UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16

OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission

File Number: 001-39902

RLX Technology Inc.

19/F, Building 1, Junhao

Central Park Plaza

No. 10 South Chaoyang

Park Avenue

Chaoyang District, Beijing

100026

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

RLX Technology Inc. |

| |

|

| |

|

|

|

| |

By |

: |

/s/ Chao Lu |

| |

Name: |

: |

Chao Lu |

| |

Title: |

: |

Chief Financial Officer |

Date: August 18, 2023

Exhibit 99.1

RLX Technology Announces Unaudited Second Quarter

2023 Financial Results

BEIJING,

August 18, 2023 /PRNEWSWIRE/ - RLX Technology Inc. ("RLX Technology" or the "Company") (NYSE: RLX), a leading

branded e-vapor company in China, today announced its unaudited financial results for the second quarter ended June 30, 2023.

Second Quarter 2023 Financial Highlights

| ● | Net revenues were RMB378.1

million (US$52.1 million) in the second quarter of 2023, compared with RMB2,233.9 million

in the same period of 2022. |

| ● | Gross margin was 26.1% in

the second quarter of 2023, compared with 43.8% in the same period of 2022. |

| ● | U.S. GAAP net income was RMB204.7

million (US$28.2 million) in the second quarter of 2023, compared with U.S. GAAP net income

of RMB441.6 million in the same period of 2022. |

| ● | Non-GAAP net income1

was RMB86.2 million (US$11.9 million) in the second quarter of 2023, compared with RMB634.7 million in the same period

of 2022. |

"During the second quarter of 2023, we continued

to firmly execute our core strategy amid the challenging market environment," said Ms. Ying (Kate) Wang, Co-founder, Chairperson

of the Board of Directors, and CEO of RLX Technology. "Specifically, we remained dedicated to offering compliant, high-quality products

while developing new products to meet users' evolving needs. Though the recent resurgence of illegal products has had a lingering impact

on our sales, we believe the impact will be temporary rather than a major trend that could derail our recovery trajectory. As a trusted

e-vapor brand for adult smokers, we remain confident that, supported by regulatory oversight, our premium products will continue to win

users' trust and gradually supplant inferior and harmful illegal products. Moving forward, we will continue prioritizing product innovation,

harm reduction, and quality control initiatives while further enhancing our product portfolio as we strive to create sustainable value

for all stakeholders."

Mr. Chao Lu, Chief Financial Officer of

RLX Technology, commented, "In light of the external challenges, especially the disruptions from illegal products, we deepened our

focus on efficiency and profitability improvement during the second quarter. Thanks to our supply chain optimizations and product design

enhancements, our topline improved sequentially to RMB378.1 million, and our gross margin rebounded by 1.9 percentage points from the

first quarter of 2023. We also strengthened cost control, which helped significantly narrow our non-GAAP operating loss. Notably, our

operating cash flow turned positive for the first time since the new regulations were enacted. We believe our strong cash position will

continue to support us in navigating the evolving markets, and we will pursue further gains in cost optimization and efficiency improvement

to accelerate the pace of recovery."

Second Quarter 2023 Financial Results

Net revenues were RMB378.1 million (US$52.1

million) in the second quarter of 2023, compared with RMB2,233.9 million in the same period of 2022. The decrease was primarily due to

the discontinuation of our older products and the negative impact of illegal products in the market after regulators' special action

ended in April, which disrupted users' adoption of our new products that comply with national standards.

Gross profit was RMB98.5 million (US$13.6

million) in the second quarter of 2023, compared with RMB977.9 million in the same period of 2022.

Gross margin was 26.1% in the second quarter

of 2023, compared with 43.8% in the same period of 2022. The decrease was primarily due to the imposition of a 36% excise tax which came

into effect on November 1, 2022.

1 Non-GAAP net income is a non-GAAP

financial measure. For more information on the Company's non-GAAP financial measures, please see the section “Non-GAAP Financial

Measures” and the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

Operating expenses were RMB47.2 million

(US$6.5 million) in the second quarter of 2023, compared with RMB530.9 million in the same period of 2022. The decrease was primarily

due to the change in share-based compensation expenses, which were positive RMB118.5 million (US$16.3 million) in the second quarter

of 2023, compared with RMB193.2 million in the same period of 2022. The change in share-based compensation expenses consisted of (i) positive

RMB15.3 million (US$2.1 million) recognized in selling expenses, (ii) positive RMB90.9 million (US$12.5 million) recognized in general

and administrative expenses, and (iii) positive RMB12.2 million (US$1.7 million) recognized in research and development expenses.

The change in share-based compensation expenses was primarily due to the changes in the fair value of the share incentive awards that

the Company granted to its employees affected by the fluctuations of the Company's share price.

Selling expenses were RMB45.2 million

(US$6.2 million) in the second quarter of 2023, compared with RMB122.6 million in the same period of 2022, primarily due to the decrease

in share-based compensation expenses.

General and administrative expenses were

positive RMB41.4 million (US$5.7 million) in the second quarter of 2023, compared with RMB290.7 million in the same period of 2022, mainly

driven by the fluctuation of share-based compensation expenses.

Research and development expenses were

RMB43.3 million (US$6.0 million) in the second quarter of 2023, compared with RMB117.6 million in the same period of 2022, mainly driven

by the decrease in share-based compensation expenses.

Income from operations was RMB51.4 million

(US$7.1 million) in the second quarter of 2023, compared with RMB446.9 million in the same period of 2022.

Income tax expense was RMB51.5 million

(US$7.1 million) in the second quarter of 2023, compared with RMB204.3 million in the same period of 2022.

U.S. GAAP net income was RMB204.7 million

(US$28.2 million) in the second quarter of 2023, compared with RMB441.6 million in the same period of 2022.

Non-GAAP net income was RMB86.2 million

(US$11.9 million) in the second quarter of 2023, compared with RMB634.7 million in the same period of 2022.

U.S. GAAP basic and diluted net income per

American depositary share ("ADS") were RMB0.154 (US$0.021) and RMB0.150 (US$0.021) in the second quarter of 2023, compared

with U.S. GAAP basic and diluted net income per ADS of RMB0.348 and RMB0.347, respectively, in the same period of 2022.

Non-GAAP basic and diluted net income per

ADS2 were RMB0.064 (US$0.009) and RMB0.062

(US$0.009), respectively, in the second quarter of 2023, compared with non-GAAP basic and diluted net income per ADS of RMB0.494 and

RMB0.492, respectively, in the same period of 2022.

Balance Sheet and Cash Flow

As of June 30, 2023, the Company had cash

and cash equivalents, restricted cash, short-term bank deposits, net, short-term investments, long-term bank deposits, net and long-term

investment securities, net of RMB15,786.6 million (US$2,177.1 million), compared with RMB15,369.2 million as of March 31, 2023.

For the second quarter ended June 30, 2023, net cash generated from operating

activities was RMB41.3 million (US$5.7 million).

2 Non-GAAP basic and diluted net income per ADS is a non-GAAP

financial measure. For more information on the Company's non-GAAP financial measures, please see the section “Non-GAAP Financial

Measures” and the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

Conference Call

The Company's management will host an earnings

conference call at 8:00 AM U.S. Eastern Time on August 18, 2023 (8:00 PM Beijing/Hong Kong Time on August 18, 2023).

Dial-in details for the earnings conference call

are as follows:

| United States (toll-free): |

+1-888-317-6003 |

| International: |

+1-412-317-6061 |

| Hong Kong, China (toll-free): |

+800-963-976 |

| Hong Kong, China: |

+852-5808-1995 |

| Mainland China: |

400-120-6115 |

| Participant Code: |

3325354 |

Participants should dial in 10 minutes before

the scheduled start time and ask to be connected to the call for "RLX Technology Inc." with the Participant Code as set forth

above.

Additionally, a live and archived webcast of

the conference call will be available on the Company's investor relations website at https://ir.relxtech.com.

A replay of the conference call will be accessible

approximately two hours after the conclusion of the call until August 25, 2023, by dialing the following telephone numbers:

| United States: |

+1-877-344-7529 |

| International: |

+1-412-317-0088 |

| Replay Access Code: |

5550144 |

About RLX Technology Inc.

RLX Technology Inc. (NYSE: RLX) is a leading

branded e-vapor company in China. The Company leverages its strong in-house technology, product development capabilities, and in-depth

insights into adult smokers' needs to develop superior e-vapor products.

For more information, please visit: http://ir.relxtech.com.

Non-GAAP Financial Measures

The Company uses non-GAAP net income and non-GAAP

basic and diluted net income per ADS, each a non-GAAP financial measure, in evaluating its operating results and for financial and operational

decision-making purposes. Non-GAAP net income represents net income excluding share-based compensation expenses. Non-GAAP basic and diluted

net income per ADS is computed using non-GAAP net income attributable to RLX Technology Inc. and the same number of ADSs used in U.S.

GAAP basic and diluted net income per ADS calculation.

The Company presents these non-GAAP financial

measures because they are used by the management to evaluate its operating performance and formulate business plans. The Company believes

that they help identify underlying trends in its business that could otherwise be distorted by the effect of certain expenses that are

included in net income. The Company also believes that the use of the non-GAAP measures facilitates investors' assessment of its operating

performance, as they could provide useful information about its operating results, enhances the overall understanding of its past performance

and future prospects and allows for greater visibility with respect to key metrics used by the management in its financial and operational

decision making.

The non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools.

They should not be considered in isolation or construed as an alternative to net income, basic and diluted net income per ADS or any

other measure of performance or as an indicator of its operating performance. Investors are encouraged to review its historical non-GAAP

financial measures to the most directly comparable U.S. GAAP measures. The non-GAAP financial measures here may not be comparable to

similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting

their usefulness as comparative measures to our data. The Company encourages investors and others to review its financial information

in its entirety and not rely on any single financial measure.

For more information on the non-GAAP financial

measures, please see the table captioned "Unaudited Reconciliation of GAAP and non-GAAP Results" set forth at the end of this

press release.

Exchange Rate Information

This announcement contains translations of certain

RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations

from RMB to U.S. dollars and from U.S. dollars to RMB are made at a rate of RMB7.2513 to US$1.00, the exchange rate on June 30,

2023, set forth in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or U.S.

dollar amounts referred could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology such as "may," "will," "expect," "anticipate,"

"aim," "estimate," "intend," "plan," "believe," "is/are likely to," "potential,"

"continue" and similar statements. Among other things, quotations from management in this announcement, as well as the Company's

strategic and operational plans, contain forward- looking statements. The Company may also make written or oral forward-looking statements

in its periodic reports to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical

facts, including but not limited to statements about the Company's beliefs and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained

in any forward-looking statement, including but not limited to the following: the Company's growth strategies; its future business development,

results of operations and financial condition; trends and competition in China's e-vapor market; changes in its revenues and certain

cost or expense items; PRC governmental policies, laws and regulations relating to the Company's industry, and general economic and business

conditions globally and in China and assumptions underlying or related to any of the foregoing. Further information regarding these risks,

uncertainties or factors is included in the Company's filings with the U.S. Securities and Exchange Commission. All information provided

in this press release and in the attachments is current as of the date of this press release, and the Company does not undertake any

obligation to update such information, except as required under applicable law.

For more information, please contact:

In China:

RLX Technology Inc.

Head of Capital Markets

Sam Tsang

Email: ir@relxtech.com

Piacente Financial Communications

Jenny Cai

Tel: +86-10-6508-0677

Email: RLX@tpg-ir.com

In the United States:

Piacente Financial Communications.

Brandi Piacente

Tel: +1-212-481-2050

Email: RLX@tpg-ir.com

RLX

TECHNOLOGY INC.

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

(All

amounts in thousands)

| | |

As of | |

| | |

December 31, | | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 1,268,512 | | |

| 1,761,694 | | |

| 242,949 | |

| Restricted cash | |

| 20,574 | | |

| 15,750 | | |

| 2,172 | |

| Short-term bank deposits, net | |

| 7,084,879 | | |

| 5,221,295 | | |

| 720,049 | |

| Receivables from online payment platforms | |

| 3,000 | | |

| 4,948 | | |

| 682 | |

| Short-term investments | |

| 2,434,864 | | |

| 2,210,005 | | |

| 304,774 | |

| Accounts and notes receivable, net | |

| 51,381 | | |

| 87,412 | | |

| 12,055 | |

| Inventories | |

| 130,901 | | |

| 90,178 | | |

| 12,436 | |

| Amounts due from related parties | |

| 5,112 | | |

| 38,352 | | |

| 5,289 | |

| Prepayments and other current assets, net | |

| 198,932 | | |

| 397,337 | | |

| 54,795 | |

| Total current assets | |

| 11,198,155 | | |

| 9,826,971 | | |

| 1,355,201 | |

| | |

| | | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Property, equipment and leasehold improvement, net | |

| 87,871 | | |

| 78,755 | | |

| 10,861 | |

| Intangible assets, net | |

| 7,552 | | |

| 6,977 | | |

| 962 | |

| Long-term investments, net | |

| 8,000 | | |

| 8,000 | | |

| 1,103 | |

| Deferred tax assets, net | |

| 63,894 | | |

| 63,894 | | |

| 8,812 | |

| Right-of-use assets, net | |

| 75,008 | | |

| 79,710 | | |

| 10,993 | |

| Long-term bank deposits, net | |

| 1,515,428 | | |

| 2,306,679 | | |

| 318,106 | |

| Long-term investment securities, net | |

| 3,409,458 | | |

| 4,271,197 | | |

| 589,025 | |

| Other non-current assets, net | |

| 13,458 | | |

| 8,029 | | |

| 1,107 | |

| Total non-current assets | |

| 5,180,669 | | |

| 6,823,241 | | |

| 940,969 | |

| Total assets | |

| 16,378,824 | | |

| 16,650,212 | | |

| 2,296,170 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Accounts and notes payable | |

| 269,346 | | |

| 132,193 | | |

| 18,230 | |

| Contract liabilities | |

| 75,226 | | |

| 94,531 | | |

| 13,036 | |

| Salary and welfare benefits payable | |

| 127,749 | | |

| 94,050 | | |

| 12,970 | |

| Taxes payable | |

| 109,676 | | |

| 82,290 | | |

| 11,348 | |

| Amounts due to related parties | |

| 423 | | |

| - | | |

| - | |

| Accrued expenses and other current liabilities | |

| 161,455 | | |

| 120,058 | | |

| 16,557 | |

| Lease liabilities - current portion | |

| 45,955 | | |

| 49,286 | | |

| 6,797 | |

| Total current liabilities | |

| 789,830 | | |

| 572,408 | | |

| 78,938 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | | |

| | |

| Deferred tax liabilities | |

| 8,653 | | |

| 8,653 | | |

| 1,193 | |

| Lease liabilities - non-current portion | |

| 39,968 | | |

| 38,878 | | |

| 5,361 | |

| Total non-current liabilities | |

| 48,621 | | |

| 47,531 | | |

| 6,554 | |

| Total liabilities | |

| 838,451 | | |

| 619,939 | | |

| 85,492 | |

| | |

| | | |

| | | |

| | |

| Shareholders' Equity: | |

| | | |

| | | |

| | |

| Total RLX Technology Inc. shareholders' equity | |

| 15,569,060 | | |

| 16,056,370 | | |

| 2,214,279 | |

| Noncontrolling interests | |

| (28,687 | ) | |

| (26,097 | ) | |

| (3,601 | ) |

| Total shareholders' equity | |

| 15,540,373 | | |

| 16,030,273 | | |

| 2,210,678 | |

| | |

| | | |

| | | |

| | |

| Total liabilities and shareholders' equity | |

| 16,378,824 | | |

| 16,650,212 | | |

| 2,296,170 | |

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME/(LOSS)

(All

amounts in thousands, except for share and per share data)

| | |

For

the three months ended | | |

For

the six months ended | |

| | |

June 30, | | |

March 31, | | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net revenues | |

| 2,233,893 | | |

| 188,877 | | |

| 378,123 | | |

| 52,146 | | |

| 3,948,343 | | |

| 567,000 | | |

| 78,193 | |

| Cost of revenues | |

| (1,256,010 | ) | |

| (78,693 | ) | |

| (171,733 | ) | |

| (23,683 | ) | |

| (2,313,457 | ) | |

| (250,426 | ) | |

| (34,535 | ) |

| Excise tax on products | |

| - | | |

| (64,458 | ) | |

| (107,853 | ) | |

| (14,874 | ) | |

| - | | |

| (172,311 | ) | |

| (23,763 | ) |

| Gross profit | |

| 977,883 | | |

| 45,726 | | |

| 98,537 | | |

| 13,589 | | |

| 1,634,886 | | |

| 144,263 | | |

| 19,895 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling expenses | |

| (122,634 | ) | |

| (85,761 | ) | |

| (45,226 | ) | |

| (6,237 | ) | |

| (198,581 | ) | |

| (130,987 | ) | |

| (18,064 | ) |

| General and administrative expenses | |

| (290,745 | ) | |

| (256,504 | ) | |

| 41,368 | | |

| 5,705 | | |

| (224,350 | ) | |

| (215,136 | ) | |

| (29,669 | ) |

| Research and development expenses | |

| (117,567 | ) | |

| (76,682 | ) | |

| (43,317 | ) | |

| (5,974 | ) | |

| (141,574 | ) | |

| (119,999 | ) | |

| (16,549 | ) |

| Total operating expenses | |

| (530,946 | ) | |

| (418,947 | ) | |

| (47,175 | ) | |

| (6,506 | ) | |

| (564,505 | ) | |

| (466,122 | ) | |

| (64,282 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income/(loss) from operations | |

| 446,937 | | |

| (373,221 | ) | |

| 51,362 | | |

| 7,083 | | |

| 1,070,381 | | |

| (321,859 | ) | |

| (44,387 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other income: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest income, net | |

| 42,724 | | |

| 148,803 | | |

| 162,888 | | |

| 22,463 | | |

| 69,875 | | |

| 311,691 | | |

| 42,984 | |

| Investment income | |

| 40,631 | | |

| 21,385 | | |

| 20,588 | | |

| 2,839 | | |

| 72,870 | | |

| 41,973 | | |

| 5,788 | |

| Others, net | |

| 115,586 | | |

| 129,157 | | |

| 21,380 | | |

| 2,948 | | |

| 232,443 | | |

| 150,537 | | |

| 20,760 | |

| Income/(loss) before income

tax | |

| 645,878 | | |

| (73,876 | ) | |

| 256,218 | | |

| 35,333 | | |

| 1,445,569 | | |

| 182,342 | | |

| 25,145 | |

| Income tax (expense)/benefit | |

| (204,316 | ) | |

| 17,571 | | |

| (51,502 | ) | |

| (7,102 | ) | |

| (316,952 | ) | |

| (33,931 | ) | |

| (4,679 | ) |

| Net income/(loss) | |

| 441,562 | | |

| (56,305 | ) | |

| 204,716 | | |

| 28,231 | | |

| 1,128,617 | | |

| 148,411 | | |

| 20,466 | |

| Less: net (loss)/income attributable

to noncontrolling interests | |

| (19,499 | ) | |

| 661 | | |

| 1,929 | | |

| 266 | | |

| (37,725 | ) | |

| 2,590 | | |

| 357 | |

| Net income/(loss) attributable

to RLX Technology Inc. | |

| 461,061 | | |

| (56,966 | ) | |

| 202,787 | | |

| 27,965 | | |

| 1,166,342 | | |

| 145,821 | | |

| 20,109 | |

| Other comprehensive loss: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| 580,438 | | |

| (148,096 | ) | |

| 563,078 | | |

| 77,652 | | |

| 534,614 | | |

| 414,982 | | |

| 57,229 | |

| Unrealized income on long-term

investment securities | |

| - | | |

| 2,873 | | |

| 5,539 | | |

| 764 | | |

| - | | |

| 8,412 | | |

| 1,160 | |

| Total other comprehensive

income/(loss) | |

| 580,438 | | |

| (145,223 | ) | |

| 568,617 | | |

| 78,416 | | |

| 534,614 | | |

| 423,394 | | |

| 58,389 | |

| Total comprehensive income/(loss) | |

| 1,022,000 | | |

| (201,528 | ) | |

| 773,333 | | |

| 106,647 | | |

| 1,663,231 | | |

| 571,805 | | |

| 78,855 | |

| Less: total comprehensive

(loss)/income attributable to noncontrolling interests | |

| (19,499 | ) | |

| 661 | | |

| 1,929 | | |

| 266 | | |

| (37,725 | ) | |

| 2,590 | | |

| 357 | |

| Total comprehensive income/(loss)

attributable to RLX Technology Inc. | |

| 1,041,499 | | |

| (202,189 | ) | |

| 771,404 | | |

| 106,381 | | |

| 1,700,956 | | |

| 569,215 | | |

| 78,498 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income/(loss) per ordinary

share/ADS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 0.348 | | |

| (0.043 | ) | |

| 0.154 | | |

| 0.021 | | |

| 0.877 | | |

| 0.111 | | |

| 0.015 | |

| Diluted | |

| 0.347 | | |

| (0.043 | ) | |

| 0.150 | | |

| 0.021 | | |

| 0.867 | | |

| 0.108 | | |

| 0.015 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ordinary shares/ADSs | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 1,323,877,777 | | |

| 1,316,798,713 | | |

| 1,318,628,588 | | |

| 1,318,628,588 | | |

| 1,329,964,500 | | |

| 1,317,718,705 | | |

| 1,317,718,705 | |

| Diluted | |

| 1,330,060,097 | | |

| 1,316,798,713 | | |

| 1,353,296,802 | | |

| 1,353,296,802 | | |

| 1,345,014,312 | | |

| 1,348,021,483 | | |

| 1,348,021,483 | |

RLX

TECHNOLOGY INC.

UNAUDITED

RECONCILIATION OF GAAP AND NON-GAAP RESULTS

(All

amounts in thousands, except for share and per share data)

| | |

For

the three months ended | | |

For

the six months ended | |

| | |

June 30, | | |

March 31, | | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net

income/(loss) | |

| 441,562 | | |

| (56,305 | ) | |

| 204,716 | | |

| 28,231 | | |

| 1,128,617 | | |

| 148,411 | | |

| 20,466 | |

| Add:

share-based compensation expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling

expenses | |

| 17,896 | | |

| 23,955 | | |

| (15,338 | ) | |

| (2,115 | ) | |

| (24,043 | ) | |

| 8,617 | | |

| 1,188 | |

| General

and administrative expenses | |

| 151,069 | | |

| 201,343 | | |

| (90,923 | ) | |

| (12,539 | ) | |

| (79,018 | ) | |

| 110,420 | | |

| 15,228 | |

| Research

and development expenses | |

| 24,213 | | |

| 14,654 | | |

| (12,229 | ) | |

| (1,686 | ) | |

| (28,998 | ) | |

| 2,425 | | |

| 334 | |

| Non-GAAP

net income | |

| 634,740 | | |

| 183,647 | | |

| 86,226 | | |

| 11,891 | | |

| 996,558 | | |

| 269,873 | | |

| 37,216 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

income/(loss) attributable to RLX Technology Inc. | |

| 461,061 | | |

| (56,966 | ) | |

| 202,787 | | |

| 27,965 | | |

| 1,166,342 | | |

| 145,821 | | |

| 20,109 | |

| Add:

share-based compensation expenses | |

| 193,178 | | |

| 239,952 | | |

| (118,490 | ) | |

| (16,340 | ) | |

| (132,059 | ) | |

| 121,462 | | |

| 16,750 | |

| Non-GAAP

net income attributable to RLX Technology Inc. | |

| 654,239 | | |

| 182,986 | | |

| 84,297 | | |

| 11,625 | | |

| 1,034,283 | | |

| 267,283 | | |

| 36,859 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP

net income per ordinary share/ADS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Basic | |

| 0.494 | | |

| 0.139 | | |

| 0.064 | | |

| 0.009 | | |

| 0.778 | | |

| 0.203 | | |

| 0.028 | |

| - Diluted | |

| 0.492 | | |

| 0.136 | | |

| 0.062 | | |

| 0.009 | | |

| 0.769 | | |

| 0.198 | | |

| 0.027 | |

| Weighted

average number of ordinary shares/ADSs | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Basic | |

| 1,323,877,777 | | |

| 1,316,798,713 | | |

| 1,318,628,588 | | |

| 1,318,628,588 | | |

| 1,329,964,500 | | |

| 1,317,718,705 | | |

| 1,317,718,705 | |

| - Diluted | |

| 1,330,060,097 | | |

| 1,345,828,279 | | |

| 1,353,296,802 | | |

| 1,353,296,802 | | |

| 1,345,014,312 | | |

| 1,348,021,483 | | |

| 1,348,021,483 | |

RLX

TECHNOLOGY INC.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(All

amounts in thousands)

| | |

For the three months

ended | | |

For the six months

ended | |

| | |

June 30, | | |

March 31, | | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net cash generated from/(used

in) operating activities | |

| 1,444,388 | | |

| (230,686 | ) | |

| 41,339 | | |

| 5,701 | | |

| 1,752,557 | | |

| (189,347 | ) | |

| (26,112 | ) |

| Net cash (used in)/generated from investing

activities | |

| (4,145,885 | ) | |

| 381,954 | | |

| 431,683 | | |

| 59,532 | | |

| (5,096,649 | ) | |

| 813,637 | | |

| 112,206 | |

| Net cash (used in)/generated from financing

activities | |

| (145,189 | ) | |

| 4,346 | | |

| (199,080 | ) | |

| (27,454 | ) | |

| (306,801 | ) | |

| (194,734 | ) | |

| (26,855 | ) |

| Effect of foreign

exchange rate changes on cash, cash equivalents and restricted cash | |

| 171,597 | | |

| 10,409 | | |

| 48,393 | | |

| 6,673 | | |

| 151,041 | | |

| 58,802 | | |

| 8,109 | |

| Net (decrease)/increase

in cash and cash equivalents and restricted cash | |

| (2,675,089 | ) | |

| 166,023 | | |

| 322,335 | | |

| 44,452 | | |

| (3,499,852 | ) | |

| 488,358 | | |

| 67,348 | |

| Cash, cash equivalents

and restricted cash at the beginning of the period | |

| 4,384,704 | | |

| 1,289,086 | | |

| 1,455,109 | | |

| 200,669 | | |

| 5,209,467 | | |

| 1,289,086 | | |

| 177,773 | |

| Cash, cash equivalents

and restricted cash at the end of the period | |

| 1,709,615 | | |

| 1,455,109 | | |

| 1,777,444 | | |

| 245,121 | | |

| 1,709,615 | | |

| 1,777,444 | | |

| 245,121 | |

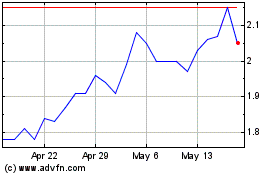

RLX Technology (NYSE:RLX)

Historical Stock Chart

From Apr 2024 to May 2024

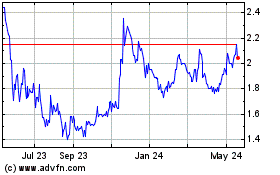

RLX Technology (NYSE:RLX)

Historical Stock Chart

From May 2023 to May 2024