mdf commerce inc. (the “Corporation”) (TSX:MDF), a

SaaS leader in digital commerce technologies, reported third

quarter financial results for the three-month period ended December

31, 2022 (Q3 FY2023). Financial references are expressed in

Canadian dollars unless otherwise indicated.

“This third quarter of fiscal 2023 represents a

second consecutive quarter with a positive adjusted EBITDA(2). In

response to macroeconomic conditions and shifting client

priorities, we’ve reduced of our global workforce by approximately

10% since the beginning of the quarter. When added to the 9%

workforce reduction from the sale of InterTrade, this represents a

total workforce reduction of approximately 19%. As our hybrid work

model has evolved, we’re reducing our real estate footprint across

various physical offices. These cost containment efforts are

expected to generate additional cost savings over the coming

quarters,” said Luc Filiatreault, President and Chief Executive

Officer of mdf commerce. “The sale of InterTrade Systems inc.

(InterTrade) on October 4, 2022 for $65.8 million has allowed us to

significantly deleverage our balance sheet, providing us with a

stronger foundation and more operational focus. Our growth efforts

are focused on further leveraging our leadership position in the

public eprocurement market and capitalizing on the US Government’s

spending initiatives.”

Sale of InterTrade and repayment of the

majority of long-term debt

On October 4, 2022, the Corporation entered into

a Share Purchase Agreement with SPS Commerce, Inc. (“SPS”) and

concurrently closed the transaction for the sale of all the issued

and outstanding shares of InterTrade. The preliminary disposal

consideration was $63.9 million (US$47.1 million), including

closing cash, working capital and post-closing adjustments. The

disposal consideration also includes a realized loss on forward

contracts entered into to hedge the USD to CAD exchange rate

fluctuations since the consideration was denominated in U.S.

dollars. As a result of the disposal of InterTrade, the Corporation

recorded a gain of $22.9 million (US$16.9 million). At closing, the

Corporation repaid the Term Facility of $21.7 million (US$16.0

million) plus accrued interest and made payments of $6.8 million

(US$5.0 million) on the Revolving Facility drawn in US dollars and

$32.0 million of the Revolving Facility drawn in Canadian dollars.

As the Term Facility was available by way of a single use

borrowing, it is no longer available to the Corporation.

Third Quarter

Fiscal 2023

Financial Results

Revenues for Q3 FY2023 were $31.7 million, an

increase of $1.0 million or 3.3% compared to $30.7 million for Q3

FY2022. On a Constant Currency(3) basis, revenues decreased by $0.4

million or 1.1% compared to Q3 FY2022. Recurring Revenue(1)

represents $24.7 million or 77.8% of revenues for Q3 FY2023

compared to $25.0 million or 75.1% of revenues for Q3 FY2022.

Revenue from InterTrade for Q3 FY2023 was $0.4

million, which represents a decrease of $3.0 million in revenue

compared to $3.4 million from both Q2 FY2023 and from Q3 FY2022.

The Q3 FY2023 decrease in revenue from the sale of this subsidiary

was partially offset by $0.9 million of revenue which was recorded

in the quarter for post-closing transition services provided to the

acquirer of InterTrade. Adjusted EBITDA(2) from InterTrade

decreased by $0.7 million compared to Q2 FY2023 to nil for Q3

FY2023, and compared to $1.1 million in Q3 FY2022.

Our two core platforms, eprocurement and

ecommerce (previously Unified Commerce before the sale of

InterTrade) contributed to revenues of the third quarter as

follows:

- The eprocurement

platform generated revenues of $19.8 million, an increase of $2.9

million or 17.3% compared to $16.9 million in Q3 FY2022. The

US-based eprocurement network, contributed positively to revenue

growth with an increase in revenues of $2.8 million or

23.2%.Revenues for Q3 FY2023 were impacted by a fair value

adjustment on Periscope Intermediate Corporation (“Periscope”)

deferred revenues at the closing date of the acquisition on August

31, 2021 which resulted in a reduction in revenues of $0.1 million

compared to $2.6 million for Q3 FY2022.Recurring Revenue(1) for the

eprocurement platform represented 88.6% for Q3 FY2023, compared to

83.0% for Q3 FY2022.

- The ecommerce

platform (previously Unified Commerce before the sale of

InterTrade), generated revenues of $6.8 million for Q3 FY2023, a

decrease of $3.0 million or 30.8% compared to $9.8 million for Q3

FY2022. The sale of InterTrade accounts for $3.0 million of the

decrease, offset by $0.9 million in other revenue from post-closing

transition services provided to the acquirer of InterTrade, and the

remaining decrease is mainly due to lower professional services

revenues in the Orckestra platform as large deployments and

solution integration services have been completed.Recurring

Revenue(1) for the ecommerce platform (previously Unified Commerce

before the sale of InterTrade), represented 43.5% of platform

revenues for Q3 FY2023 compared to 59.3% for Q3 FY2022. The lower

Recurring Revenue(1) as a percentage of total revenue is due to the

sale of InterTrade which had Recurring Revenue(1) as a percentage

of total revenue trending at over 90%, and partial offset by the

reduction of professional services in the Orckestra platform.

Revenues from the emarketplaces platform were

$5.0 million in Q3 FY2023, an increase of $1.1 million or 27.5%

from Q3 FY2022. This increase was from The Broker Forum.

Recurring Revenue(1) for the emarketplaces

platform represented 81.0% of platform revenues for Q3 FY2023

compared to 75.4% for Q3 FY2022.

Gross margin for Q3 FY2023 was $17.8 million or

56.3% compared to $17.2 million or 56.1% for Q3 FY2022.

Operating expenses in Q3 FY2023 were $23.6

million, an increase of 4.2% compared to $22.7 million in Q3

FY2022. The decrease in operating costs related to the sale of

InterTrade and salary savings from headcount reduction during Q3

FY2023, were partially offset by higher transaction-related costs

of $0.5 million as compared to Q3 FY2022.

The Corporation recorded an operating loss of

$5.8 million during Q3 FY2023, compared to $5.5 million in Q3

FY2022.

Net earnings were $15.1 million, or $0.34 net

earnings per share (basic and diluted) for Q3 FY2023, compared to a

net loss of $4.7 million, or $0.11 net loss per share (basic and

diluted) for Q3 FY2022. The increase in net earnings for Q3 FY2023

compared to Q3 FY2022 is mainly due to the gain on disposal of a

subsidiary InterTrade of $22.9 million recognized in Q3 FY2023.

Adjusted net loss(4) was $7.8 million for Q3

FY2023, compared to $4.7 million for Q3 FY2022. The increase of

Adjusted net loss(4) in Q3 FY2023 compared to prior comparative

quarter is mainly due to higher operating expenses, foreign

exchange, restructuring costs including termination benefits and on

transaction-related costs as explained previously.

Adjusted EBITDA(2) was $0.9 million for Q3

FY2023, compared to $0.7 million for Q3 FY2022.

The Periscope acquisition accounting adjustment

related to the fair value of deferred revenues at the acquisition

date, described above, resulted in a reduction of revenue of $0.1

million in Q3 FY2023 and $2.6 million in Q3 FY2022, also had an

unfavorable impact on gross margins, operating loss, net earnings,

net earnings (loss) per share (basic and diluted), Adjusted

EBITDA(2) and Adjusted Net Earnings (Loss)(4).

Summary of

consolidated results

|

Financial HighlightsIn thousands of Canadian

dollars, unless otherwise noted |

Q3 FY2023 |

|

Q2 FY2023 |

|

Q3FY2022 |

|

YTD Q3 FY2023 |

|

YTD Q3 FY2022 |

|

|

Revenues |

31,652 |

|

33,216 |

|

30,652 |

|

97,064 |

|

78,305 |

|

|

Recurring Revenue(1) |

24,728 |

|

26,481 |

|

24,952 |

|

77,233 |

|

60,705 |

|

|

Gross margin |

17,832 |

|

19,365 |

|

17,202 |

|

55,693 |

|

44,710 |

|

|

Operating loss |

(5,787 |

) |

(3,946 |

) |

(5,465 |

) |

(16,708 |

) |

(18,576 |

) |

|

Net earnings (loss) |

15,082 |

|

(89,769 |

) |

(4,673 |

) |

(81,010 |

) |

(15,266 |

) |

|

Adjusted Net Loss(4) |

(7,804 |

) |

(4,769 |

) |

(4,673 |

) |

(18,896 |

) |

(15,266 |

) |

|

Adjusted EBITDA(2) (loss) |

898 |

|

1,355 |

|

741 |

|

1,168 |

|

(1,172 |

) |

|

Net earnings (loss) per share (basic and diluted) ($)(4) |

0.34 |

|

(2.04 |

) |

(0.11 |

) |

(1.84 |

) |

(0.43 |

) |

|

Adjusted Net Loss per share (basic and diluted) ($)(4) |

(0.18 |

) |

(0.11 |

) |

(0.11 |

) |

(0.43 |

) |

(0.43 |

) |

|

Basic and diluted weighted average number of shares outstanding (in

thousands) |

43,971 |

|

43,971 |

|

43,971 |

|

43,971 |

|

35,335 |

|

Reconciliation

of net earnings

(loss), EBITDA (loss)

and Adjusted

EBITDA(2)

(loss)

|

|

|

|

|

|

|

|

|

|

In thousands of Canadian dollars, unless otherwise noted |

Q3 FY2023 |

|

Q2 FY2023 |

|

Q3 FY2022 |

|

YTD Q3 FY2023 |

|

YTD Q3 FY2022 |

|

|

Net earnings (loss) |

15,082 |

|

(89,769 |

) |

(4,673 |

) |

(81,010 |

) |

(15,266 |

) |

|

Income tax expense (recovery) |

1,194 |

|

293 |

|

(1,496 |

) |

818 |

|

(3,693 |

) |

| Depreciation of

property and equipment and amortization of intangible assets |

1,018 |

|

1,119 |

|

1,083 |

|

3,104 |

|

3,002 |

|

|

Amortization of acquired intangible assets |

3,128 |

|

3,025 |

|

2,920 |

|

9,119 |

|

5,139 |

|

|

Amortization of right of use assets |

566 |

|

591 |

|

602 |

|

1,716 |

|

1,597 |

|

|

Finance expenses |

228 |

|

1,060 |

|

397 |

|

1,911 |

|

646 |

|

|

EBITDA (loss) |

21,216 |

|

(83,681 |

) |

(1,167 |

) |

(64,342 |

) |

(8,575 |

) |

|

Gain on disposal of a subsidiary |

(22,886 |

) |

- |

|

- |

|

(22,886 |

) |

- |

|

|

Goodwill impairment loss |

- |

|

85,000 |

|

- |

|

85,000 |

|

- |

|

|

Foreign exchange loss (gain) |

594 |

|

(1,780 |

) |

1 |

|

(1,793 |

) |

(569 |

) |

|

Share-based compensation |

47 |

|

202 |

|

306 |

|

470 |

|

824 |

|

|

Restructuring costs |

1,418 |

|

809 |

|

1,552 |

|

2,498 |

|

2,392 |

|

|

Transaction-related costs |

509 |

|

805 |

|

49 |

|

2,221 |

|

4,756 |

|

|

Adjusted EBITDA(2)

(loss) |

898 |

|

1,355 |

|

741 |

|

1,168 |

|

(1,172 |

) |

Reconciliation of net earnings (loss)

and Adjusted net loss(4)

|

In thousands of Canadian dollars, unless otherwise noted |

Q3 FY2023 |

|

Q2 FY2023 |

|

Q3 FY2022 |

|

YTD Q3 FY2023 |

|

YTD Q3 FY2022 |

|

|

Net earnings (loss) |

15,082 |

|

(89,769 |

) |

(4,673 |

) |

(81,010 |

) |

(15,266 |

) |

|

Gain on disposal of a subsidiary |

(22,886 |

) |

- |

|

- |

|

(22,886 |

) |

- |

|

|

Goodwill impairment loss |

- |

|

85,000 |

|

- |

|

85,000 |

|

- |

|

|

Adjusted net loss(4) |

(7,804 |

) |

(4,769 |

) |

(4,673 |

) |

(18,896 |

) |

(15,266 |

) |

|

Weighted average number of shares outstanding: Basic

and diluted (in thousands) |

43,971 |

|

43,971 |

|

43,971 |

|

43,971 |

|

35,335 |

|

|

Net earnings (loss) per share – basic and

diluted(4) |

0.34 |

|

(2.04 |

) |

(0.11 |

) |

(1.84 |

) |

(0.43 |

) |

|

Adjusted net loss per share – basic and

diluted(4) |

(0.18 |

) |

(0.11 |

) |

(0.11 |

) |

(0.43 |

) |

(0.43 |

) |

Reconciliation

of revenues on

a Constant

Currency

basis(3)

|

In thousands of Canadian dollars |

Q3 FY2023 |

Q3FY2022 |

Var. $ |

|

Var. % |

Q3 FY2023 |

Q2FY2022 |

Var. $ |

|

Var. % |

|

YTD Q3 FY2023 |

YTD Q3 FY2022 |

Var. $ |

|

Var.% |

|

Revenues |

31,652 |

30,652 |

1,000 |

|

3.3 |

31,652 |

33,216 |

(1,564 |

) |

(4.7 |

) |

97,064 |

78,305 |

18,759 |

|

24.0 |

| Constant Currency impact |

- |

1,356 |

(1,356 |

) |

- |

- |

897 |

(897 |

) |

- |

|

- |

986 |

(986 |

) |

- |

|

Revenues in Constant

Currency(3) |

31,652 |

32,008 |

(356 |

) |

1.1 |

31,652 |

34,113 |

(2,461 |

) |

(7.2 |

) |

97,064 |

79,291 |

17,773 |

|

22.4 |

(1) Recurring Revenue and Monthly Recurring

Revenue (“MRR”) are key performance indicators. Refer to section

“11 - Non-IFRS Financial Measures and Key Performance Indicators”

of the Management’s Discussion and Analysis (MD&A) for the

third quarter ended December 31, 2022.

(2) EBITDA, Adjusted EBITDA and Adjusted EBITDA

margin are non-IFRS financial measures. Refer to section “11 -

Non-IFRS Financial Measures and Key Performance Indicators” of the

MD&A for the third quarter ended December 31, 2022.

(3) Certain revenue figures and changes from

prior period are analyzed and presented on a Constant Currency

basis and are obtained by translating revenues from the comparable

period of the prior year denominated in foreign currencies at the

foreign exchange rates of the current period. Refer to section “11

- Non-IFRS Financial Measures and Key Performance Indicators” of

the MD&A for the third quarter ended December 31, 2022.

(4) Adjusted net profit (loss) and Adjusted net

profit (loss) per share (basic and diluted) are non-IFRS financial

measures. Refer to section “11 - Non-IFRS Financial Measures and

Key Performance Indicators” of the MD&A for the third quarter

ended December 31, 2022.

About mdf

commerce inc.

mdf commerce inc. (TSX:MDF)

enables the flow of commerce by providing a broad set of software

as a service (SaaS) solutions that optimize and accelerate

commercial interactions between buyers and sellers. Our platforms

and services empower businesses around the world, allowing them to

generate billions of dollars in transactions on an annual basis.

Our eprocurement (formerly Strategic Sourcing), ecommerce and

emarketplaces solutions are supported by a strong and dedicated

team of approximately 700 employees based in Canada, the United

States, Denmark, Ukraine and China. For more information, please

visit us at mdfcommerce.com, follow us on LinkedIn or call at

1-877-677-9088.

Forward-Looking

Statements

In this press release, “mdf commerce”, the

“Corporation” or the words “we”, “our” and “us” refer, depending on

the context, either to mdf commerce inc. or to mdf commerce inc.

together with its subsidiaries and entities in which it has an

economic interest. All dollar amounts refer to Canadian dollars,

unless otherwise expressly stated.

This press release is dated February 13, 2023,

and unless specifically stated otherwise, all information disclosed

herein is provided as at December 31, 2022 and for the third

quarter of fiscal 2023.

Certain statements in this press release and in

the documents incorporated by reference herein constitute

forward-looking statements. These statements relate to future

events or our future financial performance and involve known and

unknown risks, uncertainties and other factors that may cause mdf

commerce’s, or the Corporation’s industry’s actual results, levels

of activity, performance or achievements to be materially different

from those expressed or implied by any of the Corporation’s

statements. Such factors may include, but are not limited to, risks

and uncertainties that are discussed in greater detail in the “Risk

Factors and Uncertainties” section of the Corporation’s Annual

Information Form as at March 31, 2022, as well as in the “10 - Risk

Factors and Uncertainties” section of the MD&A for the third

quarter ended December 31, 2022 and elsewhere in the Corporation’s

filings with the Canadian securities regulators, as applicable.

Forward-looking statements generally can be

identified by the use of forward-looking terminology such as “may”,

“will”, “should”, “could”, “expects”, “plans”, “anticipates”,

“intends”, “believes”, “estimates”, “predicts”, “potential” or

“continue” or the negatives of these terms or other comparable

terminology. These statements are only predictions. Forward-looking

statements are based on management’s current estimates,

expectations and assumptions, which management believes are

reasonable as of the date hereof, and are inherently subject to

significant business, economic, competitive and other uncertainties

and contingencies regarding future events and are accordingly

subject to changes after such date. Undue importance should not be

placed on forward looking statements, and the information contained

in such forward-looking statements should not be relied upon as of

any other date. Actual events or results may differ materially. We

cannot guarantee future results, levels of activity, performance or

achievement. We disclaim any intention, and assume no obligation,

to update these forward-looking statements, except as required by

applicable securities laws.

Additional information about mdf commerce,

including the Corporation’s interim condensed consolidated

financial statements as at December 31, 2022 and 2021 and for the

three-month periods then ended, MD&A for the third quarter

ended December 31, 2022 and its latest Annual Information Form as

at March 31, 2022 are available on the Corporation’s website

www.mdfcommerce.com and have been filed with SEDAR at

www.sedar.com.

Non-IFRS

Financial Measures

and Key

Performance Indicators

The Corporation’s interim condensed consolidated

financial statements for the three-month periods ended December 31,

2022 and 2021 have been prepared in accordance with International

Accounting Standard (IAS) 34, Interim Financial Reporting, through

the application of accounting principles that are compliant with

International Financial Reporting Standards (IFRS). The interim

condensed consolidated financial statements do not include all of

the information required for complete financial statements under

IFRS, including the notes.

The Corporation presents Non-IFRS financial

measures and key performance indicators to assess operating

performance. The Corporation presents Adjusted net profit (loss),

Adjusted net profit (loss) per share, profit (loss) before

interest, taxes, depreciation and amortization (“EBITDA”), Adjusted

EBITDA, Adjusted EBITDA margin, and certain Revenues presented on a

Constant Currency basis as a Non-IFRS financial measures and

Recurring Revenue and Monthly Recurring Revenues as key performance

indicators.

These Non-IFRS financial measures and key

performance indicators do not have standardized meanings under IFRS

and may not be comparable to similar measures presented by other

corporations. The reader is cautioned that these measures are being

reported in order to complement, and not replace, the analysis of

financial results in accordance with IFRS. Management uses both

measures that comply with IFRS and Non-IFRS financial measures, in

planning, overseeing and assessing the Corporation’s performance.

Certain additional disclosures including the definitions associated

with Non-IFRS financial measures as well as a reconciliation to the

most comparable IFRS measures, and key performance indicators have

been incorporated by reference and can be found in MD&A for the

third quarter ended December 31, 2022, as presented in the section

“11 - Non-IFRS Financial Measures and Key Performance Indicators”.

The MD&A for the third quarter ended December 31, 2022, is

available on SEDAR at www.sedar.com and on the Corporation’s

website mdfcommerce.com under the Investors section.

Conference

call for Third

quarter fiscal

2023 financial

results

Date: Monday, February 13, 2023Time: 2:00 p.m.

Eastern Time

To join the phone call: 1-833-630-1956Live

webcast: Click here to register

For further

information:

mdf commerce

inc.Luc Filiatreault, President & CEO Toll

free: 1-877-677-9088, ext. 2004Email:

luc.filiatreault@mdfcommerce.com

Deborah Dumoulin, Chief Financial Officer Toll

free: 1-877-677-9088, ext. 2134Email:

deborah.dumoulin@mdfcommerce.com

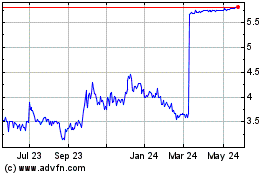

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Jan 2025 to Feb 2025

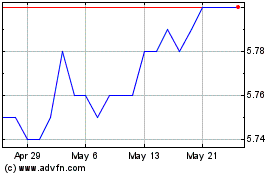

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Feb 2024 to Feb 2025