Dundee Corporation Reports Second Quarter 2010 Results

11 August 2010 - 7:01AM

Marketwired

Dundee Corporation (TSX: DC.A)(TSX: DC.PR.A)(TSX: DC.PR.B)

("Dundee" or the "Company") is pleased to announce that it has

posted its financial results and Management's Discussion and

Analysis for the quarter ended June 30, 2010 on its website

www.dundeecorporation.com and on the System for Electronic Document

Analysis and Retrieval ("SEDAR") at www.sedar.com.

Our operating EBITDA for the six months ended June 30, 2010 was

$210.6 million, well in excess of operating EBITDA of $87.0 million

earned during the same period of 2009. Net earnings per share were

$0.91 on a fully diluted basis, as compared to net earnings of

$0.28 per share in 2009.

At July 31, 2010, assets under management and administration in

our wealth management subsidiary, DundeeWealth Inc., were $72.2

billion. Through its Dynamic family of funds, DundeeWealth

continued to lead the industry in total net sales as reported by

the Investment Funds Institute of Canada. Coupled with strong

performance of core mutual funds, DundeeWealth increased mutual

fund market share to 4.11% at June 30, 2010, compared with 3.76% at

the end of 2009 and 3.33% at the end of the second quarter of the

prior year. During the first half of 2010, DundeeWealth earned

operating EBITDA of $149.0 million which compares with operating

EBITDA of $63.7 million for the same period of 2009. Included in

EBITDA for the six months ended June 30, 2010, is a pre-tax gain of

$33.3 million pertaining to the disposition of certain of its

investments in collateralized loan obligations.

Our real estate subsidiary, Dundee Realty Corporation, generated

operating EBITDA of $33.2 million in the first half of this year, a

66% improvement over operating EBITDA of $20.0 million earned in

the first half of the prior year. Improvements reflect continuing

strong demand for, and increased sales of our real estate products,

most notably in western Canada.

Propelled by our share of earnings from our equity-accounted

investments, pre-tax earnings from our resource segment were $20.2

million in the first half of 2010, compared with pre-tax earnings

of $0.7 million in the first half of the prior year. Our share of

earnings from our resource based equity accounted investments were

$22.0 million during the first half of the current year, compared

with earnings of $1.5 million during the same period of 2009.

Our asset management activities include the operations of Ned

Goodman Investment Counsel Limited ("NGIC") and Dundee Real Estate

Asset Management ("DREAM"). At June 30, 2010, NGIC and DREAM

provided sub-advisory and investment services to approximately $6.8

billion of third-party assets under management. In addition, NGIC,

together with Dundee Resources Limited, also provides investment

services in respect of the Company's portfolio of securities. These

investments include both publicly listed and private companies in a

variety of sectors.

ABOUT DUNDEE CORPORATION

Dundee Corporation is an asset management company dedicated to

wealth management, real estate and resources that, combined,

reflect approximately $76 billion under management and

administration. Its domestic wealth management activities are

carried out through its 61% controlled subsidiary, DundeeWealth

Inc. Dundee Corporation's real estate activities are conducted

through its 70% owned subsidiary, Dundee Realty Corporation, which

operates as an asset manager of commercial real estate with

activities in a land and housing business in Canada and the United

States. Resource activities are carried out through its

wholly-owned subsidiary, Dundee Resources Limited. Asset management

activities are carried out through Ned Goodman Investment Counsel

Limited and Dundee Real Estate Asset Management (DREAM).

Contacts: Dundee Corporation Ned Goodman President and Chief

Executive Officer (416) 365-5665 Dundee Corporation Lucie Presot

Vice President and Chief Financial Officer (416) 365-5157

www.dundeecorporation.com

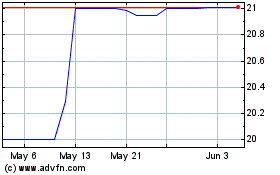

Dundee (TSX:DC.PR.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

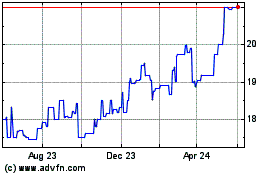

Dundee (TSX:DC.PR.B)

Historical Stock Chart

From Jul 2023 to Jul 2024