Form 8-K - Current report

20 July 2023 - 6:37AM

Edgar (US Regulatory)

0001320414

false

0001320414

2023-07-19

2023-07-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

current report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): July 19, 2023

SELECT MEDICAL HOLDINGS CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | |

001-34465 | |

20-1764048 |

(State or other jurisdiction of

Incorporation) | |

(Commission File

Number) | |

(I.R.S. Employer

Identification No.) |

4714 Gettysburg Road, P.O. Box 2034

Mechanicsburg, PA 17055

(Address of principal executive offices) (Zip Code)

(717) 972-1100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

SEM |

New York Stock Exchange (NYSE) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether either registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if either registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On July 19, 2023, Select

Medical Holdings Corporation issued a press release announcing an estimate of certain financial results for the second quarter ended June 30,

2023 in connection with discussions with its lenders regarding a proposed refinancing of certain of its outstanding indebtedness. A copy

of that press release is attached as Exhibit 99.1 to this report and incorporated herein by reference.

The information in this Current

Report on Form 8-K (including Exhibit 99.1) is being furnished solely to satisfy the requirements of Regulation FD and shall

not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing

under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrants have duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

SELECT MEDICAL HOLDINGS CORPORATION |

| |

| Date: July 19, 2023 |

By: |

/s/ Michael E. Tarvin |

| |

|

Michael E. Tarvin |

| |

|

Executive Vice President, General Counsel and Secretary |

Exhibit 99.1

|

|

| |

|

| FOR IMMEDIATE RELEASE |

4714 Gettysburg Road

Mechanicsburg, PA 17055

NYSE Symbol: SEM

|

Select Medical Holdings

Corporation Announces Estimate of Certain Financial Results

for

its Second Quarter Ended June 30, 2023 in connection with Refinancing Discussions

MECHANICSBURG, PENNSYLVANIA

— July 19, 2023 — Select Medical Holdings Corporation (“Select Medical,” “we,” “us,” or

“our”) (NYSE: SEM) is currently in discussions with its lenders regarding a proposed refinancing of certain of its outstanding

indebtedness. In connection with such discussions, Select Medical today announced an estimate of certain financial results for its second

quarter ended June 30, 2023 in advance of the announcement of actual results, which is expected to occur after market close on Thursday,

August 3, 2023.

Select Medical expects its

net operating revenue for its second quarter of 2023 to be approximately $1.67 billion. Select Medical expects earnings excluding interest,

income taxes, depreciation and amortization, gain (loss) on early retirement of debt, stock compensation expense, gain (loss) on sale

of businesses, and equity in earnings (losses) of unconsolidated subsidiaries, or Adjusted EBITDA, for the second quarter of 2023 to be

approximately $219 million. Select Medical expects fully diluted earnings per common share for the second quarter of 2023 to be approximately

$0.61. As of June 30, 2023, Select Medical expects approximately $100 million of cash and $3.75 billion of indebtedness on its balance

sheet.

The above expectations regarding

Select Medical’s financial results for the second quarter of 2023 are management estimates and projections based on currently available

information, and are subject to change upon completion of Select Medical’s financial statement closing process.

A reconciliation of Adjusted

EBITDA expectations for the second quarter of 2023 to the closest comparable GAAP financial measure is presented in table I of this release.

Please refer to Select Medical’s most recent Form 10-Q filing for a discussion of Select Medical’s use of Adjusted EBITDA

in evaluating financial performance and determining resource allocation. Each item presented in table I is an estimation of the expectations

(dollars in millions) for the second quarter of 2023.

As

previously announced, Select Medical will host a conference call regarding its second quarter results, as well as its business outlook,

on Friday, August 4, 2023, at 9:00am ET. The conference call will be a live webcast and can be accessed at Select Medical Holdings Corporation’s

website at www.selectmedicalholdings.com. A replay of the webcast will be available shortly after the call through the

same link. For listeners wishing to dial-in via telephone, or participate in the question and answer session, you may pre-register for

the call at Select Medical Earnings Call Registration to obtain your dial-in number and unique passcode for the call.

Company Overview

Select

Medical is one of the largest operators of critical illness recovery hospitals, rehabilitation hospitals, outpatient rehabilitation clinics,

and occupational health centers in the United States based on the number of facilities. Select Medical’s reportable

segments include the critical illness recovery hospital segment, the rehabilitation hospital segment, the outpatient rehabilitation segment,

and the Concentra segment. As of June 30, 2023, Select Medical operated 108 critical illness recovery hospitals in 28 states, 32 rehabilitation

hospitals in 12 states, 1,944 outpatient rehabilitation clinics in 39 states and the District of Columbia, 540 occupational health

centers in 41 states, and 141 onsite clinics at employer worksites. At June 30, 2023, Select Medical had operations in 46 states and

the District of Columbia. Information about Select Medical is available at www.selectmedical.com.

*****

Certain statements contained

herein that are not descriptions of historical facts are “forward-looking” statements (as such term is defined in the Private

Securities Litigation Reform Act of 1995). Because such statements include risks and uncertainties, actual results may differ materially

from those expressed or implied by such forward-looking statements due to factors including the following:

| · | adverse economic conditions including an inflationary environment could cause us to continue to experience

increases in the prices of labor and other costs of doing business resulting in a negative impact on our business, operating results,

cash flows, and financial condition; |

| · | shortages in qualified nurses, therapists, physicians, or other licensed providers, and/or the inability

to attract or retain qualified healthcare professionals could limit our ability to staff our facilities; |

| · | shortages in qualified health professionals could cause us to increase our dependence on contract labor,

increase our efforts to recruit and train new employees, and expand upon our initiatives to retain existing staff, which could increase

our operating costs significantly; |

| · | the continuing effects of the COVID-19 pandemic including, but not limited to, the prolonged disruption

to the global financial markets, increased operational costs due to recessionary pressures and labor costs, additional measures taken

by government authorities and the private sector to limit the spread of COVID-19, and further legislative and regulatory actions which

impact healthcare providers, including actions that may impact the Medicare program; |

| · | changes in government reimbursement for our services and/or new payment policies may result in a reduction

in revenue, an increase in costs, and a reduction in profitability; |

| · | the failure of our Medicare-certified long term care hospitals or inpatient rehabilitation facilities

to maintain their Medicare certifications may cause our revenue and profitability to decline; |

| · | the failure of our Medicare-certified long term care hospitals and inpatient rehabilitation facilities

operated as “hospitals within hospitals” to qualify as hospitals separate from their host hospitals may cause our revenue

and profitability to decline; |

| · | a government investigation or assertion that we have violated applicable regulations may result in sanctions

or reputational harm and increased costs; |

| · | acquisitions or joint ventures may prove difficult or unsuccessful, use significant resources, or expose

us to unforeseen liabilities; |

| · | our plans and expectations related to our acquisitions and our ability to realize anticipated synergies; |

| · | private third-party payors for our services may adopt payment policies that could limit our future revenue

and profitability; |

| · | the failure to maintain established relationships with the physicians in the areas we serve could reduce

our revenue and profitability; |

| · | competition may limit our ability to grow and result in a decrease in our revenue and profitability; |

| · | the loss of key members of our management team could significantly disrupt our operations; |

| · | the effect of claims asserted against us could subject us to substantial uninsured liabilities; |

| · | a security breach of our or our third-party vendors’ information technology systems may subject

us to potential legal and reputational harm and may result in a violation of the Health Insurance Portability and Accountability Act of

1996 or the Health Information Technology for Economic and Clinical Health Act; and |

| · | other factors discussed from time to time in our filings with the Securities and Exchange Commission (the

“SEC”), including factors discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2022. |

Except as required by applicable

law, including the securities laws of the United States and the rules and regulations of the SEC, we are under no obligation to publicly

update or revise any forward-looking statements, whether as a result of any new information, future events, or otherwise. You should not

place undue reliance on our forward-looking statements. Although we believe that the expectations reflected in forward-looking statements

are reasonable, we cannot guarantee future results or performance.

Investor inquiries:

Joel T. Veit

Senior Vice President and Treasurer

717-972-1100

ir@selectmedical.com

SOURCE: Select Medical Holdings Corporation

I. Net Income to Adjusted EBITDA Reconciliation

Business Outlook for the Quarter Ending June

30, 2023

(In millions, unaudited)

| Non-GAAP Measure Reconciliation(1) | |

| |

| Net income | |

$ | 92 | |

| Income tax expense | |

| 29 | |

| Interest expense | |

| 49 | |

| Equity in earnings of unconsolidated subsidiaries | |

| (11 | ) |

| Income from operations | |

| 159 | |

| Stock compensation expense | |

| 10 | |

| Depreciation and amortization | |

| 50 | |

| Adjusted EBITDA | |

$ | 219 | |

| (1) | These amounts are subject to change upon completion of Select Medical’s financial statement closing

process and audit. |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

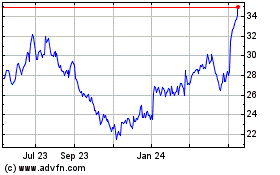

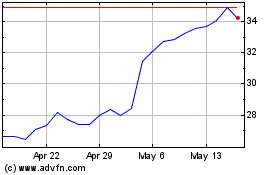

Select Medical (NYSE:SEM)

Historical Stock Chart

From Apr 2024 to May 2024

Select Medical (NYSE:SEM)

Historical Stock Chart

From May 2023 to May 2024