Park Hotels & Resorts Inc. Announces Upsizing and Pricing of Senior Notes Offering

03 May 2024 - 6:56AM

Park Hotels & Resorts Inc. (“Park” or the “Company”) (NYSE: PK)

announced today that certain of its subsidiaries, Park Intermediate

Holdings LLC (the “Operating Company”), PK Domestic Property LLC

(“PK Domestic LLC”) and PK Finance Co-Issuer Inc. (together with

the Operating Company and PK Domestic LLC, the “Issuers”), priced

an offering of $550 million aggregate principal amount of 7.000%

senior notes due 2030 (the “Notes”) at a price equal to 100% of

face value. The Notes will pay interest semi-annually in arrears,

at a rate of 7.000% per year, and will mature on February 1, 2030.

The Notes will be guaranteed by Park, PK Domestic REIT Inc. and

certain subsidiaries of the Operating Company that guarantee the

Company’s senior credit facilities and existing senior notes.

The offering has been upsized from the

previously announced amount of $450 million. The Issuers intend to

use the net proceeds of the offering, together with proceeds of a

new unsecured term loan in an aggregate principal amount of at

least $200 million that is contemplated to be incurred pursuant to

an amendment to the Company’s existing credit agreement (the “Term

Loan”) to (i) purchase all $650 million of the Issuers’ 7.500%

Senior Notes due 2025 (the “2025 Notes”) that are validly tendered

and accepted for purchase pursuant to the Issuers’ previously

announced concurrent cash tender offer for any and all 2025 Notes

(the “Tender Offer”) and to redeem any 2025 Notes not tendered in

the Tender Offer and (ii) pay related fees and expenses incurred in

connection with the offering, the Tender Offer and the redemption,

with any remaining net proceeds used for general corporate

purposes. If the Tender Offer is not consummated, the Issuers

intend to use the net proceeds from the offering, together with

Term Loan proceeds, to (i) redeem in full the 2025 Notes and (ii)

pay related fees and expenses incurred in connection with the

offering and the redemption, with any remaining net proceeds used

for general corporate purposes. The Issuers anticipate that

consummation of the offering will occur on May 16, 2024, subject to

customary closing conditions.

The Notes and the related guarantees have not

been registered under the Securities Act of 1933, as amended (the

“Securities Act”), or any state securities laws. The Notes and the

guarantees may not be offered or sold in the United States except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and applicable

state securities laws. The Notes and the guarantees will be offered

only to persons reasonably believed to be “qualified institutional

buyers” in reliance on the exemption from registration provided by

Rule 144A under the Securities Act and to certain non-U.S. persons

in offshore transactions in reliance on Regulation S under the

Securities Act.

This press release is being issued pursuant to

and in accordance with Rule 135c under the Securities Act, and it

is neither an offer to sell nor a solicitation of an offer to buy

any securities and shall not constitute an offer to sell or a

solicitation of an offer to buy, or a sale of, the Notes or any

other securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

Forward Looking

StatementsThis press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements include, but are not limited to, statements related to

the effects of Park’s decision to cease payments on its $725

million non-recourse CMBS loan secured by the 1,921-room Hilton San

Francisco Union Square and the 1,024-room Parc 55 San Francisco – a

Hilton Hotel and the lender’s exercise of its remedies, including

placing such hotels into receivership, as well as Park’s current

expectations regarding the performance of its business, financial

results, liquidity and capital resources, including anticipated

repayment of certain of its indebtedness (including the 2025

Notes), the completion of capital allocation priorities, the

expected repurchase of Park’s stock, the impact from macroeconomic

factors (including inflation, elevated interest rates, potential

economic slowdown or a recession and geopolitical conflicts), the

effects of competition, the effects of future legislation or

regulations, the expected completion of anticipated dispositions,

the declaration, payment and any change in amounts of future

dividends and other non-historical statements. Forward-looking

statements include all statements that are not historical facts,

and in some cases, can be identified by the use of forward-looking

terminology such as the words “outlook,” “believes,” “expects,”

“potential,” “continues,” “may,” “will,” “should,” “could,”

“seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,”

“anticipates”, “hopes” or the negative version of these words or

other comparable words. You should not rely on forward-looking

statements since they involve known and unknown risks,

uncertainties and other factors which are, in some cases, beyond

Park’s control and which could materially affect its results of

operations, financial condition, cash flows, performance or future

achievements or events.

All such forward-looking statements are based on

current expectations of management and therefore involve estimates

and assumptions that are subject to risks, uncertainties and other

factors that could cause actual results to differ materially from

the results expressed in these forward-looking statements. You

should not put undue reliance on any forward-looking statements and

Park urges investors to carefully review the disclosures it makes

concerning risks and uncertainties under “Risk Factors” and in

Park’s Annual Report on Form 10-K for the year ended December 31,

2023, as such factors may be updated from time to time in its

periodic filings with the Securities and Exchange Commission (the

“SEC”), which are accessible on the SEC’s website at www.sec.gov.

Except as required by law, Park undertakes no obligation to update

or revise publicly any forward-looking statements, whether as a

result of new information, future events or otherwise.

For more information, contact:

Ian Weissman Senior Vice President, Corporate Strategy 571-302-5591

iweissman@pkhotelsandresorts.com

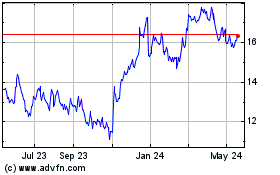

Park Hotels and Resorts (NYSE:PK)

Historical Stock Chart

From Nov 2024 to Dec 2024

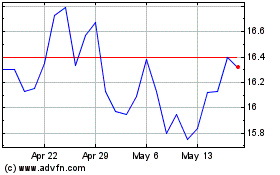

Park Hotels and Resorts (NYSE:PK)

Historical Stock Chart

From Dec 2023 to Dec 2024