false

0000884614

0000884614

2024-06-06

2024-06-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

June 6, 2024

UGI Corporation

(Exact Name of Registrant as Specified in

Charter)

Pennsylvania

(State

or Other Jurisdiction

of Incorporation) |

1-11071

(Commission

File Number) |

23-2668356

(I.R.S.

Employer

Identification No.) |

| |

|

|

500 North Gulph Road, King of Prussia, PA 19406

(Address

of Principal Executive Offices) (Zip Code) |

Registrant’s Telephone Number, Including

Area Code: 610 337-7000

Not

Applicable

Former Name or Former Address, if Changed Since Last Report

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

Symbol(s): |

|

Name

of each exchange

on which registered: |

| Common Stock, without par value |

|

UGI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events.

On June 6, 2024, UGI Corporation (the “Company”)

issued a press release relating to its proposed private offering of Convertible Senior Notes due 2028 (the “Notes”)

to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended. A copy of the press release

is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 8.01.

Neither this Current Report on Form 8-K nor the press release

constitutes an offer to sell, or the solicitation of an offer to buy, the Notes or the shares of the Company’s common stock, if

any, issuable upon conversion of the Notes.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 6, 2024

| |

UGI Corporation |

| |

|

| |

By: |

/s/ Jessica A. Milner |

| |

|

Name: Jessica A. Milner |

| |

|

Title: Secretary |

Exhibit 99.1

UGI Corporation Announces Proposed Convertible

Senior Notes Offering

VALLEY FORGE, Pa.—(BUSINESS WIRE)—June 6,

2024—UGI Corporation (NYSE: UGI) (The “Company” or “UGI”) today announced its intention to offer, subject

to market and other conditions, $600,000,000 aggregate principal amount of convertible senior notes due 2028 (the “notes”)

in a private offering to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities

Act of 1933, as amended (the “Securities Act”). UGI also expects to grant the initial purchasers of the notes an option to

purchase, for settlement within a period of 13 days from, and including, the date the notes are first issued, up to an additional $90,000,000

principal amount of notes.

The notes will be senior, unsecured obligations

of UGI, will accrue interest payable semi-annually in arrears and will mature on June 1, 2028, unless earlier repurchased or converted.

Noteholders will have the right to convert their notes in certain circumstances and during specified periods. UGI will settle conversions

in cash and, if applicable, shares of its common stock.

The notes will not be redeemable at UGI’s

election before maturity.

If certain corporate events that constitute a

“fundamental change” occur, then, subject to a limited exception, noteholders may require UGI to repurchase their notes for

cash. The repurchase price will be equal to the principal amount of the notes to be repurchased, plus accrued and unpaid interest, if

any, to, but excluding, the applicable repurchase date.

The interest rate, initial conversion rate and

other terms of the notes will be determined at the pricing of the offering.

UGI intends to use the net proceeds from the offering

to refinance existing indebtedness of UGI, including under UGI’s senior credit facility, and its subsidiaries and, for general corporate

purposes.

The offer and sale of the notes and any shares

of common stock issuable upon conversion of the notes have not been, and will not be, registered under the Securities Act or any other

securities laws, and the notes and any such shares cannot be offered or sold except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act and any other applicable securities laws. This press release does

not constitute an offer to sell, or the solicitation of an offer to buy, the notes or any shares of common stock issuable upon conversion

of the notes, nor will there be any sale of the notes or any such shares, in any state or other jurisdiction in which such offer, sale

or solicitation would be unlawful.

About UGI Corporation

UGI Corporation (NYSE: UGI) is a distributor and

marketer of energy products and services in the US and Europe. UGI offers safe, reliable, affordable, and sustainable energy solutions

to customers through its subsidiaries, which provide natural gas transmission and distribution, electric generation and distribution,

midstream services, propane distribution, renewable natural gas generation, distribution and marketing, and energy marketing services.

Forward-Looking Statements

This press release includes forward-looking statements,

including statements regarding the anticipated terms of the notes being offered, the completion, timing and size of the proposed offering

and the intended use of the proceeds. Forward-looking statements represent UGI’s current expectations regarding future events and

are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those implied by the

forward-looking statements. Among those risks and uncertainties are market conditions, including market interest rates, the trading price

and volatility of UGI’s common stock and risks relating to UGI’s business, including those described in periodic reports that

UGI files from time to time with the SEC. UGI may not consummate the proposed offering described in this press release and, if the proposed

offering is consummated, cannot provide any assurances regarding the final terms of the offering or the notes or its ability to effectively

apply the net proceeds as described above. The forward-looking statements included in this press release speak only as of the date of

this press release, and UGI does not undertake to update the statements included in this press release for subsequent developments, except

as may be required by law.

Investor Relations

610-337-1000

Tameka Morris, ext. 6297

Arnab Mukherjee, ext. 7498

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

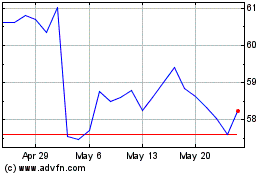

UGI (NYSE:UGIC)

Historical Stock Chart

From May 2024 to Jun 2024

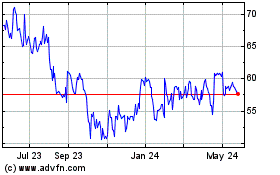

UGI (NYSE:UGIC)

Historical Stock Chart

From Jun 2023 to Jun 2024