WPP Shares Tumble as Company Sees Flat Sales, Margin in 2020 -- Update

27 February 2020 - 11:20PM

Dow Jones News

--WPP expects flat like-for-like net sales and operating profit

margin for this year, excluding any coronavirus impact

--The company's like-for-like net sales for the fourth quarter

of 2019 missed analysts' expectations

--WPP shares had their worst one-day performance since October

1998

By Adria Calatayud

Shares of WPP PLC had their worst day in more than two decades

Thursday after the company said that it expects like-for-like net

sales and operating profit margin to be flat this year, and posted

a sharper-than-anticipated fall for the fourth quarter of 2019.

The company's guidance, which excludes any hit from the

coronavirus epidemic, fell short of analysts' expectations for 2020

and highlights the difficulties facing the advertising giant as it

enters the second year of its three-year turnaround plan.

Shares at 1134 GMT were down 14% at 777.60 pence, in the

company's biggest one-day percentage drop since October 1998.

London-based WPP said like-for-like net sales--a closely-watched

measurement of its underlying operating performance--for the

quarter returned to negative territory with a 1.9% decline after a

0.5% rise in the third quarter. WPP said like-for-like net sales

fell 1.6% including its market-research unit Kantar, in which it

sold a 60% stake last year.

Analysts had forecast a 0.8% decline for the fourth quarter,

according to a consensus gathered by Vuma and based on seven

analysts' forecasts.

For 2019 as a whole, like-for-like net sales fell 1.6%, or 1.2%

including Kantar. This compares with WPP's guidance of a decline of

between 1.5% and 2.0%.

The company said it expects an improvement in like-for-like net

sales over 2020 to end the year with flat growth. Analysts expected

a 0.4% increase for 2020, according to a Vuma-compiled

consensus.

WPP said it is too early to predict the full impact of the

coronavirus epidemic.

Pretax profit fell to 928.1 million pounds ($1.20 billion) from

GBP1.26 billion on revenue that grew to GBP13.23 billion from

GBP13.05 billion, WPP said. Net profit fell to GBP62.7 million, it

said.

"The second half of 2019 was stronger than the first, with

performance improving globally and in the United States, our

largest market," Chief Executive Mark Read said. However, WPP's

North American operations were hit by a 5.7% fall in like-for-like

net sales for last year, dragging the group's performance.

Since Mr. Read took over as CEO in September 2018, the company

has moved to simplify its operations and reduce debt as it seeks to

battle increased competition from consulting firms and the growing

power of technology giants like Facebook Inc. and Alphabet Inc.'s

Google.

Under its turnaround program, launched in December 2018, WPP

aims to return the company to sustainable growth in line with its

peers in 2021 and reach a headline operating profit margin of at

least 15%.

Russ Mould, investment director at investment platform AJ Bell,

said 2020 was supposed to be the year when WPP started to deliver

the benefits of its restructuring, but guidance for zero growth

this year and the fourth-quarter slump in sales seemed

"uninspiring" for investors.

"The targets for 2021 have been maintained but the market's

patience appears to have snapped," Mr. Mould said in a note to

clients.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

February 27, 2020 07:05 ET (12:05 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

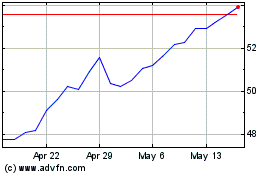

WPP (NYSE:WPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

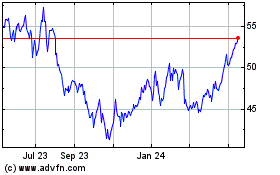

WPP (NYSE:WPP)

Historical Stock Chart

From Jul 2023 to Jul 2024