Bengal Energy Announces Term Sheet for a US$20 Million Secured Credit Facility and Provides 2014 Cuisinier Exploration Progra...

27 May 2014 - 9:00PM

Marketwired Canada

Bengal Energy Ltd. (TSX:BNG) ("Bengal" or the "Company") is pleased to announce

that it has signed an indicative term sheet for a US $20.0 million secured

credit facility (the "Facility") with a leading Australian commercial bank (the

"Lender"), and provides an update on its Cuisinier exploration program.

US $20 Million Secured Credit Facility

The Facility contemplates a borrowing base of up to US $20 million, over a three

year term at attractive fixed income market rates tied to USD LIBOR to fund its

ongoing Australian development. The Company has thoroughly stress tested its

existing production base to ensure that this Facility and Bengal's existing

unsecured debt are fully serviceable in multiple commodity price scenarios.

The initial draw on the Facility will fund past costs associated with the

Company's Cuisinier Phase 1 drilling program and further draws are expected to

fully fund its Australian development through March 2015 as well as anticipated

future development. With the Facility in place, Management expects to be able to

fund future planned exploration activities in India and Australia through

internally generated cash flows.

The Facility remains subject to the completion of due diligence by the Lender

and the entering into of a final Offer to Finance with Bengal and will remain

open for a fixed period to allow Bengal to review other competitive lending

proposals received. Management expects an average cost of capital over the term

of its finalized Facility to be within the range of five to seven percent.

"The establishment of a reserve-based facility by a leading international bank

provides another milestone in the development of Bengal's world-class Cuisinier

oil play. The Facility provides greater financial flexibility and enhanced

predictability of our free cash flow," said Chayan Chakrabarty, Bengal's

President and CEO. "Together with our existing cash flow and working capital,

this Facility will provide us with the capital needed to fund our ongoing

capital program, offer us the flexibility to finance additional development

opportunities, and free up internally generated cash flows for the financing of

other potential exploration opportunities in Australia and India."

Bengal's existing CAD $8 million (10% coupon) and CAD $1.8 million (10% coupon)

unsecured notes remain outstanding with maturities on July 31, 2015 and January

31, 2016 respectively.

Cuisinier 2014 Exploration Program Update

As previously announced, Bengal and its joint venture partners plan to drill two

exploration wells in the second and third quarters of calendar 2014 in the

Cuisinier (Barta Sub Block, ATP 752) area. These two exploration wells will

target both the Cuisinier-type productive Murta zone, as well as the deeper

Birkhead and Hutton zones. The Birkhead and Hutton formations have shown initial

production rates ranging from 500 to over 1,000 Bopd in other Cooper Basin

analog pools.

The first well is currently scheduled to spud in early June, with the second

well planned for mid-August 2014. Both wells will target independent structural

closures within the Company's Cuisinier North 3D area immediately adjacent to

the Cook and Cuisinier oil fields.

In addition, Bengal expects to participate in a number of well stimulation

interventions in the Cuisinier Pool expected to increase production rates from

selected wells. This well stimulation program is expected to take place during

the third and fourth quarters of this calendar year.

The Company also anticipates the completion and tie-in of its four remaining

development wells drilled at Cuisinier to begin in mid-July, and brought on-line

in September 2014.

Bengal also advises that an updated presentation will be posted on the Company's

website on May 30, 2014, containing additional information about its operations

and strengthened financial position.

About Bengal

Bengal Energy Ltd. (TSX:BNG) is an international oil and gas exploration and

production company with producing and prospective light oil-weighted assets in

Australia and India. Bengal offers exposure to lower risk, current production

and cash flow, combined with longer-term high, potential impact exploration

projects. The Company's strategy is to achieve per share growth in cash flow,

production and reserves while establishing an attractive portfolio of future

drilling and exploration opportunities.

Additional information is available on our website at www.bengalenergy.ca.

Forward-Looking Statements

This news release contains certain forward-looking statements or information

("forward-looking statements") as defined by applicable securities laws that

involve substantial known and unknown risks and uncertainties, many of which are

beyond Bengal's control. These statements relate to future events or our future

performance. All statements other than statements of historical fact may be

forward looking statements. The use of any of the words "plan", "expect",

"prospective", "project", "intend", "believe", "should", "anticipate",

"estimate", or other similar words or statements that certain events "may" or

"will" occur are intended to identify forward-looking statements. The

projections, estimates and beliefs contained in such forward looking statements

are based on management's estimates, opinions, and assumptions at the time the

statements were made, including assumptions relating to: the impact of economic

conditions in North America, Australia, India and globally; industry conditions;

changes in laws and regulations including, without limitation, the adoption of

new environmental laws and regulations and changes in how they are interpreted

and enforced; increased competition; the availability of qualified operating or

management personnel; fluctuations in commodity prices, foreign exchange or

interest rates; stock market volatility and fluctuations in market valuations of

companies with respect to announced transactions and the final valuations

thereof; results of exploration and testing activities; and the ability to

obtain required approvals and extensions from regulatory authorities. We believe

the expectations reflected in those forward-looking statements are reasonable

but, no assurances can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of them do so,

what benefits that Bengal will derive from them. As such, undue reliance should

not be placed on forward-looking statements. Forward-looking statements

contained herein include, but are not limited to, statements regarding: the

entering into a US$20 million credit facility, the timing to drill two

exploration wells in Cuisinier North 3D area, conducting select well

stimulations, the timing to complete and tie-in four wells at Cuisinier and the

realization of the impact of such new production.

The forward looking statements contained herein are subject to numerous known

and unknown risks and uncertainties that may cause Bengal's actual financial

results, performance or achievement in future periods to differ materially from

those expressed in, or implied by, these forward-looking statements, including

but not limited to, risks associated with: the failure to obtain required

regulatory approvals or extensions; failure to satisfy the conditions under

farm-in and joint venture agreements; failure to secure required equipment and

personnel; changes in general global economic conditions including, without

limitations, the economic conditions in North America, Australia, India;

increased competition; the availability of qualified operating or management

personnel; fluctuations in commodity prices, foreign exchange or interest rates;

changes in laws and regulations including, without limitation, the adoption of

new environmental and tax laws and regulations and changes in how they are

interpreted and enforced; the results of exploration and development drilling

and related activities; the ability to access sufficient capital from internal

and external sources; and stock market volatility. Further, certain noted

production information provided in this press release may constitute "analogous

information" under applicable securities legislation, such as production rates

from wells drilled by other industry participants located in geographical

proximity to lands held by the Company. This information is derived from

publicly available information sources that the Company believes are

predominantly independent in nature however readers are cautioned that the

information may be in error, may not be analogous to the Company's land holdings

and/or may not be representative of actual results of wells anticipated to be

drilled or completed by the Company in the future. Readers are encouraged to

review the material risks discussed in Bengal's Annual Information Form under

the heading "Risk Factors" and in Bengal's annual MD&A under the heading "Risk

Factors". The Company cautions that the foregoing list of assumptions, risks and

uncertainties is not exhaustive. The forward-looking statements contained in

this news release speak only as of the date hereof and Bengal does not assume

any obligation to publicly update or revise them to reflect new events or

circumstances, except as may be require pursuant to applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bengal Energy Ltd.

Chayan Chakrabarty

President & Chief Executive Officer

(403) 205-2526

Bengal Energy Ltd.

Jerrad Blanchard

Chief Financial Officer

(403) 205-2526

investor.relations@bengalenergy.ca

www.bengalenergy.ca

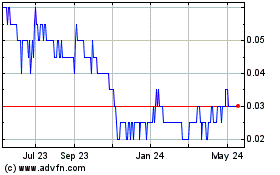

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Oct 2024 to Nov 2024

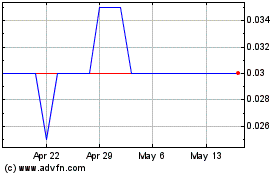

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Nov 2023 to Nov 2024