June 07, 2023 -- InvestorsHub Newswire --

Via NetworkNewsWire Editorial Coverage: The transition

from fossil fuels to electrification has created a huge increase in

demand for rare earth oxides and demand is expected to get much

larger. Rare earth oxides are irreplaceable elements integral to

permanent magnets, critical components in electric vehicles and

sustainable power generation equipment, especially windmills. About

90% of all permanent magnets are currently produced in China, which

is now considering banning or restricting exports of technology to

process and refine rare-earth elements. Beijing is also pondering

provisions prohibiting or limiting exports of alloy technology used

in making high performance magnets made from rare earths minerals.

As the transition to a cleaner world grows, China is restricting

exports of permanent magnets and related tech in favor of feeding

domestic demand, thus strangling the global transition. Governments

in North America and across the world have voiced extreme urgency

in reshaping supply chains to reduce dependence upon China and

achieve clean energy mandates. Only a few companies can be called

leaders in a nascent yet potentially explosive

market. Ucore Rare Metals Inc. (TSX.V: UCU)

(OTCQX: UURAF)

(Profile) stands out with its

transformative technology, RapidSX(TM), for separating and

purifying critical metals. Also in the hunt for market share in

this burgeoning new market is MP Materials

Corp. (NYSE:

MP), Neo Performance Materials

Inc. (TSX:

NEO), Energy Fuels Inc. (NYSE American: UUUU) (TSX:

EFR) and Li-Cycle Holdings

Corp. (NYSE: LICY), all of which have

established footholds and expanding operations in a concerted

effort to shift away from reliance upon China and achieve energy

independence.

- China has pledged to reach

carbon neutrality before 2060 and is considering bans on exports of

rare earth technology critical to the global supply chain

today.

- The U.S. DoD is actively

exploring new technology related to REE separation technology,

including awarding a $4 million contract to Ucore to explore its

innovations.

- Successful completion of the

initial U.S. DoD contract could result in additional follow-on

funding to support the company’s facility in Louisiana.

- Ucore is commissioning a

demonstration facility in Ontario to be used for DoD contract,

while designing a commercial-scale facility in Louisiana.

Click here to view the custom infographic of

the Ucore Rare Metals

Inc. editorial.

China Threatens Bans on Critical Exports

In September 2020, President Xi

Jinping announced that the People’s Republic of China will

“aim to have CO2 emissions peak before 2030 and achieve carbon

neutrality before 2060,” perhaps one of the most impactful pledges

of any of the more than 90 countries that are aiming for net-zero

emissions around mid-century. Against this backdrop, China’s

domestic market is experiencing a remarkable boom in the rare earth

oxide (also often called rare earth elements, or REE) sector. The

surge in domestic demand is expected to outpace the country’s REE

production, leading to a potential supply crunch that will affect

the globe under the current supply chain structure.

The fear of China disrupting the global supply chain has

stimulated innovation and encouraged the exploration of sustainable

alternatives to capture share in a booming rare earth minerals

market forecast to grow 12.3% annually to $9.6

billion by 2026. The United States, as part of its

commitment to the Paris climate accord, promises to reach net-zero

emissions by 2050, which means cutting the country’s greenhouse gas

emissions in half by 2030. To meet this ambitious goal, the

International Energy Agency estimates electric vehicle sales need

to reach around 60% of total vehicle sales by 2030 to reach

net-zero CO2 in 2050, while the NRDC says buildings “must rapidly

move away from fossil gas.” Little wonder there is newfound urgency

to change the curve of an existential crisis facing humanity and a

new emphasis on technologies that utilize rare earth oxides.

For more than 15 years, Ucore Rare Metals Inc.

(TSX.V: UCU)

(OTCQX:

UURAF) has been an important part of the rare

earth market, developing technology to disrupt the status quo of

rare earth elements. The company is now in a position to help solve

the impending supply crisis by assisting with the creation of an

independent supply chain of rare earth oxides for North American

manufacturers. Ucore has differentiated itself with a unique

approach that focuses on the most profitable sector of the supply

chain, processing material and avoids the risks of large CAPEX

requirements.

Ucore is fast approaching a launch point as it commissions a

commercial demonstration plant in Canada that uses RapidSX(TM) (SX

is short for “solvent extraction”), a proprietary metals separation

technology wholly owned by Ucore that is not merely an alternative

to Chinese technology but is also potentially better than anything

in use today. Going forward, Ucore is also designing a full-size

plant in the United States to supply rare earths to North American

customers. Ucore is collaborating with suppliers of rare earth

mixed concentrates from outside China, as well as end users of

these oxides including OEM Automotive manufacturers.

And now, Ucore has caught the attention of what could be a

milestone “company maker” partner: the U.S. government.

$4 Million Contract to Explore RapidSX

This month, Ucore announced that it has been awarded a $4 million

contract by the U.S. Department of Defense (“DoD”), specifically,

the US Army Contracting Command – Orlando. The DoD represents an

enormous and prestigious contracting marketplace. Securing a DoD

contract not only brings in a substantial funding stream, but it

also conveys a significant amount of credibility and visibility.

Further, the contract notes that, upon successful completion of the

initial project, a follow-on production award may be awarded to

Ucore in order to offer a streamlined method for transitioning to

follow-on production.

The objective of the new project is to help the DoD understand

Ucore’s new innovative separation processes that increase the

ability to create domestic rare earth processing plants and the

capability to source a sustainable domestic processing facility for

these important materials. In short, the U.S. government knows it

must maneuver away from China and establish a robust domestic

supply chain and is actively exploring companies and cutting-edge

technology that can support making it happen in short order.

For its part, Ucore will utilize its RapidSX Commercial

Demonstration Facility in Kingston, Ontario, to deliver a number of

technical requirements under the contract. “We believe that Ucore

has one of the West’s most compelling rare-earth-supply chain

business models,” said Ucore chair and CEO Pat Ryan. “This

U.S.-DoD project will allow us to demonstrate the RapidSX

technology platform for rare earth element separation and will

include original equipment manufacturers’ qualification trials in

coordination with our commercial development activities at the

company’s planned Louisiana SMC. The rare earth element processing

opportunity afforded Ucore through this sward is pivotal as the

company continues to seek out and collaborate with like-minded

upstream and downstream partners as part of a Western

rare-earth-element supply chain solution.”

RapidSX: A Superior Technology

The DoD wants to see first-hand the capabilities of RapidSX, as

a potential paradigm shift away from conventional metal separation

technology such as that used in China. Ucore will be showcasing

several benefits of its technology. These include demonstrating

rare earth separation processing at a rate more efficient than

conventional solvent extraction and the separation of both light

and heavy rare earths (an industry innovation).

To understand the value of this takes some clarity on light and

heavy REEs.

REEs represent a group of 17 chemically similar elements with

unique properties essential for modern technologies. Four of these

elements are critical inputs to rare earth permanent magnets. These

four elements must be separated from the rest in order for their

unique properties to be captured. However, effectively separating

these elements is a daunting task for current technological

approaches. The primary challenge arises from the similar chemical

and physical properties shared among REEs, making them hard to

isolate. The minimal differences in atomic radii and ionic charge

among the REEs complicate the separation process.

Benefits Abound with RapidSX

Being able to efficiently separate heavy and light REEs is a

differentiator for RapidSX on its own. But that is not all that

Ucore’s proprietary tech offers. There is also an environmental

impact from current extraction technology, because it generates

large volumes of toxic waste. RapidSX overcomes an additional layer

of complexity by making the process far more environmentally

friendly.

RapidSX also has a much smaller carbon footprint than other

metal separation technologies. Its smaller footprint uses less

power, and all the solvents are recycled. These features

effectively westernize a process that will enable an

environmentally safe and very economically robust business

plan.

Still More to Show Off

Ucore intends to prove to the DoD that its construction design

is a continuous process working facility capable of processing many

metric tons of feedstock. The demonstration facility in Kingston

will speak volumes to the opportunity and potential of RapidSX and

give a hint as to what is upcoming when Ucore builds its planned

full-size Strategic Metals Complex in Alexandria, Louisiana. The

full-scale production plant is scheduled to initially process 2,000

tonnes of total rare earth oxides by the end of 2024, increasing to

5,000 tonnes in 2026. Management believes that the cost of the

company’s facilities will be supported by local and state

government incentives as well as prepurchase (off-take) agreements

from major manufacturers currently under development.

All of this aligns with the final primary purpose of the $4

million DoD contract. Along with all the other benefits, Ucore will

provide the DoD with a techno-economic analysis of RapidSX versus

conventional solvent extraction.

Structured for Growth

Ucore is structured for rapid growth in a sector that will

provide products critical to the successful electrification of the

North American economy. The sector has plenty of room for multiple

players and different avenues for investor exposure.

MP Materials Corp. (NYSE:

MP) produces specialty materials that are vital

inputs for electrification and other advanced

technologies. The

company is currently expanding its manufacturing

operations downstream to provide a full supply chain solution from

materials to magnetics. In February, MP struck a deal with Sumitomo

Corp. to diversify and strengthen rare earth supplies in Japan.

Under the agreement, Sumitomo will serve as the exclusive

distributor of NdPr (neodymium-praseodymium) oxide produced by MP

to Japanese customers.

Neo Performance Materials Inc. (TSX:

NEO) manufactures the building blocks of many

modern technologies that enhance efficiency and

sustainability. Neo’s advanced industrial materials — magnetic

powders and magnets, specialty chemicals, metals and alloys — are

critical to the performance of many everyday products and emerging

technologies. In April, Neo acquired a controlling interest in SG

Technologies Group Limited, one of Europe’s leading advanced,

specialty manufacturers of rare-earth-based and other

high-performance magnets for industrial and commercial markets.

Energy Fuels Inc. (NYSE American: UUUU) (TSX:

EFR) is a Colorado-based critical

minerals company that mines uranium and produces natural

uranium concentrates that are sold to major nuclear utilities for

the production of carbon-free nuclear energy. Energy Fuels recently

began production of advanced rare earth element materials,

including mixed REE carbonate, and plans to produce commercial

quantities of separated REE oxides in the future. Energy Fuels

recently completed the acquisition of 17 mineral concessions in

Brazil that has the potential to supply 3,000 to 10,000 metric tons

of natural monazite concentrate per year for decades to Energy

Fuels’ White Mesa Mill in Utah for processing into high-purity REE

oxides and other materials.

Li-Cycle Holdings Corp. (NYSE: LICY), an industry leader in

lithium-ion battery resource recovery and the leading lithium-ion

battery recycler in North America, is taking a different approach

to meet rare earth oxide demand. The

company is leveraging its innovative Spoke & Hub

Technologies(TM) to provide a customer-centric, end-of-life

solution for lithium-ion batteries, while creating a secondary

supply of battery-grade materials. In April, Li-Cycle and VinES

Energy Solutions teamed-up via a long-term recycling relationship.

Starting in 2024, Li-Cycle will become VinES’ strategic and

preferred recycling partner for VinES’ Vietnamese-sourced battery

materials.

It is past time to look beyond China and develop strategies

specific to breaking its monopoly on REE processing. The green

energy surge is fueling an exponential rise in domestic demand, a

fact that may be unnoticed by the mainstream investing public, but

could make rare earths a rare opportunity.

For more information Ucore Rare Metals, please

visit Ucore Rare

Metals.

About NetworkNewsWire

NetworkNewsWire (“NNW”) is a financial news and

content distribution company, one of 50+ brands within

the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to reach all target markets,

industries and demographics in the most effective manner

possible; (2) article and editorial

syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a

full array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.networknewswire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.networknewswire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

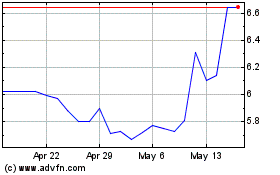

Neo Performance Materials (TSX:NEO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Neo Performance Materials (TSX:NEO)

Historical Stock Chart

From Nov 2023 to Nov 2024