Brookfield Acquires Maryland Assets - Analyst Blog

14 September 2011 - 1:58AM

Zacks

Brookfield Office Properties Inc. (BPO)

recently announced the acquisition of an office building namely,

Three Bethesda Metro Center in Bethesda, Maryland for $150.1

million from the Meridian Group. The building is currently 93.0%

leased and provides ample scope for further development.

Located at the intersection of Wisconsin Avenue and Old

Georgetown Road, the center is a 17-storied building spanning

368,400 square feet. The office building features full size atriums

with glass elevators and underground parking facility. The center

is ideally located at the Bethesda Row, and provides easy access to

all the amenities including shopping, nightlife, dining and other

entertainment amenities in that area.

Three Bethesda Metro Center in Bethesda is the company’s fourth

property in the Bethesda submarket. With this transaction;

Brookfield expects to further expand its presence in Maryland.

Based in New York, Brookfield is a publicly owned real estate

investment firm. The company owns, develops and manages premier

office properties in the United States, Canada and Australia. It

also provides ancillary real estate service businesses, such as

tenant service and amenities. The company mainly invests in high

growth and high-barrier-to-entry markets with primary focus on the

creation and sustainability of growing streams of cash flow.

Brookfield currently retains a Zacks #3 Rank, which translates

into a short-term Hold rating. We are also maintaining our

long-term Neutral recommendation on the stock. One of its

competitors, Xinyuan Real Estate Co., Ltd. (XIN)

holds a Zacks #1 Rank, which translates into a short-term Strong

Buy rating.

BROOKFLD OFFICE (BPO): Free Stock Analysis Report

XINYUAN REAL ES (XIN): Free Stock Analysis Report

Zacks Investment Research

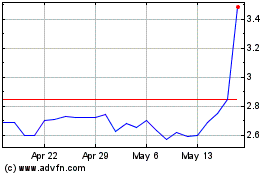

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Jun 2024 to Jul 2024

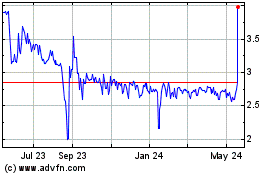

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Jul 2023 to Jul 2024