Cameco reports first quarter financial results

SASKATOON, SASKATCHEWAN--(Marketwired - Apr 29, 2014) -

ALL AMOUNTS ARE STATED IN CDN $ (UNLESS NOTED)

- strong first quarter sales and average realized price in our

uranium segment

- uranium production and sales outlook reconfirmed

- mining activities now underway at Cigar Lake

- McClean Lake mill modifications proceeding; mill will not begin

processing ore in Q2

- completed the sale of our interest in Bruce Power Limited

Partnership

Cameco (TSX:CCO) (NYSE:CCJ) today reported its consolidated

financial and operating results for the first quarter ended March

31, 2014 in accordance with International Financial Reporting

Standards (IFRS).

"We saw strong first quarter results compared to 2013," said

president and CEO, Tim Gitzel, "driven by higher uranium deliveries

and realized prices, and the sale of our interest in Bruce Power

Limited Partnership. Our operations continued to perform well, with

the highlight being the startup of production at the Cigar Lake

mine.

"As an industry, we saw positive signs in Japan, where a new

energy policy confirmed that nuclear power will remain an important

source of energy. However, that news did not change our view of the

current market, where excess supply and discretionary demand for

uranium products has resulted in further downward pressure on the

uranium price. While we do not expect improvement in the near to

medium term, the long-term outlook for the industry remains strong,

and we're making efficient use of our resources to be ready for

that future growth."

|

THREE MONTHS ENDED MARCH 31 |

|

|

|

| HIGHLIGHTS ($ MILLIONS EXCEPT WHERE INDICATED) |

2014 |

|

2013 |

|

CHANGE |

|

| Revenue |

419 |

|

444 |

|

(6 |

)% |

| Gross profit |

108 |

|

95 |

|

14 |

% |

| Net earnings attributable to equity holders |

131 |

|

9 |

|

1,356 |

% |

|

$ per common share (diluted) |

0.33 |

|

0.02 |

|

1,550 |

% |

| Adjusted net earnings (see non-IFRS) |

36 |

|

27 |

|

33 |

% |

|

$ per common share (adjusted and diluted) |

0.09 |

|

0.07 |

|

29 |

% |

| Cash provided by continuing operations (after working

capital changes)1 |

7 |

|

241 |

|

(97 |

)% |

| 1 |

For

comparison purposes, our results have been revised to exclude BPLP.

The impact of BPLP is shown separately as a discontinued

operation. |

FIRST QUARTER

Net earnings attributable to equity holders (net earnings) this

quarter were $131 million ($0.33 per share diluted) compared to $9

million ($0.02 per share diluted) in the first quarter of 2013. In

addition to the items noted below, our net earnings were affected

by a gain on the sale of our interest in BPLP of $127 million,

offset by mark-to-market losses on foreign exchange

derivatives.

On an adjusted basis, our earnings this quarter were $36 million

($0.09 per share diluted) compared to $27 million ($0.07 per share

diluted) (see non-IFRS measure) in the first quarter of 2013. The

change was mainly due to higher earnings from our uranium segment

based on higher sales volumes and higher realized prices, partially

offset by an early termination fee of $18 million incurred as a

result of the cancellation of our toll conversion agreement with

Springfields Fuels Ltd. (SFL), which was to expire in 2016.

See Financial results by segment for more detailed

discussion.

Uranium market update

In the first quarter of 2014, market conditions continued along

the same trend as in 2013. Contracted volumes remained low, putting

further downward pressure on both spot and long-term uranium

prices. On the supply side, production cutbacks and project

deferrals have contributed positively to long-term fundamentals,

but for the near term, the market continues to be adequately

supplied. Utilities remain well covered and we expect little

improvement over the near to medium term.

While there has been no fundamental change to market conditions,

there have been developments that solidify the positive long-term

outlook, including the approval of a new energy policy in Japan

that confirms nuclear power will remain an important electricity

source for the country. In addition, the Nuclear Regulatory

Authority continued to clarify the process for utilities to begin

restarting the country's idled nuclear reactors. While the initial

restarts will be a positive development, we expect it will take

some time for a significant number of reactors to resume

operations, and for the inventory that has built up since 2011 to

clear.

Long-term fundamentals remain positive as nuclear growth

continues to progress around the world. Approximately 70 new

reactors are under construction, and we expect a net increase of 93

reactors over the next 10 years, which is expected to drive an

increase in annual uranium consumption from today's 170 million

pounds to about 240 million pounds. This demand fundamental

combined with the timing, development and execution of new supply

projects and the continued performance of existing supply will

determine the pace of market recovery.

Outlook for 2014

Our strategy is to profitably produce at a pace aligned with

market signals, while maintaining the ability to respond to

conditions as they evolve.

Our outlook for 2014 reflects the expenditures necessary to help

us achieve our strategy. Our outlook for uranium revenue and

consolidated revenue, as well as our production outlook for fuel

services has changed, and is explained below. We do not provide an

outlook for the items in the table that are marked with a dash.

See 2014 Financial results by segment for details.

2014 FINANCIAL OUTLOOK

|

|

CONSOLIDATED |

|

URANIUM |

|

FUEL SERVICES |

|

NUKEM |

|

Production |

- |

|

23.8 to 24.3 million lbs |

|

12 to 13 million kgU |

|

- |

|

Sales volume |

- |

|

31 to 33 million lbs |

|

Decrease 5% to 10% |

|

9 to 11 million lbs U3O8 |

|

Revenue compared to 2013 |

Increase 5% to 10% |

|

Increase 5% to 10%1 |

|

Decrease 5% to 10% |

|

Increase 0% to 5% |

|

Average unit cost of sales (including D&A) |

- |

|

Increase 0% to 5%2 |

|

Increase 0% to 5% |

|

Increase 0% to 5% |

|

Direct administration costs compared to 20133 |

Increase 0% to 5% |

|

- |

|

- |

|

Increase 0% to 5% |

|

Exploration costs compared to 2013 |

- |

|

Decrease 35% to 40% |

|

- |

|

- |

|

Tax rate |

Recovery of 30% to 35% |

|

- |

|

- |

|

Expense of 30% to 35% |

|

Capital expenditures |

$495 million |

|

- |

|

- |

|

- |

| 1 |

Based

on a uranium spot price of $30.75 (US) per pound (the Ux spot price

as of April 28, 2014), a long-term price indicator of $45.00 (US)

per pound (the Ux long-term indicator on April 28, 2014) and an

exchange rate of $1.00 (US) for $1.08 (Cdn). |

| 2 |

This

increase is based on the unit cost of sale for produced material

and committed long-term purchases. If we make discretionary

purchases in 2014, then we expect the overall unit cost of sales to

increase further. |

| 3 |

Direct administration costs do not include stock-based compensation

expenses. |

We now expect an increase of 5% to 10% for sales revenue in our

uranium segment (previously an increase of up to 5%) due to the

impact of the strengthening US dollar. The consolidated revenue

will increase by 5% to 10% as well (previously up to 5%) due to the

impact of the uranium revenue increase.

We now expect production in our fuel services segment to be 12

million to 13 million kgU (down from previously reported 13 million

to 14 million kgU) due to the cancellation of our toll conversion

contract with SFL, which was included in the previously reported

production amount.

In our uranium and fuel services segments, our customers choose

when in the year to receive deliveries, so our quarterly delivery

patterns, sales volumes and revenue can vary significantly. We

expect our uranium deliveries for the second quarter will be

greater than the first quarter. Uranium sales are relatively

balanced for the remainder of 2014. However, not all delivery

notices have been received to date, which could alter the delivery

pattern. Typically, we receive notices six months in advance of the

requested delivery date.

SENSITIVITY ANALYSIS

For the rest of 2014:

- a change of $5 (US) per pound in both the Ux spot price ($30.75

(US) per pound on April 28, 2014) and the Ux long-term price

indicator ($45.00 (US) per pound on April 28, 2014) would change

revenue by $58 million and net earnings by $35 million

- a one-cent change in the value of the Canadian dollar versus

the US dollar would effectively change revenue by $7 million and

adjusted net earnings by $3 million, with a decrease in the value

of the Canadian dollar versus the US dollar having a positive

impact. This sensitivity is based on an exchange rate of $1.00 (US)

for $1.00 (Cdn).

PURCHASE COMMITMENTS

During the first quarter, our purchase commitments increased due

to the signing of new long-term purchase commitments, which we

believe will be beneficial for us as they have been in the past.

The increase was partially offset by the termination of our

agreement with SFL.

As of March 31, 2014, we had commitments of about $1.6 billion

(Cdn) for the following:

- approximately 29 million pounds of U3O8 equivalent from 2014 to

2028

- approximately 7 million kgU as UF6 in conversion services from

2014 to 2017, including about 4 million kgU to complete our 2014

obligations to SFL under the terminated agreement

- over 1.2 million Separative Work Units (SWU) of enrichment

services to meet existing forward sales commitments under

agreements with a non-Western supplier

See Purchase commitments in our first quarter MD&A

for more information.

ADJUSTED NET EARNINGS (NON-IFRS MEASURE)

Adjusted net earnings is a measure that does not have a

standardized meaning or a consistent basis of calculation under

IFRS (non-IFRS measure). We use this measure as a more meaningful

way to compare our financial performance from period to period. We

believe that, in addition to conventional measures prepared in

accordance with IFRS, certain investors use this information to

evaluate our performance. Adjusted net earnings is our net earnings

attributable to equity holders, adjusted to better reflect the

underlying financial performance for the reporting period. The

adjusted earnings measure reflects the matching of the net benefits

of our hedging program with the inflows of foreign currencies in

the applicable reporting period, and has been adjusted for pre-tax

adjustments on derivatives, income taxes on adjustments, and the

after tax gain on the sale of our interest in BPLP.

Adjusted net earnings is non-standard supplemental information

and should not be considered in isolation or as a substitute for

financial information prepared according to accounting standards.

Other companies may calculate this measure differently, so you may

not be able to make a direct comparison to similar measures

presented by other companies.

The table below reconciles adjusted net earnings with our net

earnings.

|

THREE MONTHS ENDED MARCH 31 |

|

| ($ MILLIONS) |

2014 |

|

2013 |

|

| Net earnings attributable to equity holders |

131 |

|

9 |

|

| Adjustments |

|

|

|

|

|

Adjustments on derivatives1 (pre-tax) |

44 |

|

25 |

|

|

Income taxes on adjustments |

(12 |

) |

(7 |

) |

|

Gain on interest in BPLP (after tax) |

(127 |

) |

- |

|

| Adjusted net earnings |

36 |

|

27 |

|

| 1 |

We do

not apply hedge accounting for our portfolio of foreign currency

forward sales contracts. However, we have adjusted our gains or

losses on derivatives to reflect what our earnings would have been

had hedge accounting been in place. |

DISCONTINUED OPERATION

On March 27, 2014, we completed the sale of our 31.6% limited

partnership interest in BPLP. The aggregate sale price for our

interest in BPLP and certain related entities was $450 million. The

sale has been accounted for effective January 1, 2014. We realized

an after tax gain of $127 million on this divestiture. See note 4

to our first quarter interim financial statements for more

information.

CRA DISCLOSURE

As previously reported, since 2008, the Canada Revenue Agency

(CRA) has disputed the offshore marketing company structure and

related transfer pricing methodology we used for certain

intercompany uranium sale and purchase agreements, and issued

notices of reassessment for our 2003 through 2008 tax returns. We

continue to believe the ultimate resolution of this matter will not

be material to our financial position, results of operations and

cash flows in the year(s) of resolution. We are updating our

disclosure on the CRA case to reflect the CRA's intention to

accelerate the frequency of reassessments.

Transfer pricing is a complex area of tax law, and it is

difficult to predict the outcome of a case like ours as there are

only a handful of reported court decisions on transfer pricing in

Canada. However, tax authorities generally test two things:

- the governance (structure)

- the price

The majority of our customers are located outside Canada and we

established an offshore marketing subsidiary. This subsidiary

entered into intercompany purchase and sales agreements as well as

uranium supply agreements with third parties. We have arm's-length

transfer price arrangements in place, which expose both parties to

the risks and the rewards accruing to them under this portfolio of

purchase and sales contracts.

With respect to the contract prices, they are generally

comparable to those established in sales contracts between

arm's-length buyers and sellers entered into at that time. We have

recorded a cumulative tax provision of $75 million, where an

argument could be made that our transfer price may have fallen

outside of an appropriate range of pricing in uranium contracts for

the period from 2003 to March 31, 2014.

We are confident that we will be successful in our case;

however, for the years 2003 through 2008, CRA issued notices of

reassessment for approximately $2.0 billion of additional income

for Canadian tax purposes, which would result in a related tax

expense of about $590 million. The Canadian Income Tax Act includes

provisions that require larger companies like us to pay 50% of the

cash tax plus related interest and penalties at the time of

reassessment. To date, under these provisions, after applying

elective deductions and tax loss carryovers, we have been required

to pay a net amount of $117 million to CRA, which includes the

amounts shown in the table below.

|

YEAR ($ MILLIONS) |

CASH TAXES |

|

INTEREST AND INSTALMENT PENALTIES |

|

TRANSFER PRICING PENALTIES |

|

TOTAL |

|

Prior to 2013 |

- |

|

13 |

|

- |

|

13 |

|

2013 |

1 |

|

9 |

|

36 |

|

46 |

|

2014 |

28 |

|

30 |

|

- |

|

58 |

|

Total |

29 |

|

52 |

|

36 |

|

117 |

Using the methodology we believe CRA will continue to apply, and

including the $2.0 billion already reassessed, we expect to receive

notices of reassessment for a total of approximately $5.7 billion

of additional income as taxable in Canada for the years 2003

through 2013, which would result in a related tax expense of

approximately $1.6 billion. As well, CRA may continue to apply

transfer pricing penalties to taxation years subsequent to 2007. As

a result, we estimate that cash taxes and transfer pricing

penalties would be between $1.25 billion and $1.3 billion. In

addition, we estimate there would be interest and instalment

penalties applied that would be material to us. We would be

responsible for remitting 50% of the cash taxes and transfer

pricing penalties (between $625 million and $650 million), plus

related interest and instalment penalties assessed, which would be

material to us.

Under the Canadian federal and provincial tax legislation, the

amount required to be remitted each year will depend on the amount

of income reassessed in that year and the availability of elective

deductions and tax loss carryovers. CRA has indicated that they

intend to accelerate the frequency of reassessments related to the

transfer pricing adjustments. Their audit of 2009 has been

completed and we have received proposed adjustments to 2009 taxable

income which are calculated in a manner consistent with prior

years. We expect the reassessment for the 2009 taxation year to be

issued in the second quarter of 2014, rather than in the fourth

quarter as was the case for previous years. In addition, we believe

CRA may complete their audit of 2010 and issue the resulting

reassessment in 2014 as well. The estimated amounts summarized in

the table below reflect this expected accelerated schedule.

|

$ MILLIONS |

2003 - 2013 |

|

20142 |

|

2015 - 2016 |

|

2017 - 2023 |

|

TOTAL |

|

50% of cash taxes and transfer pricing penalties payable in the

period1 |

37 |

|

115 - 135 |

|

450 - 475 |

|

0 - 25 |

|

625 - 650 |

|

|

|

|

|

|

|

|

|

|

| 1 |

These

amounts do not include interest and instalment penalties, which

totaled approximately $52 million to March 31, 2014. |

| 2 |

These

amounts include $28 million already paid in 2014. |

In light of our view of the likely outcome of the case as

described above, we expect to recover the amounts remitted to CRA,

including the $117 million already paid to date.

The case on the 2003 reassessment is expected to go to trial in

2015. If this timing is adhered to, we expect to have a Tax Court

decision by 2016.

Caution about forward-looking information relating to our CRA

tax dispute

This discussion of our expectations relating to our tax dispute

with CRA and future tax reassessments by CRA, including the amounts

of future additional taxable income, additional tax expense, cash

taxes payable, transfer pricing penalties, and interest and

possible instalment penalties thereon and related remittances, and

timing of a Tax Court decision, is forward-looking information that

is based upon the assumptions and subject to the material risks

discussed under the heading Caution about forward-looking

information and also on the more specific assumptions and risks

listed below. Actual outcomes may vary significantly.

- CRA will reassess us for the years 2009 through 2013 using a

similar methodology as for the years 2003 through 2008, and the

reassessments will be issued on an accelerated basis as described

above

- we will be able to apply elective deductions and tax loss

carryovers to the extent anticipated

- CRA will seek to impose transfer pricing penalties (10% of the

income adjustment) in addition to interest charges and instalment

penalties

- we will be substantially successful in our dispute with CRA and

the cumulative tax provision of $75 million to date will be

adequate to satisfy any tax liability resulting from the outcome of

the dispute to date

| Material risks that could cause actual results to differ

materially |

- CRA reassesses us for years 2009 through 2013 using a different

methodology than for years 2003 through 2008, or we are unable to

utilize elective deductions and loss carryovers to the same extent

as anticipated, resulting in the required cash payments to CRA

pending the outcome of the dispute being higher than expected

- the time lag for the reassessments for each year is different

than we currently expect

- we are unsuccessful and the outcome of our dispute with CRA

results in significantly higher cash taxes, interest charges and

penalties than the amount of our cumulative tax provision, which

could have a material adverse effect on our liquidity, financial

position, results of operations and cash flows

- cash tax payable increases due to unanticipated adjustments by

CRA not related to transfer pricing

| Financial results by segment |

|

| Uranium |

|

THREE MONTHS ENDED MARCH 31 |

|

|

|

| HIGHLIGHTS |

2014 |

|

2013 |

|

CHANGE |

|

| Production volume (million lbs) |

5.7 |

|

5.9 |

|

(3 |

)% |

| Sales volume (million lbs) |

6.9 |

|

5.1 |

|

35 |

% |

| Average spot price ($US/lb) |

34.94 |

|

42.71 |

|

(18 |

)% |

| Average long-term price ($US/lb) |

48.67 |

|

56.50 |

|

(14 |

)% |

| Average realized price |

|

|

|

|

|

|

|

($US/lb) |

46.60 |

|

48.42 |

|

(4 |

)% |

|

($Cdn/lb) |

50.58 |

|

48.25 |

|

5 |

% |

| Average unit cost of sales ($Cdn/lb) (including

D&A) |

33.30 |

|

31.90 |

|

4 |

% |

| Revenue ($ millions) |

348 |

|

247 |

|

41 |

% |

| Gross profit ($ millions) |

119 |

|

84 |

|

42 |

% |

| Gross profit (%) |

34 |

|

34 |

|

- |

|

FIRST QUARTER

Production volumes this quarter were 3% lower compared to the

first quarter of 2013 due, mainly, to lower production at Rabbit

Lake. See Operations updates for more information.

Uranium revenues were up 41% due to a 35% increase in sales

volumes and a 5% increase in the Canadian dollar average realized

price. Sales in the first quarter were higher than anticipated at

the end of 2013 due to a change in the timing of deliveries during

the quarter, which can vary significantly and are driven by

customer requests.

Our realized prices this quarter were higher than the first

quarter of 2013, primarily as a result of the weakening of the

Canadian dollar. In the first quarter of 2014, the exchange rate on

the average realized price was $1.00 (US) for $1.09 (Cdn) over the

quarter, compared to $1.00 (US) for $1.00 (Cdn) in the first

quarter of 2013.

Total cost of sales (including D&A) increased by 40% ($229

million compared to $163 million in 2013). This was mainly the

result of a 35% increase in sales volumes and an increase in

non-cash costs. In the first quarter of 2014, total non-cash costs

were $48 million compared to $20 million in the first quarter of

2013 due to the completion of a number of capital projects at our

various production facilities. Upon project completion, we begin to

depreciate the asset, which increases the non-cash portion of our

production costs.

Additionally, in the first quarter, our cost of purchased

material was higher than the average spot price for the quarter and

higher than in the first quarter of 2013. We had back-to-back

purchase and sale arrangements that, while profitable, required we

purchase material at a price higher than the current spot

price.

The net effect was a $35 million increase in gross profit for

the quarter.

The table below shows the costs of produced and purchased

uranium incurred in the reporting periods (which are non-IFRS

measures, see the paragraphs below the table). These costs do not

include selling costs such as royalties, transportation and

commissions, nor do they reflect the impact of opening inventories

on our reported cost of sales.

|

THREE MONTHS ENDED MARCH 31 |

|

|

|

| ($CDN/LB) |

2014 |

|

2013 |

|

CHANGE |

|

| Produced |

|

|

|

|

|

|

|

Cash

cost |

20.82 |

|

19.12 |

|

9 |

% |

|

Non-cash cost |

10.55 |

|

8.44 |

|

25 |

% |

|

Total production cost |

31.37 |

|

27.56 |

|

14 |

% |

|

Quantity produced (million lbs) |

5.7 |

|

5.9 |

|

(3 |

)% |

| Purchased |

|

|

|

|

|

|

|

Cash cost |

42.18 |

|

33.44 |

|

26 |

% |

|

Quantity purchased (million lbs) |

1.3 |

|

2.3 |

|

(43 |

)% |

| Totals |

|

|

|

|

|

|

|

Produced and purchased costs |

33.38 |

|

29.21 |

|

14 |

% |

|

Quantities produced and purchased (million lbs) |

7.0 |

|

8.2 |

|

(15 |

)% |

Cash cost per pound, non-cash cost per pound and total cost per

pound for produced and purchased uranium presented in the above

table are non-IFRS measures. These measures do not have a

standardized meaning or a consistent basis of calculation under

IFRS. We use these measures in our assessment of the performance of

our uranium business. We believe that, in addition to conventional

measures prepared in accordance with IFRS, certain investors use

this information to evaluate our performance and ability to

generate cash flow.

These measures are non-standard supplemental information and

should not be considered in isolation or as a substitute for

measures of performance prepared according to accounting standards.

These measures are not necessarily indicative of operating profit

or cash flow from operations as determined under IFRS. Other

companies may calculate these measures differently, so you may not

be able to make a direct comparison to similar measures presented

by other companies.

To facilitate a better understanding of these measures, the

following table presents a reconciliation of these measures to our

unit cost of sales for the first quarters of 2014 and 2013.

CASH AND TOTAL COST PER POUND RECONCILIATION

|

THREE MONTHS ENDED MARCH 31 |

|

|

|

| ($ MILLIONS) |

2014 |

|

2013 |

|

CHANGE |

|

| Cost of product sold |

180.9 |

|

144.0 |

|

26 |

% |

| Add / (subtract) |

|

|

|

|

|

|

|

Royalties |

(14.2 |

) |

(14.4 |

) |

(1 |

)% |

|

Standby charges |

(9.3 |

) |

(8.1 |

) |

15 |

% |

|

Other

selling costs |

(2.4 |

) |

2.8 |

|

(186 |

)% |

|

Change in inventories |

18.5 |

|

65.4 |

|

(72 |

)% |

| Cash operating costs (a) |

173.5 |

|

189.7 |

|

(9 |

)% |

| Add / (subtract) |

|

|

|

|

|

|

|

Depreciation and amortization |

48.3 |

|

19.5 |

|

148 |

% |

|

Change in inventories |

11.9 |

|

30.3 |

|

(61 |

)% |

| Total operating costs (b) |

233.7 |

|

239.5 |

|

(2 |

)% |

|

Uranium produced & purchased (million lbs) (c) |

7.0 |

|

8.2 |

|

(15 |

)% |

| Cash costs per pound (a ÷ c) |

24.79 |

|

23.14 |

|

7 |

% |

| Total costs per pound (b ÷ c) |

33.38 |

|

29.21 |

|

14 |

% |

|

| Fuel services |

|

| (includes results for UF6, UO2 and fuel

fabrication) |

|

|

THREE MONTHS ENDED MARCH 31 |

|

CHANGE |

|

|

HIGHLIGHTS |

2014 |

|

2013 |

|

|

|

|

Production volume (million kgU) |

4.0 |

|

4.7 |

|

(15 |

)% |

|

Sales volume (million kgU) |

1.8 |

|

3.4 |

|

(47 |

)% |

|

Average realized price ($Cdn/kgU) |

22.41 |

|

19.60 |

|

14 |

% |

|

Average unit cost of sales ($Cdn/kgU) (including D&A) |

21.36 |

|

16.27 |

|

31 |

% |

|

Revenue ($ millions) |

40 |

|

66 |

|

(39 |

)% |

|

Gross profit ($ millions) |

2 |

|

11 |

|

(82 |

)% |

|

Gross profit (%) |

5 |

|

17 |

|

(71 |

)% |

FIRST QUARTER

Total revenue decreased by 39% due to a 47% decrease in sales

volumes, offset by a 14% increase in realized price.

The total cost of products and services sold (including D&A)

decreased by 31% ($38 million compared to $55 million in the first

quarter of 2013) due to the decrease in sales volumes, partially

offset by an increase in the average unit cost of sales. When

compared to 2013, the average unit cost of sales was 31% higher due

to the mix of fuel services products sold and lower UF6

production.

The net effect was a $9 million decrease in gross profit.

NUKEM

|

|

THREE MONTHS ENDED MARCH 31 |

|

|

|

|

($ MILLIONS EXCEPT WHERE INDICATED) |

2014 |

|

2013 |

|

CHANGE |

|

|

Uranium sales (million lbs) |

0.7 |

|

2.3 |

|

(70 |

)% |

|

Revenue |

32 |

|

131 |

|

(76 |

)% |

|

Cost of product sold (including D&A) |

35 |

|

127 |

|

(72 |

)% |

|

Gross profit (loss) |

(3 |

) |

4 |

|

(175 |

)% |

|

Net loss |

(7 |

) |

(3 |

) |

(133 |

)% |

|

Adjustments on derivatives1 |

1 |

|

2 |

|

(50 |

)% |

|

Adjusted net loss |

(6 |

) |

(1 |

) |

(500 |

)% |

| 1 |

Adjustments relate to unrealized gains and losses on foreign

currency forward sales contracts (see non-IFRS measure). |

FIRST QUARTER

During the first three months of 2014, NUKEM delivered 0.7

million pounds of uranium, a decline of 1.6 million pounds (70%)

due to timing of customer requirements. NUKEM revenues amounted to

$32 million as a result of the decline in deliveries and a lower

realized price.

Gross loss amounted to $3 million, a decline of $7 million

compared to the first quarter of 2013. Included in the gross loss

for the quarter is a $6 million write-down of inventory, as a

result of a further decline in the spot price that caused the

carrying values of certain quantities to exceed their estimated net

realizable value.

While sales were significantly lower in the current year,

excluding the effects of the inventory write-down, they were at

higher margins. On a percentage basis, gross profits were 9% in the

first quarter of 2014 compared to 3% in same period last year.

Adjusted net loss for the first three months of 2014 was $6

million, compared to a loss of $1 million in 2013.

Operations updates

URANIUM PRODUCTION

|

CAMECO'S SHARE |

THREE MONTHS ENDED MARCH 31 |

|

|

|

|

|

(MILLION LBS) |

2014 |

|

2013 |

|

CHANGE |

|

2014 PLAN |

|

McArthur River/Key Lake |

3.8 |

|

3.5 |

|

9 |

% |

13.1 |

|

Rabbit Lake |

0.5 |

|

1.1 |

|

(55 |

)% |

4.1 |

|

Smith Ranch-Highland |

0.5 |

|

0.3 |

|

67 |

% |

2.0 |

|

Crow Butte |

0.2 |

|

0.2 |

|

- |

|

0.6 |

|

Inkai |

0.7 |

|

0.8 |

|

(13 |

)% |

3.0 |

|

Cigar Lake |

- |

|

- |

|

- |

|

1.0 - 1.5 |

|

Total |

5.7 |

|

5.9 |

|

(3 |

)% |

23.8 - 24.3 |

McArthur River/Key Lake

Production for the quarter was 9% higher compared to the same

period last year due to efficiency and reliability improvements at

the Key Lake mill.

We have begun developing the next freeze wall in zone 4.

Freezing of zone 4 north is underway, and production from the area

is expected to begin this year.

At McArthur River, the Canadian Nuclear Safety Commission has

approved an increase of our licence production limit to 21 million

pounds (100% basis) per year from the mine. However, the current

annual mill production licence limit at Key Lake remains at 18.7

million pounds (100% basis).

As part of our Key Lake extension environmental assessment (EA),

we are seeking approval to increase Key Lake's nominal annual

production rate to 25 million pounds and to increase our tailings

capacity. A public review and comment period for the EA concluded

in February and a regulatory decision is expected this year.

The current collective agreements with unionized employees at

McArthur River and Key Lake expired on December 31, 2013.

Bargaining began in November, 2013 and is ongoing. There is risk to

production if we are unable to reach an agreement and a work

stoppage occurs.

Cigar Lake

In the first quarter, we announced the start of mine production

at Cigar Lake. The jet boring system is performing as expected and

six ore cavities have been mined to date. The ore is routinely

transported to the McClean Lake site where it is being stored for

processing.

AREVA has made good progress on modifications to the McClean

Lake mill, and reports the following:

- the ore receiving systems have been commissioned and more than

350 tonnes of ground ore slurry has been shipped from the Cigar

Lake mine and loaded into storage tanks at the mill

- an expanded ore slurry storage facility has been completed,

including receipt of regulatory approvals

- engineering work related to the mill modifications has been

completed, all materials have been ordered and key long-lead items

have been received, and a detailed commissioning plan has been

prepared

- contractors are on site and the construction is actively

progressing

The necessary time to complete all related construction work

(installing pumps, pipes, electrical and instrumentation), and

commissioning of the new components and the process circuit with

water to ensure the systems function as designed, has led AREVA to

advise us that the mill will not begin processing ore by the end of

the second quarter.

Additionally, AREVA has advised us that work is in progress at

McClean Lake to double the mill's current capacity of 1 million

pounds per month in order to process Cigar Lake's full production,

as it is expected to ramp up to 18 million pounds per year by

2018.

We expect to produce 2 million to 3 million packaged pounds

(100% basis) in 2014, depending on the mill startup and rampup, as

well as the continued success of mining operations at Cigar

Lake.

Inkai

Production was 13% lower compared to the first quarter of 2013.

An abnormally heavy snowfall and rapid spring melt made it

difficult to deliver reagents and access the operating

wellfields.

Heavy spring snow melt in the Sozak region of Kazakhstan has

resulted in flooding and damage to the access roads that are used

to deliver reagents and supplies to several uranium mines. The

impact on production at Inkai was minimal, and based on our plans

to construct new wellfields, we remain on track for annual

production of 3.0 million pounds U3O8 (our share).

FUEL SERVICES

Fuel services produced 4.0 million kgU in the first quarter, 15%

lower than the same period last year. We decreased our production

target in 2014 to between 12 million and 13 million kgU, so

quarterly production is anticipated to be lower than comparable

periods in 2013.

Qualified persons

The technical and scientific information discussed in this

document for our material properties (McArthur River/Key Lake,

Inkai and Cigar Lake) was approved by the following individuals who

are qualified persons for the purposes of NI 43-101:

McArthur River/Key Lake

- David Bronkhorst, vice-president, mining and technology,

Cameco

Cigar Lake

- Scott Bishop, principal mine engineer, technology group,

Cameco

Inkai

- Ken Gullen, technical director, international, Cameco

CAUTION ABOUT FORWARD-LOOKING INFORMATION

This document includes statements and information about our

expectations for the future. When we discuss our strategy, plans,

future financial and operating performance, or other things that

have not yet taken place, we are making statements considered to be

forward-looking information or forward-looking

statements under Canadian and United States securities laws.

We refer to them in this document as forward-looking

information.

Key things to understand about the forward-looking information

in this document:

- It typically includes words and phrases about the future, such

as: anticipate, believe, estimate, expect, plan, will, intend,

goal, target, forecast, project, strategy and outlook (see examples

below).

- It represents our current views, and can change

significantly.

- It is based on a number of material assumptions, including

those we have listed below, which may prove to be incorrect.

- Actual results and events may be significantly different from

what we currently expect, due to the risks associated with our

business. We list a number of these material risks below. We

recommend you also review our annual information form and annual

and first quarter MD&A, which include a discussion of other

material risks that could cause actual results to differ

significantly from our current expectations.

- Forward-looking information is designed to help you understand

management's current views of our near and longer term prospects,

and it may not be appropriate for other purposes. We will not

necessarily update this information unless we are required to by

securities laws.

| Examples of forward-looking information in this document |

- our expectations about 2014 and future global uranium supply,

consumption, demand and number of new reactors, including the

discussion under the heading Uranium market update

- our consolidated outlook for the year and the outlook for our

operating segments for 2014

- our expectations for uranium deliveries in the second quarter

and uranium sales for the balance of 2014

- the discussion of our expectations relating to our tax dispute

with Canada Revenue Agency (CRA), including our estimate of the

amount and timing of expected cash taxes and transfer pricing

penalties payable to CRA

- our future plans and expectations for each of our uranium

operating properties and fuel services operating sites

- our plan for 2 million to 3 million packaged pounds (100%

basis) in 2014 from milling Cigar Lake ore at AREVA's McClean Lake

mill

- actual sales volumes or market prices for any of our products

or services are lower than we expect for any reason, including

changes in market prices or loss of market share to a

competitor

- we are adversely affected by changes in foreign currency

exchange rates, interest rates or tax rates

- our production costs are higher than planned, or necessary

supplies are not available, or not available on commercially

reasonable terms

- our estimates of production, purchases, costs, decommissioning

or reclamation expenses, or our tax expense estimates, prove to be

inaccurate

- we are unable to enforce our legal rights under our existing

agreements, permits or licences

- we are subject to litigation or arbitration that has an adverse

outcome, including lack of success in our dispute with CRA

- there are defects in, or challenges to, title to our

properties

- our mineral reserve and resource estimates are not reliable, or

we face unexpected or challenging geological, hydrological or

mining conditions

- we are affected by environmental, safety and regulatory risks,

including increased regulatory burdens or delays

- we cannot obtain or maintain necessary permits or approvals

from government authorities

- we are affected by political risks in a developing country

where we operate

- we are affected by terrorism, sabotage, blockades, civil

unrest, social or political activism, accident or a deterioration

in political support for, or demand for, nuclear energy

- we are impacted by changes in the regulation or public

perception of the safety of nuclear power plants, which adversely

affect the construction of new plants, the relicensing of existing

plants and the demand for uranium

- there are changes to government regulations or policies that

adversely affect us, including tax and trade laws and policies

- our uranium and conversion suppliers fail to fulfil delivery

commitments

- our Cigar Lake mining or production plans are delayed or do not

succeed, including as a result of any difficulties with the jet

boring mining method or freezing the deposit to meet production

targets, or any difficulties with the McClean Lake mill

modifications or commissioning or milling of Cigar Lake ore, or our

inability to acquire any of the required jet boring equipment

- our McArthur River development, mining or production plans are

delayed or do not succeed for any reason

- we are affected by natural phenomena, including inclement

weather, fire, flood and earthquakes

- our operations are disrupted due to problems with our own or

our customers' facilities, the unavailability of reagents,

equipment, operating parts and supplies critical to production,

equipment failure, lack of tailings capacity, labour shortages,

labour relations issues (including an inability to renew agreements

with unionized employees at McArthur River and Key Lake), strikes

or lockouts, underground floods, cave-ins, ground movements,

tailings dam failures, transportation disruptions or accidents, or

other development and operating risks

- our expectations regarding sales and purchase volumes and

prices for uranium and fuel services

- our expectations regarding the demand for uranium, the

construction of new nuclear power plants and the relicensing of

existing nuclear power plants not being more adversely affected

than expected by changes in regulation or in the public perception

of the safety of nuclear power plants

- our expected production level and production costs

- the assumptions regarding market conditions upon which we have

based our capital expenditures expectations

- our expectations regarding spot prices and realized prices for

uranium

- our expectations regarding tax rates and payments, foreign

currency exchange rates and interest rates

- our expectations about the outcome of the dispute with CRA

- our decommissioning and reclamation expenses

- our mineral reserve and resource estimates, and the assumptions

upon which they are based, are reliable

- the geological, hydrological and other conditions at our

mines

- our Cigar Lake mining and production plans succeed, including

the additional jet boring equipment is acquired on schedule, the

jet boring mining method works as anticipated and the deposit

freezes as planned

- mill modifications and commissioning of the McClean Lake mill

are completed as planned and the mill is able to process Cigar Lake

ore as expected, including our expectation of processing 2 million

to 3 million packaged pounds (100% basis) in 2014

- our McArthur River development, mining and production plans

succeed

- our ability to continue to supply our products and services in

the expected quantities and at the expected times

- our ability to comply with current and future environmental,

safety and other regulatory requirements, and to obtain and

maintain required regulatory approvals

- our operations are not significantly disrupted as a result of

political instability, nationalization, terrorism, sabotage,

blockades, civil unrest, breakdown, natural disasters, governmental

or political actions, litigation or arbitration proceedings, the

unavailability of reagents, equipment, operating parts and supplies

critical to production, labour shortages, labour relations issues

(including an inability to renew agreements with unionized

employees at McArthur River and Key Lake), strikes or lockouts,

underground floods, cave-ins, ground movements, tailings dam

failure, lack of tailings capacity, transportation disruptions or

accidents or other development or operating risks

Quarterly dividend notice

We announced today that our board of directors approved a

quarterly dividend of $0.10 per share on the outstanding common

shares of the corporation that is payable on July 15, 2014, to

shareholders of record at the close of business on June 30,

2014.

Conference call

We invite you to join our first quarter conference call on

Tuesday, April 29th, 2014 at 1:00 p.m. Eastern.

The call will be open to all investors and the media. To join

the call, please dial (866) 223-7781 (Canada and US) or (416)

340-2216. An operator will put your call through. A live audio feed

of the conference call will be available from a link at cameco.com.

See the link on our home page on the day of the call.

A recorded version of the proceedings will be available:

- on our website, cameco.com, shortly after the call

- on post view until midnight, Eastern, May 30, 2014 by calling

(800) 408-3053 (Canada and US) or (905) 694-9451 (Passcode

9624310#)

Additional information

You can find a copy of our first quarter MD&A and interim

financial statements on our website at cameco.com, on SEDAR at

sedar.com and on EDGAR at sec.gov/edgar.shtml.

Additional information, including our 2013 annual management's

discussion and analysis, annual audited financial statements and

annual information form, is available on SEDAR at sedar.com, on

EDGAR at sec.gov/edgar.shtml and on our website at cameco.com.

Profile

We are one of the world's largest uranium producers, a

significant supplier of conversion services and one of two CANDU

fuel manufacturers in Canada. Our competitive position is based on

our controlling ownership of the world's largest high-grade

reserves and low-cost operations. Our uranium products are used to

generate clean electricity in nuclear power plants around the

world. We also explore for uranium in the Americas, Australia and

Asia. Our shares trade on the Toronto and New York stock exchanges.

Our head office is in Saskatoon, Saskatchewan.

As used in this news release, the terms we, us, our, the Company

and Cameco mean Cameco Corporation and its subsidiaries; including

NUKEM GmbH, unless otherwise indicated.

CamecoInvestor inquiries:Rachelle Girard(306) 956-6403Media

inquiries:Gord Struthers(306) 956-6593

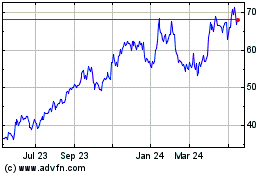

Cameco (TSX:CCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cameco (TSX:CCO)

Historical Stock Chart

From Dec 2023 to Dec 2024