false

0001811074

0001811074

2024-10-02

2024-10-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 2, 2024

Texas

Pacific Land Corporation

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

1-39804 |

75-0279735 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| |

|

|

| 1700 Pacific Avenue, Suite 2900, |

|

|

| Dallas, Texas |

|

75201 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 214-969-5530

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

|

Common Stock, par value $0.001 per share

|

|

TPL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On October 2, 2024, Texas

Pacific Land Corporation (the “Company”) issued a press release announcing the acquisition of oil and gas royalty interests

in approximately 7,490 total net royalty acres primarily located in the Midland Basin for $286 million in cash (the “Royalty Interest

Acquisition”). A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by

reference herein.

The Company is also furnishing

a copy of a presentation (the “Presentation”) containing additional information concerning the Royalty Interest Acquisition

that the Company intends to use in one or more meetings with investors or analysts. A copy of the Presentation is furnished as Exhibit

99.2 to this Current Report on Form 8-K and is incorporated by reference herein.

The information in this Item

7.01, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), and shall not be deemed to be incorporated by reference into any filing under

the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

Exhibit

No. |

|

Description

of Exhibit |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Texas

Pacific Land Corporation |

| |

|

|

Date:

October 2, 2024 |

By: |

/s/

Micheal W. Dobbs |

| |

Name:

|

Micheal W. Dobbs |

| |

Title: |

SVP, General Counsel

and Secretary |

Exhibit 99.1

TEXAS PACIFIC LAND CORPORATION ACQUIRES PERMIAN

OIL AND GAS MINERAL AND ROYALTY INTRESTS IN CASH TRANSACTION

Acquisition of High-Quality Acreage in Core

Regions of the Permian to Generate Accretive Growth

DALLAS, TX (October 2, 2024) –

Texas Pacific Land Corporation (NYSE: TPL) (the “Company” or “TPL”) today announced the closing of an acquisition

of Permian oil and gas mineral and royalty interests for $286 million in cash.

The interests span across approximately

7,490 net royalty acres (“NRA”) located primarily in the Midland Basin in Martin (~2,220 NRA), Midland (~2,080 NRA), and other

counties, with over 80% of the acquired interests adjacent to or overlapping existing TPL surface and royalty acreage. Exxon Mobil Corporation

(NYSE: XOM) and Diamondback Energy Inc (NYSE: FANG) operate approximately 66% of the acreage. The acquired assets have current production

of approximately 1,300 barrels of oil equivalent per day (~78% liquids), with strong line of sight to near-term development and production

growth.

“These acquired assets simultaneously

high-grade our legacy oil and gas royalty footprint, increase cash flow and earnings per share, and strengthen our growth profile,”

said Tyler Glover, Chief Executive Officer of the Company. “This acquisition significantly expands TPL’s net royalty acreage

in the Midland Basin, with the acquired assets located in some of the highest quality subregions prospective for multiple proven formations.

The acreage is predominately operated by premier upstream companies such as Exxon, Diamondback, Occidental, and ConocoPhillips, with twelve

rigs currently running on the footprint. We anticipate next-twelve-months production to generate a double-digit cash flow yield, with

additional growth potential as over half of the Drilling and Spacing Units have seen limited, if any, development and contain numerous

permits and recently drilled-but-uncompleted wells. Our recent acquisitions meaningfully enhance TPL’s free cash flow per share,

offering incremental flexibility to sustainably increase shareholder return of capital.”

| Asset Map |

|

About Texas Pacific Land

Corporation

Texas Pacific Land Corporation is one of the largest

landowners in the State of Texas with approximately 873,000 acres of land in West Texas, with the majority of its ownership concentrated

in the Permian Basin. The Company is not an oil and gas producer, but its surface and royalty ownership provide revenue opportunities

throughout the life cycle of a well. These revenue opportunities include fixed fee payments for use of our land, revenue for sales of

materials (caliche) used in the construction of infrastructure, providing sourced water and/or treated produced water, revenue from our

oil and gas royalty interests, and revenues related to saltwater disposal on our land. The Company also generates revenue from pipeline,

power line and utility easements, commercial leases and temporary permits related to a variety of land uses including midstream infrastructure

projects and hydrocarbon processing facilities.

Visit TPL at http://www.TexasPacific.com.

Contact:

Investor Relations

IR@TexasPacific.com

Exhibit 99.2

Permian Oil and Gas Mineral and Royalty Interests Acquisition October 2024

Disclaimers This presentation has been designed to provide general information about Texas Pacific Land Corporation and its subsidiaries (“T PL” or the “Company”). Any information contained or referenced herein is suitable only as an introduction to the Company. The recipient is strongly encouraged to refer to and supplement this presentation with informati on the Company has filed with the Securities and Exchange Commission (“SEC”). The Company makes no representation or warranty, express or implied, as to the accuracy or completeness of the information co nta ined in this presentation, and nothing contained herein is, or shall be, relied upon as a promise or representation, whether as to the past or to the future. This presentation does not purport to include all of the informat ion that may be required to evaluate the subject matter herein and any recipient hereof should conduct its own independent analysis of the Company and the data contained or referred to herein. Unless otherwise stated, statements in this presentation are made as of the date of this presentation, and nothing shall crea te an implication that the information contained herein is correct as of any time after such date. TPL reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. The Company disclaims any obligations to update the data, information or opinions contained herein or to notify the market or any other party of any such changes, other than required by law. Industry and Market Data The Company has neither sought nor obtained consent from any third party for the use of previously published information. Any su ch statements or information should not be viewed as indicating the support of such third party for the views expressed herein. The Company shall not be responsible or have any liability for any misinformation contained i n a ny third party report, SEC or other regulatory filing. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to a variety of factors, which could cause our results to differ materia lly from those expressed in these third - party publications. Some of the data included in this presentation is based on TPL’s good faith estimates, which are derived from TPL’s review of internal sources as well as the third party sourc es described above. All registered or unregistered service marks, trademarks and trade names referred to in this presentation are the property of their respective owners, and TPL’s use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and trade names. Forward - looking Statements This presentation contains certain forward - looking statements within the meaning of the U.S. federal securities laws that are ba sed on TPL’s beliefs, as well as assumptions made by, and information currently available to, TPL, and therefore involve risks and uncertainties that are difficult to predict. These statements include, but are not limited to , s tatements about strategies, plans, objectives, expectations, intentions, expenditures and assumptions and other statements that are not historical facts. When used in this document, words such as “anticipate,” “believe,” “estim ate ,” “expect,” “intend,” “plan” and “project” and similar expressions are intended to identify forward - looking statements. You should not place undue reliance on these forward - looking statements. Although we believe our plans, inte ntions and expectations reflected in or suggested by the forward - looking statements we make in this presentation are reasonable, we may be unable to achieve these plans, intentions or expectations and actual results, per formance or achievements may vary materially and adversely from those envisaged in this document. For more information concerning factors that could cause actual results to differ from those expressed or forecaste d, see TPL’s annual report on Form 10 - K and quarterly reports on Form 10 - Q filed with the SEC. The tables, graphs, charts and other analyses provided throughout this document are provided for illustrative purposes only and t her e is no guarantee that the trends, outcomes or market conditions depicted on them will continue in the future. There is no assurance or guarantee with respect to the prices at which the Company’s common stock will trade, and such securities may not trade at prices that may be implied herein. TPL’s forecasts and expectations for future periods are dependent upon many assumptions, including the drilling and developme nt plans of our customers, estimates of production and potential drilling locations, which may be affected by commodity price declines or other factors that are beyond TPL’s control. These materials are provided merely for general informational purposes and are not intended to be, nor should they be constru ed as 1) investment, financial, tax or legal advice, 2) a recommendation to buy or sell any security, or 3) an offer or solicitation to subscribe for or purchase any security. These materials do not consider the investment objecti ve, financial situation, suitability or the particular need or circumstances of any specific individual who may receive or review this presentation, and may not be taken as advice on the merits of any investment decision. Although TP L b elieves the information herein to be reliable, the Company and persons acting on its behalf make no representation or warranty, express or implied, as to the accuracy or completeness of those statements or any other writte n o r oral communication it makes, safe as provided for by law, and the Company expressly disclaims any liability relating to those statements or communications (or any inaccuracies or omissions therein). These cautionary sta tem ents qualify all forward - looking statements attributable to us or persons acting on our behalf. 2

Oil and Gas Mineral and Royalty Interests Acquisition 3 ▪ TPL acquired 7 , 490 net royalty acres 1 (“NRA”) primarily located in the Midland Basin for $ 286 million in an all - cash transaction – Transaction effective date of April 1 , 2024 , subject to customary adjustments ▪ Summary Asset Statistics – 6 , 942 NRAs located in Midland Basin ( 93 % ) and 548 NRAs located in Delaware Basin ( 7 % ) o Midland Basin NRAs primarily located in Martin ( 32 % ), Midland ( 30 % ) and Glasscock ( 14 % ) counties – Top operators include ExxonMobil (~ 45 % of total NRAs) and Diamondback (~ 21 % of total NRAs) – Over 80 % of acquired assets directly overlap with or are within a one - mile radius of existing TPL royalty position ▪ Financial and Operating Summary Highlights – Current production of approximately 1 , 300 barrels of oil equivalent per day 2 (“boe/d”)(~ 78 % liquids), expected to grow to over 2 , 000 boe/d next year – Significant near - term development inventory supports production growth outlook – Over half of the Drilling and Spacing Units in core Midland Basin counties have minimal existing development, providing long - term growth runway underpinned by highly economic locations – Expected to generate double - digit cash flow yields based on current strip 3 ▪ Acquired assets were not part of a broad marketing process ▪ TPL does not anticipate adding additional headcount or G&A as a result of the acquisition (1) Normalized to 1/8 th (2) Production as of June 2024 (3) Based on production month for the period October 2024 – September 2025 and commodity strip pricing as of 9/25/2024 Asset Map

45% 22% 7% 5% 3% 2% 16% 1,293 Gross Wells Acquired Asset Highlights 4 Top Operators by NRA Horizontal Rig Activity Top Operators by Producing Horizontal Wells Total Net Wells Total Gross Wells Delaware Gross Wells Midland Gross Wells Status 0.3 87 2 85 Completed 0.6 158 25 133 DUC 1.2 148 22 126 Permits 2.1 393 49 344 Total Near - term Development Overview 45% 21% 7% 5% 5% 17% 7,490 NRA Exxon Diamondback Occidental Vital Ovintiv ConocoPhillips Others 12 Rigs currently running on Acquired Assets

1700 Pacific Avenue, Suite 2900 Dallas, Texas 75201 Texas Pacific Land Corporation

v3.24.3

Cover

|

Oct. 02, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 02, 2024

|

| Entity File Number |

1-39804

|

| Entity Registrant Name |

Texas

Pacific Land Corporation

|

| Entity Central Index Key |

0001811074

|

| Entity Tax Identification Number |

75-0279735

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1700 Pacific Avenue

|

| Entity Address, Address Line Two |

Suite 2900,

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75201

|

| City Area Code |

214

|

| Local Phone Number |

969-5530

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

TPL

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

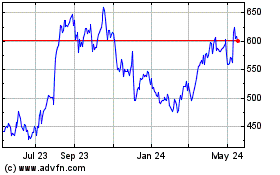

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Feb 2025 to Mar 2025

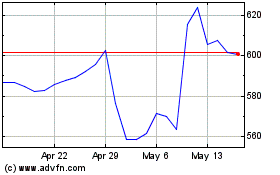

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Mar 2024 to Mar 2025