SelectQuote Completes First Phase of Recapitalization with $100 Million Securitization

17 October 2024 - 7:05AM

Business Wire

SelectQuote, Inc. (NYSE: SLQT), a leading distributor of

Medicare insurance policies and owner of a rapidly-growing

Healthcare Services platform, today announced the completion of a

$100 million securitization transaction on October 15, 2024.

Securitization provides advanced financing against the Company’s

expected collections for policies previously sold. The Company’s

receivables totaled approximately $1 billion as of June 30, 2024,

and only a portion of the total receivables balance was securitized

in this transaction. The Company will use the proceeds from this

first securitization to pay down a portion of its outstanding term

debt. The new securitized debt offers a materially lower cost of

capital than the Company’s term debt.

The transaction also includes a meaningful maturity extension

for the remainder of SelectQuote’s term debt from September 15,

2025 to September 30, 2027, and provides a path to an additional

extension to September 30, 2028 upon completion of agreed upon

payment milestones. While the Company believes future

securitization deals remain the most attractive solution to a

permanent recapitalization, it has hired an investment bank to

conduct a strategic review of all available options to meet the

Company's payment milestones, strengthen the balance sheet, and

fund continued investment in core business lines.

SelectQuote CEO Tim Danker commented, “This securitization marks

an important milestone for SelectQuote. This innovative approach to

financing our business comes at a significant improvement to the

Company’s current cost of capital. This transaction marks a

critical first step toward our ultimate goal of significantly

improving our capital structure and unlocking value for

shareholders.”

About SelectQuote:

Founded in 1985, SelectQuote (NYSE: SLQT) provides solutions

that help consumers protect their most valuable assets: their

families, health, and property. The Company pioneered the model of

providing unbiased comparisons from multiple, highly-rated

insurance companies allowing consumers to choose the policy and

terms that best meet their unique needs. Two foundational pillars

underpin SelectQuote’s success: a strong force of highly-trained

and skilled agents who provide a consultative needs analysis for

every consumer, and proprietary technology that sources and routes

high-quality leads.

With an ecosystem offering high touchpoints for consumers across

insurance, medicare, pharmacy, and value-based care, the Company

now has four core business lines: SelectQuote Senior, SelectQuote

Healthcare Services, SelectQuote Life, and SelectQuote Auto and

Home. SelectQuote Senior serves the needs of a demographic that

sees around 10,000 people turn 65 each day with a range of Medicare

Advantage and Medicare Supplement plans. SelectQuote Healthcare

Services is comprised of the SelectRx Pharmacy, a Patient-Centered

Pharmacy Home™ (PCPH) accredited pharmacy, and Healthcare Select

which proactively connects consumers with a wide breadth of

healthcare services supporting their needs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016309712/en/

Investor Relations: Sloan Bohlen 877-678-4083

investorrelations@selectquote.com

Media: Matt Gunter 913-286-4931 matt.gunter@selectquote.com

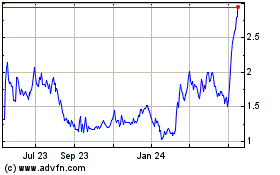

SelectQuote (NYSE:SLQT)

Historical Stock Chart

From Nov 2024 to Dec 2024

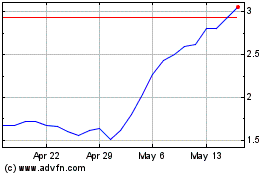

SelectQuote (NYSE:SLQT)

Historical Stock Chart

From Dec 2023 to Dec 2024