- GAAP revenue of $7.9 million, the second highest quarterly

revenue in company history

- Adjusted revenue of $8.2 million from sales of 70 units,

excluding $0.3 million of recall-related costs

- Produced 46 units during the quarter, consisting of vehicles,

powertrains, and mobile DC fast chargers

- Nearly 5 million driven miles, compared to 2.2 million a year

ago

- Full year revenue guidance of $35-45 million

Lightning eMotors, a leading provider of zero-emission

powertrains and medium-duty and specialty commercial electric

vehicles for fleets, today announced consolidated results for the

second quarter ended June 30, 2023.

“The second quarter represented the second highest quarterly

revenue in our history,” stated Tim Reeser, Lightning Co-founder

and CEO. “With the supply issues and associated disruption from the

Romeo battery issue now behind us, we are ramping production of our

new ZEV4 trucks and buses to meet the growing demand and charting a

path towards positive gross margin. We also delivered the first

customer units of our Mobile DC Fast Charger and are seeing strong

interest in this product.”

Continued Reeser, “During the end of Q2 and into the second half

of 2023, we have seen our cash needs reduce materially as we sell

through the finished goods inventory built over the last several

quarters and use the existing raw materials inventory to build to

meet new orders. In addition, we continue to see the benefits of

previous cost reduction actions and are well positioned from an

inventory perspective to meet our full-year guidance with minimal

incremental purchases. While we convert our inventory to cash, we

will also continue to seek additional sources of capital in order

to strengthen our overall liquidity outlook.”

GAAP revenue was impacted by $0.3 million from the booking of

apportioned cost of an accommodation we made to support our

customers, as we bought back vehicles with defective Romeo

batteries.

Second Quarter 2023 Financial Results

Second quarter production was 46 units, down from 74 units in

the first quarter of 2022. Unit sales were 70, compared to 36 in

the year-ago quarter. Second quarter revenue was $7.9 million,

compared to $3.5 million for the prior year quarter. Excluding

customer refunds related to the Romeo battery recall, adjusted

revenue was $8.2 million.

Second quarter net loss was $21.4 million, or $3.70 per share,

compared to net income of $35.7 million, or $6.94 per diluted

share, during the second quarter of last year.

Second quarter adjusted EBITDA loss was $17.1 million, compared

to a loss of $13.9 million during the same period in the prior

year. Adjusted revenue and adjusted EBITDA are non-GAAP measures.

See explanatory language and reconciliation to the GAAP measures

below.

Guidance

Based on current demand and supply conditions, the Company

expects:

- 2023 revenue to be in the range of $35 million to $45

million

- 2023 unit sales to be in the range of 300 to 350 units

- 2023 unit production to be in the range of 200 to 230

units

We have reduced the top end of our annual revenue guidance from

$50 million to $45 million and also lowered the top end of the unit

sales accordingly. We reduced the top end of the revenue and unit

sales to reflect a change made to conserve cash. We are now only

ordering inventory for firm orders, and while we may receive

additional orders during the second half of this year we may not be

able to obtain the inventory needed to complete the builds in the

fourth quarter. We also lowered the unit production range to

reflect both the change to a build-to-order model and because we

still have a material amount of finished goods inventory to

sell.

Webcast and Conference Call Information

Company management will host a conference call on Monday, August

14, 2023, at 4:30 p.m. Eastern Time, to discuss the Company's

financial results.

Interested investors and other parties can listen to a webcast

of the live conference call and access the Company’s second quarter

update presentation by logging onto the Investor Relations section

of the Company's website at ir.lightningemotors.com.

The conference call can be accessed live over the phone by

dialing (877) 407-6910 (domestic) or +1 (201) 689-8731

(international).

About Lightning eMotors

Lightning eMotors (NYSE: ZEV) has been providing specialized and

sustainable fleet solutions since 2009, deploying complete

zero-emission-vehicle solutions for commercial fleets since 2018 –

including cargo and passenger vans, ambulances, shuttle buses, Type

A school buses, work trucks, city buses, and motor coaches. The

Lightning eMotors team designs, engineers, customizes, and

manufactures zero-emission vehicles to support the wide array of

fleet customer needs with a full suite of control software,

telematics, analytics, and charging solutions to simplify the

buying and ownership experience and maximize uptime and energy

efficiency. To learn more, visit our website at

lightningemotors.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of U.S. federal securities laws. Such forward-looking

statements include, but are not limited to, statements regarding

the financial statements of Lightning eMotors (including guidance),

its product and customer developments, its expectations, hopes,

beliefs, intentions, plans, prospects or strategies regarding the

future revenues and expenses, its expectations regarding the

availability and timing of components and supplies and the business

plans of Lightning eMotors’ management team. Any statements

contained herein that are not statements of historical fact may be

deemed to be forward-looking statements. In addition, any

statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking statements. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intends,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “would” and similar expressions may

identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. The

forward-looking statements contained in this press release are

based on certain assumptions and analyses made by the management of

Lightning eMotors considering their respective experience and

perception of historical trends, current conditions and expected

future developments and their potential effects on Lightning

eMotors as well as other factors they believe are appropriate in

the circumstances. There can be no assurance that future

developments affecting Lightning eMotors will be those anticipated.

These forward-looking statements contained in this press release

are subject to known and unknown risks, uncertainties, assumptions

and other factors that may cause actual results or outcomes to be

materially different from any future results or outcomes expressed

or implied by the forward-looking statements. These risks,

uncertainties, assumptions and other factors, many of which are

described in our most recent annual report on Form 10-K and our

other filings with the U.S. Securities and Exchange Commission,

include, but are not limited to: (i) those related to our

operations and business and financial performance; (ii) our ability

to service our debt; (iii) our ability to have access to an

adequate supply of batteries, motors, chassis and other critical

components for our vehicles on the timeline we expect (iv) our

ability to attract and retain customers; (v) our ability to

generate revenue or sales; (vi) the success of our customers'

development programs which will drive future revenues; (vii) our

ability to execute on our business strategy; (viii) our ability to

compete effectively; (ix) our ability to maintain the New York

Stock Exchange’s listing standards, (x) potential business and

supply chain disruptions, including those related to physical

security threats, information technology or cyber-attacks,

epidemics, pandemics, sanctions, political unrest, war, terrorism

or natural disasters; (xi) macroeconomic factors, including current

global and regional market conditions, commodity prices, inflation

and deflation; (xii) federal, state, and local laws, regulations

and government incentives, particularly those related to the

commercial electric vehicle market; (xiii) the volatility in the

price of our securities due to a variety of factors, including

changes in the competitive industries in which we operate,

variations in operating performance across competitors, changes in

laws and regulations affecting our business and changes in the

capital structure; (xiv) planned and potential business or asset

acquisitions or combinations; (xv) the size and growth of the

markets in which we operate; (xvi) the mix of products utilized by

our customers and such customers’ needs for these products and

their ability to obtain financing; (xvii) market acceptance of new

product offerings; and (xviii) our funding and liquidity plans.

Moreover, we operate in a competitive and rapidly changing

environment, and new risks may emerge from time to time. You should

not put undue reliance on any forward-looking statements.

Forward-looking statements should not be read as a guarantee of

future performance or results and will not necessarily be accurate

indications of the times at, or by, which such performance or

results will be achieved, if at all. Should one or more of these

risks or uncertainties materialize or should any of the assumptions

being made prove incorrect, actual results may vary in material

respects from those projected in these forward-looking statements.

We undertake no obligation to update or revise any forward-looking

statements, whether because of new information, future events or

otherwise, except as may be required under applicable securities

laws.

Lightning eMotors,

Inc.

Consolidated Balance

Sheets

(in thousands, except share

data)

June 30, 2023

December 31,

2022

(Unaudited)

Assets

Current assets

Cash and cash equivalents

$

12,620

$

56,011

Accounts receivable, net of allowance of

$2,041 and $2,028 as of June 30, 2023 and December 31, 2022,

respectively

8,660

9,899

Inventories

57,147

47,066

Prepaid expenses and other current

assets

6,679

9,401

Total current assets

85,106

122,377

Property and equipment, net

12,971

11,519

Operating lease right-of-use asset,

net

7,072

7,735

Other assets

2,010

1,928

Total assets

$

107,159

$

143,559

Liabilities and stockholders’

equity

Current liabilities

Accounts payable

$

10,255

$

7,961

Accrued expenses and other current

liabilities

7,853

6,270

Warrant liability

10

60

Current debt, net of debt discount

53,290

—

Total current liabilities

73,230

15,940

Long-term debt, net of debt discount

2,982

62,103

Operating lease obligation, net of current

portion

6,772

7,735

Derivative liability

2

78

Earnout liability

446

2,265

Other long-term liabilities

794

880

Total liabilities

84,226

89,001

Stockholders’ equity

Preferred stock, par value $0.0001,

1,000,000 shares authorized and no shares issued and outstanding as

of June 30, 2023 and December 31, 2022

—

—

Common stock, par value $0.0001,

250,000,000 shares authorized as of June 30, 2023 and December 31,

2022; 6,144,553 and 4,492,157 shares issued and outstanding as of

June 30, 2023 and December 31, 2022, respectively

1

1

Additional paid-in capital

234,209

220,951

Accumulated deficit

(211,277

)

(166,394

)

Total stockholders’ equity

22,933

54,558

Total liabilities and stockholders’

equity

$

107,159

$

143,559

Lightning eMotors,

Inc.

Consolidated Statements of

Operations

(in thousands, except share and

per share data)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Revenue, net of customer refunds

$

7,916

$

3,536

$

9,227

$

8,948

Cost of revenues

12,933

4,889

21,085

12,611

Gross loss

(5,017

)

(1,353

)

(11,858

)

(3,663

)

Operating expenses

Research and development

1,381

1,810

3,468

3,752

Selling, general and administrative

13,025

12,559

27,873

24,158

Total operating expenses

14,406

14,369

31,341

27,910

Loss from operations

(19,423

)

(15,722

)

(43,199

)

(31,573

)

Other (income) expense, net

Interest expense, net

3,492

3,849

6,621

7,710

(Gain) loss from change in fair value of

warrant liabilities

(44

)

(1,126

)

(50

)

(1,314

)

(Gain) loss from change in fair value of

derivative liability

(24

)

(10,087

)

(63

)

(12,642

)

(Gain) loss from change in earnout

liability

(1,413

)

(44,131

)

(1,819

)

(50,303

)

(Gain) loss on extinguishment of debt

—

—

(2,965

)

—

Other expense (income), net

14

35

(40

)

(6

)

Total other (income) expense, net

2,025

(51,460

)

1,684

(56,555

)

Net income (loss)

$

(21,448

)

$

35,738

$

(44,883

)

$

24,982

Net income (loss) per share, basic

$

(3.70

)

$

9.48

$

(8.47

)

$

6.64

Net income (loss) per share, diluted

$

(3.70

)

$

6.94

$

(8.47

)

$

4.70

Weighted-average shares outstanding,

basic

5,800,106

3,770,406

5,299,921

3,763,443

Weighted-average shares outstanding,

diluted

5,800,106

4,260,511

5,299,921

4,264,065

Lightning eMotors,

Inc.

Consolidated Statements of

Cash Flows

(in thousands)

(Unaudited)

Six Months Ended June

30,

2023

2022

Cash flows from operating

activities

Net income (loss)

$

(44,883

)

$

24,982

Adjustments to reconcile net income (loss)

to net cash used in operating activities:

Depreciation and amortization

1,213

768

Provision for doubtful accounts

1,942

498

Provision for inventory obsolescence and

write-downs

2,864

777

Loss (gain) on disposal of fixed asset

—

37

Gain on extinguishment of debt

(2,965

)

—

Change in fair value of warrant

liability

(50

)

(1,314

)

Change in fair value of earnout

liability

(1,819

)

(50,303

)

Change in fair value of derivative

liability

(63

)

(12,642

)

Stock-based compensation

2,801

2,408

Amortization of debt discount

4,170

4,413

Non-cash impact of operating lease

right-of-use asset

663

551

Issuance of common stock for debt

468

—

Changes in operating assets and

liabilities:

Accounts receivable

(4,645

)

1,843

Inventories

(9,003

)

(11,382

)

Prepaid expenses and other assets

2,702

(2,658

)

Accounts payable

2,294

1,186

Accrued expenses and other liabilities

611

1,658

Net cash used in operating activities

(43,700

)

(39,178

)

Cash flows from investing

activities

Purchase of property and equipment

(2,539

)

(3,930

)

Proceeds from disposal of property and

equipment

—

—

Net cash used in investing activities

(2,539

)

(3,930

)

Cash flows from financing

activities

Payments on finance lease obligations

(92

)

(35

)

Proceeds from exercise of stock

options

10

123

Tax withholding payment related to net

settlement of equity awards

(14

)

(108

)

Net cash provided by (used in) financing

activities

2,848

(20

)

Net (decrease) increase in cash

(43,391

)

(43,128

)

Cash - Beginning of period

56,011

168,538

Cash - End of period

$

12,620

$

125,410

Supplemental cash flow information

- Cash paid for interest

$

2,746

$

3,526

Significant noncash

transactions

Conversion of notes for common stock

$

10,461

$

—

Property and equipment included in

accounts payable and accruals

48

708

Finance lease right-of-use asset in

exchange for a lease liability

(161

)

786

Inventory repossessed for accounts

receivable

3,942

—

Non-GAAP Financial Measures

In addition to our results determined in accordance with GAAP,

we believe the following non-GAAP measures are useful in evaluating

our operational performance. We use the following non-GAAP

financial information among other operational metrics to evaluate

our ongoing operations and for internal planning and forecasting

purposes. We believe that non-GAAP financial information, when

taken collectively, may be helpful to investors in assessing our

operating performance. The presentation of non-GAAP financial

information should not be considered in isolation or as a

substitute for, or superior to, the financial information prepared

and presented in accordance with GAAP.

EBITDA and Adjusted EBITDA

EBITDA is defined as net income (loss) before depreciation and

amortization and interest expense. Adjusted EBITDA is defined as

net income (loss) before depreciation and amortization, interest

expense, stock-based compensation, gains or losses related to the

change in fair value of warrant, derivative and earnout share

liabilities and other non-recurring costs determined by management,

such as gains or losses on extinguishment of debt and losses

related to the Romeo battery recall. EBITDA and adjusted EBITDA are

intended as supplemental measures of our performance that are

neither required by, nor presented in accordance with, GAAP. We

believe that using EBITDA and adjusted EBITDA provide an additional

tool for investors to use in evaluating ongoing operating results

and trends while comparing our financial measures with those of

comparable companies, which may present similar non-GAAP financial

measures to investors. However, you should be aware that when

evaluating EBITDA and adjusted EBITDA we may incur future expenses

similar to those excluded when calculating these measures. In

addition, our presentation of these measures should not be

construed as an inference that our future results will be

unaffected by unusual or non-recurring items. Our computation of

EBITDA and adjusted EBITDA may not be comparable to other similarly

titled measures computed by other companies, because all companies

may not calculate EBITDA and adjusted EBITDA in the same

fashion.

Because of these limitations, EBITDA and adjusted EBITDA should

not be considered in isolation or as a substitute for performance

measures calculated in accordance with GAAP. We compensate for

these limitations by relying primarily on our GAAP results and

using EBITDA and adjusted EBITDA on a supplemental basis. You

should review the reconciliations of net income (loss) to EBITDA

and adjusted EBITDA below and not rely on any single financial

measure to evaluate our business.

The following table reconciles net income (loss) to EBITDA and

adjusted EBITDA for the three and six months ended June 30, 2023

and 2022:

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Net income (loss)

$

(21,448

)

$

35,738

$

(44,883

)

$

24,982

Adjustments:

Depreciation and amortization

681

407

1,213

768

Interest expense, net

3,492

3,849

6,621

7,710

EBITDA

$

(17,275

)

$

39,994

$

(37,049

)

$

33,460

Stock-based compensation

1,359

1,436

2,801

2,408

(Gain) loss from change in fair value of

warrant liabilities

(44

)

(1,126

)

(50

)

(1,314

)

(Gain) loss from change in fair value of

derivative liability

(24

)

(10,087

)

(63

)

(12,642

)

(Gain) loss from change in earnout

liability

(1,413

)

(44,131

)

(1,819

)

(50,303

)

(Gain) loss on extinguishment of debt

—

—

(2,965

)

—

Romeo battery recall

254

—

2,509

—

Adjusted EBITDA

$

(17,143

)

$

(13,914

)

$

(36,636

)

$

(28,391

)

Adjusted Revenue

Adjusted revenue is defined as revenue before customer refunds.

The following table reconciles revenue, net of customer refunds and

adjusted revenue for the three and six months ended June 30, 2023

and 2022:

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Revenue, net of customer refunds

$

7,916

$

3,536

$

9,227

$

8,948

Customer refunds

254

—

2,509

—

Adjusted Revenue

$

8,170

$

3,536

$

11,736

$

8,948

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230814950322/en/

Investor Relations Contact: Brian Smith (800) 223-0740

ir@lightningemotors.com

Media Relations Contact: Nick Bettis (800) 223-0740

pressrelations@lightningemotors.com

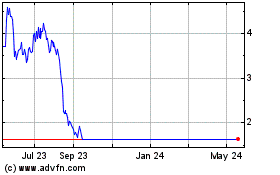

Lightning eMotors (NYSE:ZEV)

Historical Stock Chart

From Jan 2025 to Feb 2025

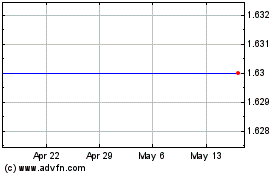

Lightning eMotors (NYSE:ZEV)

Historical Stock Chart

From Feb 2024 to Feb 2025