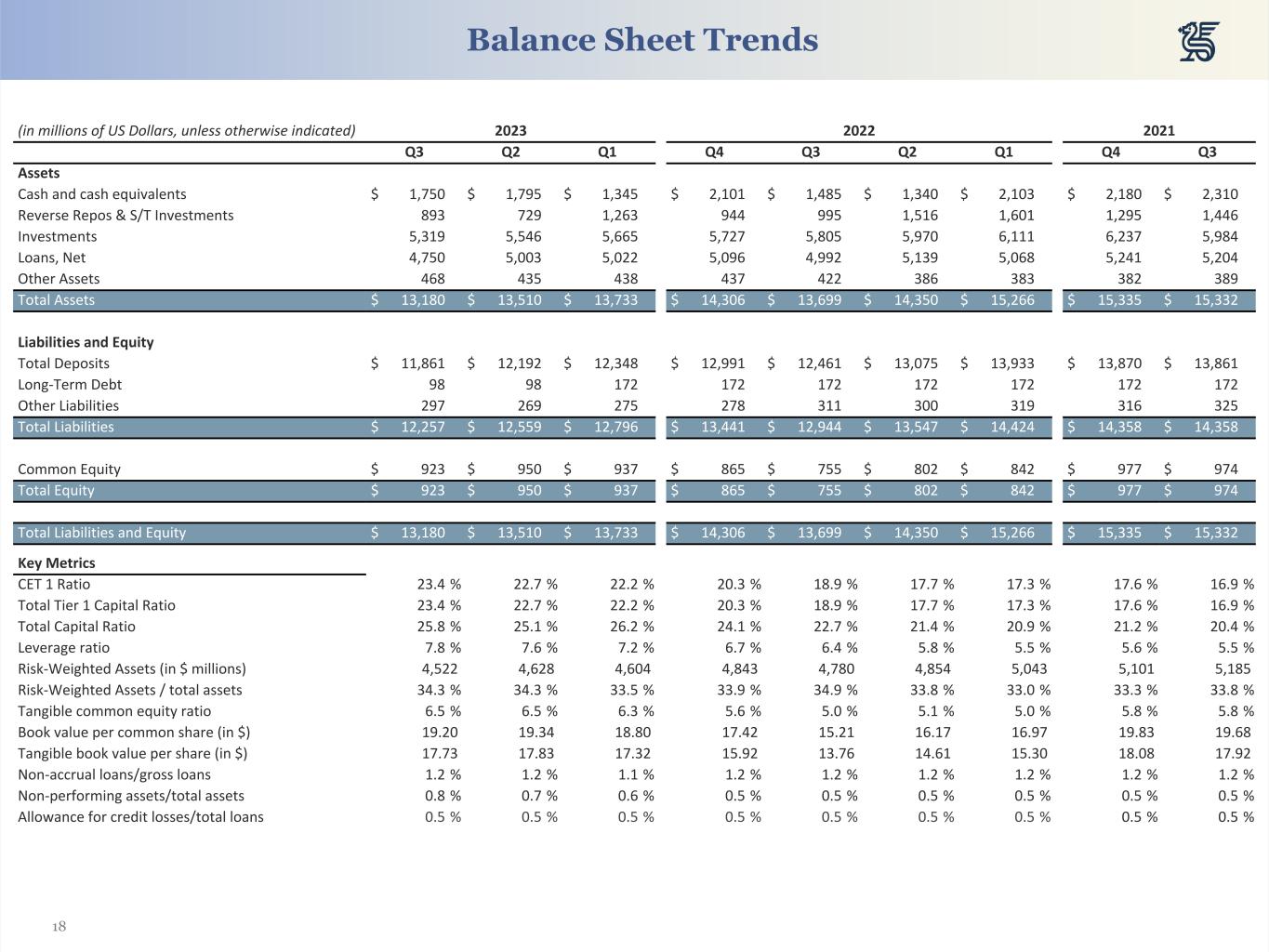

Period end deposit balances were $11.9 billion, a decrease of 8.7% compared to $13.0 billion at December 31, 2022, primarily due to deposit movements in the Channel Islands and UK, and Cayman Islands segments as customers activated their funds and sought higher yielding products. Average deposits were $12.1 billion in the quarter ended September 30, 2023, compared to $12.2 billion in the second quarter of 2023.

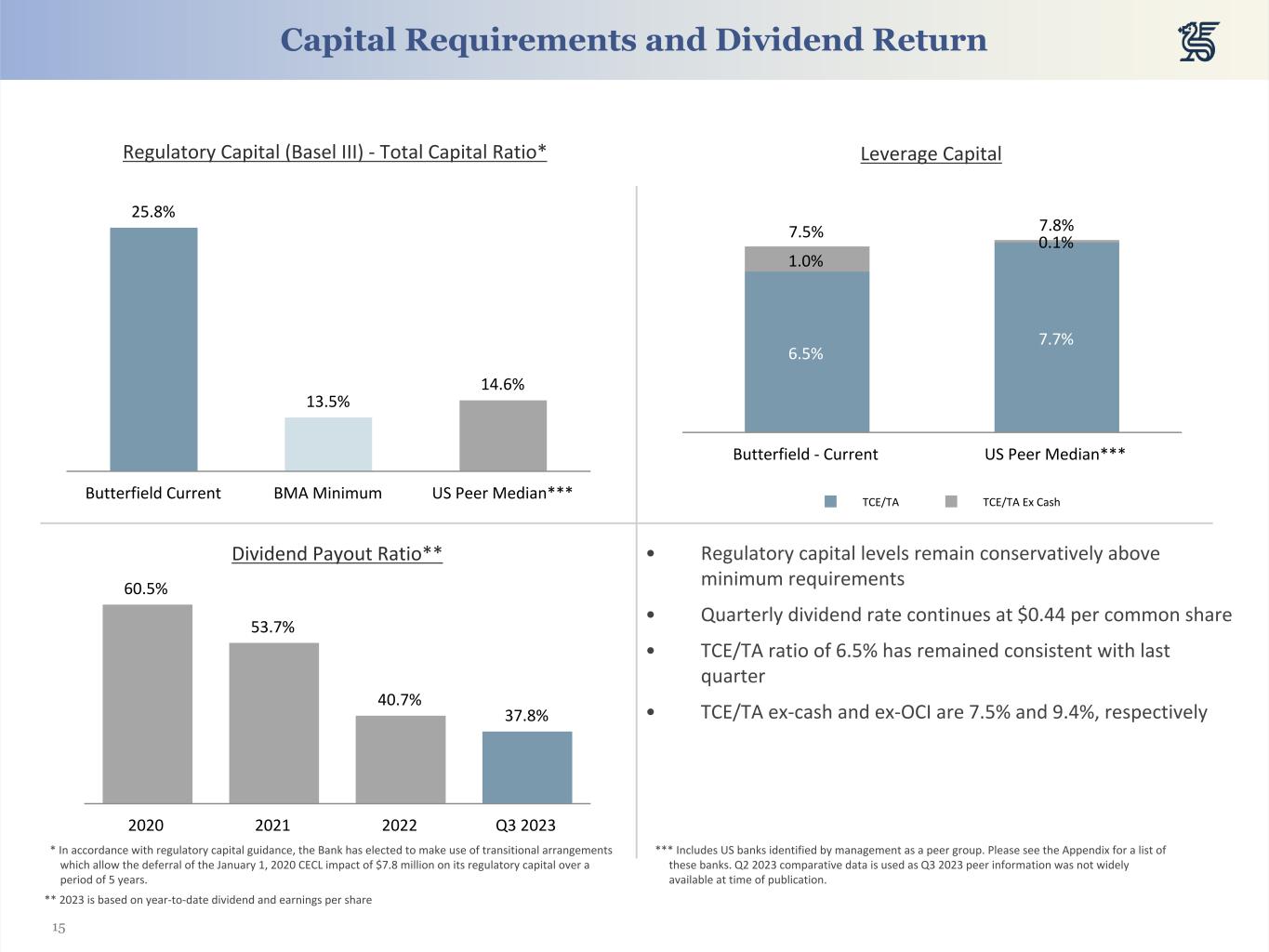

The Bank maintained its balanced capital return policy. The Board again declared a quarterly dividend of $0.44 per common share to be paid on November 22, 2023 to shareholders of record on November 8, 2023. During the third quarter of 2023, Butterfield repurchased 1.1 million common shares under the Bank's share repurchase plan.

The current total regulatory capital ratio as at September 30, 2023 was 25.8% as calculated under Basel III, compared to 24.1% as at December 31, 2022. Both of these ratios remain significantly above the minimum Basel III regulatory requirements applicable to the Bank.

(1) See table "Reconciliation of US GAAP Results to Core Earnings" below for reconciliation of US GAAP results to non-GAAP measures. 2

ANALYSIS AND DISCUSSION OF THIRD QUARTER RESULTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| Income statement | | Three months ended (Unaudited) | | |

| (in $ millions) | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | | | |

| Non-interest income | | 52.0 | | | 50.2 | | | 49.9 | | | | | |

| Net interest income before provision for credit losses | | 90.2 | | | 92.5 | | | 91.2 | | | | | |

| Total net revenue before provision for credit losses and other gains (losses) | | 142.2 | | | 142.6 | | | 141.1 | | | | | |

| Provision for credit (losses) recoveries | | (0.5) | | | (1.5) | | | (0.8) | | | | | |

| Total other gains (losses) | | — | | | 4.0 | | | 0.1 | | | | | |

| Total net revenue | | 141.7 | | | 145.1 | | | 140.4 | | | | | |

| Non-interest expenses | | (92.5) | | | (83.5) | | | (82.0) | | | | | |

| Total net income before taxes | | 49.1 | | | 61.5 | | | 58.4 | | | | | |

| Income tax benefit (expense) | | (0.4) | | | (0.5) | | | (0.9) | | | | | |

| Net income | | 48.7 | | | 61.0 | | | 57.4 | | | | | |

| | | | | | | | | | |

| Net earnings per share | | | | | | | | | | |

Basic | | 1.00 | | | 1.23 | | | 1.16 | | | | | |

Diluted | | 0.99 | | | 1.22 | | | 1.15 | | | | | |

| | | | | | | | | | |

Per diluted share impact of other non-core items 1 | | 0.17 | | | (0.08) | | | 0.01 | | | | | |

Core earnings per share on a fully diluted basis 1 | | 1.16 | | | 1.14 | | | 1.16 | | | | | |

| | | | | | | | | | |

Adjusted weighted average number of participating shares on a fully diluted basis (in thousands of shares) | | 49,140 | | | 49,890 | | | 49,847 | | | | | |

| | | | | | | | | | |

| Key financial ratios | | | | | | | | | | |

| Return on common equity | | 20.6 | % | | 25.9 | % | | 28.5 | % | | | | |

Core return on average tangible common equity 1 | | 26.1 | % | | 26.3 | % | | 31.6 | % | | | | |

Return on average assets | | 1.4 | % | | 1.8 | % | | 1.6 | % | | | | |

| Net interest margin | | 2.76 | % | | 2.83 | % | | 2.59 | % | | | | |

Core efficiency ratio 1 | | 58.3 | % | | 57.6 | % | | 57.0 | % | | | | |

(1)See table "Reconciliation of US GAAP Results to Core Earnings" below for reconciliation of US GAAP results to non-GAAP measures.

| | | | | | | | | | | | | | | |

| Balance Sheet | | As at | |

| (in $ millions) | | September 30, 2023 | | December 31, 2022 | |

| Cash and cash equivalents | | 1,750 | | | 2,101 | | |

| Securities purchased under agreements to resell | | 154 | | | 60 | | |

| Short-term investments | | 739 | | | 884 | | |

| Investments in securities | | 5,319 | | | 5,727 | | |

| Loans, net of allowance for credit losses | | 4,750 | | | 5,096 | | |

| Premises, equipment and computer software, net | | 154 | | | 146 | | |

| Goodwill and intangibles, net | | 71 | | | 74 | | |

| Accrued interest and other assets | | 244 | | | 217 | | |

| Total assets | | 13,180 | | | 14,306 | | |

| | | | | |

| Total deposits | | 11,861 | | | 12,991 | | |

| Accrued interest and other liabilities | | 297 | | | 278 | | |

| Long-term debt | | 98 | | | 172 | | |

| Total liabilities | | 12,257 | | | 13,441 | | |

| | | | | |

| Common shareholders’ equity | | 923 | | | 865 | | |

| Total shareholders' equity | | 923 | | | 865 | | |

| Total liabilities and shareholders' equity | | 13,180 | | | 14,306 | | |

| | | | | |

| Key Balance Sheet Ratios: | | September 30, 2023 | | December 31, 2022 | |

Common equity tier 1 capital ratio2 | | 23.4 | % | | 20.3 | % | |

Tier 1 capital ratio2 | | 23.4 | % | | 20.3 | % | |

Total capital ratio2 | | 25.8 | % | | 24.1 | % | |

Leverage ratio2 | | 7.8 | % | | 6.7 | % | |

| Risk-Weighted Assets (in $ millions) | | 4,522 | | 4,843 | |

| Risk-Weighted Assets / total assets | | 34.3 | % | | 33.9 | % | |

| Tangible common equity ratio | | 6.5 | % | | 5.6 | % | |

| Book value per common share (in $) | | 19.20 | | 17.42 | |

| Tangible book value per share (in $) | | 17.73 | | 15.92 | |

| Non-accrual loans/gross loans | | 1.2 | % | | 1.2 | % | |

| Non-performing assets/total assets | | 0.8 | % | | 0.5 | % | |

| Allowance for credit losses/total loans | | 0.5 | % | | 0.5 | % | |

| | | | | |

(2)In accordance with regulatory capital guidance, the Bank has elected to make use of transitional arrangements which allow the deferral of the January 1, 2020 Current Expected Credit Loss ("CECL") impact of $7.8 million on its regulatory capital over a period of 5 years.

QUARTER ENDED SEPTEMBER 30, 2023 COMPARED WITH THE QUARTER ENDED JUNE 30, 2023

Net Income

Net income for the quarter ended September 30, 2023 was $48.7 million, down $12.3 million from $61.0 million in the prior quarter (see also discussion of non-core items below).

The $12.3 million change in net income in the quarter ended September 30, 2023 compared to the previous quarter was due principally to the following:

•$9.0 million increase in non-interest expenses, driven by staff-related and indirect tax costs due to expenses associated with the group-wide restructuring and higher technology and communications costs as the core banking system upgrade in Bermuda came into operation;

•$1.8 million increase in non-interest income primarily due to higher banking fees as a result of increased card volumes and day count and an increase in loan prepayment fees;

•$2.3 million decrease in net interest income before provision for credit losses primarily due to increasing deposit costs outpacing increases in yields on loans and treasury assets;

•$4.0 million decrease in total other gains (losses) due to a gain realized on the liquidation settlement from a legacy investment written-off in the previous quarter that did not recur in the current quarter; and

•$1.0 million decrease in provision from credit losses as a result of losses recognized on a small number of loan facilities in Bermuda in the prior quarter and a decrease in loan balances.

Non-Core Items1

Non-core items resulted in expenses, net of gains, of $8.2 million in the third quarter of 2023. Non-core items for the quarter relates mainly to the group-wide restructuring that resulted in the recognition of redundancy expenses.

Management does not believe that comparative period expenses, gains or losses identified as non-core are indicative of the results of operations of the Bank in the ordinary course of business.

(1)See table "Reconciliation of US GAAP Results to Core Earnings" below for reconciliation of US GAAP results to non-GAAP measures.

BALANCE SHEET COMMENTARY AT SEPTEMBER 30, 2023 COMPARED WITH DECEMBER 31, 2022

Total Assets

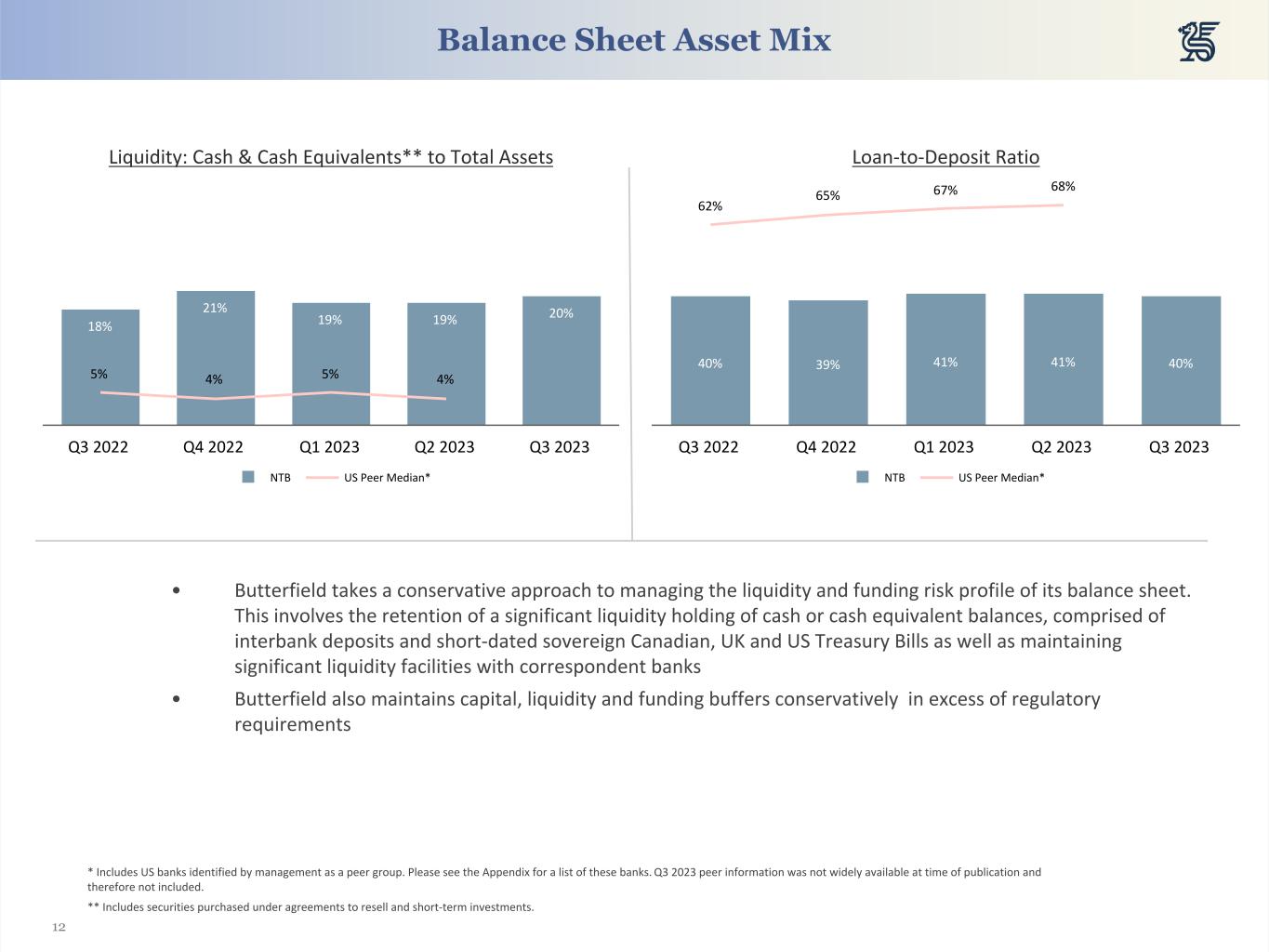

Total assets of the Bank were $13.2 billion at September 30, 2023, a decrease of $1.1 billion from December 31, 2022. The Bank maintained a highly liquid position at September 30, 2023, with $8.0 billion of cash, bank deposits, reverse repurchase agreements and liquid investments representing 60.4% of total assets, compared with 61.3% at December 31, 2022.

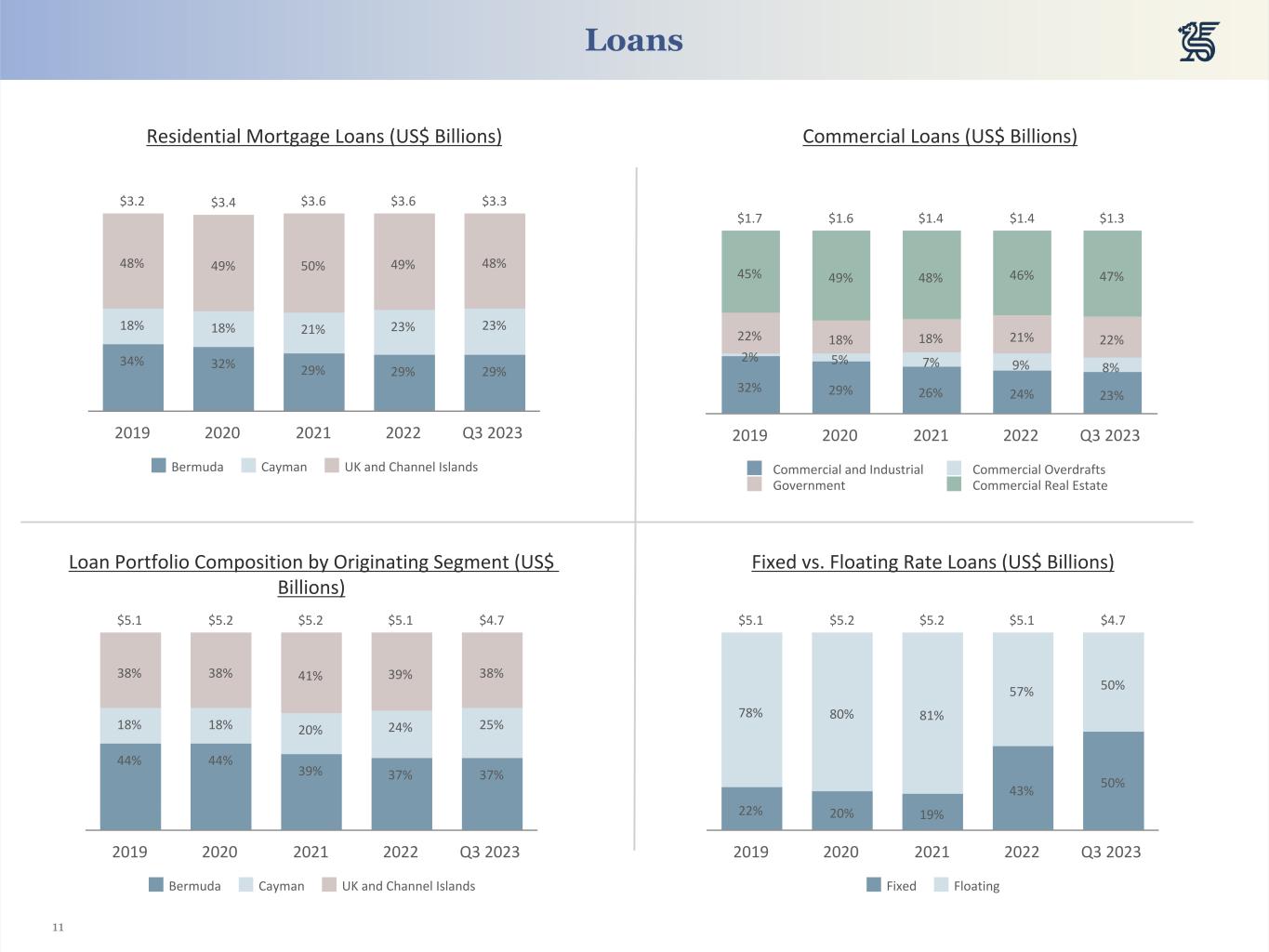

Loans Receivable

The loan portfolio totaled $4.7 billion at September 30, 2023, which was $0.3 billion lower than December 31, 2022 balances. The decrease was driven primarily by scheduled paydowns in the portfolio as well as prepayments in the Channel Islands and UK residential mortgage portfolio.

The allowance for credit losses at September 30, 2023 totaled $26.0 million, an increase of $1.1 million from $25.0 million at December 31, 2022. The movement was driven by an increase in credit card provisions, specific provisions on a small number of loan facilities in Bermuda and updated forward-looking economic forecasts. This was partially offset by net paydowns.

The loan portfolio represented 36.0% of total assets at September 30, 2023 (December 31, 2022: 35.6%), while loans as a percentage of total deposits was 40.0% at September 30, 2023 (December 31, 2022: 39.2%). The increase in both ratios was attributable principally to a decrease in deposit balances at September 30, 2023.

As of September 30, 2023, the Bank had gross non-accrual loans of $59.4 million, representing 1.2% of total gross loans, a decrease of $3.7 million from $63.1 million, or 1.2% of total loans, at December 31, 2022. The decrease in non-accrual loans was driven by the settlement of a residential mortgage in the Channel Islands and UK segment and partially offset by a number of net new Bermuda residential mortgages.

Other real estate owned (“OREO”) remained stable compared to December 31, 2022 at $0.8 million.

Investment in Securities

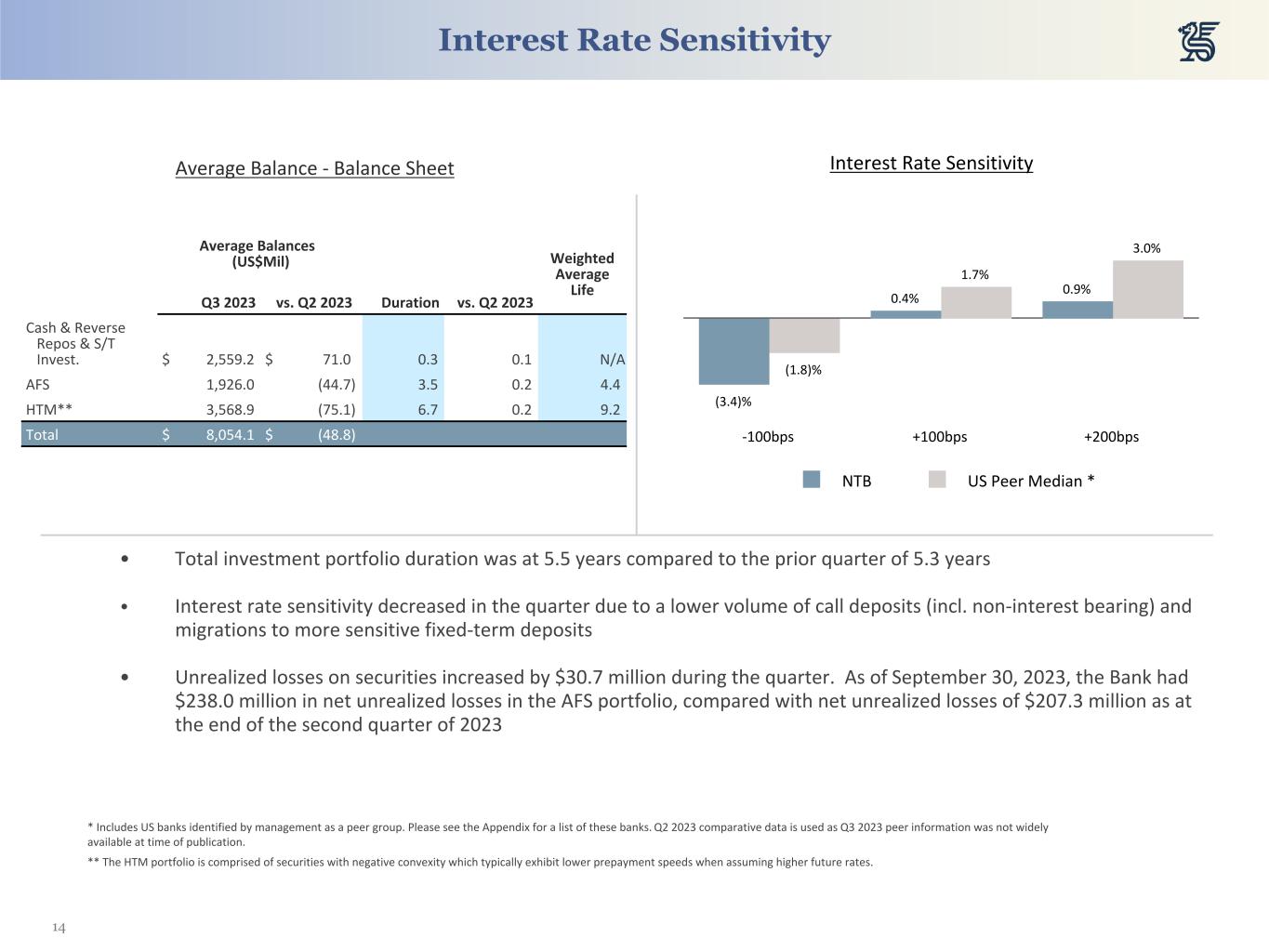

The investment portfolio was $5.3 billion at September 30, 2023, which was $0.4 billion lower versus December 31, 2022 balances. The changes were attributable to paydowns and maturities in the portfolio, the majority of which were invested into short-term treasury assets.

The investment portfolio is made up of high quality assets with 100% invested in A-or-better-rated securities. The investment book yield was 2.06% during the quarter ended September 30, 2023 versus 2.07% during the previous quarter. Total net unrealized losses on the available-for-sale portfolio increased to $238.0 million, compared with total net unrealized losses of $220.2 million at December 31, 2022, as a result of an increase in long-term US dollar interest rates.

Deposits

Average total deposit balances were $12.1 billion for the quarter ended September 30, 2023, a decrease of $0.1 billion compared to the previous quarter, while period end balances as at September 30, 2023 were $11.9 billion, a decrease of $1.1 billion compared to December 31, 2022, as customers activated their funds and also sought higher yielding financial investments.

Average Balance Sheet2

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended |

| September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| (in $ millions) | Average balance ($) | Interest ($) | Average rate (%) | | Average balance ($) | Interest ($) | Average rate (%) | | Average balance ($) | Interest ($) | Average rate (%) |

| Assets | | | | | | | | | | | |

| Cash and cash equivalents and short-term investments | 2,559.2 | | 28.8 | | 4.47 | | | 2,488.2 | | 25.2 | | 4.06 | | | 2,818.4 | | 10.0 | | 1.40 | |

| Investment in securities | 5,494.9 | | 28.5 | | 2.06 | | | 5,614.7 | | 28.9 | | 2.07 | | | 6,007.3 | | 29.4 | | 1.94 | |

| | | | | | | | | | | |

| Available-for-sale | 1,926.0 | | 8.8 | | 1.81 | | | 1,970.7 | | 8.8 | | 1.78 | | | 2,140.1 | | 8.5 | | 1.58 | |

| Held-to-maturity | 3,568.9 | | 19.7 | | 2.19 | | | 3,644.0 | | 20.2 | | 2.22 | | | 3,867.3 | | 20.9 | | 2.14 | |

| Loans | 4,897.5 | | 80.4 | | 6.51 | | | 4,984.1 | | 79.8 | | 6.42 | | | 5,123.1 | | 65.3 | | 5.05 | |

| Commercial | 1,394.9 | | 23.2 | | 6.60 | | | 1,396.7 | | 23.0 | | 6.59 | | | 1,523.3 | | 20.8 | | 5.41 | |

| Consumer | 3,502.6 | | 57.2 | | 6.47 | | | 3,587.4 | | 56.8 | | 6.35 | | | 3,599.8 | | 44.5 | | 4.90 | |

| Interest earning assets | 12,951.6 | | 137.7 | | 4.22 | | | 13,087.0 | | 133.9 | | 4.10 | | | 13,948.9 | | 104.6 | | 2.98 | |

| Other assets | 416.7 | | | | | 402.0 | | | | | 369.1 | | | |

| Total assets | 13,368.3 | | | | | 13,489.0 | | | | | 14,317.9 | | | |

| Liabilities | | | | | | | | | | | |

| Deposits - interest bearing | 9,340.4 | | (46.1) | | (1.96) | | | 9,308.0 | | (38.5) | | (1.66) | | | 9,939.5 | | (11.1) | | (0.44) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Securities sold under agreement to repurchase | — | | — | | — | | | 0.4 | | — | | (5.45) | | | — | | — | | — | |

| Long-term debt | 98.4 | | (1.4) | | (5.53) | | | 147.4 | | (2.9) | | (8.02) | | | 172.1 | | (2.4) | | (5.53) | |

| Interest bearing liabilities | 9,438.8 | | (47.5) | | (2.00) | | | 9,455.8 | | (41.4) | | (1.76) | | | 10,111.7 | | (13.5) | | (0.53) | |

| Non-interest bearing current accounts | 2,739.3 | | | | | 2,863.2 | | | | | 3,074.6 | | | |

| Other liabilities | 279.3 | | | | | 243.6 | | | | | 256.2 | | | |

| Total liabilities | 12,457.4 | | | | | 12,562.6 | | | | | 13,442.4 | | | |

| Shareholders’ equity | 910.9 | | | | | 926.4 | | | | | 875.5 | | | |

| Total liabilities and shareholders’ equity | 13,368.3 | | | | | 13,489.0 | | | | | 14,317.9 | | | |

Non-interest bearing funds net of

non-interest earning assets

(free balance) | 3,512.8 | | | | | 3,631.2 | | | | | 3,837.2 | | | |

| Net interest margin | | 90.2 | | 2.76 | | | | 92.5 | | 2.83 | | | | 91.2 | | 2.59 | |

(2) Averages are based upon a daily averages for the periods indicated.

Assets Under Administration and Assets Under Management

Total assets under administration for the trust and custody businesses were $129.5 billion and $29.0 billion, respectively, at September 30, 2023, while assets under management were $5.2 billion at September 30, 2023. This compares with $106.2 billion, $32.2 billion and $5.0 billion, respectively, at December 31, 2022.

Reconciliation of US GAAP Results to Core Earnings

The table below shows the reconciliation of net income in accordance with US GAAP to core earnings, a non-GAAP measure, which excludes certain significant items that are included in our US GAAP results of operations. We focus on core net income, which we calculate by adjusting net income to exclude certain income or expense items that are not representative of our business operations, or “non-core”. Core net income includes revenue, gains, losses and expense items incurred in the normal course of business. We believe that expressing earnings and certain other financial measures excluding these non-core items provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Bank and predicting future performance. We believe that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Bank on the same basis as management.

| | | | | | | | | | | | | | | | | | | | | |

| Core Earnings | Three months ended | | |

| (in $ millions except per share amounts) | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | | | |

| Net income | 48.7 | | | 61.0 | | | 57.4 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Non-core items | | | | | | | | | |

| Non-core (gains) losses | | | | | | | | | |

| | | | | | | | | |

Liquidation settlement from an investment previously written-off | — | | | (4.0) | | | — | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total non-core (gains) losses | — | | | (4.0) | | | — | | | | | |

| Non-core expenses | | | | | | | | | |

| Early retirement program, voluntary separation, redundancies and other non-core compensation costs | 8.2 | | | — | | | — | | | | | |

| Tax compliance review costs | — | | | — | | | 0.2 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total non-core expenses | 8.2 | | | — | | | 0.2 | | | | | |

| Total non-core items | 8.2 | | | (4.0) | | | 0.2 | | | | | |

| Core net income | 57.0 | | | 57.0 | | | 57.6 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Average common equity | 940.2 | | | 943.3 | | | 799.0 | | | | | |

| Less: average goodwill and intangible assets | (72.9) | | | (74.0) | | | (75.1) | | | | | |

| Average tangible common equity | 867.2 | | | 869.3 | | | 723.9 | | | | | |

| Core earnings per share fully diluted | 1.16 | | | 1.14 | | | 1.16 | | | | | |

| Return on common equity | 20.6 | % | | 25.9 | % | | 28.5 | % | | | | |

| Core return on average tangible common equity | 26.1 | % | | 26.3 | % | | 31.6 | % | | | | |

| | | | | | | | | |

| Shareholders' equity | 922.9 | | | 950.3 | | | 754.9 | | | | | |

| Less: goodwill and intangible assets | (70.6) | | | (74.0) | | | (71.9) | | | | | |

| Tangible common equity | 852.3 | | | 876.3 | | | 683.0 | | | | | |

| Basic participating shares outstanding (in millions) | 48.1 | | | 49.1 | | | 49.6 | | | | | |

| Tangible book value per common share | 17.73 | | | 17.83 | | | 13.76 | | | | | |

| | | | | | | | | |

| Non-interest expenses | 92.5 | | | 83.5 | | | 82.0 | | | | | |

| Less: non-core expenses | (8.2) | | | — | | | (0.2) | | | | | |

| Less: amortization of intangibles | (1.4) | | | (1.4) | | | (1.4) | | | | | |

| Core non-interest expenses before amortization of intangibles | 82.9 | | | 82.1 | | | 80.4 | | | | | |

| Core revenue before other gains and losses and provision for credit losses | 142.2 | | | 142.6 | | | 141.1 | | | | | |

| Core efficiency ratio | 58.3 | % | | 57.6 | % | | 57.0 | % | | | | |

Conference Call Information:

Butterfield will host a conference call to discuss the Bank’s results on Wednesday, October 25, 2023 at 10:00 a.m. Eastern Time. Callers may access the conference call by dialing +1 (844) 855-9501 (toll-free) or +1 (412) 858-4603 (international) ten minutes prior to the start of the call and referencing the Conference ID: Butterfield Group. A live webcast of the conference call, including a slide presentation, will be available in the investor relations section of Butterfield’s website at www.butterfieldgroup.com. A replay of the call will be archived on the Butterfield website for 12 months.

About Non-GAAP Financial Measures:

Certain statements in this release involve the use of non-GAAP financial measures. We believe such measures provide useful information to investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with US GAAP; however, our non-GAAP financial measures have a number of limitations. As such, investors should not view these disclosures as a substitute for results determined in accordance with US GAAP, and they are not necessarily comparable to non-GAAP financial measures that other companies use. See "Reconciliation of US GAAP Results to Core Earnings" for additional information.

Forward-Looking Statements:

Certain of the statements made in this release are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions estimates, intentions, and future performance, including, without limitation, our intention to make share repurchases and our dividend payout target, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual results, performance, capital, ownership or achievements of Butterfield to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements due to a variety of factors, including worldwide economic conditions (including economic growth and general business conditions) and fluctuations of interest rates, inflation, a decline in Bermuda’s sovereign credit rating, the successful completion and integration of acquisitions (including our progress on subsequent closings of the acquisition of trust assets from Credit Suisse) or the realization of the anticipated benefits of such acquisitions in the expected time-frames or at all, success in business retention (including the retention of relationships associated with our Credit Suisse acquisition) and obtaining new business, the impact of the COVID-19 pandemic, the success of our updated systems and platforms and other factors. Forward-looking statements can be identified by words such as "anticipate," "assume," "believe," "estimate," "expect," "indicate," "intend," "may," "plan," "point to," "predict," "project," "seek," "target," "potential," "will," "would," "could," "should," "continue," "contemplate" and other similar expressions, although not all forward-looking statements contain these identifying words. All statements other than statements of historical fact are statements that could be forward-looking statements.

All forward-looking statements in this disclosure are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in our SEC reports and filings, including under the caption "Risk Factors" in our most recent Form 20-F. Such reports are available upon request from Butterfield, or from the Securities and Exchange Commission ("SEC"), including through the SEC’s website at https://www.sec.gov. Any forward-looking statements made by Butterfield are current views as at the date they are made. Except as otherwise required by law, Butterfield assumes no obligation and does not undertake to review, update, revise or correct any of the forward-looking statements included in this disclosure, whether as a result of new information, future events or other developments. You are cautioned not to place undue reliance on the forward-looking statements made by Butterfield in this disclosure. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, and should only be viewed as historical data. BF-All

About Butterfield:

Butterfield is a full-service bank and wealth manager headquartered in Hamilton, Bermuda, providing services to clients from Bermuda, the Cayman Islands, Guernsey and Jersey, where our principal banking operations are located, and The Bahamas, Switzerland, Singapore and the United Kingdom, where we offer specialized financial services. Banking services comprise deposit, cash management and lending solutions for individual, business and institutional clients. Wealth management services are composed of trust, private banking, asset management and custody. In Bermuda, the Cayman Islands and Guernsey, we offer both banking and wealth management. In The Bahamas, Singapore and Switzerland, we offer select wealth management services. In the UK, we offer residential property lending. In Jersey, we offer select banking and wealth management services. Butterfield is publicly traded on the New York Stock Exchange (symbol: NTB) and the Bermuda Stock Exchange (symbol: NTB.BH). Further details on the Butterfield Group can be obtained from our website at: www.butterfieldgroup.com.

Investor Relations Contact: Media Relations Contact:

Noah Fields Nicky Stevens

Investor Relations Group Strategic Marketing & Communications

The Bank of N.T. Butterfield & Son Limited The Bank of N.T. Butterfield & Son Limited

Phone: (441) 299 3816 Phone: (441) 299 1624

E-mail: noah.fields@butterfieldgroup.com Cellular: (441) 524 4106

E-mail: nicky.stevens@butterfieldgroup.com

INDEX TO FINANCIAL STATEMENTS

| | | | | |

| Unaudited Consolidated Financial Statements | Page |

Consolidated Balance Sheets (unaudited) as of September 30, 2023 and December 31, 2022 | |

Consolidated Statements of Operations (unaudited) for the Three and Nine Months Ended September 30, 2023 and 2022 | |

Consolidated Statements of Comprehensive Income (unaudited) for the Three and Nine Months Ended September 30, 2023 and 2022 | |

Consolidated Statements of Changes in Shareholders’ Equity (unaudited) for the Three and Nine Months Ended September 30, 2023 and 2022 | |

Consolidated Statements of Cash Flows (unaudited) for the Nine Months Ended September 30, 2023 and 2022 | |

| Notes to the Consolidated Financial Statements (unaudited) | |

The Bank of N.T. Butterfield & Son Limited

Consolidated Balance Sheets (unaudited)

(In thousands of US dollars, except share and per share data)

| | | | | | | | |

| As at |

| September 30, 2023 | December 31, 2022 |

| Assets | | |

| Cash and demand deposits with banks - Non-interest bearing | 96,703 | | 93,032 | |

| Demand deposits with banks - Interest bearing | 167,775 | | 258,239 | |

| Cash equivalents - Interest bearing | 1,485,300 | | 1,749,516 | |

| Cash and cash equivalents | 1,749,778 | | 2,100,787 | |

| Securities purchased under agreements to resell | 154,113 | | 59,871 | |

| Short-term investments | 738,810 | | 884,478 | |

| Investment in securities | | |

| Equity securities at fair value | — | | 236 | |

| Available-for-sale at fair value (amortized cost: $2,035,947 (2022: $2,209,078)) | 1,797,940 | | 1,988,865 | |

| Held-to-maturity (fair value: $2,829,583 (2022: $3,197,508)) | 3,520,650 | | 3,738,080 | |

| Total investment in securities | 5,318,590 | | 5,727,181 | |

| Loans | | |

| Loans | 4,775,786 | | 5,121,391 | |

| Allowance for credit losses | (26,017) | | (24,961) | |

| Loans, net of allowance for credit losses | 4,749,769 | | 5,096,430 | |

| Premises, equipment and computer software, net | 153,949 | | 146,141 | |

| | |

| Goodwill | 23,100 | | 22,892 | |

| Other intangible assets, net | 47,533 | | 51,478 | |

| Equity method investments | 7,059 | | 12,484 | |

| Other real estate owned, net | 815 | | 800 | |

| | |

| Accrued interest and other assets | 236,010 | | 203,520 | |

| | |

| Total assets | 13,179,526 | | 14,306,062 | |

| | |

| Liabilities | | |

| Deposits | | |

| Non-interest bearing | 2,568,879 | | 3,039,701 | |

| Interest bearing | 9,292,147 | | 9,951,375 | |

| Total deposits | 11,861,026 | | 12,991,076 | |

| | |

| Employee benefit plans | 93,127 | | 92,018 | |

| | |

| | |

| | |

| Accrued interest and other liabilities | 204,003 | | 185,864 | |

| | |

| Total other liabilities | 297,130 | | 277,882 | |

| Long-term debt | 98,431 | | 172,289 | |

| Total liabilities | 12,256,587 | | 13,441,247 | |

| Commitments, contingencies and guarantees (Note 10) | | |

| | |

| Shareholders' equity | | |

| | |

Common share capital (BMD 0.01 par; authorized voting ordinary shares 2,000,000,000 and non-voting ordinary shares 6,000,000,000) issued and outstanding: 48,689,935 (2022: 50,277,466) | 488 | | 503 | |

| | |

| Additional paid-in capital | 1,005,558 | | 1,032,632 | |

| Retained earnings (Accumulated deficit) | 320,825 | | 229,732 | |

| Less: treasury common shares, at cost: 619,212 (2022: 619,212) | (17,845) | | (20,600) | |

| Accumulated other comprehensive income (loss) | (386,087) | | (377,452) | |

| Total shareholders’ equity | 922,939 | | 864,815 | |

| Total liabilities and shareholders’ equity | 13,179,526 | | 14,306,062 | |

| | |

The accompanying notes are an integral part of these consolidated financial statements.

The Bank of N.T. Butterfield & Son Limited

Consolidated Statements of Operations (unaudited)

(In thousands of US dollars, except per share data)

| | | | | | | | | | | | | | |

| Three months ended | Nine months ended |

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 |

| Non-interest income | | | | |

| Asset management | 7,999 | | 7,413 | | 24,165 | | 22,294 | |

| Banking | 14,066 | | 14,051 | | 40,219 | | 39,647 | |

| Foreign exchange revenue | 11,358 | | 11,834 | | 33,353 | | 36,311 | |

| Trust | 14,670 | | 12,568 | | 41,765 | | 38,572 | |

| Custody and other administration services | 3,318 | | 3,343 | | 9,981 | | 10,271 | |

| | | | |

| | | | |

| | | | |

| Other non-interest income | 579 | | 711 | | 2,842 | | 4,556 | |

| Total non-interest income | 51,990 | | 49,920 | | 152,325 | | 151,651 | |

| Interest income | | | | |

| Interest and fees on loans | 80,373 | | 65,268 | | 237,646 | | 175,866 | |

| Investments (none of the investment securities are intrinsically tax-exempt) | | | | |

| | | | |

| Available-for-sale | 8,797 | | 8,518 | | 26,463 | | 30,023 | |

| Held-to-maturity | 19,701 | | 20,893 | | 60,794 | | 55,796 | |

| Cash and cash equivalents, securities purchased under agreements to resell and short-term investments | 28,823 | | 9,969 | | 81,164 | | 15,225 | |

| Total interest income | 137,694 | | 104,648 | | 406,067 | | 276,910 | |

| Interest expense | | | | |

| Deposits | 46,131 | | 11,095 | | 119,316 | | 20,720 | |

| Long-term debt | 1,371 | | 2,400 | | 6,720 | | 7,201 | |

| Securities sold under agreement to repurchase | — | | — | | 9 | | — | |

| Total interest expense | 47,502 | | 13,495 | | 126,045 | | 27,921 | |

| Net interest income before provision for credit losses | 90,192 | | 91,153 | | 280,022 | | 248,989 | |

| Provision for credit (losses) recoveries | (531) | | (793) | | (2,729) | | (783) | |

| Net interest income after provision for credit losses | 89,661 | | 90,360 | | 277,293 | | 248,206 | |

| Net gains (losses) on equity securities | — | | 42 | | 43 | | 28 | |

| Net realized gains (losses) on available-for-sale investments | (3) | | — | | (14) | | — | |

| | | | |

| | | | |

| Net gains (losses) on other real estate owned | 9 | | (25) | | 38 | | 14 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Net other gains (losses) | — | | 54 | | 4,015 | | 910 | |

| Total other gains (losses) | 6 | | 71 | | 4,082 | | 952 | |

| Total net revenue | 141,657 | | 140,351 | | 433,700 | | 400,809 | |

| Non-interest expense | | | | |

| Salaries and other employee benefits | 49,929 | | 41,005 | | 133,452 | | 122,424 | |

| Technology and communications | 15,958 | | 14,295 | | 44,782 | | 42,411 | |

| Professional and outside services | 4,294 | | 4,839 | | 14,087 | | 15,323 | |

| Property | 7,744 | | 7,923 | | 22,682 | | 23,414 | |

| Indirect taxes | 5,392 | | 5,192 | | 16,435 | | 16,599 | |

| Non-service employee benefits expense | 1,398 | | 958 | | 4,193 | | 2,823 | |

| Marketing | 1,549 | | 1,456 | | 4,747 | | 4,547 | |

| Amortization of intangible assets | 1,438 | | 1,402 | | 4,292 | | 4,286 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other expenses | 4,828 | | 4,921 | | 15,514 | | 15,112 | |

| Total non-interest expense | 92,530 | | 81,991 | | 260,184 | | 246,939 | |

| Net income before income taxes | 49,127 | | 58,360 | | 173,516 | | 153,870 | |

| Income tax benefit (expense) | (381) | | (929) | | (1,566) | | (2,959) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Net income | 48,746 | | 57,431 | | 171,950 | | 150,911 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Earnings per common share | | | | |

| Basic earnings per share | 1.00 | | 1.16 | | 3.49 | | 3.04 | |

| Diluted earnings per share | 0.99 | | 1.15 | | 3.46 | | 3.03 | |

| | | | |

| | | | |

| | | | |

The accompanying notes are an integral part of these consolidated financial statements.

The Bank of N.T. Butterfield & Son Limited

Consolidated Statements of Comprehensive Income (unaudited)

(In thousands of US dollars)

| | | | | | | | | | | | | | |

| Three months ended | Nine months ended |

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 |

| | | | |

| Net income | 48,746 | | 57,431 | | 171,950 | | 150,911 | |

| | | | |

| Other comprehensive income (loss), net of taxes | | | | |

Unrealized net gains (losses) on translation of net investment in foreign operations | (704) | | (4,305) | | (348) | | (8,388) | |

Net changes on investments transferred to held-to-maturity | 2,651 | | 3,080 | | 7,282 | | (93,860) | |

| Unrealized net gains (losses) on available-for-sale investments | (30,752) | | (88,092) | | (16,694) | | (218,201) | |

| Employee benefit plans adjustments | 508 | | 1,773 | | 1,125 | | 4,382 | |

| Other comprehensive income (loss), net of taxes | (28,297) | | (87,544) | | (8,635) | | (316,067) | |

| | | | |

| Total comprehensive income (loss) | 20,449 | | (30,113) | | 163,315 | | (165,156) | |

The accompanying notes are an integral part of these consolidated financial statements.

The Bank of N.T. Butterfield & Son Limited

Consolidated Statements of Changes in Shareholders' Equity (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | Nine months ended |

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 |

| Number of shares | In thousands of

US dollars | Number of shares | In thousands of

US dollars | Number of shares | In thousands of

US dollars | Number of shares | In thousands of

US dollars |

| Common share capital issued and outstanding | | | | | | | | |

| Balance at beginning of period | 49,757,131 | | 498 | | 50,248,890 | | 502 | | 50,277,466 | | 503 | | 49,911,351 | | 499 | |

| | | | | | | | |

| Retirement of shares | (1,075,131) | | (10) | | — | | — | | (1,943,126) | | (19) | | (102,000) | | (1) | |

| Issuance of common shares | 7,935 | | — | | 9,058 | | 1 | | 355,595 | | 4 | | 448,597 | | 5 | |

| Balance at end of period | 48,689,935 | | 488 | | 50,257,948 | | 503 | | 48,689,935 | | 488 | | 50,257,948 | | 503 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Additional paid-in capital | | | | | | | | |

| Balance at beginning of period | | 1,024,846 | | | 1,023,097 | | | 1,032,632 | | | 1,017,640 | |

| Share-based compensation | | 5,038 | | | 4,351 | | | 14,524 | | | 11,297 | |

| Share-based settlements | | 22 | | | 18 | | | 557 | | | 613 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Retirement of shares | | (24,348) | | | — | | | (42,151) | | | (2,080) | |

| | | | | | | | |

| | | | | | | | |

Issuance of common shares, net of underwriting discounts and commissions | | — | | | (1) | | | (4) | | | (5) | |

| | | | | | | | |

| Balance at end of period | | 1,005,558 | | | 1,027,465 | | | 1,005,558 | | | 1,027,465 | |

| | | | | | | | |

| Retained earnings (Accumulated deficit) | | | | | | | | |

| Balance at beginning of period | | 300,375 | | | 152,880 | | | 229,732 | | | 104,329 | |

| | | | | | | | |

| Net Income for the period | | 48,746 | | | 57,431 | | | 171,950 | | | 150,911 | |

Common share cash dividends declared and paid, $0.44 and $1.32 per share (2022: $0.44 and $1.32 per share) | | (21,426) | | | (21,839) | | | (65,250) | | | (65,494) | |

| Retirement of shares | | (6,870) | | | — | | | (15,607) | | | (1,274) | |

| | | | | | | | |

| | | | | | | | |

| Balance at end of period | | 320,825 | | | 188,472 | | | 320,825 | | | 188,472 | |

| | | | | | | | |

| Treasury common shares | | | | | | | | |

| Balance at beginning of period | 619,212 | | (17,651) | | 619,212 | | (20,600) | | 619,212 | | (20,600) | | 619,212 | | (20,058) | |

| Purchase of treasury common shares | 1,075,131 | | (31,423) | | — | | — | | 1,943,126 | | (55,023) | | 102,000 | | (3,897) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Retirement of shares | (1,075,131) | | 31,229 | | — | | — | | (1,943,126) | | 57,778 | | (102,000) | | 3,355 | |

| Balance at end of period | 619,212 | | (17,845) | | 619,212 | | (20,600) | | 619,212 | | (17,845) | | 619,212 | | (20,600) | |

| | | | | | | | |

| Accumulated other comprehensive income (loss) | | | | | | | | |

| Balance at beginning of period | | (357,790) | | | (353,440) | | | (377,452) | | | (124,917) | |

Other comprehensive income (loss), net of taxes | | (28,297) | | | (87,544) | | | (8,635) | | | (316,067) | |

| Balance at end of period | | (386,087) | | | (440,984) | | | (386,087) | | | (440,984) | |

| Total shareholders' equity | | 922,939 | | | 754,856 | | | 922,939 | | | 754,856 | |

The accompanying notes are an integral part of these consolidated financial statements.

The Bank of N.T. Butterfield & Son Limited

Consolidated Statements of Cash Flows (unaudited)

(In thousands of US dollars)

| | | | | | | | | |

| Nine months ended |

| September 30, 2023 | September 30, 2022 | |

| Cash flows from operating activities | | | |

| Net income | 171,950 | | 150,911 | | |

| | | |

| | | |

| Adjustments to reconcile net income to operating cash flows | | | |

| Depreciation and amortization | 26,850 | | 31,260 | | |

| Provision for credit losses (recoveries) | 2,729 | | 783 | | |

| Share-based payments and settlements | 15,081 | | 11,910 | | |

| | | |

| Net change in equity securities at fair value | 236 | | (28) | | |

| Net realized (gains) losses on available-for-sale investments | 14 | | — | | |

| | | |

| | | |

| | | |

| Net (gains) losses on other real estate owned | (38) | | (14) | | |

| (Increase) decrease in carrying value of equity method investments | 209 | | 238 | | |

| Dividends received from equity method investments | 5,216 | | 119 | | |

| | | |

| | | |

| | | |

| Net other non-cash movements | 1,089 | | — | | |

| Changes in operating assets and liabilities | | | |

| (Increase) decrease in accrued interest receivable and other assets | (30,995) | | (58,569) | | |

| Increase (decrease) in employee benefit plans, accrued interest payable and other liabilities | (6,351) | | 11,005 | | |

| Cash provided by (used in) operating activities | 185,990 | | 147,615 | | |

| | | |

| Cash flows from investing activities | | | |

| (Increase) decrease in securities purchased under agreements to resell | (94,242) | | (252,838) | | |

| Short-term investments other than restricted cash: proceeds from maturities and sales | 1,595,489 | | 2,218,276 | | |

| Short-term investments other than restricted cash: purchases | (1,394,737) | | (1,812,381) | | |

| Available-for-sale investments: proceeds from sale | 5,586 | | — | | |

| Available-for-sale investments: proceeds from maturities and pay downs | 240,789 | | 198,451 | | |

| Available-for-sale investments: purchases | (71,859) | | (83,900) | | |

| Held-to-maturity investments: proceeds from maturities and pay downs | 216,951 | | 327,401 | | |

| Held-to-maturity investments: purchases | — | | (383,332) | | |

| Net (increase) decrease in loans | 375,529 | | (131,421) | | |

| Additions to premises, equipment and computer software | (21,409) | | (20,783) | | |

| | | |

| Proceeds from sale of other real estate owned | 359 | | 731 | | |

| | | |

| | | |

| | | |

| Cash provided by (used in) investing activities | 852,456 | | 60,204 | | |

| | | |

| Cash flows from financing activities | | | |

| Net increase (decrease) in deposits | (1,180,727) | | (695,114) | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Repayment of long-term debt | (75,000) | | — | | |

| Common shares repurchased | (55,023) | | (3,897) | | |

| | | |

| | | |

| | | |

| Cash dividends paid on common shares | (65,250) | | (65,494) | | |

| | | |

| | | |

| Cash provided by (used in) financing activities | (1,376,000) | | (764,505) | | |

| Net effect of exchange rates on cash, cash equivalents and restricted cash | (1,955) | | (139,283) | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (339,509) | | (695,969) | | |

| Cash, cash equivalents and restricted cash: beginning of period | 2,116,546 | | 2,203,497 | | |

| Cash, cash equivalents and restricted cash: end of period | 1,777,037 | | 1,507,528 | | |

| | | |

| Components of cash, cash equivalents and restricted cash at end of period | | | |

| Cash and cash equivalents | 1,749,778 | | 1,484,819 | | |

| Restricted cash included in short-term investments on the consolidated balance sheets | 27,259 | | 22,709 | | |

| Total cash, cash equivalents and restricted cash at end of period | 1,777,037 | | 1,507,528 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Supplemental disclosure of non-cash items | | | |

| Transfer to (out of) other real estate owned | 336 | | 1,193 | | |

| Transfer of available-for-sale investments to held-to-maturity investments | — | | 998,157 | | |

| Initial recognition of right-of-use assets and operating lease liabilities | — | | 138 | | |

| | | |

| | | |

The accompanying notes are an integral part of these consolidated financial statements.

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited)

(In thousands of US dollars, unless otherwise stated)

Note 1: Nature of business

The Bank of N.T. Butterfield & Son Limited (“Butterfield”, the “Bank” or the “Company”) is incorporated under the laws of Bermuda and has a banking license under the Banks and Deposit Companies Act, 1999 (“the Act”). Butterfield is regulated by the Bermuda Monetary Authority (“BMA”), which operates in accordance with Basel principles.

Butterfield is a full service bank and wealth manager headquartered in Hamilton, Bermuda. The Bank operates its business through three geographic segments: Bermuda, the Cayman Islands, and the Channel Islands and the United Kingdom ("UK"), where its principal banking operations are located and where it offers specialized financial services. Butterfield offers banking services, comprised of retail and corporate banking, and wealth management, which consists of trust, private banking, and asset management. In the Bermuda and Cayman Islands segments, Butterfield offers both banking and wealth management. In the Channel Islands and the UK segment, the Bank offers wealth management and residential property lending. Butterfield also has operations in the jurisdictions of The Bahamas, Canada, Mauritius, Singapore and Switzerland, which are included in our Other segment.

The Bank's common shares trade on the New York Stock Exchange under the symbol "NTB" and on the Bermuda Stock Exchange ("BSX") under the symbol "NTB.BH".

Note 2: Significant accounting policies

The accompanying unaudited interim consolidated financial statements of the Bank have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and should be read in conjunction with the Bank’s audited financial statements for the year ended December 31, 2022.

In the opinion of Management, these unaudited interim consolidated financial statements reflect all adjustments (consisting primarily of normal recurring accruals) considered necessary for a fair statement of the Bank’s financial position and results of operations as at the end of and for the periods presented. The Bank’s results for interim periods are not necessarily indicative of results for the full year.

The preparation of financial statements in conformity with GAAP requires Management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the unaudited consolidated financial statements and the reported amounts of revenues and expenses during the reporting period, and actual results could differ from those estimates. Management believes that the most critical accounting policies upon which the financial condition depends and which involve the most complex or subjective decisions or assessments, are as follows:

•Allowance for credit losses

•Fair value of financial instruments

•Impairment of goodwill

•Employee benefit plans

•Share-based compensation

New Accounting Standards

Troubled Debt Restructurings and Vintage Disclosures

Beginning January 1, 2023, the Bank adopted Accounting Standards Update ("ASU") 2022-02, Financial Instruments - Credit Losses (Topic 326), Troubled Debt Restructurings and Vintage Disclosures. This ASU eliminates the accounting guidance for troubled debt restructurings ("TDRs") by creditors that have adopted the CECL model while enhancing disclosure requirements for loan refinancings and restructurings made with borrowers experiencing financial difficulty. In addition, this ASU also requires disclosure of current period gross charge-offs by year of origination. The Bank has elected to adopt these amendments on a prospective basis.

Accordingly, from the date of adoption, the Bank will evaluate whether a modified loan represents a new loan or a continuation of an existing loan. If the effective yield on the restructured loan is at least equal to the effective yield for comparable loans with similar collection risks and the modifications to the original loan are more than minor, the Bank will derecognize the existing loan and recognize the restructured loan as a new loan. If a loan restructuring does not meet these conditions, the Bank will account for the modification as a continuation of the existing loan. See Note 6: Loans for the new required disclosures.

New Accounting Pronouncements

There were no accounting developments issued during the nine months ended September 30, 2023 or accounting standards pending adoption which impacted the Bank.

Note 3: Cash and cash equivalents

| | | | | | | | |

| September 30, 2023 | December 31, 2022 |

| | |

| Non-interest bearing | | |

| Cash and demand deposits with banks | 96,703 | | 93,032 | |

| | |

| Interest bearing¹ | | |

| Demand deposits with banks | 167,775 | | 258,239 | |

| Cash equivalents | 1,485,300 | | 1,749,516 | |

| Sub-total - Interest bearing | 1,653,075 | | 2,007,755 | |

| | |

| Total cash and cash equivalents | 1,749,778 | | 2,100,787 | |

¹Interest bearing cash and cash equivalents includes certain demand deposits with banks as at September 30, 2023 in the amount of $111.5 million (December 31, 2022: $157.2 million) that are earning interest at a negligible rate.

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited)

(In thousands of US dollars, unless otherwise stated)

Note 4: Short-term investments

| | | | | | | | |

| September 30, 2023 | December 31, 2022 |

| | |

| Unrestricted | | |

| Maturing within three months | 368,199 | | 390,540 | |

| Maturing between three to six months | 301,679 | | 421,734 | |

| Maturing between six to twelve months | 41,673 | | 56,445 | |

| Total unrestricted short-term investments | 711,551 | | 868,719 | |

| | |

| Affected by drawing restrictions related to minimum reserve and derivative margin requirements | |

| | |

| Interest earning demand and term deposits | 27,259 | | 15,759 | |

| Total restricted short-term investments | 27,259 | | 15,759 | |

| | |

| Total short-term investments | 738,810 | | 884,478 | |

Note 5: Investment in securities

Amortized Cost, Carrying Amount and Fair Value

On the consolidated balance sheets, equity securities and available-for-sale ("AFS") investments are carried at fair value and held-to-maturity ("HTM") investments are carried at amortized cost.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2023 | December 31, 2022 |

| Amortized

cost | Gross

unrealized

gains | Gross

unrealized

losses | Fair value | Amortized

cost | Gross

unrealized

gains | Gross

unrealized

losses | Fair value |

| Equity securities | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Mutual funds | — | | — | | — | | — | | 724 | | — | | (488) | | 236 | |

| Total equity securities | — | | — | | — | | — | | 724 | | — | | (488) | | 236 | |

| | | | | | | | |

| Available-for-sale | | | | | | | | |

| | | | | | | | |

| US government and federal agencies | 1,749,637 | | — | | (227,848) | | 1,521,789 | | 1,919,285 | | 14 | | (206,523) | | 1,712,776 | |

| Non-US governments debt securities | 266,321 | | — | | (7,557) | | 258,764 | | 262,892 | | — | | (11,429) | | 251,463 | |

| | | | | | | | |

| Asset-backed securities - Student loans | 40 | | — | | — | | 40 | | 5,640 | | — | | (14) | | 5,626 | |

| | | | | | | | |

| Residential mortgage-backed securities | 19,949 | | — | | (2,602) | | 17,347 | | 21,261 | | — | | (2,261) | | 19,000 | |

| | | | | | | | |

| Total available-for-sale | 2,035,947 | | — | | (238,007) | | 1,797,940 | | 2,209,078 | | 14 | | (220,227) | | 1,988,865 | |

| | | | | | | | |

| Held-to-maturity¹ | | | | | | | | |

| US government and federal agencies | 3,520,650 | | — | | (691,067) | | 2,829,583 | | 3,738,080 | | — | | (540,572) | | 3,197,508 | |

| Total held-to-maturity | 3,520,650 | | — | | (691,067) | | 2,829,583 | | 3,738,080 | | — | | (540,572) | | 3,197,508 | |

¹For the nine months ended September 30, 2023, and the nine months ended September 30, 2022, the provision for credit losses for HTM investments was nil.

Investments with Unrealized Loss Positions

The Bank does not believe that the AFS debt securities that were in an unrealized loss position as of September 30, 2023, comprising 170 securities representing 100% of the AFS portfolios' carrying value (December 31, 2022: 163 and 99.8%), represent credit losses. Total gross unrealized AFS losses were 13.2% of the fair value of the affected securities (December 31, 2022: 11.1%).

The Bank’s HTM debt securities are comprised of US government and federal agencies securities and have a zero credit loss assumption under the CECL model. HTM debt securities that were in an unrealized loss position as of September 30, 2023, were comprised of 219 securities representing 100% of the HTM portfolios’ carrying value (December 31, 2022: 220 and 100.0%). Total gross unrealized HTM losses were 24.4% of the fair value of affected securities (December 31, 2022: 16.9%).

Management does not intend to sell and it is likely that management will not be required to sell the securities prior to the anticipated recovery of the cost of these securities. Unrealized losses were attributable primarily to changes in market interest rates, relative to when the investment securities were purchased, and not due to a decrease in the credit quality of the investment securities. The issuers continue to make timely principal and interest payments on the securities. The following describes the processes for identifying credit impairment in security types with the most significant unrealized losses as shown in the preceding tables.

Management believes that all the US government and federal agencies securities do not have any credit losses, given the explicit and implicit guarantees provided by the US federal government.

Management believes that all the Non-US governments debt securities do not have any credit losses, given the explicit guarantee provided by the issuing government.

Investments in Asset-backed securities - Student loans are composed of securities collateralized by Federal Family Education Loan Program loans (“FFELP loans”). FFELP loans benefit from a US federal government guarantee of at least 97% of defaulted principal and accrued interest, with additional credit support provided in the form of over-collateralization, subordination and excess spread, which collectively total in excess of 100%. Accordingly, the vast majority of FFELP loan-backed securities are not exposed to traditional consumer credit risk.

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited) (continued)

(In thousands of US dollars, unless otherwise stated)

Investments in Residential mortgage-backed securities relates to 13 securities (December 31, 2022: 13) which are rated AAA and possess similar significant credit enhancement as described above. No credit losses were recognized on these securities as the weighted average credit support and the weighted average loan-to-value ratios range from 15.6% - 49.1% and 46.1% - 54.8%, respectively. Current credit support is significantly greater than any delinquencies experienced on the underlying mortgages.

In the following tables, debt securities with unrealized losses that are not deemed to be credit impaired and for which an allowance for credit losses has not been recorded are categorized as being in a loss position for "less than 12 months" or "12 months or more" based on the point in time that the fair value most recently declined below the amortized cost basis. | | | | | | | | | | | | | | | | | | | | |

| Less than 12 months | 12 months or more | | |

| September 30, 2023 | Fair

value | Gross

unrealized

losses | Fair

value | Gross

unrealized

losses | Total

fair value | Total gross

unrealized

losses |

| Available-for-sale securities with unrealized losses | | | | | | |

| | | | | | |

| US government and federal agencies | 78,492 | | (1,102) | | 1,443,297 | | (226,746) | | 1,521,789 | | (227,848) | |

| Non-US governments debt securities | — | | — | | 258,764 | | (7,557) | | 258,764 | | (7,557) | |

| | | | | | |

| Asset-backed securities - Student loans | — | | — | | 40 | | — | | 40 | | — | |

| | | | | | |

| Residential mortgage-backed securities | — | | — | | 17,347 | | (2,602) | | 17,347 | | (2,602) | |

| Total available-for-sale securities with unrealized losses | 78,492 | | (1,102) | | 1,719,448 | | (236,905) | | 1,797,940 | | (238,007) | |

| | | | | | |

| Held-to-maturity securities with unrealized losses | | | | | | |

| US government and federal agencies | — | | — | | 2,829,583 | | (691,067) | | 2,829,583 | | (691,067) | |

| | | | | | |

| | | | | | |

| Less than 12 months | 12 months or more | | |

| December 31, 2022 | Fair

value | Gross

unrealized

losses | Fair

value | Gross

unrealized

losses | Total

fair value | Total gross

unrealized

losses |

| Available-for-sale securities with unrealized losses | | | | | | |

| | | | | | |

| US government and federal agencies | 713,462 | | (68,016) | | 995,154 | | (138,507) | | 1,708,616 | | (206,523) | |

| Non-US governments debt securities | — | | — | | 251,463 | | (11,429) | | 251,463 | | (11,429) | |

| | | | | | |

| Asset-backed securities - Student loans | — | | — | | 5,626 | | (14) | | 5,626 | | (14) | |

| | | | | | |

| Residential mortgage-backed securities | 14,474 | | (1,618) | | 4,526 | | (643) | | 19,000 | | (2,261) | |

| Total available-for-sale securities with unrealized losses | 727,936 | | (69,634) | | 1,256,769 | | (150,593) | | 1,984,705 | | (220,227) | |

| | | | | | |

| Held-to-maturity securities with unrealized losses | | | | | | |

| US government and federal agencies | 1,462,005 | | (142,228) | | 1,735,503 | | (398,344) | | 3,197,508 | | (540,572) | |

| | | | | | |

Investment Maturities

The following table presents the remaining term to contractual maturity of the Bank’s securities. The actual maturities may differ as certain securities offer prepayment options to the borrowers.

| | | | | | | | | | | | | | | | | | | | | | | |

| Remaining term to maturity | | |

| September 30, 2023 | Within

3 months | 3 to 12

months | 1 to 5

years | 5 to 10

years | Over

10 years | No specific or single

maturity | Carrying

amount |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Available-for-sale | | | | | | | |

| | | | | | | |

| US government and federal agencies | — | | 202,473 | | 494,506 | | — | | — | | 824,810 | | 1,521,789 | |

| Non-US governments debt securities | 22,392 | | 150,151 | | 86,221 | | — | | — | | — | | 258,764 | |

| | | | | | | |

| Asset-backed securities - Student loans | — | | — | | — | | — | | — | | 40 | | 40 | |

| | | | | | | |

| Residential mortgage-backed securities | — | | — | | — | | — | | — | | 17,347 | | 17,347 | |

| | | | | | | |

| Total available-for-sale | 22,392 | | 352,624 | | 580,727 | | — | | — | | 842,197 | | 1,797,940 | |

| | | | | | | |

| Held-to-maturity | | | | | | | |

| US government and federal agencies | — | | — | | — | | — | | — | | 3,520,650 | | 3,520,650 | |

| | | | | | | |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited) (continued)

(In thousands of US dollars, unless otherwise stated)

Pledged Investments

The Bank pledges certain US government and federal agencies investment securities to further secure the Bank's issued customer deposit products. The secured party does not have the right to sell or repledge the collateral.

| | | | | | | | | | | | | | |

| September 30, 2023 | December 31, 2022 |

| Pledged Investments | Amortized

cost | Fair

value | Amortized

cost | Fair

value |

| Available-for-sale | 28,632 | | 25,567 | | — | | — | |

| Held-to-maturity | 135,543 | | 113,724 | | 32,938 | | 24,991 | |

Sale Proceeds and Realized Gains and Losses of AFS Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended |

| September 30, 2023 | September 30, 2022 |

| Sale proceeds | Gross realized gains | Gross realized

(losses) | Transfers to HTM | Sale

proceeds | Gross realized

gains | Gross realized

(losses) | Transfers to HTM1 |

| Asset-backed securities - Student loans | 5,586 | | — | | (14) | | — | | — | | — | | — | | — | |

| US government and federal agencies | — | | — | | — | | — | | — | | — | | — | | 998,157 | |

| Total | 5,586 | | — | | (14) | | — | | — | | — | | — | | 998,157 | |

1During the nine months ended September 30, 2022, certain investments were transferred out of the AFS categorization and into HTM. The transfers were recorded at fair value of the securities on the date of transfer. The related net unrealized losses of $99.1 million that were recorded in AOCIL will be accreted over the remaining life of the transferred investments using the effective interest rate method.

Taxability of Interest Income

None of the investments' interest income have received a specific preferential income tax treatment in any of the jurisdictions in which the Bank owns investments.

Note 6: Loans

The principal means of securing residential mortgages, personal, credit card and business loans are entitlements over assets and guarantees. Mortgage loans are generally repayable over periods of up to thirty years and personal and business loans are generally repayable over terms not exceeding five years. Government loans are repayable over a variety of terms which are individually negotiated. Amounts owing on credit cards are revolving and typically a minimum amount is due within 30 days from billing. The credit card portfolio is managed as a single portfolio and includes consumer and business cards. The effective yield on total loans as at September 30, 2023 is 6.46% (December 31, 2022: 5.91%). The interest receivable on total loans as at September 30, 2023 is $21.7 million (December 31, 2022: $16.6 million). The interest receivable is included in Accrued interest and other assets on the consolidated balance sheets and is excluded from all loan amounts disclosed in this note.

Loans' Credit Quality

The four credit quality classifications set out in the following tables are defined below and describe the credit quality of the Bank's lending portfolio. These classifications each encompass a range of more granular internal credit rating grades. Loans' internal credit ratings are assigned by the Bank's customer relationship managers as well as members of the Bank's jurisdictional and Group Credit Committees. The borrowers' financial condition is documented at loan origination and maintained periodically thereafter at a frequency which can be up to monthly for certain loans. The loans' performing status, as well as current economic trends, are continuously monitored. The Bank's jurisdictional and Group Credit Committees meet on a monthly basis. The Bank also has a Group Provisions and Impairments Committee which is responsible for approving significant provisions and other impairment charges.

A pass loan shall mean a loan that is expected to be repaid as agreed. A loan is classified as pass where the Bank is not expected to face repayment difficulties because the present and projected cash flows are sufficient to repay the debt and the repayment schedule as established by the agreement is being followed. Loans in this category are reviewed by the Bank’s management on at least an annual basis.

A special mention loan shall mean a loan under close monitoring by the Bank’s management on at least a quarterly basis. Loans in this category are currently still performing, but are potentially weak and present an undue credit risk exposure, but not to the point of justifying a classification of substandard.

A substandard loan shall mean a loan whose evident unreliability makes repayment doubtful and there is a threat of loss to the Bank unless the unreliability is averted. Loans in this category are under close monitoring by the Bank’s management on at least a quarterly basis.

A non-accrual loan shall mean either management is of the opinion full payment of principal or interest is in doubt or that the principal or interest is 90 days past due unless it is a residential mortgage loan which is well secured and collection efforts are reasonably expected to result in amounts due. Loans in this category are under close monitoring by the Bank’s management on at least a quarterly basis.

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited) (continued)

(In thousands of US dollars, unless otherwise stated)

The amortized cost of loans by credit quality classification and allowance for expected credit losses by class of loans is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2023 | | | Pass | Special

mention | Substandard | Non-accrual | Total amortized cost | Allowance for expected credit losses | Total net loans |

| Commercial loans | | | | | | | | | |

| | | | | | | | | |

| Government | | | 277,981 | | — | | — | | — | | 277,981 | | (992) | | 276,989 | |

| Commercial and industrial | | | 267,173 | | — | | 870 | | 18,401 | | 286,444 | | (10,174) | | 276,270 | |

| Commercial overdrafts | | | 107,284 | | — | | 186 | | 382 | | 107,852 | | (387) | | 107,465 | |

| Total commercial loans | | | 652,438 | | — | | 1,056 | | 18,783 | | 672,277 | | (11,553) | | 660,724 | |

| | | | | | | | | |

| Commercial real estate loans | | | | | | | | | |

| Commercial mortgage | | | 586,094 | | 342 | | 1,411 | | 3,097 | | 590,944 | | (1,448) | | 589,496 | |

| Construction | | | 11,868 | | — | | — | | — | | 11,868 | | — | | 11,868 | |

| Total commercial real estate loans | | | 597,962 | | 342 | | 1,411 | | 3,097 | | 602,812 | | (1,448) | | 601,364 | |

| | | | | | | | | |

| Consumer loans | | | | | | | | | |

| Automobile financing | | | 19,582 | | — | | 17 | | 162 | | 19,761 | | (77) | | 19,684 | |

| Credit card | | | 79,811 | | — | | 480 | | — | | 80,291 | | (1,844) | | 78,447 | |

| Overdrafts | | | 39,608 | | — | | — | | 43 | | 39,651 | | (300) | | 39,351 | |

Other consumer1 | | | 41,625 | | — | | 1,611 | | 803 | | 44,039 | | (1,274) | | 42,765 | |

| Total consumer loans | | | 180,626 | | — | | 2,108 | | 1,008 | | 183,742 | | (3,495) | | 180,247 | |

| | | | | | | | | |

| Residential mortgage loans | | | 3,141,713 | | 18,172 | | 120,556 | | 36,514 | | 3,316,955 | | (9,521) | | 3,307,434 | |

| | | | | | | | | |

| Total | | | 4,572,739 | | 18,514 | | 125,131 | | 59,402 | | 4,775,786 | | (26,017) | | 4,749,769 | |

1Other consumer loans’ amortized cost includes $7 million of cash and portfolio secured lending and $26 million of lending secured by buildings in construction or other collateral.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2022 | | | Pass | Special

mention | Substandard | Non-accrual | Total amortized cost | Allowance for expected credit losses | Total net loans |

| Commercial loans | | | | | | | | | |

| | | | | | | | | |

| Government | | | 281,518 | | — | | — | | — | | 281,518 | | (1,368) | | 280,150 | |

| Commercial and industrial | | | 298,137 | | — | | 796 | | 18,461 | | 317,394 | | (10,359) | | 307,035 | |

| Commercial overdrafts | | | 123,874 | | — | | 632 | | 45 | | 124,551 | | (416) | | 124,135 | |

| Total commercial loans | | | 703,529 | | — | | 1,428 | | 18,506 | | 723,463 | | (12,143) | | 711,320 | |

| | | | | | | | | |

| Commercial real estate loans | | | | | | | | | |

| Commercial mortgage | | | 613,090 | | 2,082 | | 1,503 | | 3,182 | | 619,857 | | (884) | | 618,973 | |

| Construction | | | 7,474 | | — | | — | | — | | 7,474 | | — | | 7,474 | |

| Total commercial real estate loans | | | 620,564 | | 2,082 | | 1,503 | | 3,182 | | 627,331 | | (884) | | 626,447 | |

| | | | | | | | | |

| Consumer loans | | | | | | | | | |

| Automobile financing | | | 20,673 | | — | | — | | 161 | | 20,834 | | (93) | | 20,741 | |

| Credit card | | | 77,419 | | — | | 295 | | — | | 77,714 | | (1,043) | | 76,671 | |

| Overdrafts | | | 44,414 | | — | | — | | 6 | | 44,420 | | (355) | | 44,065 | |

Other consumer1 | | | 56,699 | | — | | — | | 801 | | 57,500 | | (1,205) | | 56,295 | |

| Total consumer loans | | | 199,205 | | — | | 295 | | 968 | | 200,468 | | (2,696) | | 197,772 | |

| | | | | | | | | |

| Residential mortgage loans | | | 3,419,186 | | 8,132 | | 102,413 | | 40,398 | | 3,570,129 | | (9,238) | | 3,560,891 | |

| | | | | | | | | |

| Total | | | 4,942,484 | | 10,214 | | 105,639 | | 63,054 | | 5,121,391 | | (24,961) | | 5,096,430 | |

1Other consumer loans’ amortized cost includes $9 million of cash and portfolio secured lending and $37 million of lending secured by buildings in construction or other collateral.

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited) (continued)

(In thousands of US dollars, unless otherwise stated)

Based on the most recent analysis performed, the amortized cost of loans by year of origination and credit quality classification is as follows:

| | | | | | | | | | | | | | | | | |