Dividend 15 Split Corp. II Announces Successful Overnight Offering

28 March 2014 - 1:30AM

Marketwired Canada

Dividend 15 Split Corp. II (the "Company") is pleased to announce that it has

completed the overnight marketing of up to 1,935,000 Preferred Shares and up to

1,935,000 Class A Shares. Total proceeds of the offering are expected to be

approximately $35.8 million. The Company has granted the dealers an

overallotment of 290,250 units if exercised, bringing the total to $41.2

million.

The offering is being co-led by National Bank Financial Inc., CIBC and RBC

Capital Markets and also includes BMO Capital Markets, TD Securities Inc., GMP

Securities L.P. and Canaccord Genuity Corp. The sales period of the overnight

offering has now ended.

The Preferred Shares will be offered at a price of $10.00 per Preferred Share to

yield 5.25% on the issue price and the Class A Shares will be offered at a price

of $8.50 per Class A Share to yield 14.12% on the issue price. The closing price

on the TSX of each of the Preferred Shares and the Class A Shares on March 26,

2014 was $10.22 and $9.10, respectively.

The net proceeds of the secondary offering will be used by the Company to invest

in an actively managed portfolio of dividend-yielding common shares which

includes each of the 15 Canadian companies listed below:

Bank of Montreal Enbridge Inc. TELUS Corporation

The Bank of Nova Scotia Manulife Financial Corp. Thomson-Reuters

BCE Inc. National Bank of Canada Corporation

Canadian Imperial Bank Royal Bank of Canada The Toronto-Dominion Bank

of Commerce Sun Life Financial Inc. TransAlta Corporation

CI Financial Corp. TransCanada Corporation

The Company's investment objectives are:

Preferred Shares:

i. to provide holders of the Preferred Shares with fixed, cumulative

preferential monthly cash dividends in the amount of $0.04375 per

Preferred Share to yield 5.25% per annum on the original issue price;

and

ii. on or about December 1, 2019, to pay the holders of the Preferred Shares

the original issue price of those shares.

Class A Shares:

i. to provide holders of the Class A Shares with regular monthly cash

dividends initially targeted to be $0.10 per Class A; and

ii. on or about December 1, 2019, to pay the holders of Class A Shares at

least the original issue price of those shares.

The Company will today file an amended and restated preliminary short form

prospectus, containing important information relating to the Preferred Shares

and the Class A Shares, with securities commissions or similar authorities in

all provinces of Canada. The amended and restated preliminary short form

prospectus is still subject to completion or amendment. Copies of the amended

and restated preliminary short form prospectus may be obtained from your

registered financial advisor using the contact information for such advisor, or

from representatives of the underwriters listed above. Investors should read the

prospectus before making an investment decision. There will not be any sale or

any acceptance of an offer to buy the securities until a receipt for the final

prospectus has been issued.

FOR FURTHER INFORMATION PLEASE CONTACT:

Dividend 15 Split Corp. II

Investor Relations

416-304-4443 or toll free at 1-877-4-Quadra (1-877-478-2372)

www.dividend15.com

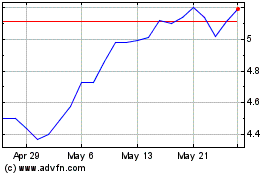

Dividend 15 Split Corp II (TSX:DF)

Historical Stock Chart

From Dec 2024 to Dec 2024

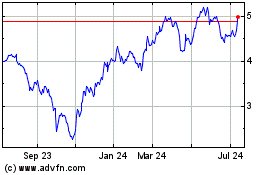

Dividend 15 Split Corp II (TSX:DF)

Historical Stock Chart

From Dec 2023 to Dec 2024