Docebo Announces Initial Public Offering in the United States and Public Offering in Canada

01 December 2020 - 10:37PM

Business Wire

Docebo Inc. (“Docebo”) (TSX:DCBO) today announced the launch of

a marketed public offering of Docebo’s common shares in the United

States and Canada, representing Docebo's initial public offering in

the United States.

In connection with the initial public offering in the United

States, Docebo has filed an application to list its common shares

on The Nasdaq Global Select Market (the "Nasdaq") under the ticker

"DCBO". Trading of Docebo’s common shares is expected to commence

on the Nasdaq following pricing of the offering. Docebo’s common

shares will continue to trade on the Toronto Stock Exchange (the

"TSX") under the symbol "DCBO".

A total of US$125 million of common shares will be offered by

Docebo for sale in the offering, which will be conducted through a

syndicate of underwriters led by Morgan Stanley, Goldman Sachs

& Co. LLC and Canaccord Genuity, as joint lead book-running

managers. The offering will be priced in the context of the market,

with the price and total size of the offering to be determined at

the time of entering into an underwriting agreement for the

offering (the “Underwriting Agreement”).

Docebo will also grant the underwriters an over-allotment

option, exercisable for a period of 30 days from the date of the

Underwriting Agreement, to purchase up to US$18.75 million of

additional common shares, representing in the aggregate 15% of the

total number of common shares to be sold pursuant to the

offering.

Docebo expects that the net proceeds of the offering will be

used primarily to strengthen the Company's financial position and

allow it to pursue its growth strategies, which include: expanding

its customer base; supporting the growth of existing customers;

expanding its solutions; and other general corporate purposes.

Closing of the offering will be subject to a number of customary

conditions, including the entering into of the Underwriting

Agreement, the listing of Docebo’s common shares on the Nasdaq and

the TSX, and any required approvals of the Nasdaq and the TSX.

In connection with the offering, Docebo filed a preliminary

prospectus supplement to its base shelf prospectus with the

securities regulatory authorities in each of the provinces and

territories of Canada. The preliminary prospectus supplement and a

base shelf prospectus have also been filed with the U.S. Securities

and Exchange Commission as part of a registration statement on Form

F-10 under the U.S.-Canada multijurisdictional disclosure system

(MJDS). The public offering will be made in Canada only by means of

the base shelf prospectus and preliminary prospectus supplement and

in the United States only by means of the registration statement,

including the base shelf prospectus and preliminary prospectus

supplement. Such documents contain important information about the

offering. Copies of the base shelf prospectus and the preliminary

prospectus supplement can be found on SEDAR at www.sedar.com, and a

copy of the registration statement can be found on EDGAR at

www.sec.gov. Copies of such documents may also be obtained from any

of the following sources: Morgan Stanley & Co. LLC, Attn:

Prospectus Department - 180 Varick Street, 2nd Floor - New York, NY

10014; Goldman Sachs & Co. LLC, Attention: Prospectus

Department, 200 West Street, New York, NY 10282, by telephone at

1-866-471-2526 or by e-mail at prospectus-ny@ny.email.gs.com; and

Canaccord Genuity LLC, Attention: Syndicate Department, 99 High

Street, 12th Floor, Boston MA 021990, by email at

prospectus@cgf.com.

Prospective investors should read the base shelf prospectus and

the preliminary prospectus supplement as well as the registration

statement before making an investment decision.

No securities regulatory authority has either approved or

disapproved the contents of this press release. This press release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the common shares in

any province, state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such province, state

or jurisdiction.

Forward-Looking Statements

This news release may contain “forward-looking information” and

“forward-looking statements” (collectively, “forward-looking

information”) within the meaning of applicable securities laws,

including, without limitation, statements regarding the conduct of

the offering; the intended listing of the common shares on the

Nasdaq; obtaining required approvals from the Nasdaq and the TSX;

the granting of the underwriters’ over-allotment option; and the

anticipated use of proceeds from the offering.

This forward-looking information is based on our opinions,

estimates and assumptions that, while considered by the Company to

be appropriate and reasonable as of the date of this press release,

are subject to known and unknown risks, uncertainties, assumptions

and other factors that may cause the actual results, level of

activity, performance or achievements to be materially different

from those expressed or implied by such forward-looking

information, including, without limitation: there being

insufficient investor demand for the offering; economic and market

conditions being conducive to the offering on the timeline

currently anticipated or at all; fluctuations in the market price

of the common shares; risks related to the COVID-19 pandemic and

its impact on Docebo, economic conditions, and global markets; the

failure of Docebo and/or the underwriters to satisfy closing

conditions to the offering; the failure of Docebo to satisfy

certain Nasdaq and/or TSX listing requirements; the failure of

Docebo to use any of the proceeds received from the offering in a

manner consistent with current expectations; and other unforeseen

events, developments, or factors causing any of the aforesaid

expectations, assumptions, and other factors ultimately being

inaccurate or irrelevant and those factors discussed in greater

detail under the “Risk Factors” section of the prospectus

supplement dated December 1, 2020 and our Annual Information Form

for the year ended December 31, 2019, each available under our

profile on SEDAR at www.sedar.com, and should be considered

carefully by prospective investors.

If any of these risks or uncertainties materialize, or if the

opinions, estimates or assumptions underlying the forward-looking

information prove incorrect, actual results or future events might

vary materially from those anticipated in the forward-looking

information. Although we have attempted to identify important risk

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

risk factors not presently known to us or that we presently believe

are not material that could also cause actual results or future

events to differ materially from those expressed in such

forward-looking information. There can be no assurance that such

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

information. No forward-looking statement is a guarantee of future

results. Accordingly, you should not place undue reliance on

forward-looking information, which speaks only as of the date made.

The forward-looking information contained in this press release

represents our expectations as of the date specified herein, and

are subject to change after such date. However, we disclaim any

intention or obligation or undertaking to update or revise any

forward-looking information whether as a result of new information,

future events or otherwise, except as required under applicable

securities laws.

All of the forward-looking information contained in this press

release is expressly qualified by the foregoing cautionary

statements.

About Docebo

Docebo is redefining the way enterprises learn by applying new

technologies to the traditional corporate learning management

system market. Docebo provides an easy-to-use, highly configurable

learning platform with the end-to-end capabilities designed to make

customers, partners, and employees love their learning

experience.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201201005626/en/

Investor Relations Dennis Fong investors@docebo.com (416)

283-9930

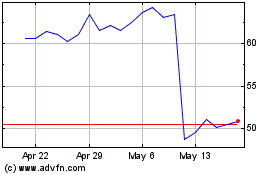

Docebo (TSX:DCBO)

Historical Stock Chart

From Jan 2025 to Feb 2025

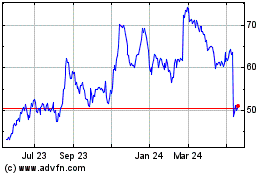

Docebo (TSX:DCBO)

Historical Stock Chart

From Feb 2024 to Feb 2025