Cenovus announces restart of West White Rose Project

31 May 2022 - 7:30PM

Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) and its partners have

agreed to restart the West White Rose Project offshore Newfoundland

and Labrador. First oil from the platform is anticipated in the

first half of 2026, with peak production anticipated to reach

approximately 80,000 barrels per day (bbls/d), 45,000 bbls/d net to

Cenovus, by year-end 2029.

“The joint venture owners have worked together to significantly

de-risk this project over the past 16 months. As a result, we’re

confident restarting West White Rose provides superior value for

our shareholders compared with the option of abandonment and

decommissioning,” said Alex Pourbaix, Cenovus President & Chief

Executive Officer. “With the project about 65% complete, combined

with the work done over the past 16 months to firm up cost

estimates and rework the project plan, we are confident in our

decision to restart this project in 2023.”

The restart decision builds on Cenovus’s September 2021

restructuring of its working interests in the White Rose and Terra

Nova fields, improving the strategic alignment across the two

assets. Cenovus and Suncor, as part of the restructuring, have

entered into an agreement whereby Cenovus will decrease its working

interest in the White Rose field and satellite extensions while

Suncor will take a larger stake, with the approval of the West

White Rose project restarting. Cenovus has reduced its stake

in the original field to 60% from 72.5% and to 56.375% from 68.875%

in the satellite extensions. Nalcor has a 5% working interest

in the satellite fields.

Contributing to the decision to restart the project is an

amended royalty structure with the Government of Newfoundland and

Labrador which provides safeguards to the project’s economics in

periods of low commodity prices.

The remaining capital required to achieve first oil is expected

to be approximately $2.0 billion to $2.3 billion net to Cenovus.

This includes construction costs of approximately $1.6 billion to

$1.8 billion net to Cenovus for the completion of the West White

Rose full platform, and about $400 million to $500 million net

to Cenovus for subsea drilling and completions work and

the SeaRose floating production, storage and offloading

(FPSO) vessel’s asset life extension. Capital to complete the

project is largely offset by deferral of planned decommissioning

costs of $1.6 billion to $1.8 billion over the next five years that

had been assumed in the business plan presented at Cenovus’s

Investor Day in December 2021.

Included in the West White Rose Project capital estimate is $120

million net to Cenovus to be spent in 2022 as the company works

towards full restart of the West White Rose Project in 2023. This

amount will be added to Cenovus’s 2022 Corporate Guidance at its

next update later this year.

About the West White Rose ProjectThe West White

Rose Project will add an expected 14 years of production to the

White Rose field and is about 65% complete. The field’s production

has tidewater access to global markets and receives Brent-like

pricing. Construction includes the completion of the concrete

gravity structure and topsides, which will serve as the drilling

platform for the project. Once installed, the platform will be tied

into existing infrastructure. A scheduled 70-day drydock program

for the SeaRose FPSO will proceed in 2024.

Advisory Presentation Basis

Cenovus presents production volumes on a net to Cenovus before

royalties basis, unless otherwise stated.

Forward-looking InformationThis document

contains certain forward-looking statements and forward-looking

information (collectively referred to as “forward-looking

information”) within the meaning of applicable securities

legislation, including the United States Private Securities

Litigation Reform Act of 1995, about Cenovus’s current

expectations, estimates and projections about the future, based on

certain assumptions made in light of experiences and perceptions of

historical trends. Although Cenovus believes that the expectations

represented by such forward-looking information are reasonable,

there can be no assurance that such expectations will prove to be

correct.

Forward-looking information in this document is identified by

words such as “anticipate”, “confident”, “estimate”, “expect”,

“will” or similar expressions and includes suggestions of future

outcomes, including, but not limited to, statements about: timing

and estimated capital cost expenditures for the West White Rose

Project restart; expected peak production capacity and production

life of the White Rose field; and Cenovus’s 2022 guidance.

Developing forward-looking information involves reliance on a

number of assumptions and consideration of certain risks and

uncertainties, some of which are specific to Cenovus and others

that apply to the industry generally. The factors or assumptions on

which the forward-looking information in this news release are

based include, but are not limited to: the amended royalty

structure with the Government of Newfoundland and Labrador; and the

assumptions inherent in Cenovus’s 2022 guidance available on

cenovus.com.

Except as required by applicable securities laws, Cenovus

disclaims any intention or obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise. Readers are cautioned that

the foregoing lists are not exhaustive and are made as at the date

hereof. Events or circumstances could cause actual results to

differ materially from those estimated or projected and expressed

in, or implied by, the forward-looking information. For additional

information regarding Cenovus’s material risk factors, the

assumptions made, and risks and uncertainties which could cause

actual results to differ from the anticipated results, refer to

“Risk Management and Risk Factors” and “Advisory” in

Cenovus’s Management's Discussion and Analysis for the periods

ending December 31, 2021 and March 31, 2022, and to the risk

factors, assumptions and uncertainties described in other documents

Cenovus files from time to time with securities regulatory

authorities in Canada (available on SEDAR at sedar.com, on EDGAR at

sec.gov and Cenovus’s website at cenovus.com).

Cenovus Energy Inc.

Cenovus Energy Inc. is an integrated energy company with oil and

natural gas production operations in Canada and the Asia Pacific

region, and upgrading, refining and marketing operations in Canada

and the United States. The company is focused on managing its

assets in a safe, innovative and cost-efficient manner, integrating

environmental, social and governance considerations into its

business plans. Cenovus common shares and warrants are listed on

the Toronto and New York stock exchanges, and the company’s

preferred shares are listed on the Toronto Stock Exchange. For more

information, visit cenovus.com.

Find Cenovus on Facebook, Twitter, LinkedIn, YouTube and

Instagram.

Cenovus contacts

|

Investors |

Media |

| Investor Relations general

line |

Media Relations general line |

| 403-766-7711 |

403-766-7751 |

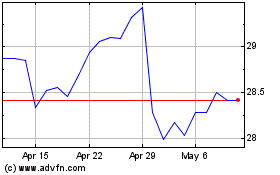

Cenovus Energy (TSX:CVE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cenovus Energy (TSX:CVE)

Historical Stock Chart

From Nov 2023 to Nov 2024