Bloom Select Income Fund Closes Over Allotment

09 May 2012 - 11:23PM

Marketwired

Bloom Select Income Fund (the "Fund") (TSX:BLB.UN) is pleased to

announce that it has completed the issuance of an additional

474,813 units for gross proceeds of $4,748,130. This issuance was

pursuant to the exercise of the over-allotment option granted to

the Agents in connection with the Fund's recently completed initial

public offering. With the exercise of the over-allotment option,

the total gross proceeds raised by the Fund are $54,748,130. The

units are listed on the Toronto Stock Exchange under the symbol

BLB.UN.

The Fund has been created to enable investors to invest in a

diversified portfolio comprised primarily of publicly listed or

traded Canadian securities. The Fund's portfolio will be actively

managed by Bloom Investment Counsel, Inc. (the "Manager"), and will

be comprised primarily of eligible high dividend paying Canadian

common equity securities, income trusts and real estate investment

trusts that have a Beta of less than 1.0 at the time of investment.

Beta is a measure of volatility of a security in comparison to the

market as a whole. It reflects the tendency of a security's returns

to respond to changes in the market. A Beta of less than 1.0 means

that the security has historically been less volatile than the

market.

The Fund's investment objectives are to provide holders of units

with:

i. an investment in an actively managed portfolio comprised primarily of

Canadian equity securities that exhibit low volatility at the time of

investment;

ii. monthly cash distributions that have a large component of Canadian

eligible dividends; and

iii.the opportunity for capital appreciation.

Based on the Manager's current estimates, the initial

distribution target for the Fund until the period ending December

2013 is expected to be $0.041666 per Unit per month ($0.50 per

annum to yield 5.0% on the subscription price of $10.00 per Unit).

Although distributions are not expected to change, the Fund intends

to annually set distribution targets based on the Manager's

assessment of the actual and expected cash flow of the Fund for the

period.

The syndicate of agents for this offering was co-led by BMO

Capital Markets, CIBC and RBC Capital Markets, and included TD

Securities Inc., GMP Securities L.P., National Bank Financial Inc.,

Scotiabank, Canaccord Genuity Corp., Raymond James Ltd., Desjardins

Securities Inc., Macquarie Private Wealth Inc., Mackie Research

Capital Corporation, Dundee Securities Ltd. and HSBC Securities

(Canada) Inc.

Contacts: Bloom Funds Investor Relations 416-861-9941 or

1-855-BLOOM18 www.bloomfunds.ca

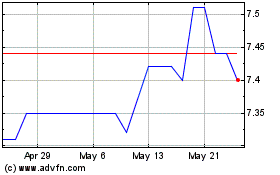

Bloom Select Income (TSX:BLB.UN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bloom Select Income (TSX:BLB.UN)

Historical Stock Chart

From Feb 2024 to Feb 2025