UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| o | Definitive Proxy Statement |

| |

| x | Definitive Additional Materials |

| |

| o | Soliciting Material under § 240.14a-12 |

| | |

| Vista Outdoor Inc. |

| (Name of Registrant as Specified in Its Charter) |

| | | | | | | | |

| (Name of Person(s) Filing Proxy Statement, if Other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

| |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which the transaction applies: |

| | |

| (2) | Aggregate number of securities to which the transaction applies: |

| | |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of the transaction: |

| | |

| (5) | Total fee paid: |

| | |

| | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

SUPPLEMENT DATED JUNE 10, 2024 TO PROXY STATEMENT/PROSPECTUS DATED APRIL 2, 2024

This document is a supplement dated June 10, 2024 (“Supplement”) to the proxy statement/prospectus dated April 2, 2024 and first mailed to shareholders of Vista Outdoor Inc. (“Vista Outdoor” or the “Company”) on or about April 9, 2024. That proxy statement/prospectus was supplemented by an earlier supplement dated May 28, 2024 and, as supplemented, is referred to herein as the Proxy Statement/Prospectus. In the following supplemental disclosures, new text within amended and supplemented paragraphs from the Proxy Statement/Prospectus is bold and underlined, while deleted text is stricken-through, where applicable.

INTRODUCTION AND EXPLANATORY NOTE

Capitalized terms used herein, but not otherwise defined, shall have the meanings ascribed to such terms in the Proxy Statement/Prospectus. Except as described in this Supplement, the information provided in the Proxy Statement/Prospectus relating to the Transaction continues to apply. This Supplement and the documents referred to in this Supplement should be read in conjunction with the Proxy Statement/Prospectus, the annexes and exhibits to the Proxy Statement/Prospectus and the documents referred to in the Proxy Statement/Prospectus, each of which should be read in its entirety. To the extent that information in this Supplement differs from, updates or conflicts with information contained in the Proxy Statement/Prospectus, the information in this Supplement supersedes the information in the Proxy Statement/Prospectus.

If you need another copy of the Proxy Statement/Prospectus, please contact Broadridge Investor Communications Solutions at 800-542-1061. The Proxy Statement/Prospectus may also be found on the Internet at www.sec.gov and on the website of the Company, located at www.vistaoutdoor.com.

As previously disclosed, on October 15, 2023, Vista Outdoor entered into an Agreement and Plan of Merger (as may be amended from time to time, the “Merger Agreement”) with Revelyst, Inc. (“Revelyst”), CSG Elevate II Inc. (“Merger Sub Parent”), CSG Elevate III Inc., a wholly owned subsidiary of Merger Sub Parent (“Merger Sub”), and, solely for the purposes of specific provisions therein, CZECHOSLOVAK GROUP a.s. (“CSG”), pursuant to which, on the terms and conditions set forth therein and in accordance with the Delaware General Corporation Law, Merger Sub will merge with and into Vista Outdoor with Vista Outdoor surviving the merger as a wholly owned subsidiary of Merger Sub Parent (the “Merger” and, together with the other transactions contemplated by the Merger Agreement and the related transaction documents, the “Transaction”).

UPDATES TO BACKGROUND OF THE TRANSACTION

Set forth below are further supplemental disclosures with respect to the “Background of the Transaction” section of the Proxy Statement/Prospectus to reflect relevant developments that have occurred since the filing of the supplement to the Proxy Statement/Prospectus dated May 28, 2024 (the “Prior Supplement”).

Supplemental Disclosures to the Proxy Statement/Prospectus in Connection with the Background of the Transaction

The Proxy Statement/Prospectus, as supplemented by the Prior Supplement, describes the background of the Transaction up to and including May 28, 2024. The Prior Supplement is hereby amended by inserting the following text below the fourth full paragraph on page 9 of the Prior Supplement.

On June 3, 2024, a representative of Investor 1 delivered a letter to Mr. Callahan expressing Investor 1’s interest in pursuing a transaction to acquire the Sporting Products Business in an all-cash transaction for $1.91 billion, on a cash-free debt-free basis (the “Investor 1 First Indication”).

On June 5, 2024, a representative of Investor 1 contacted Mr. Callahan to convey that Investor 1 proposed to reimburse Vista Outdoor for (i) half of the $47,750,000 termination fee that would be payable by Vista Outdoor to CSG in the event that the Vista Outdoor Board determined to terminate the merger agreement with CSG and enter into a transaction with Investor 1 and (ii) $750,000, representing Investor 1’s 25% share of the expense reimbursement amount paid to MNC on November 16, 2023, resulting in the Investor 1 First Indication having an effective proposed purchase price of $1,886,875,000.

On June 6, 2024, MNC delivered a letter to the Vista Outdoor Board pursuant to which MNC expressed interest in acquiring Vista Outdoor in an all-cash transaction for $39.50 per share of Vista Outdoor Common Stock (the “MNC Third Indication”) together with draft documentation with respect to debt financing commitments. That same morning, MNC issued a press release with respect to the MNC Third Indication.

Later that morning, Mr. Vanderbrink and a representative of CSG had a call to discuss the Investor 1 First Indication and the MNC Third Indication. The representative of CSG informed Mr. Vanderbrink that CSG did not intend to make an offer to change the terms of the Transaction at the current time based on CSG’s belief that the Transaction is superior from a financial point of view to both the Investor 1 First Indication and the MNC Third Indication.

On June 6, 2024, a meeting of the Vista Outdoor Board was held with representatives of Morgan Stanley, Moelis, Cravath and Gibson Dunn also in attendance. At the meeting, the Vista Outdoor Board reviewed the Investor 1 First Indication and the MNC Third Indication. Representatives of Cravath reviewed with the members of the Vista Outdoor Board their fiduciary duties and the obligations of Vista Outdoor under the merger agreement with CSG. The Vista Outdoor Board asked questions and further considered and discussed the Investor 1 First Indication. Following discussion, the Vista Outdoor Board determined that the Investor 1 First Indication would not be more favorable to Vista Outdoor stockholders from a financial point of view than, and would not reasonably be expected to be superior to, the Transaction and should therefore be rejected.

On June 7, 2024, Vista Outdoor delivered a letter to Investor 1 notifying Investor 1 of the rejection of the Investor 1 First Indication.

Later that day, a representative of Investor 1 delivered a further letter to Mr. Callahan expressing Investor 1’s interest in pursuing a transaction to acquire the Sporting Products Business in an all-cash transaction for $2,008,500,000, on a cash-free debt-free basis (the “Investor 1 Second Indication”). The $47,750,000 termination fee payable to CSG in the event that Vista Outdoor determined to terminate the merger agreement with CSG and enter into a transaction with Investor 1 would be payable by Vista Outdoor, resulting in the Investor 1 Second Indication having an effective proposed purchase price of $1,960,750,000.

Later that day, a meeting of the Vista Outdoor Board was held with representatives of Morgan Stanley, Moelis, Cravath and Gibson Dunn also in attendance. At the meeting, the Vista Outdoor Board reviewed the Investor 1 Second Indication and the MNC Third Indication. Representatives of Cravath reviewed with the members of the Vista Outdoor Board their fiduciary duties and the framework under the merger agreement with CSG for the Vista Outdoor Board’s review of alternative proposals. The Vista Outdoor Board asked questions and further considered and discussed the Investor 1 Second Indication. Following such discussion, the Vista Outdoor Board determined that (i) the Investor 1 Second Indication would reasonably be expected to lead to a Company Superior Proposal (as defined in the merger agreement with CSG) and (ii) the failure to engage in discussions and negotiations with Investor 1 with respect to the Investor 1 Second Indication would reasonably be expected to be inconsistent with the directors’ fiduciary duties under applicable law (the “June 7 Determination”). The Board then resolved to authorize Vista Outdoor management to, subject to entry into a non-disclosure agreement with Investor 1 in accordance with the terms of the merger agreement with CSG, (i) engage in discussions and negotiations with Investor 1 with respect to the Investor 1 Second Indication and (ii) provide to Investor 1 certain non-public information requested by Investor 1.

Later that evening, Mr. Vanderbrink called a representative of Investor 1 to notify them of the June 7 Determination. Following that call, Mr. Vanderbrink sent Investor 1 a letter stating the June 7 Determination and a draft non-disclosure agreement between Vista Outdoor and Investor 1 (the “Investor 1 NDA”). On June 8, 2024, representatives of Investor 1 and Cravath negotiated the terms of the Investor 1 NDA and Vista Outdoor and Investor 1 entered into the Investor 1 NDA later that day.

On June 8, 2024, representatives of Morgan Stanley and representatives of JPM had a call to discuss the Investor 1 Second Indication and the MNC Third Indication. On June 8 and June 9, 2024, Mr. Vanderbrink and representatives of CSG had calls to discuss the Investor 1 Second Indication and the MNC Third

Indication. The representatives of CSG informed Mr. Vanderbrink that CSG did not intend to make an offer to change the terms of the Transaction at the current time.

On June 9, 2024, a meeting of the Vista Outdoor Board was held with representatives of Morgan Stanley, Moelis, Cravath and Gibson Dunn also in attendance. At the meeting, representatives of Morgan Stanley and Moelis presented, solely for information purposes, their financial analyses of the MNC Third Indication and representatives of Cravath reviewed with the members of the Vista Outdoor Board the details of the proposed financing for the MNC Third Indication that had been provided by MNC to date. Representatives of Cravath also reviewed with the members of the Vista Outdoor Board their fiduciary duties and the framework under the merger agreement with CSG for the Vista Outdoor Board’s review of alternative proposals. The Vista Outdoor Board asked questions and then further considered and discussed the MNC Third Indication. Following discussion, the Vista Outdoor Board determined that the MNC Third Indication would not be more favorable to Vista Outdoor stockholders from a financial point of view than, and would not reasonably be expected to be superior to, the Transaction and should therefore be rejected. Also at the meeting, the Vista Outdoor Board discussed whether to authorize the adjournment of the Special Meeting scheduled for June 14, 2024 to enable Vista Outdoor to engage with Investor 1 and communicate with its stockholders prior to the Special Meeting. Following the discussion, the Board authorized the adjournment of the Special Meeting to July 2, 2024.

Later that day, at the request of representatives of Investor 1, Mr. Vanderbrink attended an in-person dinner with representatives of Investor 1 ahead of a diligence meeting scheduled for the following day.

On the morning of June 10, 2024, before the opening of trading on NYSE, Vista Outdoor issued (i) a letter to MNC notifying MNC of the rejection of the MNC Third Indication and a press release setting forth the text of that letter and (ii) a press release confirming that it was engaging in discussions with Investor 1 and would be adjourning the Special Meeting originally scheduled for June 14, 2024 to July 2, 2024 to enable Vista Outdoor to engage with Investor 1 and communicate with its stockholders prior to the Special Meeting.

CERTAIN SUPPLEMENTAL DISCLOSURES

Supplemental Disclosures to the Proxy Statement/Prospectus in Connection with the Certain Unaudited Prospective Financial Information

The section entitled “The Transaction— Certain Unaudited Prospective Financial Information” is hereby amended by inserting the following text below the first full paragraph on page 115 of the Proxy Statement/Prospectus.

Certain Unaudited Prospective Financial Information (Outdoor Products)

On an annual basis, Vista Outdoor management prepares non-public, unaudited internal financial projections for the upcoming three year period for each of its Sporting Products business and its Outdoor Products business, which are used by Vista Outdoor’s Management Development and Compensation Committee to set performance targets for Vista Outdoor’s corporate executive officers under Vista Outdoor’s Executive Officer Incentive Plan. Consistent with such practice, Vista Outdoor management prepared non-public, unaudited internal financial projections for fiscal years 2025 through 2027 for Vista Outdoor’s Outdoor Products business (the “Outdoor Products FY 2025-2027 Projections”). In connection with the Vista Outdoor Board’s evaluation of the unsolicited indications of interest received from MNC Capital pursuant to which MNC expressed interest in acquiring Vista Outdoor in an all-cash transaction (the “MNC Indications”), Vista Outdoor management also prepared non-public, unaudited internal financial projections for fiscal years 2028 through 2029 for Vista Outdoor’s Outdoor Products business based on an extrapolation of the Outdoor Products FY 2025-2027 Projections (together with the Outdoor Products FY 2025-2027 Projections, the “Outdoor Products Projections”).

At the direction of the Vista Outdoor Board, Vista Outdoor management provided the Outdoor Products Projections on a confidential basis to Morgan Stanley and Moelis, and the Vista Outdoor Board approved and directed Morgan Stanley and Moelis to use the Outdoor Products Projections in connection with their respective financial analyses. In addition, at the direction of the Vista Outdoor Board, Vista Outdoor management provided the Outdoor Products Projections on a confidential basis to CSG and its financial advisors and MNC and its financial advisors. The summary of the Outdoor Products Projections in this proxy statement/prospectus is presented solely to provide you with access to certain non-public information that was made available to each party, their respective boards of directors and advisors in connection with the parties’ respective evaluations. Such information may not be appropriate for other purposes, and is not intended to influence any stockholder to make any investment decision with respect to the Transaction or for any other purpose.

The Outdoor Products Projections were not prepared with a view toward public disclosure, nor were they prepared with a view toward compliance with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants with respect to financial projections. The Outdoor Products Projections were, in general, prepared solely for internal use and are subjective in many respects and thus subject to interpretation. Vista Outdoor management believes that the assumptions used as a basis for the Outdoor Products Projections were reasonable based on the information available to Vista Outdoor management at the time such projections were prepared. However, this information is not fact and should not be relied upon in any way as necessarily indicative of actual future results, and readers of this proxy statement/prospectus are cautioned not to place undue reliance on any such information.

Neither Vista Outdoor’s independent auditors nor any other independent accountants have compiled, examined or performed any procedures with respect to the Outdoor Products Projections, nor have they expressed any opinion or any other form of assurance on such information or its achievability, and assume no responsibility for, and disclaim any association with, the Outdoor Products Projections.

The reports of Vista Outdoor’s independent registered public accounting firm incorporated by reference in this proxy statement/prospectus relate to Vista Outdoor’s historical financial information. The report of the Revelyst Business’s independent registered public accounting firm included in this proxy statement/prospectus relates to the Revelyst Business’s historical combined financial information. None of those reports

extends to any of the Outdoor Products Projections and should not be read to do so. The summary of the Outdoor Products Projections is not being included in this proxy statement/prospectus to influence the decision of any Vista Outdoor stockholders as to whether to approve any of the Proposals, but is being included because the information was among the factors considered by the Vista Outdoor Board in evaluating the MNC Indications and was provided to Vista Outdoor’s financial advisors for their use and reliance in connection with their respective financial analyses and opinions.

While the Outdoor Products Projections were prepared in good faith by Vista Outdoor management, the Outdoor Products Projections were based on information available at the time that the Outdoor Products Projections were prepared as well as numerous variables and assumptions that are inherently uncertain, many of which are beyond the control of Vista Outdoor management. Important factors that may affect actual results and cause the Outdoor Products Projections not to be achieved, or that may change the underlying variables and assumptions on which the Outdoor Products Projections were based and cause the Outdoor Products Projections to be different if prepared at a later date, include, but are not limited to, the availability and costs of raw materials and components, the labor market, consumer demand, the legislative and regulatory environment and general business and economic conditions, in each case that are different from those anticipated within the Outdoor Products Projections, as well as other factors described under “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” beginning on pages 37 and 64, respectively. Even if such variables and assumptions prove to be correct, any delay in timing could cause future results to differ materially from projected amounts. In addition, other than to give effect to estimated annual incremental costs that would be required to operate the Outdoor Products Business on a standalone basis (the “Standalone Costs”), the Outdoor Products Projections were developed without giving effect to the Transaction and therefore do not reflect, among other things, any costs incurred in connection with the Transaction, any costs that may be incurred in connection with taking action to obtain regulatory approval for the Transaction, any changes to strategy or operations of the Outdoor Products Business that may be implemented as a result of the Transaction (other than the Standalone Costs) or the effect of any failure to complete the Transaction. The Outdoor Products Projections also reflect assumptions as to certain business decisions that are subject to change. As a result, actual results may differ materially from those contained in the Outdoor Products Projections. Accordingly, there can be no assurance that any aspect of the Outdoor Products Projections will be realized.

The inclusion of the Outdoor Products Projections in this proxy statement/prospectus should not be regarded as an indication that any of Vista Outdoor, Revelyst, CSG or their respective affiliates, advisors or other representatives considered that any information contained in those Outdoor Products Projections are necessarily indicative of actual future events, and nothing in them should be relied upon as such. Although the Outdoor Products Projections are presented with numerical specificity, they are forward-looking statements that involve inherent risks and uncertainties. Further, the Outdoor Products Projections cover multiple years and such information by its nature becomes less reliable with each successive year. Further, the inclusion of the Outdoor Products Projections does not constitute an admission or representation by Vista Outdoor, Revelyst or CSG that this information is material. None of Vista Outdoor, Revelyst or CSG or their respective affiliates, officers, directors, partners, advisors or other representatives can give any assurance that actual results will not differ from the Outdoor Products Projections, and none of them has updated or undertakes any obligation, except as required by law, to update or otherwise revise or reconcile them to reflect circumstances existing after the date on which they were generated or to reflect the occurrence of future events even in the event that any or all of the assumptions underlying the projections are shown to be in error.

None of Vista Outdoor, Revelyst or CSG or any of their respective affiliates, officers, directors, partners, advisors or other representatives has made, makes or is authorized in the future to make any representation to any stockholder regarding the ultimate performance of the Outdoor Products Business compared to the information contained in the Outdoor Products Projections or that forecasted results will be achieved. None of Vista Outdoor, Revelyst or CSG has made any representation in the Merger Agreement, Separation Agreement or otherwise, concerning the Outdoor Products Projections.

A summary of the Outdoor Products Projections is set forth below and is subject to the important qualifications, limitations and cautionary considerations described above:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | FY2025E | | FY2026E | | FY2027E | | FY2028E | | FY2029E |

Revenue | | $ | 1,260 | | | $ | 1,372 | | | $ | 1,502 | | | $ | 1,618 | | | $ | 1,715 | |

Adjusted EBITDA (1) | | $ | 90 | | | $ | 145 | | | $ | 210 | | | $ | 228 | | | $ | 242 | |

Unlevered Free Cash Flow (2) | | $ | 76 | | | $ | 86 | | | $ | 135 | | | $ | 147 | | | $ | 159 | |

__________________

(1)For purposes of the Outdoor Products Projections, Vista Outdoor calculated Adjusted EBITDA as net income before other income/(expense), interest, taxes and depreciation and amortization, (i) excluding non-recurring and non-cash items, except fully burdened by stock-based compensation and (ii) including the impact of the Standalone Costs.

(2)At the direction of Vista Outdoor management, Morgan Stanley and Moelis calculated Unlevered Free Cash Flow (using the information included in the Outdoor Products Projections) as Adjusted EBITDA (i) less unlevered taxes using a tax rate of 24% as provided by Vista Outdoor management, (ii) less capital expenditures, (iii) adjusted for changes in other assets and liabilities, and (iv) adjusted for changes in net working capital.

The Adjusted EBITDA and Unlevered Free Cash Flow measures included in the Outdoor Products Projections are non-GAAP financial measures. Investors and other readers should consider non-GAAP financial measures only as supplements to, not as substitutes for or as superior measures to, the measures of financial performance prepared in accordance with GAAP. Additionally, since the non-GAAP financial measures are not determined in accordance with GAAP, the non-GAAP financial measures have no standardized meaning across companies, or as prescribed by GAAP and, therefore, may not be comparable to the calculation of similar measures or measures with the same title used by other companies.

UPDATES TO OPINION OF MORGAN STANLEY & CO. LLC

Supplemental Disclosures to the Proxy Statement/Prospectus in Connection with the Opinion of Morgan Stanley & Co. LLC

The section entitled “The Transaction—Opinion of Morgan Stanley & Co. LLC” is hereby amended by inserting the following text below the first paragraph on page 106 of the Proxy Statement/Prospectus.

Summary of Financial Analyses in Connection with the MNC Third Indication

At the meeting of the Vista Outdoor Board held on June 9, 2024, Morgan Stanley presented, solely for informational purposes, its financial analyses regarding the consideration proposed to be received by holders of Vista Outdoor Common Stock pursuant to the MNC Third Indication. Morgan Stanley did not opine on the fairness, from a financial point of view, of the consideration to be received by holders of Vista Outdoor Common Stock pursuant to the MNC Third Indication.

Morgan Stanley’s analyses were not intended to, and do not, constitute an opinion or recommendation as to how the Vista Outdoor stockholders should vote at the Special Meeting.

Morgan Stanley assumed and relied upon, without independent verification, the accuracy and completeness of the information that was publicly available or supplied or otherwise made available to Morgan Stanley by Vista Outdoor, and formed a substantial basis for its analyses. With respect to the Outdoor Products Projections (as defined in the section entitled “Certain Unaudited Prospective Financial Information” beginning on page 112), Morgan Stanley assumed, at Vista Outdoor’s direction, that they had been reasonably prepared and reflected the best currently available estimates and judgments of Vista Outdoor as to the future financial performance of the Outdoor Products Business.

Morgan Stanley is not a legal, tax or regulatory advisor. Morgan Stanley is a financial advisor only and relied upon, without independent verification, the assessment of Vista Outdoor and its legal, tax or regulatory advisors with respect to legal, tax or regulatory matters. Morgan Stanley expressed no opinion with respect to the fairness of the MNC Third Indication. Morgan Stanley did not make any independent valuation or appraisal of the assets or liabilities of the Outdoor Products Business, nor was Morgan Stanley furnished with any such valuations or appraisals. Morgan Stanley’s analyses were necessarily based on financial, economic, market and other conditions as in effect on, and the information made available to Morgan Stanley as of, June 9, 2024. Events occurring after June 9, 2024 may affect Morgan Stanley’s analyses and the assumptions used in preparing it, and Morgan Stanley did not assume any obligation to update or revise its analyses.

Summary of Financial Analyses

The following is a summary of the material financial analyses performed by Morgan Stanley in connection with its presentation to the Vista Outdoor Board on June 9, 2024. The following summary is not a complete description of the financial analyses performed and factors considered by Morgan Stanley, nor does the order of analyses described represent the relative importance or weight given to those financial analyses.

In performing its financial analyses summarized below, at the direction of the Vista Outdoor Board, Morgan Stanley used and relied upon the Outdoor Products Projections provided by Vista Outdoor management, as more fully described below in the section entitled “Certain Unaudited Prospective Financial Information” beginning on page 112. Additionally, based on information provided by Vista Outdoor, Morgan Stanley assumed throughout its analyses that the cash consideration to be received by Vista Outdoor stockholders for the Sporting Products Business is equal to $16.00 per Vista Outdoor share, which is the cash portion of the Merger Consideration that Vista Outdoor stockholders would receive at Closing pursuant to the Transaction Agreements as of the date of Morgan Stanley’s presentation (the “Sporting Products Per Share Cash Consideration”). Morgan Stanley considered in its analyses that the value of Vista Outdoor per

share is equal to the Sporting Products Business Per Share Cash Consideration plus the value of the Outdoor Products Business per Vista Outdoor share (the “Total Package Value”).

Some of the financial analyses summarized below include information presented in tabular format. In order to fully understand the financial analyses used by Morgan Stanley, the tables must be read together with the text of each summary. The tables alone do not constitute a complete description of the financial analyses. The analyses listed in the tables and described below must be considered as a whole. Furthermore, mathematical analysis (such as determining the average or median) is not in itself a meaningful method of using the data referred to below. Assessing any portion of such analyses and of the factors reviewed, without considering all analyses and factors, could create a misleading or incomplete view of the process underlying Morgan Stanley’s analyses.

Certain of the following terms are used throughout this summary of financial analyses:

•UU“AV” refers to aggregate enterprise value, calculated as equity value, plus principal value of total debt (inclusive of finance leases if applicable for the company being analyzed), plus non-controlling interest (as applicable for the company being analyzed), less cash, cash equivalents and marketable securities; and

•“Adjusted EBITDA”, which is referred to as “Adj. EBITDA”, (i) when used in the context of the Outdoor Products Projections has the meaning given to such term in the section entitled “Certain Unaudited Prospective Financial Information” beginning on page 112 and (ii) otherwise refers to earnings before interest, tax, depreciation and amortization, as adjusted, for the company being analyzed.

Discounted Cash Flow Analysis

Morgan Stanley performed a discounted cash flow analysis, which is designed to provide an implied value of a company by calculating the present value of the estimated future cash flows and terminal value of such company. Morgan Stanley calculated a range of implied values per share of the Outdoor Products Business based on estimates of future cash flows for fiscal year 2025 through end of fiscal year 2029. Morgan Stanley performed this analysis on the estimated future cash flows contained in the Outdoor Products Projections.

Morgan Stanley based its analysis on the estimated Unlevered Free Cash Flow (as set forth in the section entitled “Certain Unaudited Prospective Financial Information” beginning on page 112) expected to be generated by the Outdoor Products Business. Morgan Stanley calculated terminal values based on a terminal AV / LTM Adj. EBITDA exit multiple ranging from 8.0x to 10.0x. The Unlevered Free Cash Flow from fiscal year 2025 through end of fiscal year 2029 and terminal values were then discounted to present values as of March 31, 2024 using a range of discount rates of 12.1% to 13.1% (which Morgan Stanley derived based on Morgan Stanley’s estimate of the Outdoor Products Business’s weighted average cost of capital) to calculate an implied AV range for the Outdoor Products Business. Morgan Stanley estimated the weighted average cost of capital for the Outdoor Products Business using the capital asset pricing model and based on its professional judgment and experience. Based on the above-described analysis, Morgan Stanley derived a range of estimated implied values of the Outdoor Products Business per Vista Outdoor share of $30.50 to $36.10, which resulted in a Total Package Value range of $46.50 to $52.10, rounded to the nearest $0.05.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sporting Products Per Share Cash Consideration | | Implied Per Share Range for Outdoor Products | | Total Package Value Range | | MNC Third Indication (For Reference) |

| 8.0x – 10.0x LTM Adj. EBITDA, 12.1% – 13.1% WACC | | $16.00 | | $30.50 – $36.10 | | $46.50 – $52.10 | | $39.50 |

Based on the Outdoor Products Projections as provided by Vista Outdoor management, Morgan Stanley calculated sensitivities on projected compound annual growth rate and long-term EBITDA margin assuming a terminal AV / LTM Adj. EBITDA exit multiple ranging from 8.0x to 10.0x and a range of discount rates of 12.1% to 13.1% (which Morgan Stanley derived based on Morgan Stanley’s estimate of the Outdoor Products Business’s weighted average cost of capital). Based on this analysis, Morgan Stanley derived a downward adjusted Total Package Value range of $41.90 to $46.40 and an upward adjusted Total Package Value range of $52.00 to $58.80, rounded to the nearest $0.05.

Discounted Equity Value Analysis

Morgan Stanley performed a discounted equity value analysis, which is designed to provide insight into a theoretical estimate of the future implied value of a company’s equity as a function of that company’s estimated future earnings. The resulting equity value is subsequently discounted to arrive at an estimate of the implied present value for such company’s potential future per share equity value. In connection with this analysis, Morgan Stanley calculated a range of implied present equity values per share for the Outdoor Products Business.

To calculate the discounted per share equity value for the Outdoor Products Business, Morgan Stanley utilized estimated Adj. EBITDA for the next 12 months (“NTM”) following March 31, 2026. Based upon the application of its professional judgment and experience, Morgan Stanley applied a range of multiples of AV to NTM Adj. EBITDA as of March 31, 2026 of 7.0x to 10.0x, and discounted the resulting equity values at a discount rate of 12.1% based on Morgan Stanley’s estimate of the Outdoor Products Business’s current cost of equity. Based on this analysis, Morgan Stanley derived a range of estimated implied values of the Outdoor Products Business per Vista Outdoor share of $26.95 to $35.40, which resulted in a Total Package Value range of $42.95 to $51.40, rounded to the nearest $0.05.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sporting Products Per Share Cash Consideration | | Implied Equity Value Per Share Range for Outdoor Products | | Total Package Value Range | | MNC Third Indication (For Reference) |

| 7.0x – 10.0x NTM Adj. EBITDA, 12.1% Base Cost of Equity | | $16.00 | | $26.95 – $35.40 | | $42.95 – $51.40 | | $39.50 |

Based on the Outdoor Products Projections as provided by Vista Outdoor management, Morgan Stanley calculated sensitivities on projected compound annual growth rate and long-term EBITDA margin assuming a range of multiples of AV to NTM Adj. EBITDA as of March 31, 2024 of 7.0x to 10.0x and a discount rate of 12.1% based on Morgan Stanley’s estimate of the Outdoor Products Business’s then-current cost of equity. Based on this analysis, Morgan Stanley derived a downward adjusted Total Package Value range of $40.25 to $47.65 and an upward adjusted Total Package Value range of $47.60 to $57.85, rounded to the nearest $0.05.

Leveraged Buyout Analysis

Morgan Stanley analyzed the Outdoor Products Business from the perspective of a potential purchaser that was not a strategic buyer, but rather was primarily a financial sponsor buyer that would effect a hypothetical leveraged buyout of the Outdoor Products Business. Morgan Stanley based its analysis on the Outdoor Products Projections. Morgan Stanley assumed an illustrative transaction date as of March 31, 2024 and a 5-year investment period ending March 30, 2029. Based on its professional judgment and experience, Morgan Stanley assumed (i) a target range of annualized internal rates of return for the financial sponsor of 17.5% to 22.5% and (ii) a range of exit multiples from 8.0x to 10.0x LTM Adj. EBITDA. Based on the above-described analysis, Morgan Stanley derived a range of implied values of the Outdoor Products Business per Vista Outdoor share of $22.45 to $29.35, which resulted in a Total Package Value range of $38.45 to $45.35, rounded to the nearest $0.05.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sporting Products Per Share Cash Consideration | | Implied AV Per Share Range for Outdoor Products | | Total Package Value Range | | MNC Third Indication (For Reference) |

| 8.0x – 10.0x LTM Adj. EBITDA, 17.5% – 22.5% IRR | | $16.00 | | $22.45 – $29.35 | | $38.45 – $45.35 | | $39.50 |

Based on the Outdoor Products Projections as provided by Vista Outdoor management, Morgan Stanley calculated sensitivities on projected compound annual growth rate and long-term EBITDA margin assuming (i) a target range of annualized rates of return for the financial sponsor of 17.5% to 22.5% and (ii) a range of exit multiples from 8.0x to 10.0x LTM Adj. EBITDA. Based on this analysis, Morgan Stanley derived a downward adjusted Total Package Value range of $35.50 to $40.95 and an upward adjusted Total Package Value range of $41.95 to $50.45, rounded to the nearest $0.05.

Comparable Companies Analysis

Morgan Stanley performed a comparable companies analysis, which attempts to provide an implied value of a company by comparing it to similar companies that are publicly traded. Morgan Stanley reviewed and compared the Outdoor Products Projections with comparable publicly available consensus equity analyst research estimates for selected companies, selected based on Morgan Stanley’s professional judgement and experience, that share similar business characteristics and have certain comparable operating characteristics including, among other things, similarly sized revenue and/or revenue growth rates, market capitalizations, profitability, scale and/or other similar operating characteristics (these companies are referred to herein as the “comparable companies”). No comparable companies were excluded from Morgan Stanley’s analysis.

For purposes of this analysis, Morgan Stanley analyzed the ratio of AV to Adj. EBITDA estimated for the the Outdoor Products Business fiscal years 2024 and 2025 and using publicly available consensus equity analyst research estimates for comparison purposes with the comparable companies. Results of the analysis for the comparable companies is indicated in the following table:

| | | | | | | | | | | | | | |

Outdoor Products Peers | | AV / Estimated 2024 Adj. EBITDA | | AV / Estimated 2025 Adj. EBITDA |

Topgolf Callaway Brands | | 10.2x | | 8.7x |

Helen of Troy | | 10.3x | | 9.7x |

Fox Factory Holding(1) | | 11.1x | | 10.0x |

Yeti Holdings | | 13.0x | | 10.7x |

Traeger | | N/A | | 10.8x |

Acushnet Holdings | | 15.8x | | 13.0x |

Thule Group | | 19.9x | | 16.8x |

__________________

(1)Pro forma adjustments made to account for November 2023 acquisition of Marucci.

Based on its analysis of the relevant metrics for each of the comparable companies and upon the application of its professional judgment and experience, Morgan Stanley selected a representative range of 7.0x to 10.0x Adj. EBITDA and applied this range of multiples to the estimated NTM Adj. EBITDA provided by Vista Outdoor management in the Outdoor Products Projections. Morgan Stanley derived a range of implied values of the Outdoor Products Business per Vista Outdoor share of $16.30 to $20.85, which resulted in a Total Package Value range of $32.30 to $36.85, rounded to the nearest $0.05.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sporting Products Per Share Cash Consideration | | Implied AV Per Share Range for Outdoor Products | | Total Package Value Range | | MNC Third Indication (For Reference) |

| 7.0x – 10.0x NTM Adj. EBITDA | | $16.00 | | $16.30 – $20.85 | | $32.30 – $36.85 | | $39.50 |

No company utilized in the comparable companies analysis is identical to the Outdoor Products Business. In evaluating the comparable companies, Morgan Stanley made numerous assumptions with respect to industry performance, general business, regulatory, economic, market and financial conditions and other matters, many of which are beyond the Outdoor Products Business’s control. These include, among other things, the impact of competition on the Outdoor Products Business’s business and its industry generally, industry growth and the absence of any adverse material change in the financial condition and prospects of the Outdoor Products Business and its industry, and in the financial markets in general. Mathematical analysis (such as determining the mean or a median) is not in itself a meaningful method of using selected company data.

Based on the application of Morgan Stanley’s professional judgment and experience, Morgan Stanley did not calculate sensitivities as it relates to its comparable companies analysis.

General

In connection with the review of the MNC Third Indication by the Vista Outdoor Board, Morgan Stanley performed a variety of financial and comparative analyses solely for informational purposes. The preparation of financial analyses is a complex process and is not necessarily susceptible to a partial analysis or summary description. Morgan Stanley believes that selecting any portion of its analyses, without considering all analyses as a whole, would create an incomplete view of the process underlying its analyses. In addition, Morgan Stanley may have given various analyses and factors more or less weight than other analyses and factors and may have deemed various assumptions more or less probable than other assumptions. As a result, the ranges of valuations resulting from any particular analysis described above should not be taken to be Morgan Stanley’s view of the actual value of the Outdoor Products Business or the Total Package Value.

In performing its analyses, Morgan Stanley made numerous judgments and assumptions with respect to industry performance, general business, regulatory, economic, market and financial conditions and other matters, many of which are beyond the control of the Sporting Products Business or the Outdoor Products Business. These include, among other things, the impact of competition on the Sporting Products Business or the Outdoor Products Business’s business and the industry generally, industry growth and the absence of any adverse material change in the financial condition and prospects of the Sporting Products Business or the Outdoor Products Business, the industry or the financial markets in general. Any estimates contained in Morgan Stanley’s analyses are not necessarily indicative of future results or actual values, which may be significantly more or less favorable than those suggested by such estimates.

Morgan Stanley conducted the analyses described above solely for informational purposes. These analyses do not purport to be appraisals of Vista Outdoor Common Stock, the Sporting Products Business or the Outdoor Products Business, or to reflect the price at which shares of Vista Outdoor Common Stock might actually trade.

Morgan Stanley’s analyses and its presentation to the Vista Outdoor Board was one of many factors taken into consideration by the Vista Outdoor Board in deciding to reject the MNC Third Indication. The Vista Outdoor Board was informed by Morgan Stanley that it should not definitively rely upon or use its analyses to form the definitive basis for any decision, contract, commitment or action whatsoever, with respect to any proposed transaction or otherwise. Consequently, the analyses as described above should not be viewed as determinative of the opinion of the Vista Outdoor Board.

UPDATES TO OPINION OF MOELIS & COMPANY LLC

Supplemental Disclosures to the Proxy Statement/Prospectus in Connection with the Opinion of Moelis & Company LLC

The section entitled “The Transaction—Opinion of Moelis & Company LLC” is hereby amended by inserting the following text before the second to last full paragraph on page 112 of the Proxy Statement/Prospectus.

June 2024 Report of Moelis & Company LLC

The following is a summary of the material financial analyses presented by Moelis to the Vista Outdoor Board at a meeting held on June 9, 2024 in connection with the Vista Outdoor Board’s discussion of the status of the MNC Third Indication.

Unless the context indicates otherwise, Moelis calculated (a) each Total Enterprise Value for Vista Outdoor as adjusted to reflect (i) the net proceeds from the sale of Sporting Products Business (consisting of gross proceeds of $1,960 million, less estimated adjustments pursuant to the Merger Agreement of approximately $96 million) and (ii) estimated net proceeds of approximately $46 million from the proceeds of the expected divestiture of certain assets, as well as insurance proceeds from the fire at a Fiber Energy Pellet Mill facility for an aggregate adjustment of $1,910 million (collectively, the “Estimated Total Net Sale Proceeds”), (b) each equity value for Vista Outdoor based on debt (less cash and cash equivalents) (“net debt”) as of March 31, 2024 of $660 million and (c) per share amounts for Vista Outdoor Common Stock based on diluted shares outstanding as of March 31, 2024, using the treasury stock method. All such information for Vista Outdoor was provided by management of Vista Outdoor. As used below, “Unaffected Share Price” refers to Vista Outdoor Common Stock’s closing stock price on February 29, 2024, the last trading day prior to public disclosure of the MNC Third Indication.

Selected Publicly Traded Companies Analysis

Moelis reviewed financial and stock market information of ten publicly traded companies engaged in the business of manufacturing sporting and outdoor goods (the “Selected Public Sporting & Outdoor Goods Companies”), one publicly traded company engaged in the business of manufacturing outdoor cooking equipment (“Traeger Inc.”) and two publicly traded companies engaged in the business of manufacturing certain types of consumer electronic products (“Garmin Ltd.” and “GoPro, Inc.” and, collectively with Traeger and the Selected Public Sporting & Outdoor Companies, the “Selected Public Outdoor Companies”), in each case, whose operations Moelis believed, based on its experience and professional judgment, to be generally relevant in certain respects to the Outdoor Products Business for purposes of Moelis’ analysis, and for which consensus Wall Street research was available. No companies meeting this selection criteria were excluded from the analysis. Moelis reviewed the TEV of each of the Selected Public Outdoor Companies, as well as Vista Outdoor, as a multiple of estimated Adj. EBITDA for each of calendar years 2024 and 2025 (“CY2024E” and “CY2025E”, respectively), based on consensus Wall Street research available as of June 6, 2024. Financial data for the Selected Public Outdoor Companies was based on public filings as of the relevant company’s most recently reported quarter end or semi-annual report, where applicable.

This data is summarized in the following table(1):

| | | | | | | | | | | |

| TEV/ Adj. EBITDA |

| 2024E | | 2025E |

| Selected Sporting & Outdoor Goods Companies | | | |

| Shimano Inc. | 19.7x | | 16.3x |

| Topgolf Callaway Brands Corp. | 9.8x | | 8.7x |

| Acushnet Holdings Corp.. | 14.0x | | 13.3x |

| | | | | | | | | | | |

| YETI Holdings, Inc. | 12.0x | | 11.0x |

| Giant Manufacturing Co. Ltd. | 13.3x | | 10.7x |

| Thule Group AB. | 17.6x | | 15.5x |

| Dometic Group AB | 9.6x | | 8.5x |

| Compass Diversified Holdings | 9.4x | | 8.4x |

| Solo Brands, Inc. | 10.8x | | 8.7x |

| Globeride, Inc. | 6.3x | | 5.6x |

| Mean | 12.3x | | 10.7x |

| Median | 11.4x | | 9.7x |

| Selected Outdoor Cooking Publicly Traded Companies | | | |

| Traeger Inc. | NM | | 30.5x |

| Selected Consumer Electronic Companies | | | |

| Garmin Ltd. | 20.1x | | 18.2x |

| GoPro, Inc. | NM | | NM |

| Selected Public Outdoor Companies | | | |

| Mean | 13.0x | | 13.0x |

| Median | 12.0x | | 10.9x |

| Vista Outdoor Consensus | 6.4x | | 5.8x |

__________________

(1)“NM” indicates information not meaningful because EBITDA was negative or de minimis.

In reviewing the Selected Public Outdoor Companies data for purposes of determining TEV ranges for the Outdoor Products Business, Moelis placed more emphasis on the Selected Public Sporting & Outdoor Goods Companies because of the Outdoor Products Business’s large majority of revenue arising from the sporting and outdoor goods sector. Moelis noted, however, that the Selected Public Sporting & Outdoor Goods Companies were limited in comparability because of several factors, including (i) some of them are mono-brand companies, as contrasted to the Outdoor Products Business’s robust portfolio of brands, (ii) different levels of brand recognition and geographic sales distribution, (iii) the Outdoor Products Business’s projected revenue compound annual growth rate (“CAGR”) from CY2023 to CY2025E is below the median of the Selected Public Sporting & Outdoor Goods Companies, (iv) the Outdoor Products Business’s significantly higher projected CY2023 to CY2025E Adj. EBITDA CAGR, and (v) the Outdoor Products Business’s significantly lower CY2024E Adj. EBITDA margin. Overall, Moelis took into account the estimated performance over the entire length of the term of the Outdoor Product Projections, from the near-term lower demand environment to the significant projected improvement in results in the longer term, driven in part by the GEAR Up transformational plan. Moelis’ TEV range for the Outdoor Products Business was informed by a premium to the multiples for Globeride, Inc., at the low end, and a discount to the overall median of the Selected Public Sporting & Outdoor Goods Companies, at the high end, as Adj. EBITDA margins for the Outdoor Products Business approach the current median of the Selected Public Sporting & Outdoor Companies over time.

Based on the foregoing and using its professional judgment, Moelis selected multiples ranges of (i) 8.5x to 10.5x TEV/Adj. EBITDA for CY2024E and (ii) 7.75x to 9.00x TEV/Adj. EBITDA for CY2025E. Moelis then applied such multiples ranges to the corresponding financial data for the Outdoor Products Business (CY2024E and CY2025E Adj. EBITDA estimates for the Outdoor Products Business, based on the Outdoor Product Projections) to derive ranges of implied TEVs for the Outdoor Products Business. Moelis also derived the implied TEV ranges for Vista Outdoor by adding the implied TEV ranges for the Outdoor

Products Business to the Estimated Total Net Sale Proceeds. This analysis indicated the following implied TEV ranges for each of the Outdoor Products Business and Vista Outdoor:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | ($ in millions) |

| Implied TEV Ranges based on: | | Estimated Total Net Sale Proceeds | | Vista Outdoor TEV Range based on: |

CY2024E Adj. EBITDA | | CY2025E Adj. EBITDA | | | | CY2024E

Adj. EBITDA | | CY2025E

Adj. EBITDA |

| $636 - $786 | | $973 - $1,130 | | $1,910 | | $2,546 - $2,696 | | $2,883 - $3,040 |

Moelis then derived an implied per share reference range from the resulting implied Vista Outdoor TEV range, using the net debt and diluted share information described above. This analysis indicated the following implied per share reference range for Vista Outdoor Common Stock, as compared to the Unaffected Share Price and the MNC Third Indication:

| | | | | | | | | | | | | | | | | | | | |

| Implied Vista Outdoor Per Share Value |

| Unaffected Share Price | | MNC Third Indication | | Implied Per Share Reference Range based on: |

| | | | CY2024E

Adj. EBITDA | | CY2025E

Adj. EBITDA |

| $31.20 | | $39.50 | | $31.69 - $34.21 | | $37.35 - $39.98 |

Selected Precedent Transactions Analysis

Moelis reviewed financial information of selected transactions involving target businesses engaged in the business of manufacturing sporting and outdoor goods (the “Selected Precedent Outdoor Transactions”) whose operations Moelis believed, based on its experience and professional judgment, were generally relevant in certain respects to the Outdoor Products Business for purposes of Moelis’ analysis and for which TEV/LTM EBITDA multiples were publicly available. Moelis reviewed implied TEV of each target business as a multiple of LTM EBITDA immediately preceding announcement of the relevant transaction (unless otherwise noted). Implied TEVs were based on the announced purchase prices paid for the target businesses, as well as announced LTM EBITDA for such target businesses (unless otherwise noted).

This data is summarized in the following table(2):

| | | | | | | | | | | | | | | | | | | | |

Announcement Date | | Target | | Acquirer | | TEV / LTM EBITDA |

| February 2024 | | Snow Peak, Inc. | | Bain Capital, LP | | 24.6x |

| November 2023 | | Marucci Sports, LLC | | Fox Factory Holding Corp. | | 11.4x |

| October 2022 | | Weber Inc. | | BDT Capital Partners LLC | | NM |

| July 2022 | | Simms Fishing Products LLC(3) | | Vista Outdoor | | 18.5x |

| July 2022 | | Fox Racing Inc.(4) | | Vista Outdoor | | 12.6x |

| January 2022 | | Accell Group N.V. | | Kohlberg Kravis Roberts & Co. LP, Teslin Capital Management B.V. | | 13.4x |

| September 2021 | | Igloo Coolers Products Corp.(5) | | Dometic Group AB | | 16.5x |

| September 2021 | | WAWGD, Inc. (d/b/a Foresight Sports, Inc.)(6) | | Vista Outdoor | | 11.0x |

| June 2021 | | Rhino-Rack Pty Ltd(7) | | Clarus Corporation | | 12.2x |

| September 2020 | | Boa Technology, Inc. | | Compass Diversified Holdings | | 18.5x |

| | | | | | | | | | | | | | | | | | | | |

| March 2020 | | Marucci Sports, LLC | | Compass Diversified Holdings | | 13.8x |

| August 2019 | | Fox International Group Limited | | Lew’s Holdings Corporation | | 14.5x |

| September 2018 | | Amer Sports, Inc. | | Anta Sports Products Ltd., FountainVest Partners, Tencent Holdings Ltd. | | 22.9x |

| July 2018 | | Eyewear Business of Vista Outdoor(8) | | Antelope Brands Bidco Inc. (affiliate of undisclosed European private equity fund) | | 12.0x |

| May 2017 | | Newell Brands Inc. Winter Sports Business | | Kohlberg & Company, L.L.C. | | 9.6x |

| August 2016 | | 5.11 Tactical® | | Compass Diversified Holdings | | 10.5x |

| February 2016 | | Steel Technology, LLC(9) | | Helen of Troy Limited | | <~12.0x |

| February 2016 | | Bell Sports Corp.(10) | | Vista Outdoor | | 11.6x |

| July 2015 | | CamelBak Products, LLC(11) | | Vista Outdoor | | 11.6x |

| February 2014 | | Easton Baseball/Softball Business of Easton-Bell Sports, Inc. | | Bauer Performance Sports Ltd. | | 5.3x |

| November 2013 | | Costa Inc. | | Essilor International | | 13.4x |

| September 2013 | | Bushnell Corporation(12) | | Vista Outdoor | | 9.7x |

| All Selected Precedent Transactions | | | | |

| Mean | | 13.7x |

| Median | | 12.4x |

| Vista Outdoor Transactions | | | | |

| Mean | | 12.4x |

| Median | | 11.6x |

| Selected Precedent Transactions Excluding Vista Outdoor Transactions | | | | |

| Mean | | 14.4x |

| Median | | 13.4x |

__________________

(2)“NM” indicates information not meaningful because EBITDA was negative.

(3)Excludes future tax benefits; TEV/ LTM EBITDA including tax attributes is 20.7x.

(4)Excludes earn-out; TEV/ LTM EBITDA including earn-out is 13.7x.

(5)Excludes earn-out; TEV/ LTM EBITDA including earn-out is 22.0x.

(6)Excludes future tax benefits; TEV/ LTM EBITDA including tax attributes is 12.6x.

(7)TEV/ LTM EBITDA including earn-out is 12.7x.

(8)TEV/ LTM EBITDA provided by Revelyst Management.

(9)Implies a pre-synergy TEV/ LTM EBITDA of less than 12x.

(10)TEV/ LTM EBITDA provided by Revelyst Management.

(11)TEV/ LTM EBITDA provided by Revelyst Management.

(12)TEV/ LTM EBITDA calculated based on 25% of 2012A EBITDA and 75% of 2013E EBITDA; TEV/ CY 2012A EBITDA is 10.6x.

In reviewing the Selected Precedent Outdoor Transactions for purposes of determining EBITDA multiples ranges for the Outdoor Products Business, Moelis noted that the comparability of the Selected Precedent Transactions to the evaluation of the MNC Third Indication were limited due of several factors, including (i) limited recent comparable precedent transactions with publicly available TEV / LTM EBITDA

multiples of comparable size and product portfolios, and (ii) the Outdoor Products Business’s significant increase in projected Adj. EBITDA relative to current levels, resulting in difficulty in deriving related comparable precedent multiples in light of the unknown projected EBITDA trajectories for the other recently acquired businesses in the sector.

Moelis further noted that: (i) the recent acquisition of Snow Peak, Inc. was included in the Selected Precedent Outdoor Transactions in light of its recency and similarity to Vista Outdoor in product offerings despite Snow Peak, Inc. not being included in the Selected Public Outdoor Companies because of its relatively smaller scale and focus on non-U.S. end-markets, and (ii) the Outdoor Products Business Adj. EBITDA amounts for FY 2024 used in this analysis did not include pro forma adjustments for cost cutting initiatives related to either the sale of the Sporting Products Business or the Outdoor Products Business’s GEAR Up transformational plan.

Based on the foregoing and using its professional judgment, Moelis selected multiples ranges of 11.0x – 12.5x LTM Adj. EBITDA, and which selected ranges generally reflected (i) a lower bound informed by the transaction multiples for Vista Outdoor’s acquisitions over the immediately preceding five years, with a particular focus on Foresight Sports, Inc. and a discount to Marucci Sports, LLC / Fox Factory Holding Corp. in light of Marucci Sports, LLC’s significant EBITDA growth since its last acquisition in early 2020 and (ii) an upper bound informed by the median of the Selected Precedent Outdoor Transactions multiples. Moelis then applied such multiples range to the corresponding financial data for the Outdoor Products Business for the LTM period ended March 31, 2024 to derive TEV ranges. Moelis also derived the implied TEV ranges for Vista Outdoor by adding the implied TEV ranges for the Outdoor Products Business to the Estimated Total Net Sale Proceeds. This analysis indicated the following implied TEV ranges for each of the Outdoor Products Business and Vista Outdoor:

| | | | | | | | | | | | | | |

| ($ in millions) |

| Implied TEV Ranges based on: | | Estimated Total Net Sale Proceeds | | Vista Outdoor TEV Range based on: |

03/31/2024A Adj. EBITDA | | | | 03/31/2024A

Adj. EBITDA |

| $493 - $561 | | $1,910 | | $2,403 - $2,471 |

Moelis then derived an implied per share reference range from the resulting implied Vista Outdoor TEV range, using the net debt and diluted share information described above. This analysis indicated the following implied per share reference range for Vista Outdoor Common Stock, as compared to the Unaffected Share Price and the MNC Third Indication:

| | | | | | | | | | | | | | |

| Implied Vista Outdoor Per Share Value |

| Unaffected Share Price | | MNC Third Indication | | Implied Per Share Reference Range based on: |

| | | | 03/31/2024A

Adj. EBITDA |

| $31.20 | | $39.50 | | $29.28 - $30.41 |

Discounted Cash Flow Analysis

Moelis performed a discounted cash flow analysis of the Outdoor Products Business using the Outdoor Product Projections to calculate the present value of the estimated future Unlevered Free Cash Flow (as set forth in the section entitled “—Certain Unaudited Prospective Financial Information” beginning on page 112) projected to be generated by the Outdoor Products Business and an estimate of the present value of the terminal value of the Outdoor Products Business. In performing its discounted cash flow analysis, Moelis applied a range of discount rates of 9.75% to 14.75% based on an estimate of the Outdoor Products Business’s weighted average cost of capital. The estimated weighted average cost of capital range was derived using the Capital Asset Pricing Model, as well as a size premium.

Moelis applied this range of discount rates to (i) the estimated after-tax Unlevered Free Cash Flow for the fiscal years ending March 2025 through March 2029 (discounted to March 31, 2024, using the mid-year discounting convention) and (ii) a range of estimated terminal values derived by applying a range of multiples of 8.5x to 10.5x to the Outdoor Products Business’s estimated Adj. EBITDA for fiscal year ending March 2029, as set forth in the Outdoor Product Projections. In determining a range of terminal multiples, Moelis relied on CY2024E Adj. EBITDA multiples for the Selected Public Outdoor Companies as well as a discount to the TEV/NTM EBITDA multiples for the Selected Public Sporting and Outdoor Companies over both the pre-Covid and the 2017-to-current periods. In doing so, Moelis noted that (i) following an increase in demand for consumer discretionary goods during the Covid pandemic, the Selected Public Outdoor Companies have traded at depressed levels since mid-2022 as demand has diminished in part due to higher interest rates and other macro-economic factors, and (ii) the average TEV/NTM EBITDA multiples for the selected publicly traded companies over the 2017-to-current period and pre-Covid period were higher than the average over the last twelve months and 2024 year-to-date periods, respectively. Moelis also noted that the Outdoor Product Projections include 14.0% Adj. EBITDA margins by fiscal year ending March 2027, a significant increase from the fiscal year ending March 2024 Adj. EBITDA margin of 3.4%, and generally in-line with the median of the Selected Public Sporting and Outdoor Companies Adj. EBITDA margins.

Moelis also derived the implied TEV ranges for Vista Outdoor by adding the implied TEV ranges for the Outdoor Products Business to the Estimated Total Net Sale Proceeds. This analysis indicated the following implied TEV range for each of the Outdoor Products Business and Vista Outdoor:

| | | | | | | | | | | | | | |

| ($ in millions) |

| Implied TEV Range | | Estimated Total Net Sale Proceeds | | Vista Outdoor TEV Range |

| $1,446 - $2,059 | | $1,910 | | $3,355 - $3,969 |

Moelis then derived an implied per share reference range from the resulting implied Vista Outdoor TEV range, using the net debt and diluted share information described above. This analysis indicated the following implied per share reference range for Vista Outdoor Common Stock, as compared to the Unaffected Share Price and the MNC Third Indication:

| | | | | | | | | | | | | | |

| Implied Vista Outdoor Per Share Value |

| Unaffected Share Price | | MNC Third Indication | | Implied Per Share Reference Range based on: |

| $31.20 | | $39.50 | | $45.28 - $55.58 |

LBO Analysis

Moelis also reviewed theoretical purchase prices that could be paid by a hypothetical financial buyer in a leveraged buyout of the Outdoor Products Business based on (i) the Outdoor Products Business’s estimated after-tax Unlevered Free Cash Flow for the fiscal years ending March 2025 through March 2029 and (ii) estimated exit values for the Outdoor Products Business derived by applying a range of multiples of 8.5x to 10.5x to the Outdoor Products Business’s estimated Adj. EBITDA for the fiscal year ending March 2029 (based on the Outdoor Product Projections). In addition, this analysis assumed total debt/FY2024A Adj. EBITDA for the Outdoor Products Business of 4.0x, and required internal rates of return for the financial buyer ranging from 20.0% to 25.0%. Moelis also derived the implied TEV ranges for Vista Outdoor by adding the implied TEV ranges for the Outdoor Products Business to the Estimated Total Net Sale Proceeds.

This analysis indicated the following implied TEV range for each of the Outdoor Products Business and Vista Outdoor:

| | | | | | | | | | | | | | |

| | ($ in millions) |

| Implied TEV Range | | Estimated Total Net Sale Proceeds | | Vista Outdoor TEV Range |

| $944 - $1,310 | | $1,910 | | $2,854 - $3,220 |

Moelis then derived an implied per share reference range from the resulting implied Vista Outdoor TEV range, using the net debt and diluted share information described above. This analysis indicated the following implied per share reference range for Vista Outdoor Common Stock, as compared to the Unaffected Share Price and the MNC Third Indication:

| | | | | | | | | | | | | | |

| Implied Vista Outdoor Per Share Value |

| Unaffected Share Price | | MNC Third Indication | | Implied Per Share Reference Range |

| $31.20 | | $39.50 | | $36.86 - $43.00 |

Historical TEV to NTM EBITDA Multiples Performance Review

Moelis also reviewed the historical TEV/NTM EBITDA multiples for the Selected Public Outdoor Companies and Vista Outdoor over certain periods of time. This review indicated high, low, mean and median TEV/NTM EBITDA multiples for the median Selected Public Outdoor Companies since June 6, 2023 (including Weber Inc. until announcement of its pending acquisition by BDT Capital Partners LLC and excluding GoPro, Inc. because of its significant volatility), based on publicly available information and Wall Street research, of 12.4x, 9.8x, 10.9x and 10.7x, respectively, as compared to the corresponding multiples for Vista Outdoor over the same time period of 6.1x, 4.7x, 5.5x and 5.5x, respectively.

Analyst Price Targets

Moelis reviewed forward stock price targets for Vista Outdoor Common Stock in five recently published, publicly available Wall Street research analysts’ reports as of June 6, 2024, which indicated low and high stock price targets ranging from $37.00 to $41.00 per share, with a mean of $39.20 per share.

Forward-Looking Statements

Some of the statements made and information contained in these materials, excluding historical information, are “forward-looking statements,” including those that discuss, among other things: Vista Outdoor’s (“we”, “us” or “our”) plans, objectives, expectations, intentions, strategies, goals, outlook or other non-historical matters; projections with respect to future revenues, income, earnings per share or other financial measures for Vista Outdoor; and the assumptions that underlie these matters. The words “believe,” “expect,” “anticipate,” “intend,” “aim,” “should” and similar expressions are intended to identify such forward-looking statements. To the extent that any such information is forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities Litigation Reform Act of 1995.

Numerous risks, uncertainties and other factors could cause our actual results to differ materially from the expectations described in such forward-looking statements, including the following: risks related to the Transaction, including (i) the failure to receive, on a timely basis or otherwise, the required approval of the Transaction by our stockholders, (ii) the possibility that any or all of the various conditions to the consummation of the Transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals), (iii) the possibility that competing offers or acquisition proposals may be made, (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement relating to the Transaction, including in circumstances which would require Vista Outdoor to pay a termination fee, (v) the effect of the announcement or pendency of the Transaction on our ability to attract, motivate or retain key executives and employees, our ability to maintain relationships with our customers, vendors, service providers and others with whom we do business, or our operating results and business generally, (vi) risks related to the Transaction diverting management’s attention from our ongoing business operations and (vii) that the Transaction may not achieve some or all of any anticipated benefits with respect to either business segment and that the Transaction may not be completed in accordance with our expected plans or anticipated timelines, or at all; impacts from the COVID-19 pandemic on our operations, the operations of our customers and suppliers and general economic conditions; supplier capacity constraints, production or shipping disruptions or quality or price issues affecting our operating costs; the supply, availability and costs of raw materials and components; increases in commodity, energy, and production costs; seasonality and weather conditions; our ability to complete acquisitions, realize expected benefits from acquisitions and integrate acquired businesses; reductions in or unexpected changes in or our inability to accurately forecast demand for ammunition, accessories, or other outdoor sports and recreation products; disruption in the service or significant increase in the cost of our primary delivery and shipping services for our products and components or a significant disruption at shipping ports; risks associated with diversification into new international and commercial markets, including regulatory compliance; our ability to take advantage of growth opportunities in international and commercial markets; our ability to obtain and maintain licenses to third-party technology; our ability to attract and retain key personnel; disruptions caused by catastrophic events; risks associated with our sales to significant retail customers, including unexpected cancellations, delays, and other changes to purchase orders; our competitive environment; our ability to adapt our products to changes in technology, the marketplace and customer preferences, including our ability to respond to shifting preferences of the end consumer from brick and mortar retail to online retail; our ability to maintain and enhance brand recognition and reputation; others’ use of social media to disseminate negative commentary about us, our products, and boycotts; the outcome of contingencies, including with respect to litigation and other proceedings relating to intellectual property, product liability, warranty liability, personal injury, and environmental remediation; our ability to comply with extensive federal, state and international laws, rules and regulations; changes in laws, rules and regulations relating to our business, such as federal and state ammunition regulations; risks associated with cybersecurity and other industrial and physical security threats; interest rate risk; changes in the current tariff structures; changes in tax rules or pronouncements; capital market volatility and the availability of financing; foreign currency exchange rates and fluctuations in those rates; general economic and business conditions in the United States and our markets outside the United States, including as a result of the war in Ukraine and the imposition of sanctions on Russia, the COVID-19 pandemic, conditions affecting employment levels, consumer confidence and spending, conditions in the retail environment, and other economic conditions affecting demand for our products and the financial health of our customers.

You are cautioned not to place undue reliance on any forward-looking statements we make, which are based only on information currently available to us and speak only as of the date hereof. A more detailed description of risk factors that may affect our operating results can be found in Part 1, Item 1A, Risk Factors, of our Annual Report on Form 10-K for fiscal year 2024 and in the filings we make with the SEC from time to time. We undertake no obligation to update any forward-looking statements, except as otherwise required by law.

No Offer or Solicitation

This communication is neither an offer to sell, nor a solicitation of an offer to buy any securities, the solicitation of any vote, consent or approval in any jurisdiction pursuant to or in connection with the Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information and Where to Find It

These materials may be deemed to be solicitation material in respect of the Transaction. In connection with the Transaction, Revelyst, a subsidiary of Vista Outdoor, filed with the SEC a registration statement on Form S-4 in connection with the proposed issuance of shares of common stock of Revelyst to Vista Outdoor stockholders pursuant to the Transaction, which Form S-4 includes a proxy statement of Vista Outdoor that also constitutes a prospectus of Revelyst. INVESTORS AND STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING OUR PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The registration statement was declared effective by the SEC on March 22, 2024, and we have mailed the definitive proxy statement/prospectus to each of our stockholders entitled to vote at the meeting relating to the approval of the Transaction. Investors and stockholders may obtain the proxy statement/prospectus and any other documents free of charge through the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Vista Outdoor are available free of charge on our website at www.vistaoutdoor.com.

Participants in Solicitation

Vista Outdoor, Revelyst, Merger Sub Parent, Merger Sub and CSG and their respective directors, executive officers and certain other members of management and employees, under SEC rules, may be deemed to be “participants” in the solicitation of proxies from our stockholders in respect of the Transaction. Information about our directors and executive officers is set forth in our proxy statement on Schedule 14A for our 2023 Annual Meeting of Stockholders, which was filed with the SEC on June 12, 2023, and subsequent statements of changes in beneficial ownership on file with the SEC. These documents are available free of charge through the SEC’s website at www.sec.gov. Additional information regarding the interests of potential participants in the solicitation of proxies in connection with the Transaction, which may, in some cases, be different than those of our stockholders generally, is also included in the proxy statement/prospectus relating to the Transaction.

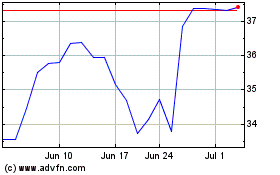

Vista Outdoor (NYSE:VSTO)

Historical Stock Chart

From May 2024 to Jun 2024

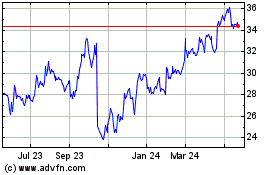

Vista Outdoor (NYSE:VSTO)

Historical Stock Chart

From Jun 2023 to Jun 2024