FT Portfolios Canada Co. Announces Distribution for Its Exchange Traded Funds

23 December 2021 - 3:04AM

FT Portfolios Canada Co. (“First Trust Canada”) is pleased to

announce cash and reinvested distributions for its Exchange Traded

Funds (the “ETFs”) listed on the Toronto Stock Exchange for the

month ending December 31, 2021. Reinvested distributions generally

represent realized capital gains and other income or special

distributions received by the ETFs over and above cash

distributions paid out during the year and are paid to unitholders,

as required, to ensure the ETFs are not liable for ordinary income

tax. These will be reinvested and the resulting units immediately

consolidated, so that the number of units held by each investor

will not change.

The cash distributions are payable on January

10, 2022 to Unitholders of record on December 31, 2021 with an

ex-dividend date of December 30, 2021. The effective record date

and payable date for the reinvested distributions will be December

31, 2021. Details for the per unit distribution amounts are shown

below:

|

Fund Name |

Fund |

Cash Distribution |

Reinvested Distribution |

|

Ticker |

Amount ($) |

Amount ($) |

|

First Trust Value Line® Dividend Index ETF (CAD-Hedged) |

FUD |

0.0450 |

4.2368 |

|

FUD.A |

0.0200 |

3.7142 |

|

First Trust AlphaDEX™ Emerging Market Dividend ETF

(CAD-Hedged) |

FDE |

0.2200 |

- |

|

FDE.A |

0.1850 |

- |

|

First Trust Senior Loan ETF (CAD-Hedged) |

FSL |

0.0597 |

- |

|

FSL.A |

0.0371 |

- |

|

First Trust AlphaDEX™ European Dividend Index ETF (CAD-Hedged) |

EUR |

0.1768 |

- |

|

EUR.A |

0.0755 |

- |

|

First Trust Global Risk Managed Income Index ETF |

ETP |

0.0450 |

- |

|

ETP.A |

0.0350 |

- |

|

First Trust Tactical Bond Index ETF |

FTB |

0.0475 |

- |

|

First Trust JFL Fixed Income Core Plus ETF |

FJFB |

0.0368 |

0.1150 |

|

First Trust Nasdaq Cybersecurity ETF (formerly First Trust

AlphaDEX™ U.S. Consumer Discretionary Sector Index ETF) |

CIBR |

0.3199 |

- |

|

Fund Name |

Fund |

Cash Distribution |

Reinvested Distribution |

|

Ticker |

Amount ($) |

Amount ($) |

|

First Trust NASDAQ® Clean Edge® Green Energy ETF (formerly First

Trust AlphaDEX™ U.S. Financial Sector Index ETF) |

QCLN |

0.0237 |

0.3680 |

|

First Trust AlphaDEX™ U.S. Health Care Sector Index ETF |

FHH |

- |

2.2774 |

|

FHH.F |

- |

1.2399 |

|

First Trust AlphaDEX™ U.S. Industrials Sector Index ETF |

FHG |

0.0444 |

1.9470 |

|

FHG.F |

0.0947 |

2.3784 |

|

First Trust NYSE Arca Biotechnology ETF (formerly First Trust

AlphaDEX™ U.S. Materials Sector Index ETF) |

FBT |

2.2136 |

- |

|

First Trust AlphaDEX™ U.S. Technology Sector Index ETF |

FHQ |

0.8472 |

15.6709 |

|

FHQ.F |

0.4803 |

5.0147 |

|

First Trust Cloud Computing ETF (formerly First Trust AlphaDEX™

U.S. Utilities Sector Index ETF) |

SKYY |

0.2199 |

- |

|

First Trust Morningstar Dividend Leaders ETF (CAD‐Hedged) (formerly

First Trust Dorsey Wright U.S. Sector Rotation Index ETF

(CAD‐Hedged)) |

FDL |

0.3454 |

2.1168 |

|

First Trust Canadian Capital Strength ETF |

FST |

0.1500 |

- |

|

FST.A |

0.0300 |

- |

|

First Trust Indxx Innovative Transaction and Process ETF |

BLCK |

0.2093 |

0.0091 |

|

First Trust JFL Global Equity ETF |

FJFG |

- |

0.0063 |

|

First Trust Cboe Vest U.S. Equity Buffer ETF - November (Hedged

Units) |

NOVB.F |

- |

2.1201 |

|

First Trust Cboe Vest U.S. Equity Buffer ETF - August (Hedged

Units) |

AUGB.F |

- |

2.9653 |

About First Trust

First Trust Canada is the trustee, manager and

promoter of the First Trust ETFs. First Trust Canada and its

affiliates First Trust Advisors L.P. (“FTA”), portfolio advisor to

the First Trust ETFs, an Ontario Securities Commission registered

portfolio manager and U.S. Securities and Exchange Commission

registered investment advisor, and First Trust Portfolios L.P.

(“FTP”), a FINRA registered broker-dealer, are privately held

companies that provide a variety of investment services. FTA has

collective assets under management or supervision of approximately

US $217 billion as of November 30, 2021 through exchange-traded

funds, closed-end funds, mutual funds and separate managed

accounts.

Further information about the Fund can be found

at www.firsttrust.ca.

For further information, please contact: FT

Portfolios Canada Co. 416-865-8065/877-622-5552

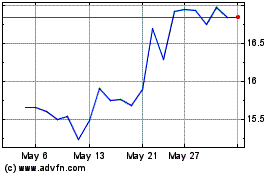

First Trust Nasdaq Clean... (TSX:QCLN)

Historical Stock Chart

From Oct 2024 to Nov 2024

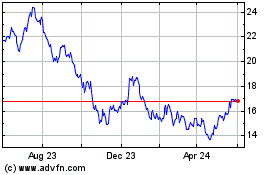

First Trust Nasdaq Clean... (TSX:QCLN)

Historical Stock Chart

From Nov 2023 to Nov 2024