Allied Properties Real Estate Investment Trust ("Allied") (TSX:

"AP.UN") today announced results for the three months ended

June 30, 2024. “Our occupied and leased area remained steady

in the second quarter, and our urban office portfolio continued to

outperform the market,” said Cecilia Williams, President & CEO.

“With utilization and demand clearly rising in Montréal, Toronto,

Calgary and Vancouver, we expect our occupied and leased area to

reach a point of positive inflection by the end of the year.”

Operations

Utilization of urban office space is moving

steadily upward in Montréal, Toronto, Calgary and Vancouver. The

trend is evident throughout Allied’s workspace portfolio and

confirmed in numerous published reports. For example, Colliers’

Workplace Activity Tracker places utilization in early June of 2024

compared to November of 2019 at 66% for Downtown Montréal, 84% for

Downtown Toronto, 81% for Downtown Calgary and 70% for Downtown

Vancouver.

The upward utilization trend is consistent with

the intense utilization of storefront retail space in Allied’s

mixed-use, amenity-rich urban neighbourhoods in Montréal, Toronto,

Calgary and Vancouver. In the month of June, for example, The Well

had 829,058 recorded visits.

Allied conducted 262 lease tours in its rental

portfolio in the second quarter. Allied’s occupied and leased area

at the end of the quarter was 85.8% and 87.1%, respectively.

Occupied area remained above market occupancy in all urban markets

other than Vancouver, and occupied and leased area held steady for

the first time in six quarters with nearly 60% of the leases

maturing in the quarter being renewed, closer to Allied’s normal

level of 70% to 75%.

Allied leased a total of 469,375 square feet of

GLA in the second quarter, 444,963 square feet in its rental

portfolio and 24,412 square feet in its development portfolio. Of

the 444,963 square feet Allied leased in its rental portfolio,

163,873 square feet were vacant, 128,980 square feet were maturing

in the quarter and 152,110 square feet were maturing after the

quarter.

Average in-place net rent per occupied square

foot improved in the second quarter to $25.08. Allied continued to

achieve rent increases on renewal (up 9.7% ending-to-starting base

rent and up 16.2% average-to-average base rent).

Allied continues to focus on user experience for

the tens of thousands of people in Canada’s major cities who use

Allied workspace daily. On completing its fourth consecutive annual

user-experience assessment with Grace Hill KingsleySurveys late

last year, Allied exceeded industry averages materially in most

rating areas, including the all-important net promoter score, which

it exceeded by 250%. Management expects its focus on user

experience to support ongoing leasing efforts over the remainder of

2024 and into 2025.

Results

On April 1, 2024, Allied acquired a 90%

ownership interest in 400 West Georgia Street in Vancouver (“400

West Georgia”) and increased its ownership interest in 19 Duncan

Street in Toronto (“19 Duncan”) from 50% to 95%. Management

recognized that these portfolio-optimization transactions would put

temporary downward pressure on Allied’s FFO and AFFO per unit

pending lease-up of the remaining workspace at 400 West Georgia

(18% of GLA) and lease-up of the 464 rental-residential units at 19

Duncan (now underway).

Allied’s second-quarter results include the

impact of the portfolio-optimization transactions for a full

quarter. Operating income from continuing operations was $82

million, up 5% from the comparable quarter last year. Allied’s net

income and comprehensive income was $28 million, in large part due

to a fair value loss on investment properties flowing from declines

in development-property valuations.

FFO(1) was $73 million (52.6 cents per unit),

down 10.6% from $82 million (58.8 cents per unit) in the comparable

quarter last year. AFFO(1) was $67 million (47.7 cents per unit),

down 11.1% from $75 million (53.6 cents per unit) in the comparable

quarter last year. This resulted in FFO and AFFO pay-out ratios(1)

in the second quarter of 85.6% and 94.4%, respectively, and in the

first half of 81.5% and 88.8%, respectively.

Same Asset NOI(1) from Allied’s rental portfolio

was down 2.3% while Same Asset NOI from its total portfolio was up

1.7%, reflecting the productivity of its upgrade and development

portfolio.

The non-GAAP results that would have been

achieved in the quarter independently of the 400 West Georgia and

19 Duncan transactions were as expected by Management: FFO(2) would

have been $79 million (56.7 cents per unit), down 3.7% from $82

million (58.8 cents per unit) in the comparable quarter last year;

and (ii) AFFO(2) would have been $72 million (51.9 cents per unit),

down 3.3% from $75 million (53.6 cents per unit) in the comparable

quarter last year. This would have resulted in FFO and AFFO pay-out

ratios(2) in the second quarter of 79.4% and 86.8%, respectively,

and in the first half of 78.6% and 85.3%,

respectively._______________________________________(1) This is a

non-GAAP measure and includes the results of the continuing

operations and the discontinued operations (except for Same Asset

NOI, which only includes continuing operations) and excludes

condominium related items, financing prepayment costs, and the

mark-to-market adjustment on unit-based compensation. Refer to the

Non-GAAP Measures section below.(2) This is a non-GAAP measure and

includes the results of the continuing operations and the

discontinued operations and excludes condominium related items,

financing prepayment costs, the mark-to-market adjustment on

unit-based compensation and 400 West Georgia and 19 Duncan

transactions. Refer to the Non-GAAP Measures section below.

Portfolio and Balance-Sheet

Optimization

Allied’s mission is to serve knowledge-based

organizations ever more successfully over time. Its fundamental

strategy is to concentrate ownership and operation of distinctive

urban workspace in mixed-use, amenity-rich urban neighbourhoods in

Canada’s major cities and to upgrade its portfolio

continuously.

Allied has demonstrated commitment to the

balance sheet over its life as a public real estate entity. This is

both a fundamental principle of risk management and essential to

maintaining ongoing access to the bond market.

On August 16, 2023, Allied completed the sale of

its urban-data-centre portfolio for $1.35 billion, a sale price

meaningfully above IFRS value. In doing so, Allied accelerated an

ongoing process of portfolio and balance-sheet optimization. This

process continued in the first half of 2024.

Allied has now entered into a definitive

agreement to reorganize the ownership of TELUS Sky in Calgary,

bringing that development project to successful completion for all

concerned. Westbank and Allied will sell their respective 1/3

interests in the commercial component of TELUS Sky to TELUS, and

TELUS will sell its 1/3 interest in the residential component to

Westbank and Allied in equal shares, with the result that TELUS

will own 100% of the commercial component and Westbank and Allied

will own 100% of the residential component in equal shares. On

closing, expected to occur in the third quarter, Allied will

receive net proceeds of approximately $32 million.

Allied has also made rapid and material progress

in selling non-core properties at or above IFRS value. This

includes the pending sale of five properties in Montréal and two in

Toronto, which Management expects to complete in the second half of

2024.

All seven pending sales involve properties that

are smaller, and no property is part of a major concentration or

assembly of distinctive urban workspace in Allied’s portfolio. The

pricing of three properties reflects intensification potential,

which the private market is prepared to recognize, with the result

that the pricing is meaningfully above Allied’s IFRS value. The

pricing of the four remaining properties is based on capitalization

rates consistent with Allied’s IFRS value. The current yield to

Allied on the seven properties is low, with the result that the

proceeds can be used to reduce indebtedness in a manner that will

be accretive to Allied’s FFO and AFFO per unit.

Allied will apply the net proceeds of the TELUS

Sky transaction and the closing proceeds from the pending sales

(approaching the $200 million target established in the first

quarter) to accretive debt reduction with a view to offsetting the

temporary pressure on its FFO and AFFO per unit and its

debt-metrics flowing from the 400 West Georgia and 19 Duncan

transactions.

Over the remainder of 2024 and into 2025, Allied

intends to sell additional non-core properties at or above IFRS

value for proceeds of approximately $200 million. Given its

experience with the seven pending sales, all of which were

unsolicited and several of which attracted multiple offers,

Management is confident in its ability to achieve this target as

well.

Allied has two debt facilities maturing in 2025,

a $200 million unsecured debenture due on April 21, 2025 (the

“Debenture”), and a $400 million unsecured term loan due on October

22, 2025 (the “Term Loan”). Allied is working toward refinancing

the Debenture and the Term Loan in a manner that will prioritize

liquidity and continue the ongoing improvement in its

debt-metrics.

Allied has considerable optionality in

addressing the Debenture, the Term Loan and debt that matures in

2026. Allied’s options include various combinations of the

following: (i) utilizing proceeds from the TELUS Sky transaction

and the sale of non-core assets (up to $400 million in aggregate);

(ii) utilizing proceeds of secured financing on the residential

component of TELUS Sky (approximately $50 million); (iii)

successfully completing negotiations now underway for an extension

of the Term Loan; (iv) arranging secured financing on select

unencumbered properties; and (v) accessing the bond market on the

basis of a single solicited rating from Morningstar DBRS.

“We’re committed to maintaining and ultimately

improving our access to the bond market and will continue to manage

our balance sheet accordingly,” said Michael Emory, Founder &

Executive Chair. “We’re also committed to maintaining our monthly

distribution. These commitments are mutually reinforcing, well

within our operating capability and appropriately responsive to

equity and debt investors.”

Outlook

In the first half, Allied experienced steady

demand for urban workspace, urban rental-residential space and

urban amenity space, as well as strong and quantifiable engagement

among users of space in the Allied portfolio generally. Management

expects this to underpin operating and financial results in 2024

that will fully support Allied’s distribution commitment and

approach a point of positive inflection by the end of the year.

Financial Measures

The following tables summarize GAAP financial measures for the

three and six months ended June 30, 2024, and 2023:

| |

For the three months ended June 30 |

| (in

thousands except for % amounts) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Continuing operations |

|

|

|

|

|

Rental revenue |

$ |

146,750 |

|

$ |

136,137 |

|

$ |

10,613 |

|

7.8 |

% |

|

Property operating costs |

$ |

(64,359 |

) |

$ |

(58,037 |

) |

$ |

(6,322 |

) |

(10.9 |

)% |

|

Operating income |

$ |

82,391 |

|

$ |

78,100 |

|

$ |

4,291 |

|

5.5 |

% |

|

Interest income |

$ |

9,615 |

|

$ |

10,225 |

|

$ |

(610 |

) |

(6.0 |

)% |

|

Interest expense |

$ |

(29,932 |

) |

$ |

(26,797 |

) |

$ |

(3,135 |

) |

(11.7 |

)% |

|

General and administrative expenses

(1) |

$ |

(7,320 |

) |

$ |

(4,714 |

) |

$ |

(2,606 |

) |

(55.3 |

)% |

|

Condominium marketing expenses |

$ |

(65 |

) |

$ |

(192 |

) |

$ |

127 |

|

66.1 |

% |

|

Amortization of other assets |

$ |

(382 |

) |

$ |

(360 |

) |

$ |

(22 |

) |

(6.1 |

)% |

|

Net income from joint venture |

$ |

535 |

|

$ |

2,423 |

|

$ |

(1,888 |

) |

(77.9 |

)% |

|

Fair value loss on investment properties and investment

properties held for sale |

$ |

(44,983 |

) |

$ |

(73,471 |

) |

$ |

28,488 |

|

38.8 |

% |

|

Fair value gain on Exchangeable LP Units |

$ |

27,870 |

|

$ |

10,510 |

|

$ |

17,360 |

|

165.2 |

% |

|

Fair value (loss) gain on derivative

instruments |

$ |

(3,490 |

) |

$ |

15,357 |

|

$ |

(18,847 |

) |

(122.7 |

)% |

|

Impairment of residential inventory |

$ |

(6,177 |

) |

$ |

— |

|

$ |

(6,177 |

) |

(100.0 |

)% |

| Net income and

comprehensive income from continuing operations |

$ |

28,062 |

|

$ |

11,081 |

|

$ |

16,981 |

|

153.2 |

% |

| Net income and

comprehensive income from discontinued operations |

$ |

— |

|

$ |

115,184 |

|

$ |

(115,184 |

) |

(100.0 |

)% |

| Net income and

comprehensive income |

$ |

28,062 |

|

$ |

126,265 |

|

$ |

(98,203 |

) |

(77.8 |

)% |

|

|

|

|

|

|

(1) For the three months ended June 30,

2024, general and administrative expenses increased by $2,606 or

55.3% from the comparable period. This was primarily due to the

fair value adjustment on the total return swap of $1,683 on

unit-based compensation plans and lower capitalization to

qualifying investment properties of $630 for the directly

attributable employee costs related to the sale of the UDC

portfolio in 2023. The fair value adjustment on the total return

swap is added back in the calculation of FFO.

| |

For the six months ended June 30 |

| (in

thousands except for % amounts) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Continuing operations |

|

|

|

|

|

Rental revenue |

$ |

290,327 |

|

$ |

274,627 |

|

$ |

15,700 |

|

5.7 |

% |

|

Property operating costs |

$ |

(129,465 |

) |

$ |

(119,362 |

) |

$ |

(10,103 |

) |

(8.5 |

)% |

|

Operating income |

$ |

160,862 |

|

$ |

155,265 |

|

$ |

5,597 |

|

3.6 |

% |

|

Interest income |

$ |

24,374 |

|

$ |

19,969 |

|

$ |

4,405 |

|

22.1 |

% |

|

Interest expense |

$ |

(53,363 |

) |

$ |

(49,361 |

) |

$ |

(4,002 |

) |

(8.1 |

)% |

|

General and administrative expenses

(1) |

$ |

(13,818 |

) |

$ |

(10,884 |

) |

$ |

(2,934 |

) |

(27.0 |

)% |

|

Condominium marketing expenses |

$ |

(100 |

) |

$ |

(312 |

) |

$ |

212 |

|

67.9 |

% |

|

Amortization of other assets |

$ |

(760 |

) |

$ |

(730 |

) |

$ |

(30 |

) |

(4.1 |

)% |

|

Net income (loss) from joint venture |

$ |

1,287 |

|

$ |

(583 |

) |

$ |

1,870 |

|

320.8 |

% |

|

Fair value loss on investment properties and investment

properties held for sale |

$ |

(164,175 |

) |

$ |

(151,828 |

) |

$ |

(12,347 |

) |

(8.1 |

)% |

|

Fair value gain on Exchangeable LP Units |

$ |

57,511 |

|

$ |

10,510 |

|

$ |

47,001 |

|

447.2 |

% |

|

Fair value gain on derivative instruments |

$ |

3,658 |

|

$ |

7,333 |

|

$ |

(3,675 |

) |

(50.1 |

)% |

|

Impairment of residential inventory |

$ |

(6,177 |

) |

$ |

— |

|

$ |

(6,177 |

) |

(100.0 |

)% |

| Net income (loss) and

comprehensive income (loss) from continuing

operations |

$ |

9,299 |

|

$ |

(20,621 |

) |

$ |

29,920 |

|

145.1 |

% |

| Net income and

comprehensive income from discontinued operations |

$ |

— |

|

$ |

133,203 |

|

$ |

(133,203 |

) |

(100.0 |

)% |

| Net income and

comprehensive income |

$ |

9,299 |

|

$ |

112,582 |

|

$ |

(103,283 |

) |

(91.7 |

)% |

|

|

|

|

|

|

(1) For the six months ended June 30, 2024,

general and administrative expenses increased by $2,934 or 27.0%

from the comparable period primarily due to the fair value

adjustment on the total return swap of $1,683 on unit-based

compensation plans and lower capitalization to qualifying

investment properties of $985 for the directly attributable

employee costs related to the disposition of the UDC portfolio in

2023. The fair value adjustment on the total return swap is added

back in the calculation of FFO.

The following table summarizes other financial

measures as at June 30, 2024, and 2023:

| |

As at June 30 |

| (in

thousands except for per unit and % amounts) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Investment properties

(1) |

$ |

9,777,747 |

|

$ |

9,725,755 |

|

$ |

51,992 |

|

0.5 |

% |

| Unencumbered

investment properties

(2) |

$ |

8,506,667 |

|

$ |

8,416,150 |

|

$ |

90,517 |

|

1.1 |

% |

| Total Assets

(1) |

$ |

10,981,068 |

|

$ |

12,185,427 |

|

$ |

(1,204,359 |

) |

(9.9 |

)% |

| Cost of PUD as a % of

GBV

(2) |

|

11.4 |

% |

|

11.4 |

% |

|

— |

|

— |

% |

| NAV per unit

(3) |

$ |

44.43 |

|

$ |

50.80 |

|

$ |

(6.37 |

) |

(12.5 |

)% |

| Debt

(1) |

$ |

4,272,514 |

|

$ |

4,474,519 |

|

$ |

(202,005 |

) |

(4.5 |

)% |

| Total indebtedness

ratio

(2) |

|

39.1 |

% |

|

36.9 |

% |

|

— |

|

2.2 |

% |

| Annualized Adjusted

EBITDA

(2) |

$ |

383,112 |

|

$ |

425,540 |

|

$ |

(42,428 |

) |

(10.0 |

)% |

| Net debt as a multiple

of Annualized Adjusted EBITDA

(2) |

10.9x |

|

10.5x |

|

0.4x |

|

— |

|

| Interest coverage

ratio including interest capitalized and excluding financing

prepayment costs - three months trailing

(2) |

2.3x |

|

2.3x |

|

|

— |

|

— |

|

|

Interest coverage ratio including interest capitalized and

excluding financing prepayment costs - twelve months

trailing

(2) |

2.6x |

|

2.6x |

|

|

— |

|

— |

|

(1) This measure is presented on an IFRS

basis.(2) This is a non-GAAP measure and includes the results of

the continuing operations and the discontinued operations. Refer to

the Non-GAAP Measures section below.(3) Prior to Allied's

conversion to an open-end trust, net asset value per unit ("NAV per

unit") was calculated as total equity as at the corresponding

period ended, divided by the actual number of Units and class B

limited partnership units of Allied Properties Exchangeable Limited

Partnership ("Exchangeable LP Units") outstanding at period end.

With Allied's conversion to an open-end trust on June 12, 2023, NAV

per unit is calculated as total equity plus the value of

Exchangeable LP Units as at the corresponding period ended, divided

by the actual number of Units and Exchangeable LP Units. The

rationale for including the value of Exchangeable LP Units is

because they are economically equivalent to Units, receive

distributions equal to the distributions paid on the Units and are

exchangeable, at the holder's option, for Units.

Non-GAAP Measures

Management uses financial measures based on

International Financial Reporting Standards ("IFRS" or "GAAP") and

non-GAAP measures to assess Allied's performance. Non-GAAP measures

do not have any standardized meaning prescribed under IFRS, and

therefore, should not be construed as alternatives to net income or

cash flow from operating activities calculated in accordance with

IFRS. Refer to the Non-GAAP Measures section on page 16 of the

MD&A as at June 30, 2024, available on www.sedarplus.ca,

for an explanation of the composition of the non-GAAP measures used

in this press release and their usefulness for readers in assessing

Allied's performance. Such explanation is incorporated by reference

herein.

The following tables summarize non-GAAP

financial measures for the three and six months ended June 30,

2024, and 2023:

| |

For the three months ended June 30 |

| (in thousands except for per

unit and % amounts)(1) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Adjusted EBITDA |

$ |

95,778 |

|

$ |

106,385 |

|

$ |

(10,607 |

) |

(10.0 |

)% |

| Same Asset NOI -

rental portfolio |

$ |

75,612 |

|

$ |

77,404 |

|

$ |

(1,792 |

) |

(2.3 |

)% |

| Same Asset NOI - total

portfolio |

$ |

85,025 |

|

$ |

83,621 |

|

$ |

1,404 |

|

1.7 |

% |

| FFO |

$ |

72,089 |

|

$ |

82,224 |

|

$ |

(10,135 |

) |

(12.3 |

)% |

| FFO per unit

(diluted) |

$ |

0.516 |

|

$ |

0.588 |

|

$ |

(0.072 |

) |

(12.2 |

)% |

| FFO pay-out

ratio |

|

87.2 |

% |

|

76.5 |

% |

|

— |

|

10.7 |

% |

| All

amounts below are excluding condominium related items, financing

prepayment costs, and the mark-to-market adjustment on unit-based

compensation: |

|

FFO |

$ |

73,483 |

|

$ |

82,216 |

|

$ |

(8,733 |

) |

(10.6 |

)% |

|

FFO per unit (diluted) |

$ |

0.526 |

|

$ |

0.588 |

|

$ |

(0.062 |

) |

(10.5 |

)% |

|

FFO pay-out ratio |

|

85.6 |

% |

|

76.5 |

% |

|

— |

|

9.1 |

% |

|

AFFO |

$ |

66,612 |

|

$ |

74,958 |

|

$ |

(8,346 |

) |

(11.1 |

)% |

|

AFFO per unit (diluted) |

$ |

0.477 |

|

$ |

0.536 |

|

$ |

(0.059 |

) |

(11.0 |

)% |

|

AFFO pay-out ratio |

|

94.4 |

% |

|

83.9 |

% |

|

— |

|

10.5 |

% |

|

|

|

|

|

|

(1) These non-GAAP measures include the results

of the continuing operations and the discontinued operations

(except for Same Asset NOI - rental portfolio, which only includes

continuing operations).

| |

For the six months ended June 30 |

| (in thousands except for per

unit and % amounts)(1) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Adjusted EBITDA |

$ |

192,280 |

|

$ |

209,380 |

|

$ |

(17,100 |

) |

(8.2 |

)% |

| Same Asset NOI -

rental portfolio |

$ |

150,430 |

|

$ |

153,672 |

|

$ |

(3,242 |

) |

(2.1 |

)% |

| Same Asset NOI - total

portfolio |

$ |

169,251 |

|

$ |

165,484 |

|

$ |

3,767 |

|

2.3 |

% |

| FFO |

$ |

153,238 |

|

$ |

163,399 |

|

$ |

(10,161 |

) |

(6.2 |

)% |

| FFO per unit

(diluted) |

$ |

1.096 |

|

$ |

1.169 |

|

$ |

(0.073 |

) |

(6.2 |

)% |

| FFO pay-out

ratio |

|

82.1 |

% |

|

77.0 |

% |

|

— |

|

5.1 |

% |

|

All amounts below are excluding condominium related items,

financing prepayment costs, and the mark-to-market adjustment on

unit-based compensation: |

|

FFO |

$ |

154,277 |

|

$ |

163,301 |

|

$ |

(9,024 |

) |

(5.5 |

)% |

|

FFO per unit (diluted) |

$ |

1.104 |

|

$ |

1.168 |

|

$ |

(0.064 |

) |

(5.5 |

)% |

|

FFO pay-out ratio |

|

81.5 |

% |

|

77.0 |

% |

|

— |

|

4.5 |

% |

|

AFFO |

$ |

141,666 |

|

$ |

149,440 |

|

$ |

(7,774 |

) |

(5.2 |

)% |

|

AFFO per unit (diluted) |

$ |

1.014 |

|

$ |

1.069 |

|

$ |

(0.055 |

) |

(5.1 |

)% |

|

AFFO pay-out ratio |

|

88.8 |

% |

|

84.2 |

% |

|

— |

|

4.6 |

% |

|

|

|

|

|

|

(1) These non-GAAP measures include the results of the

continuing operations and the discontinued operations (except for

Same Asset NOI - rental portfolio, which only includes continuing

operations).

The following tables reconcile the non-GAAP

measures to the most comparable IFRS measures for the three and six

months ended June 30, 2024, and the comparable period in 2023.

These terms do not have any standardized meaning prescribed under

IFRS and may not be comparable to similarly titled measures

presented by other publicly traded entities.

The following table reconciles Allied's net

income and comprehensive income to Adjusted EBITDA, a non-GAAP

measure, for the three and six months ended June 30, 2024, and

2023.

| |

Three months ended |

|

Six months ended |

|

|

June 30, 2024 |

June 30, 2023 |

|

June 30, 2024 |

June 30, 2023 |

|

Net income and comprehensive income for the period |

$ |

28,062 |

|

$ |

126,265 |

|

|

$ |

9,299 |

|

$ |

112,582 |

|

| Interest expense |

|

29,932 |

|

|

28,578 |

|

|

|

53,363 |

|

|

52,913 |

|

| Amortization of other

assets |

|

433 |

|

|

360 |

|

|

|

870 |

|

|

730 |

|

| Amortization of improvement

allowances |

|

9,236 |

|

|

8,154 |

|

|

|

18,808 |

|

|

16,522 |

|

| Impairment of residential

inventory |

|

6,177 |

|

|

— |

|

|

|

6,177 |

|

|

— |

|

| Fair value loss (gain) on

investment properties and investment properties held for sale

(1) |

|

44,989 |

|

|

(30,905 |

) |

|

|

163,993 |

|

|

44,886 |

|

| Fair value gain on

Exchangeable LP Units |

|

(27,870 |

) |

|

(10,510 |

) |

|

|

(57,511 |

) |

|

(10,510 |

) |

| Fair value loss (gain) on

derivative instruments |

|

3,490 |

|

|

(15,357 |

) |

|

|

(3,658 |

) |

|

(7,333 |

) |

|

Mark-to-market adjustment on unit-based compensation |

|

1,329 |

|

|

(200 |

) |

|

|

939 |

|

|

(410 |

) |

|

Adjusted EBITDA (2) |

$ |

95,778 |

|

$ |

106,385 |

|

|

$ |

192,280 |

|

$ |

209,380 |

|

(1) Includes Allied's proportionate share of the

equity accounted investment's fair value loss on investment

properties of $6 and fair value gain on investment properties of

$182 for the three and six months ended June 30, 2024,

respectively (June 30, 2023 - fair value gain on investment

properties of $1,280 and fair value loss on investment properties

of $2,743, respectively).(2) The Adjusted EBITDA for the three and

six months ended June 30, 2023 includes the Urban Data Centre

segment which was classified as a discontinued operation from Q4

2022 until its disposition in August 2023.

The following table reconciles operating income to net operating

income, a non-GAAP measure, for the three and six months ended

June 30, 2024, and 2023.

| |

Three months ended |

Six months ended |

| |

June 30, 2024 |

June 30, 2023 |

June 30, 2024 |

June 30, 2023 |

|

Operating income, IFRS basis |

$ |

82,391 |

|

$ |

78,100 |

|

$ |

160,862 |

|

$ |

155,265 |

|

| Add:

investment in joint venture |

|

583 |

|

|

1,140 |

|

|

1,193 |

|

|

2,149 |

|

|

Operating income, proportionate basis |

$ |

82,974 |

|

$ |

79,240 |

|

$ |

162,055 |

|

$ |

157,414 |

|

| Amortization of improvement

allowances (1)(2) |

|

9,236 |

|

|

8,023 |

|

|

18,808 |

|

|

16,261 |

|

|

Amortization of straight-line rent (1)(2) |

|

(2,212 |

) |

|

(1,626 |

) |

|

(3,710 |

) |

|

(3,405 |

) |

|

NOI from continuing operations |

$ |

89,998 |

|

$ |

85,637 |

|

$ |

177,153 |

|

$ |

170,270 |

|

|

NOI from discontinued operations |

$ |

— |

|

$ |

13,797 |

|

$ |

— |

|

$ |

26,866 |

|

|

Total NOI |

$ |

89,998 |

|

$ |

99,434 |

|

$ |

177,153 |

|

$ |

197,136 |

|

(1) Includes Allied's proportionate share of the

equity accounted investment of the following amounts for the three

and six months ended June 30, 2024: amortization improvement

allowances of $197 and $376, respectively (June 30, 2023 -

$144 and $327, respectively) and amortization of straight-line rent

of $(50) and $(95), respectively (June 30, 2023 - $(50) and

$(98), respectively). (2) Excludes the Urban Data Centre segment

which was classified as a discontinued operation starting in Q4

2022. For the three and six months ended June 30, 2024, the

Urban Data Centre segment's amortization of improvement allowances

was $nil and $nil, respectively (June 30, 2023 - $131 and

$261, respectively). For the three and six months ended

June 30, 2024, the Urban Data Centre segment's amortization of

straight-line rent was $nil and $nil, respectively (June 30,

2023 - $(203) and $(465), respectively).

Same Asset NOI, a non-GAAP measure, is measured as the net

operating income for the properties that Allied owned and operated

for the entire duration of both the current and comparative

period.

| |

Three months ended |

Change |

| |

June 30, 2024 |

June 30, 2023 |

$ |

% |

|

Rental Portfolio - Same Asset NOI |

$ |

75,612 |

$ |

77,404 |

$ |

(1,792 |

) |

(2.3 |

)% |

| Assets

Held for Sale - Same Asset NOI |

|

2,346 |

|

3,232 |

|

(886 |

) |

(27.4 |

) |

|

Rental Portfolio and Assets Held for Sale - Same Asset

NOI |

$ |

77,958 |

$ |

80,636 |

$ |

(2,678 |

) |

(3.3 |

%) |

|

Development Portfolio - Same Asset NOI |

|

7,067 |

|

2,985 |

|

4,082 |

|

136.8 |

|

|

Total Portfolio - Same Asset NOI |

$ |

85,025 |

$ |

83,621 |

$ |

1,404 |

|

1.7 |

% |

|

Acquisitions |

|

3,665 |

|

— |

|

3,665 |

|

|

|

Dispositions |

|

29 |

|

14,250 |

|

(14,221 |

) |

|

|

Lease terminations |

|

19 |

|

— |

|

19 |

|

|

|

Development fees and corporate items |

|

1,260 |

|

1,563 |

|

(303 |

) |

|

|

Total NOI |

$ |

89,998 |

$ |

99,434 |

$ |

(9,436 |

) |

(9.5 |

%) |

| |

Six months ended |

Change |

| |

June 30, 2024 |

June 30, 2023 |

$ |

% |

|

Rental Portfolio - Same Asset NOI |

$ |

150,430 |

$ |

153,672 |

$ |

(3,242 |

) |

(2.1 |

)% |

| Assets

Held for Sale - Same Asset NOI |

|

5,381 |

|

6,348 |

|

(967 |

) |

(15.2 |

) |

|

Rental Portfolio and Assets Held for Sale - Same Asset

NOI |

$ |

155,811 |

$ |

160,020 |

$ |

(4,209 |

) |

(2.6 |

%) |

|

Development Portfolio - Same Asset NOI |

|

13,440 |

|

5,464 |

|

7,976 |

|

146.0 |

|

|

Total Portfolio - Same Asset NOI |

$ |

169,251 |

$ |

165,484 |

$ |

3,767 |

|

2.3 |

% |

|

Acquisitions |

|

3,665 |

|

— |

|

3,665 |

|

|

|

Dispositions |

|

37 |

|

27,771 |

|

(27,734 |

) |

|

|

Lease terminations |

|

28 |

|

193 |

|

(165 |

) |

|

|

Development fees and corporate items |

|

4,172 |

|

3,688 |

|

484 |

|

|

|

Total NOI |

$ |

177,153 |

$ |

197,136 |

$ |

(19,983 |

) |

(10.1 |

%) |

The following tables reconcile Allied's net

income (loss) and comprehensive income (loss) from continuing

operations to FFO, FFO excluding condominium related items,

financing prepayment costs, and the mark-to-market adjustment on

unit-based compensation, AFFO, and AFFO excluding condominium

related items, financing prepayment costs, and the mark-to-market

adjustment on unit-based compensation, which are non-GAAP measures,

for the three and six months ended June 30, 2024, and

2023.

| |

Three months ended |

|

|

June 30, 2024 |

June 30, 2023 |

Change |

|

Net income and comprehensive income from continuing operations |

$ |

28,062 |

|

$ |

11,081 |

|

$ |

16,981 |

|

| Net income and comprehensive

income from discontinued operations |

|

— |

|

|

115,184 |

|

|

(115,184 |

) |

| Adjustment to fair value of

investment properties and investment properties held for sale |

|

44,983 |

|

|

(29,625 |

) |

|

74,608 |

|

| Adjustment to fair value of

Exchangeable LP Units |

|

(27,870 |

) |

|

(10,510 |

) |

|

(17,360 |

) |

| Adjustment to fair value of

derivative instruments |

|

3,490 |

|

|

(15,357 |

) |

|

18,847 |

|

| Impairment of residential

inventory |

|

6,177 |

|

|

— |

|

|

6,177 |

|

| Incremental leasing costs |

|

2,592 |

|

|

2,295 |

|

|

297 |

|

| Amortization of improvement

allowances |

|

9,039 |

|

|

8,010 |

|

|

1,029 |

|

| Amortization of property,

plant and equipment (1) |

|

99 |

|

|

101 |

|

|

(2 |

) |

| Distributions on Exchangeable

LP Units |

|

5,314 |

|

|

1,771 |

|

|

3,543 |

|

| Adjustments relating to joint

venture: |

|

|

|

|

Adjustment to fair value on investment properties |

|

6 |

|

|

(1,280 |

) |

|

1,286 |

|

|

Amortization of improvement allowances |

|

197 |

|

|

144 |

|

|

53 |

|

|

Interest expense(2) |

|

— |

|

|

410 |

|

|

(410 |

) |

|

FFO |

$ |

72,089 |

|

$ |

82,224 |

|

$ |

(10,135 |

) |

| Condominium marketing

costs |

|

65 |

|

|

192 |

|

|

(127 |

) |

| Financing prepayment

costs |

|

— |

|

|

— |

|

|

— |

|

|

Mark-to-market adjustment on unit-based compensation |

|

1,329 |

|

|

(200 |

) |

|

1,529 |

|

|

FFO excluding condominium related items, financing

prepayment costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

73,483 |

|

$ |

82,216 |

|

$ |

(8,733 |

) |

| Amortization of straight-line

rent |

|

(2,162 |

) |

|

(1,779 |

) |

|

(383 |

) |

| Regular leasing

expenditures |

|

(2,166 |

) |

|

(2,973 |

) |

|

807 |

|

| Regular and recoverable

maintenance capital expenditures |

|

(678 |

) |

|

(849 |

) |

|

171 |

|

| Incremental leasing costs

(related to regular leasing expenditures) |

|

(1,814 |

) |

|

(1,607 |

) |

|

(207 |

) |

| Adjustment relating to joint

venture: |

|

|

|

|

Amortization of straight-line rent |

|

(50 |

) |

|

(50 |

) |

|

— |

|

|

Regular leasing expenditures |

|

(1 |

) |

|

— |

|

|

(1 |

) |

|

AFFO excluding condominium related items, financing

prepayment costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

66,612 |

|

$ |

74,958 |

|

$ |

(8,346 |

) |

|

|

|

|

|

| Weighted average number of

units (3) |

|

|

|

|

Basic |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

|

Diluted |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

| |

|

|

|

| Per unit - basic |

|

|

|

|

FFO |

$ |

0.516 |

|

$ |

0.588 |

|

$ |

(0.072 |

) |

|

FFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

0.526 |

|

$ |

0.588 |

|

$ |

(0.062 |

) |

|

AFFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

0.477 |

|

$ |

0.536 |

|

$ |

(0.059 |

) |

| |

|

|

|

| Per unit - diluted |

|

|

|

|

FFO |

$ |

0.516 |

|

$ |

0.588 |

|

$ |

(0.072 |

) |

|

FFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

0.526 |

|

$ |

0.588 |

|

$ |

(0.062 |

) |

|

AFFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

0.477 |

|

$ |

0.536 |

|

$ |

(0.059 |

) |

| |

|

|

|

| Pay-out Ratio |

|

|

|

|

FFO |

|

87.2 |

% |

|

76.5 |

% |

|

10.7 |

% |

|

FFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

|

85.6 |

% |

|

76.5 |

% |

|

9.1 |

% |

|

AFFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

|

94.4 |

% |

|

83.9 |

% |

|

10.5 |

% |

(1) Property, plant and equipment relates to owner-occupied

property.(2) This amount represents interest expense on Allied's

joint venture investment in TELUS Sky and is not capitalized under

IFRS, but is allowed as an adjustment under REALPAC's definition of

FFO. (3) The weighted average number of units includes Units and

Exchangeable LP Units. The Exchangeable LP Units were re-classified

from non-controlling interests in equity to liabilities in the

unaudited condensed consolidated financial statements on Allied's

conversion to an open-end trust on June 12, 2023.

| |

Six months ended |

|

|

June 30, 2024 |

June 30, 2023 |

Change |

|

Net income (loss) and comprehensive income (loss) from continuing

operations |

$ |

9,299 |

|

$ |

(20,621 |

) |

$ |

29,920 |

|

| Net income and comprehensive

income from discontinued operations |

|

— |

|

|

133,203 |

|

|

(133,203 |

) |

| Adjustment to fair value of

investment properties and investment properties held for sale |

|

164,175 |

|

|

42,143 |

|

|

122,032 |

|

| Adjustment to fair value of

Exchangeable LP Units |

|

(57,511 |

) |

|

(10,510 |

) |

|

(47,001 |

) |

| Adjustment to fair value of

derivative instruments |

|

(3,658 |

) |

|

(7,333 |

) |

|

3,675 |

|

| Impairment of residential

inventory |

|

6,177 |

|

|

— |

|

|

6,177 |

|

| Incremental leasing costs |

|

5,303 |

|

|

4,535 |

|

|

768 |

|

| Amortization of improvement

allowances |

|

18,432 |

|

|

16,195 |

|

|

2,237 |

|

| Amortization of property,

plant and equipment (1) |

|

199 |

|

|

201 |

|

|

(2 |

) |

| Distributions on Exchangeable

LP Units |

|

10,628 |

|

|

1,771 |

|

|

8,857 |

|

| Adjustments relating to joint

venture: |

|

|

|

|

Adjustment to fair value on investment properties |

|

(182 |

) |

|

2,743 |

|

|

(2,925 |

) |

|

Amortization of improvement allowances |

|

376 |

|

|

327 |

|

|

49 |

|

|

Interest expense (2) |

|

— |

|

|

745 |

|

|

(745 |

) |

|

FFO |

$ |

153,238 |

|

$ |

163,399 |

|

$ |

(10,161 |

) |

| Condominium marketing

costs |

|

100 |

|

|

312 |

|

|

(212 |

) |

| Financing prepayment

costs |

|

— |

|

|

— |

|

|

— |

|

|

Mark-to-market adjustment on unit-based compensation |

|

939 |

|

|

(410 |

) |

|

1,349 |

|

|

FFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

154,277 |

|

$ |

163,301 |

|

$ |

(9,024 |

) |

| Amortization of straight-line

rent |

|

(3,615 |

) |

|

(3,772 |

) |

|

157 |

|

| Regular leasing

expenditures |

|

(3,753 |

) |

|

(4,099 |

) |

|

346 |

|

| Regular and recoverable

maintenance capital expenditures |

|

(1,428 |

) |

|

(2,717 |

) |

|

1,289 |

|

| Incremental leasing costs

(related to regular leasing expenditures) |

|

(3,712 |

) |

|

(3,175 |

) |

|

(537 |

) |

| Adjustment relating to joint

venture: |

|

|

|

|

Amortization of straight-line rent |

|

(95 |

) |

|

(98 |

) |

|

3 |

|

|

Regular leasing expenditures |

|

(8 |

) |

|

— |

|

|

(8 |

) |

|

AFFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

141,666 |

|

$ |

149,440 |

|

$ |

(7,774 |

) |

|

|

|

|

|

| Weighted average number of

units (3) |

|

|

|

|

Basic |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

|

Diluted |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

| |

|

|

|

| Per unit - basic |

|

|

|

|

FFO |

$ |

1.096 |

|

$ |

1.169 |

|

$ |

(0.073 |

) |

|

FFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

1.104 |

|

$ |

1.168 |

|

$ |

(0.064 |

) |

|

AFFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

1.014 |

|

$ |

1.069 |

|

$ |

(0.055 |

) |

| |

|

|

|

| Per unit - diluted |

|

|

|

|

FFO |

$ |

1.096 |

|

$ |

1.169 |

|

$ |

(0.073 |

) |

|

FFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

1.104 |

|

$ |

1.168 |

|

$ |

(0.064 |

) |

|

AFFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

1.014 |

|

$ |

1.069 |

|

$ |

(0.055 |

) |

| |

|

|

|

| Pay-out Ratio |

|

|

|

|

FFO |

|

82.1 |

% |

|

77.0 |

% |

|

5.1 |

% |

|

FFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

|

81.5 |

% |

|

77.0 |

% |

|

4.5 |

% |

|

AFFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

|

88.8 |

% |

|

84.2 |

% |

|

4.6 |

% |

(1) Property, plant and equipment relates to owner-occupied

property.(2) This amount represents interest expense on Allied's

joint venture investment in TELUS Sky and is not capitalized under

IFRS, but is allowed as an adjustment under REALPAC's definition of

FFO. (3) The weighted average number of units includes Units and

Exchangeable LP Units. The Exchangeable LP Units were re-classified

from non-controlling interests in equity to liabilities in the

unaudited condensed consolidated financial statements on Allied's

conversion to an open-end trust on June 12, 2023.

The following tables reconcile Allied's net

income (loss) and comprehensive income (loss) from continuing

operations to FFO, FFO excluding condominium related items,

financing prepayment costs, the mark-to-market adjustment on

unit-based compensation, and the 400 West Georgia and 19 Duncan

transactions, and AFFO excluding condominium related items,

financing prepayment costs, the mark-to-market adjustment on

unit-based compensation, and the 400 West Georgia and 19 Duncan

transactions, which are non-GAAP measures, for the three and six

months ended June 30, 2024, and 2023.

FFO excluding condominium related items,

financing prepayment costs, the mark-to-market adjustment on

unit-based compensation, and the 400 West Georgia and 19 Duncan

transactions starts with FFO and removes the effects of the

acquisitions on April 1, 2024, which includes a 45% interest in 19

Duncan in Toronto and a 90% interest in 400 West Georgia in

Vancouver (the "Acquisitions"), condominium revenue, condominium

cost of sales, condominium marketing costs, financing prepayment

costs and the mark-to-market adjustment on unit-based compensation.

FFO excluding condominium related items, financing prepayment

costs, the mark-to-market adjustment on unit-based compensation,

and the 400 West Georgia and 19 Duncan transactions is reconciled

to net income and comprehensive income from continuing operations,

which is the most directly comparable IFRS measure. Management

believes this is a useful measure as stabilized occupancy has not

been reached at the properties acquired through the Acquisitions,

the condominium and financing prepayment items are not indicative

of recurring operating performance, and the mark-to-market

adjustments of unit-based compensation can fluctuate widely with

the market.

AFFO excluding condominium related items,

financing prepayment costs, the mark-to-market adjustment on

unit-based compensation, and the 400 West Georgia and 19 Duncan

transactions starts with AFFO and removes the effects of the

Acquisitions, condominium revenue, condominium cost of sales,

condominium marketing costs, financing prepayment costs and the

mark-to-market adjustment on unit-based compensation. AFFO

excluding condominium related items, financing prepayment costs,

the mark-to-market adjustment on unit-based compensation, and the

400 West Georgia and 19 Duncan transactions is reconciled to net

income and comprehensive income from continuing operations, which

is the most directly comparable IFRS measure. Management believes

this is a useful measure as stabilized occupancy has not been

reached at the properties acquired through the Acquisitions, the

condominium and financing prepayment items are not indicative of

recurring economic earnings, and the mark-to-market adjustments of

unit-based compensation can fluctuate widely with the market.

FFO and AFFO pay-out ratios excluding

condominium related items, financing prepayment costs, the

mark-to-market adjustment on unit-based compensation, and the 400

West Georgia and 19 Duncan transactions are non-GAAP measures.

These payout ratios are calculated by dividing the actual

distributions declared (excluding any special distributions

declared in cash or Units) by FFO and AFFO excluding condominium

related items, financing prepayment costs, the mark-to-market

adjustment on unit-based compensation, and the 400 West Georgia and

19 Duncan transactions in a given period. Management considers

these metrics a useful way to evaluate Allied's distribution paying

capacity as stabilized occupancy has not been reached at the

properties acquired under the Acquisitions.

| |

Three months ended |

|

|

June 30, 2024 |

June 30, 2023 |

Change |

|

Net income and comprehensive income from continuing operations |

$ |

28,062 |

|

$ |

11,081 |

|

$ |

16,981 |

|

| Net income and comprehensive

income from discontinued operations |

|

— |

|

|

115,184 |

|

|

(115,184 |

) |

| Adjustment to fair value of

investment properties and investment properties held for sale |

|

44,983 |

|

|

(29,625 |

) |

|

74,608 |

|

| Adjustment to fair value of

Exchangeable LP Units |

|

(27,870 |

) |

|

(10,510 |

) |

|

(17,360 |

) |

| Adjustment to fair value of

derivative instruments |

|

3,490 |

|

|

(15,357 |

) |

|

18,847 |

|

| Impairment of residential

inventory |

|

6,177 |

|

|

— |

|

|

6,177 |

|

| Incremental leasing costs |

|

2,592 |

|

|

2,295 |

|

|

297 |

|

| Amortization of improvement

allowances |

|

9,039 |

|

|

8,010 |

|

|

1,029 |

|

| Amortization of property,

plant and equipment (1) |

|

99 |

|

|

101 |

|

|

(2 |

) |

| Distributions on Exchangeable

LP Units |

|

5,314 |

|

|

1,771 |

|

|

3,543 |

|

| Adjustments relating to joint

venture: |

|

|

|

|

Adjustment to fair value on investment properties |

|

6 |

|

|

(1,280 |

) |

|

1,286 |

|

|

Amortization of improvement allowances |

|

197 |

|

|

144 |

|

|

53 |

|

|

Interest expense (2) |

|

— |

|

|

410 |

|

|

(410 |

) |

|

FFO |

$ |

72,089 |

|

$ |

82,224 |

|

$ |

(10,135 |

) |

| Condominium marketing

costs |

|

65 |

|

|

192 |

|

|

(127 |

) |

| Financing prepayment

costs |

|

— |

|

|

— |

|

|

— |

|

| Mark-to-market adjustment on

unit-based compensation |

|

1,329 |

|

|

(200 |

) |

|

1,529 |

|

| 400

West Georgia and 19 Duncan transactions |

|

5,702 |

|

|

— |

|

|

5,702 |

|

|

FFO excluding condominium related items, financing

prepayment costs, the mark-to-market adjustment on unit-based

compensation, and 400 West Georgia and 19 Duncan

transactions |

$ |

79,185 |

|

$ |

82,216 |

|

$ |

(3,031 |

) |

| Amortization of straight-line

rent |

|

(2,162 |

) |

|

(1,779 |

) |

|

(383 |

) |

| Regular leasing

expenditures |

|

(2,166 |

) |

|

(2,973 |

) |

|

807 |

|

| Regular and recoverable

maintenance capital expenditures |

|

(678 |

) |

|

(849 |

) |

|

171 |

|

| Incremental leasing costs

(related to regular leasing expenditures) |

|

(1,814 |

) |

|

(1,607 |

) |

|

(207 |

) |

| 400 West Georgia and 19 Duncan

transactions |

|

172 |

|

|

— |

|

|

172 |

|

| Adjustment relating to joint

venture: |

|

|

|

|

Amortization of straight-line rent |

|

(50 |

) |

|

(50 |

) |

|

— |

|

|

Regular leasing expenditures |

|

(1 |

) |

|

— |

|

|

(1 |

) |

|

AFFO excluding condominium related items, financing

prepayment costs, the mark-to-market adjustment on unit-based

compensation, and 400 West Georgia and 19 Duncan

transactions |

$ |

72,486 |

|

$ |

74,958 |

|

$ |

(2,472 |

) |

|

|

|

|

|

| Weighted average number of

units (3) |

|

|

|

|

Basic |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

|

Diluted |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

| |

|

|

|

| Per unit - basic |

|

|

|

| FFO excluding condominium

related items, financing prepayment costs, the mark-to-market

adjustment on unit-based compensation, and 400 West Georgia and 19

Duncan transactions |

$ |

0.567 |

|

$ |

0.588 |

|

$ |

(0.021 |

) |

| AFFO excluding condominium

related items, financing prepayment costs, the mark-to-market

adjustment on unit-based compensation, and 400 West Georgia and 19

Duncan transactions |

$ |

0.519 |

|

$ |

0.536 |

|

$ |

(0.017 |

) |

| |

|

|

|

| |

|

|

|

| Per unit - diluted |

|

|

|

| FFO excluding condominium

related items, financing prepayment costs, the mark-to-market

adjustment on unit-based compensation, and 400 West Georgia and 19

Duncan transactions |

$ |

0.567 |

|

$ |

0.588 |

|

$ |

(0.021 |

) |

| AFFO excluding condominium

related items, financing prepayment costs, the mark-to-market

adjustment on unit-based compensation, and 400 West Georgia and 19

Duncan transactions |

$ |

0.519 |

|

$ |

0.536 |

|

$ |

(0.017 |

) |

| |

|

|

|

| Pay-out Ratio |

|

|

|

| FFO excluding condominium

related items, financing prepayment costs, the mark-to-market

adjustment on unit-based compensation, and 400 West Georgia and 19

Duncan transactions |

|

79.4 |

% |

|

76.5 |

% |

|

2.9 |

% |

| AFFO

excluding condominium related items, financing prepayment costs,

the mark-to-market adjustment on unit-based compensation, and 400

West Georgia and 19 Duncan transactions |

|

86.8 |

% |

|

83.9 |

% |

|

2.9 |

% |

(1) Property, plant and equipment relates to owner-occupied

property.(2) This amount represents interest expense on Allied's

joint venture investment in TELUS Sky and is not capitalized under

IFRS, but is allowed as an adjustment under REALPAC's definition of

FFO. (3) The weighted average number of units includes Units and

Exchangeable LP Units. The Exchangeable LP Units were reclassified

from non-controlling interests in equity to liabilities in the

unaudited condensed consolidated financial statements on Allied's

conversion to an open-end trust on June 12, 2023.

| |

Six months ended |

|

|

June 30, 2024 |

June 30, 2023 |

Change |

|

Net income (loss) and comprehensive income (loss) from continuing

operations |

$ |

9,299 |

|

$ |

(20,621 |

) |

$ |

29,920 |

|

| Net income and comprehensive

income from discontinued operations |

|

— |

|

|

133,203 |

|

|

(133,203 |

) |

| Adjustment to fair value of

investment properties and investment properties held for sale |

|

164,175 |

|

|

42,143 |

|

|

122,032 |

|

| Adjustment to fair value of

Exchangeable LP Units |

|

(57,511 |

) |

|

(10,510 |

) |

|

(47,001 |

) |

| Adjustment to fair value of

derivative instruments |

|

(3,658 |

) |

|

(7,333 |

) |

|

3,675 |

|

| Impairment of residential

inventory |

|

6,177 |

|

|

— |

|

|

6,177 |

|

| Incremental leasing costs |

|

5,303 |

|

|

4,535 |

|

|

768 |

|

| Amortization of improvement

allowances |

|

18,432 |

|

|

16,195 |

|

|

2,237 |

|

| Amortization of property,

plant and equipment (1) |

|

199 |

|

|

201 |

|

|

(2 |

) |

| Distributions on Exchangeable

LP Units |

|

10,628 |

|

|

1,771 |

|

|

8,857 |

|

| Adjustments relating to joint

venture: |

|

|

|

|

Adjustment to fair value on investment properties |

|

(182 |

) |

|

2,743 |

|

|

(2,925 |

) |

|

Amortization of improvement allowances |

|

376 |

|

|

327 |

|

|

49 |

|

|

Interest expense (2) |

|

— |

|

|

745 |

|

|

(745 |

) |

|

FFO |

$ |

153,238 |

|

$ |

163,399 |

|

$ |

(10,161 |

) |

| Condominium marketing

costs |

|

100 |

|

|

312 |

|

|

(212 |

) |

| Financing prepayment

costs |

|

— |

|

|

— |

|

|

— |

|

| Mark-to-market adjustment on

unit-based compensation |

|

939 |

|

|

(410 |

) |

|

1,349 |

|

| 400

West Georgia and 19 Duncan transactions |

|

5,702 |

|

|

— |

|

|

5,702 |

|

|

FFO excluding condominium related items, financing

prepayment costs, the mark-to-market adjustment on unit-based

compensation, and 400 West Georgia and 19 Duncan

transactions |

$ |

159,979 |

|

$ |

163,301 |

|

$ |

(3,322 |

) |

| Amortization of straight-line

rent |

|

(3,615 |

) |

|

(3,772 |

) |

|

157 |

|

| Regular leasing

expenditures |

|

(3,753 |

) |

|

(4,099 |

) |

|

346 |

|

| Regular and recoverable

maintenance capital expenditures |

|

(1,428 |

) |

|

(2,717 |

) |

|

1,289 |

|

| Incremental leasing costs

(related to regular leasing expenditures) |

|

(3,712 |

) |

|

(3,175 |

) |

|

(537 |

) |

| 400 West Georgia and 19 Duncan

transactions |

|

172 |

|

|

— |

|

|

172 |

|

| Adjustment relating to joint

venture: |

|

|

|

|

Amortization of straight-line rent |

|

(95 |

) |

|

(98 |

) |

|

3 |

|

|

Regular leasing expenditures |

|

(8 |

) |

|

— |

|

|

(8 |

) |

|

AFFO excluding condominium related items, financing

prepayment costs, the mark-to-market adjustment on unit-based

compensation, and 400 West Georgia and 19 Duncan

transactions |

$ |

147,540 |

|

$ |

149,440 |

|

$ |

(1,900 |

) |

|

|

|

|

|

| Weighted average number of

units (3) |

|

|

|

|

Basic |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

|

Diluted |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

| |

|

|

|

| Per unit - basic |

|

|

|

| FFO excluding condominium

related items, financing prepayment costs, the mark-to-market

adjustment on unit-based compensation, and 400 West Georgia and 19

Duncan transactions |

$ |

1.145 |

|

$ |

1.168 |

|

$ |

(0.023 |

) |

| AFFO excluding condominium

related items, financing prepayment costs, the mark-to-market

adjustment on unit-based compensation, and 400 West Georgia and 19

Duncan transactions |

$ |

1.056 |

|

$ |

1.069 |

|

$ |

(0.013 |

) |

| |

|

|

|

| Per unit - diluted |

|

|

|

| FFO excluding condominium

related items, financing prepayment costs, the mark-to-market

adjustment on unit-based compensation, and 400 West Georgia and 19

Duncan transactions |

$ |

1.145 |

|

$ |

1.168 |

|

$ |

(0.023 |

) |

| AFFO excluding condominium

related items, financing prepayment costs, the mark-to-market

adjustment on unit-based compensation, and 400 West Georgia and 19

Duncan transactions |

$ |

1.056 |

|

$ |

1.069 |

|

$ |

(0.013 |

) |

| |

|

|

|

| Pay-out Ratio |

|

|

|

| FFO excluding condominium

related items, financing prepayment costs, the mark-to-market

adjustment on unit-based compensation, and 400 West Georgia and 19

Duncan transactions |

|

78.6 |

% |

|

77.0 |

% |

|

1.6 |

% |

| AFFO

excluding condominium related items, financing prepayment costs,

the mark-to-market adjustment on unit-based compensation, and 400

West Georgia and 19 Duncan transactions |

|

85.3 |

% |

|

84.2 |

% |

|

1.1 |

% |

(1) Property, plant and equipment relates to owner-occupied

property.(2) This amount represents interest expense on Allied's

joint venture investment in TELUS Sky and is not capitalized under

IFRS, but is allowed as an adjustment under REALPAC's definition of

FFO.(3) The weighted average number of units includes Units and

Exchangeable LP Units. The Exchangeable LP Units were re-classified

from non-controlling interests in equity to liabilities in the

unaudited condensed consolidated financial statements on Allied's

conversion to an open-end trust on June 12, 2023.

Cautionary Statements

This press release may contain forward-looking

statements with respect to Allied, its operations, strategy,

financial performance and condition, and the assumptions underlying

any of the foregoing. These statements generally can be identified

by the use of forward-looking words such as “forecast”, “outlook”,

“may”, “will”, “expect”, “estimate”, “anticipate”, “intends”,

“believe”, “assume”, “plans” or “continue” or the negative thereof

or similar variations. The forward-looking statements in this press

release are not guarantees of future results, operations or

performance and are based on estimates and assumptions that are

subject to risks and uncertainties, including those described under

“Risks and Uncertainties” in Allied’s Annual MD&A, which is

available at www.sedarplus.ca. Those risks and uncertainties

include risks associated with financing and interest rates, access

to capital, general economic conditions and lease roll-over.

Allied’s actual results and performance discussed herein could

differ materially from those expressed or implied by such

statements. These cautionary statements qualify all forward-looking

statements attributable to Allied and persons acting on its behalf.

All forward-looking statements speak only as of the date of this

press release and, except as required by applicable law, Allied has

no obligation to update such statements.

About Allied

Allied is a leading owner-operator of

distinctive urban workspace in Canada’s major cities. Allied’s

mission is to provide knowledge-based organizations with workspace

that is sustainable and conducive to human wellness, creativity,

connectivity and diversity. Allied’s vision is to make a continuous

contribution to cities and culture that elevates and inspires the

humanity in all people.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Cecilia C. WilliamsPresident & Chief Executive Officer(416)

977-9002cwilliams@alliedreit.com

Nanthini MahalingamSenior Vice President & Chief Financial

Officer(416) 977-9002nmahalingam@alliedreit.com

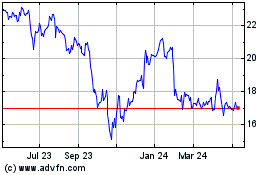

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Jan 2025 to Feb 2025

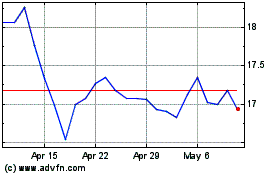

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Feb 2024 to Feb 2025