Serabi Gold plc (AIM: SRB) (TSX: SBI) (LSE: SBI.WT), the Brazilian

focused gold exploration and development company, has published its

unaudited financial results for the three month period ending 31

March 2013 and at the same time has also published its Management's

Discussion and Analysis for the same period. Both documents,

together with this announcement, have been posted on the Company's

website at www.serabigold.com and are also available on SEDAR at

www.sedar.com.

Corporate Highlights for the last

quarter

Funding for Palito development

On 17 January 2013 the Company completed the placement of 270

million new ordinary shares to raise in aggregate UK£ 16.2 million

to finance the development and start-up of underground mining

operations at its Palito Mine. The placement of new shares was

underwritten by Fratelli Investments Limited, one of the Company's

major shareholders.

Progress on Palito Operations

- Mine dewatering completed in January 2013;

- New mine management team and contract mining personnel in

place;

- Development mining now underway;

- Stoping of remnant blocks commenced;

- Development ore stockpile being generated;

- Two main ventilation raises to surface have been started;

- Reassembly of the primary crushing circuit due for completion

by end of second quarter 2013;

- Remediation of flotation circuit due for completion by end of

second quarter 2013;

- Detailed engineering of milling circuit complete and

disassembly of old plant underway; and

- Initial mining fleet on site in February 2013. Further items

expected to be commissioned at start of third quarter of 2013.

Kenai Transaction

Announcement of proposed acquisition of Kenai Resources Limited

in May 2013

Significant Benefits of the transaction:

- Kenai's wholly owned subsidiary Gold Aura do Brasil Mineração

Ltda ("GOAB") owns the high-grade Sao Chico gold deposit, some 23

kilometres from Serabi's Palito gold mine. Sao Chico hosts a NI

43-101 compliant combined Measured and Indicated Mineral Resource

of 25,275 ounces of gold at 29.77 grammes per tonne ("g/t") and an

Inferred Mineral Resource of 71,385 ounces gold at 26.03 g/t.

- Serabi's nearby Palito gold mine is set to recommence gold

production by the end of 2013.

- The existing Palito gold recovery plant is currently being

refurbished and upgraded, and Sao Chico is expected to be the first

satellite gold resource to supplement Palito mine production with

high grade material, taking advantage of the excess plant capacity

available to quickly expand Serabi's future gold production.

- An exploration programme at Sao Chico including an approximate

6,000 metre drill campaign is expected to start mid-2013, with

strong potential to increase the current mineral resource.

Highlights of the Arrangement include:

- Shareholders of Kenai will receive 0.85 of one new ordinary

share of 5 pence par value of Serabi (a "Serabi Share") in exchange

for each Kenai Share held (the "Exchange Ratio").

- On completion of the Transaction, Kenai shareholders will own

approximately 20.8% of Serabi's enlarged issued share capital (and

22.1% on a fully diluted basis)

- Daniel Kunz, Chairman of Kenai will join the Serabi board on

closing (subject to satisfactory regulatory enquiries in compliance

with the AIM Rules)

- Kenai information circular to be issued before end May, with

Kenai's shareholder meeting to vote on the transaction scheduled

for July 5, 2013

Appointment of Peel Hunt as Joint

Broker

Peel Hunt LLP were appointed joint broker on April 22, 2013

Financial Highlights

3 months ended 3 months ended

31 March 2013 31 March 2012

(unaudited) (unaudited)

US$ US$

-------------- --------------

Operating Loss for period (1,359,226) (1,315,126)

Loss per ordinary share (basic and diluted) (0.43) cents (1.56) cents

3 months ended 3 months ended

31 March 2013 31 March 2012

(unaudited) (unaudited)

US$ US$

-------------- --------------

Mine development and fixed asset

expenditures during the period 2,079,391 51,910

Exploration and development expenditures

during the period 111,137 931,607

Cash at end of period 20,222,386 3,382,198

Equity Shareholders funds at end of period 63,907,398 47,388,560

Michael Hodgson, CEO,

said:

"We are continuing to make excellent progress with the mine

development and plant remediation works at Palito and remain

focused on starting up the plant and commencing gold production

before the end of 2013.

The announcement of the proposed acquisition of the nearby

high-grade Sao Chico project is a demonstration of our desire to

grow our production base through the development of satellite

deposits and we hope that Sao Chico will be the first of these. Sao

Chico has strong synergies with Palito in mining skills and ore

processing and in our opinion represents, like Palito, a low

capital, quick payback opportunity."

Enquiries:

Serabi Gold plc

Michael Hodgson Tel: +44 (0)20 7246 6830

Chief Executive Mobile: +44 (0)7799 473621

Clive Line Tel: +44 (0)20 7246 6830

Finance Director Mobile: +44 (0)7710 151692

Email: contact@serabigold.com

Website:

http://www.serabigold.com/

Beaumont Cornish Limited

Nominated Adviser

Roland Cornish Tel: +44 (0)20 7628 3396

Michael Cornish Tel: +44 (0)20 7628 3396

Peel Hunt LLP

Joint UK Broker

Matthew Armitt Tel: +44 (0)20 7418 9000

Andy Crossley Tel: +44 (0)20 7418 9000

Fox Davies Capital Ltd

Joint UK Broker

Jonathan Evans Tel: +44 (0)20 3463 5010

Blythe Weigh Communications Ltd

Public Relations

Tim Blythe Tel: +44 (0)20 7138 3204

Mobile: +44 7816 924626

Rob Kellner Tel: +44 (0)20 7138 3204

Mobile: +44 7800 554377

Copies of this release are available from the Company's website

at www.serabimining.com

Forward-looking statements This press

release contains forward-looking statements. All statements, other

than of historical fact, that address activities, events or

developments that the Company believes, expects or anticipates will

or may occur in the future (including, without limitation,

statements regarding the estimation of mineral resources,

exploration results, potential mineralization, potential mineral

resources and mineral reserves) are forward-looking statements.

Forward-looking statements are often identifiable by the use of

words such as "anticipate", "believe", "plan", may", "could",

"would", "might" or "will", "estimates", "expect", "intend",

"budget", "scheduled", "forecasts" and similar expressions or

variations (including negative variations) of such words and

phrases. Forward-looking statements are subject to a number of

risks and uncertainties, that may cause actual results or events to

differ materially from those discussed in the forward-looking

statements. Factors that could cause actual results or events to

differ materially from current expectations include, among other

things, without limitation, failure to establish estimated mineral

resources, the possibility that future exploration results will not

be consistent with the Company's expectations, the price of gold

and other risks identified in the Company's most recent annual

information form filed with the Canadian securities regulatory

authorities on SEDAR.com. Any forward-looking statement speaks only

as of the date on which it is made and, except as may be required

by applicable securities laws, the Company disclaims any intent or

obligation to update any forward-looking statement.

Qualified Persons Statement The

information contained within this announcement has been reviewed

and verified by Michael Hodgson, CEO of the Company. Mr Hodgson is

an Economic Geologist by training with over 25 years' experience in

the mining industry. He holds a BSc (Hons) Geology, University of

London, a MSc Mining Geology, University of Leicester and is a

Fellow of the Institute of Materials, Minerals and Mining and a

Chartered Engineer of the Engineering Council of UK, recognizing

him as both a Qualified Person for the purposes of Canadian

National Instrument 43-101 and by the AIM Guidance Note on Mining

and Oil & Gas Companies dated June 2009.

Quality Assurance and Quality Control

Procedures Disclosure

The Company has implemented and maintains a Serabi quality

assurance/quality control (QA/QC) protocol at its JDO Project as

defined in its "NI 43-101 Technical Report for the Jardim Do Ouro

Project, Para State, Brazil" dated 22 December 2010. This ensures

best industry practice in sampling and analysis of exploration and

resource definition samples. The insertion of field duplicates,

certified standards and blank samples into the sample stream form

part of the Serabi procedure (these act as an independent check on

contamination, precision and accuracy in the analytical

laboratory).

Assay results are reported once rigorous QAQC procedures have

been approved

Neither the Toronto Stock Exchange, nor any other securities

regulatory authority, has approved or disapproved of the contents

of this news release.

The following information, comprising the Finance Review, the

Income Statement, the Group Balance Sheet, Group Statement of

Changes in Shareholders' Equity and Group Cash Flow, is extracted

from the Condensed Interim Financial Statements and the Management

Discussion and Analysis.

The Company will, in compliance with Canadian regulatory

requirements, post its Management Discussion and Analysis for the

three months ended 31 March 2013 together with the Condensed

Interim Financial Statements on SEDAR at www.sedar.com. These

documents will also available from the Company's website -

www.serabigold.com.

Outlook

Remediation and development works are progressing well and the

Company remains ahead of schedule with the underground mine

development work benefitting from the earlier than planned

completion of the de-watering of the mine. Rehabilitation of the

processing plant is progressing in line with expectations and

accordingly the Company still anticipates being able to start the

commissioning of the plant before the end of 2013.

A number of refining and trading groups have been approached to

provide terms to the refining and purchase of the copper/gold

concentrate that will be produced at the Palito Mine and which is

expected to account for in excess of 70% of the revenues of the

operation. The Company is evaluating the submissions and expects to

be in a position to finalise terms in the coming few months.

The Company's strategy has been to develop additional satellite

high grade gold mining opportunities in relatively close proximity

to the current Palito mine and process plant, with a view that ore

mined could be treated through a centralised processing facility

located at Palito. The high grade Sao Chico property is at a more

advanced stage than Serabi's own discoveries at Currutela, Palito

South and Piaui. The proposed acquisition of the Sao Chico property

therefore presents the Company, if the transaction is approved by

Kenai shareholders, with the opportunity to reduce the timeframe

for the development of its first satellite deposit to augment

Palito mine production with further high grade feed, taking

advantage of the excess plant capacity available.

The first stage of activity at Sao Chico will be the

commencement of an estimated 6,000 metre diamond drilling programme

which will be supplemented by ground geophysics and surface

sampling to establish other potential areas of interest within the

Sao Chico exploration licence. The current Sao Chico resource

comprises approximately 25,000 Measured and Indicated ounces, and

71,000 Inferred ounces, both averaging over 26 g/t. over just 3

veins, and with 10 more veins identified.

Current design work on the Palito plant remediation will take

into account the potential future processing requirements of ore

taken from Sao Chico.

The Company's exploration activities at Palito will however be

limited whilst the Company focuses its attention and personnel

resources at Palito towards the remediation and development works.

The directors expect that future exploration activity at Palito

will be financed from the cash flow from gold production at Palito

and may therefore not be undertaken until such time as sufficient

and sustainable levels of cash flow are achieved.

FINANCE REVIEW

Results of Operations

The loss from operations decreased by US$320,001 from

US$1,384,267 for the 3 months ended 31 March 2012 to US$1,064,266

for the 3 month period ended 31 March 2013 a reduction of 23%

primarily arising from a change in the manner in which costs

associated with maintenance activities of the plant are treated for

accounting purposes and reduced depreciation costs.

In the 3 months to 31 March 2012 all costs relating to the

maintenance of the process plant were treated as an operating

expense as they were incurred, this cost for that 3 month period

being BrR$207,954 (US$117,694). Since the decision was taken by the

Board, at the end of June 2012, to proceed with the development of

the Palito Mine, the plant has been considered to be in a state of

refurbishment and all costs related to the plant are being

capitalised as part of the overall mine development costs and

therefore there is no comparable expense reported in the income

statement for the 3 month period to 31 March 2013.

Administration costs have shown an overall increase from

US$810,786 for the 3 month period ended 31 March 2012 to US$908,753

for the 3 month period to 31 March 2013. The expense for the 3

months to 31 March 2012 included a charge in respect of labour

claims amounting to US$182,531 and there has no similar expense

recorded for the period to 31 March 2013. The Company has made a

provision in the 3 month period ended 31 March 2013 of $300,000 in

respect of bonus payments that it anticipates making to senior

management personnel in respect of the preceding financial year's

performance review period. Excluding these two items from the

analysis, administration costs for the 3 months to 31 March 2103

show a small reduction of US$19,000 in comparison with the 3 months

to 31 March 2012.

The reduction in depreciation charges between the two periods

reflects many of the Company's assets reaching the end of their

original forecast lives for amortisation purposes and have

therefore now been fully amortised. Depreciation charges for the 3

months to 31 March 2013 are US$107,667 compared with US$426,637 for

the 3 month period to 31 March 2012

The Company recorded a foreign exchange loss of US$255,218 in

the 3 month period to 31 March 2013 which compares with a foreign

exchange gain of US$87,190 recorded for the 3 months ended 31 March

2012. The loss for the 3 months to 31 March 2013 primarily

comprises losses on cash holdings denominated in GB Pounds Sterling

and Euros. The Company holds funds in certain currencies in

anticipation of future expenditures that are anticipated to be

settled in those currencies. These currency holdings were acquired

early in the quarter, which saw a period of strengthening of the US

dollar against most major currencies resulting in these book

exchange losses. Subsequent strengthening of Sterling following the

end of the quarter will have reversed some of these recorded

losses.

Net interest charges for the 3 month period to 31 March 2013

were US$39,742 compared with US$18,049 for the corresponding period

3 month period to 31 March 2012. An analysis of the composition of

these charges is set out in the table below:

2013 2012

US$ US$

Interest on short term loan 26,630 -

Interest expense on convertible loan stock 15,639 13,927

Other interest and finance expenses 230 5,301

------------ -------------

42,499 19,228

Interest income (2,757) 1,179

------------ -------------

39,742 18,049

------------ -------------

Interest charges on the short term loan relate to a US$6.0

million facility provided by Fratelli Investments Limited

("Fratelli") which was entered into on 1 October 2012. Under the

loan agreement a facility fee of 3% was payable to Fratelli and

interest accrued at the rate of 12% per annum. The facility was

repaid in January 2013 from the proceeds of a UK£ 16.2 million

placement of new ordinary shares that was completed on 17 January

2013.

Other interest and finance expenses are primarily related to the

Brazilian operation and the reduction in the 3 months to 31 March

2013 compared with the 3 months to 31 March 2012 reflects reduced

levels of settlements with long term creditors to which interest is

being applied and also reduced levels of penalties from tax

authorities for past adjustments of taxes due to be collected by

the Company on behalf of both the Federal and State tax

authorities.

Liquidity and Capital Resources

The Company had a working capital position of US$19,177,385, at

31 March 2013 compared to US$(2,760,102) at 31 December 2012. The

working capital position at 31 December 2012 was inclusive of a

US$4.5 million short term loan received from a major shareholder

which was repaid in January 2013, following the successful

completion of a share placement on 17 January 2013 raising gross

proceeds of UK£ 16.2 million This share placement and the repayment

of the loan comprise the principle reasons for the significant

improvement in the working capital position of the Company which

has resulted in an increase in cash resources available to the

company of US$17.64 million compared with 31 December 2012.

The levels of inventories have increased by US$73,000 compared

with 31 December 2012, reflecting the increasing levels of activity

and comprise consumables for the development mining activities that

are now underway. Equally the level of creditors has increased by

approximately US$294,000 as orders for equipment and consumables

are placed.

The Company does not have any asset backed commercial paper

investments. As the Company has no revenue and has in recent years

primarily supported its activities by the issue of further equity,

the working capital position at any time reflects the timing of the

most recent share placement completed by the Company.

During the three month period ended 31 March 2013, the Company

issued 270,000,000 Ordinary Shares for gross cash proceeds of UK£

16.2 million. The placement had been underwritten by one of the

Company's major shareholders who received an underwriting fee of

8,135,035 Warrants in respect of the placement. Each Warrant

entitles the holder to subscribe for one Ordinary Share at a price

of UK£ 0.10 at any time until 16 January 2015.

The Company has, during the three month period ended 31 March

2013, incurred costs of US$111,000 for development and exploration

expenditures on its mineral properties, US$240,000 on asset

purchases, US$1,839,000 related to the rehabilitation and

development of the Palito Mine and used cash of US$1,127,000 to

support its operating activities. Further details of the

exploration and development activities conducted during the period

are set out elsewhere in this MD&A.

On 31 March 2013, the Company's total assets amounted to

US$68,764,922 which compares to the US$48,203,224 reported at 31

December 2012. The current asset component has increased by some

US$17,888,000 million reflecting the higher cash balances following

the completion of the share placement with the non-current asset

component increasing by US$2,674,049 Whilst some US$2.2 million has

been expended on non-current assets the exchange rate movements

between the Brazilian Real and the United States Dollar has

resulted in exchange variations increasing the carrying value of

exploration interests by US$0.2 million and of mining property,

plant and equipment by US$0.37 million. Depreciation charges of

US$0.1 million during the 3 months ended 31 March 2013 account for

the remaining change in value compared to 31 December 2012. Total

assets are mostly comprised of property, plant and equipment, which

as at 31 March 2013 totalled US$29,187,365 (December 2012:

US$26,848,991), of which US$3.7 million relates to recent project

development expenditures at the Palito Mine and deferred

exploration and development cost which as at 31 March 2013 totalled

US$17,696,480 (December 2012: US$17,360,805), of which US$16.6

million relates to capitalised exploration expenditures at, or in

close proximity to, the Palito Mine. The Company's total assets

also included cash holdings of US$20,222,386 (December 2012:

US$2,582,046).

Receivables of US$182,018 as at 31 March 2013 have increased

compared to 31 December 2012 when the receivables balance was

US$85,509. The receivables as of 31 March 2013 includes a down

payment of approximately US$87,000 in respect of mining equipment

that is due to be delivered to the project site during the second

quarter of 2013. The remaining balance represents other deposits

paid by the Company. Prepayments as of 31 March 2013 were

US$681,188 compared with US$603,005 as at 31 December 2012, an

increase of US$78,000. The prepayments primarily represent prepaid

taxes in Brazil amounting to US$536,000, of which the majority is

federal and state sales taxes which the Company expects to recover

either through off-set against other federal tax liabilities or

through recovery directly.

The Company's total liabilities at 31 March 2013 were

US$4,857,524 (December 2012: US$8,942,223). The total liabilities

at 31 December 2012 included the short term loan payable to

Fratelli Investments Limited which, including interest, amounted to

US$4,580,745 as well as accounts payable to suppliers and other

accrued liabilities of US$2,384,724. At 31 March 2013 accounts

payable to suppliers and other accrued liabilities totalled

$2,834,933. This increase reflects a provision of $300,000 for 2012

bonus entitlements for senior management as well as a general

increase reflecting the higher levels of activity. The total

liabilities include US$386,729 including accrued interest (December

2012: US$364,656) attributable to the £ 300,000 loan from a related

party, which has a repayment date of 31 October 2014 subject to the

right of the holder at any time, on one or more occasions, on or

before the repayment date, to convert any of the outstanding

amounts owed by the Company to Ordinary Shares at a price of 15

pence per Ordinary Share. It also includes the amount of

US$1,635,873 (December 2012: US$1,612,098) in respect of provisions

including US$1,241,434 (December 2012: US$1,223,392) for the cost

of remediation of the current Palito Mine site at the conclusion of

operational activity.

During the early part of 2012 the Company commissioned a

Preliminary Economic Assessment ("PEA") of the viability of

re-commencing mining operations at the Palito Mine. The report

which was completed and published in June 2012 was positive and the

Company entered into a conditional subscription agreement with

Fratelli Investments Limited ("Fratelli") on 2 October 2012 to

subscribe for and underwrite a placement of new shares to finance

the development and start-up of production at the Palito gold mine.

In addition, Fratelli agreed to provide an interim secured loan

facility of US$6.0 million to provide additional working capital to

the Company and to enable it to commence the initial works at

Palito. The placing of 270 million new Ordinary Shares with

Fratelli and other subscribers was completed on 17 January 2013,

raising gross proceeds of UK£ 16.2 million. The Company has repaid

out of the proceeds the amount of the loan facility that had been

drawn down, which at that time was US$4.5 million plus accrued

interest. Management considers that the Company has adequate access

to capital to be able to complete the necessary mine development

and process plant and infrastructure rehabilitation works that are

required in order to be able to commence gold production before the

end of 2013. From the time that production operations commence at

planned rates management anticipates that the Company will have

sufficient cash flow to be able to meet all its obligations as and

when they fall due and to, at least in part, finance the

exploration and development activities that it would like to

undertake on its other exploration projects.

There are, however, risks associated with the commencement of

any new mining and processing operation whereby unforeseen

technical and logistical events result in additional time being

required for commissioning or additional costs needing to be

incurred, giving rise to the possibility that additional working

capital may be required to fund these delays or additional capital

requirements. Should additional working capital be required the

Directors consider that further sources of finance could be secured

within the required timescale.

SERABI GOLD PLC

Condensed Consolidated Statements of Comprehensive Income

--------------------------

For the three months ended

31 March

2013 2012

(expressed in US$) (unaudited) (unaudited)

------------ ------------

CONTINUING OPERATIONS

Revenue -- --

Operating expenses -- (117,694)

------------ ------------

Gross loss -- (117,694)

Administration expenses (908,753) (810,786)

Share based payments (47,846) (29,150)

Depreciation of plant and equipment (107,667) (426,637)

------------ ------------

Operating loss (1,064,266) (1,384,267)

Foreign exchange (loss)/gain (255,218) 87,190

Finance expense (42,499) (19,228)

Finance income 2,757 1,179

------------ ------------

Loss before taxation (1,359,226) (1,315,126)

Income tax expense -- --

------------ ------------

Loss for the period from continuing operations

(1) (2) (1,359,226) (1,315,126)

------------ ------------

Other comprehensive income (net of tax)

Exchange differences on translating foreign

operations 609,475 1,166,852

------------ ------------

Total comprehensive loss for the period (2) (749,751) (148,274)

------------ ------------

------------ ------------

Loss per ordinary share (basic and diluted) (1) (0.43c) (1.56c)

------------ ------------

(1) All revenue and expenses arise from continuing operations.

(2) The Group has no non-controlling interests and all losses are

attributable to the equity holders of the Parent Company.

SERABI GOLD PLC

Condensed Consolidated Balance Sheets

As at As at As at

31 March 31 March 31 December

2013 2012 2012

(expressed in US$) (unaudited) (unaudited) (audited)

----------- ----------- -----------

Non-current assets

Development and deferred exploration 17,696,480 17,998,296 17,360,805

costs

Property, plant and equipment 29,187,365 28,690,108 26,848,991

----------- ----------- -----------

Total non-current assets 46,883,845 46,688,404 44,209,796

----------- ----------- -----------

Current assets

Inventories 795,485 1,140,908 722,868

Trade and other receivables 182,018 107,047 85,509

Prepayments and accrued income 681,188 661,105 603,005

Cash and cash equivalents 20,222,386 3,382,198 2,582,046

----------- ----------- -----------

Total current assets 21,881,077 5,291,258 3,993,428

----------- ----------- -----------

Current liabilities

Trade and other payables 2,295,152 2,186,333 2,001,683

Interest bearing liabilities -- -- 4,580,745

Accruals 408,540 115,214 171,102

----------- ----------- -----------

Total current liabilities 2,703,692 2,301,547 6,753,530

----------- ----------- -----------

Net current assets / (liabilities) 19,177,385 2,989,711 (2,760,102)

----------- ----------- -----------

Total assets less current liabilities 66,061,230 49,678,115 41,449,694

----------- ----------- -----------

Non-current liabilities

Trade and other payables 131,230 510,506 211,939

Provisions 1,635,873 1,460,029 1,612,098

Interest bearing liabilities 386,729 319,020 364,656

----------- ----------- -----------

Total non-current liabilities 2,153,832 2,289,555 2,188,693

----------- ----------- -----------

Net assets 63,907,398 47,388,560 39,261,001

----------- ----------- -----------

Equity

Share capital 52,773,993 31,416,993 31,416,993

Share premium reserve 54,083,565 50,306,920 50,182,624

Option reserve 2,069,189 1,990,465 2,019,782

Other reserves 427,615 780,028 780,028

Translation reserve (3,996,836) 91,685 (4,606,311)

Accumulated losses (41,450,128) (37,197,531) (40,532,115)

----------- ----------- -----------

Equity shareholders' funds 63,907,398 47,388,560 39,261,001

----------- ----------- -----------

The interim financial information has not been audited and does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. Whilst the financial information included in

this announcement has been compiled in accordance with

International Financial Reporting Standards ("IFRS") this

announcement itself does not contain sufficient financial

information to comply with IFRS. The Group statutory accounts for

the year ended 31 December 2012 prepared under IFRS as adopted in

the EU and with IFRS and their interpretations adopted by the

International Accounting Standards Board will be filed with the

Registrar of Companies following their adoption by shareholders at

the next Annual General Meeting. The auditor's report on these

accounts was unqualified but did contain an Emphasis of Matter with

respect to the Company and the Group regarding Going Concern and

the future availability of project finance. The auditor's report

did not contain a statement under Section 498 (2) or 498 (3) of the

Companies Act 2006.

SERABI GOLD PLC

Condensed Consolidated

Statements of Changes in

Shareholders' Equity

(expressed in US$)

Share

Share Share option

(unaudited) capital premium reserve

------------ ----------- -----------

Equity shareholders'

funds at 31 December

2011 29,291,551 48,292,057 1,956,349

------------ ----------- -----------

Foreign currency

adjustments -- -- --

Loss for the period -- -- --

------------ ----------- -----------

Total comprehensive

income for the period -- -- --

Issue of new ordinary

shares for cash 2,125,442 2,047,509 --

Costs associated with

issue of new ordinary

shares for cash -- (32,646) --

Share option expense -- -- 34,116

------------ ----------- -----------

Equity shareholders'

funds at 31 March 2012 31,416,993 50,306,920 1,990,465

------------ ----------- -----------

Foreign currency

adjustments -- -- --

Loss for the period -- -- --

------------ ----------- -----------

Total comprehensive

income for the period -- -- --

Costs associated with

issue of new ordinary

shares for cash -- (124,296) --

Share options lapsed -- -- (87,276)

Share option expense -- -- 116,593

------------ ----------- -----------

Equity shareholders'

funds at 31 December

2012 31,416,993 50,182,624 2,019,782

------------ ----------- -----------

Foreign currency

adjustments -- -- --

Loss for the period -- -- --

------------ ----------- -----------

Total comprehensive

income for the period -- -- --

Issue of new ordinary

shares for cash 21,357,000 4,182,600 --

Costs associated with

issue of new ordinary

shares for cash -- (281,659) --

Warrants lapsed in period -- -- --

Share option expense -- -- 49,407

------------ ----------- -----------

Equity shareholders'

funds at 31 March 2013 52,773,993 54,083,565 2,069,189

------------ ----------- -----------

(expressed in US$)

Other Translation Accumulated Total

(unaudited) reserves reserve losses equity

----------- ----------- ----------- -----------

Equity shareholders'

funds at 31 December

2011 702,095 (1,075,167) (35,882,405) 43,284,480

----------- ----------- ----------- -----------

Foreign currency

adjustments -- 1,166,852 -- 1,166,852

Loss for the period -- -- (1,315,126) (1,315,126)

----------- ----------- ----------- -----------

Total comprehensive

income for the period -- 1,166,852 (1,315,126) (148,274)

Issue of new ordinary

shares for cash 77,933 -- -- 4,250,884

Costs associated with

issue of new ordinary

shares for cash -- -- -- (32,646)

Share option expense -- -- -- 34,116

----------- ----------- ----------- -----------

Equity shareholders'

funds at 31 March 2012 780,028 91,685 (37,197,531) 47,388,560

----------- ----------- ----------- -----------

Foreign currency

adjustments -- (4,697,996) -- (4,697,996)

Loss for the period -- -- (3,421,860) (3,421,860)

----------- ----------- ----------- -----------

Total comprehensive

income for the period -- (4,697,996) (3,421,860) (8,119,856)

Costs associated with

issue of new ordinary

shares for cash -- -- -- (124,296)

Share options lapsed -- -- 87,276 --

Share option expense -- -- -- 116,593

----------- ----------- ----------- -----------

Equity shareholders'

funds at 31 December

2012 780,028 (4,606,311) (40,532,115) 39,261,001

----------- ----------- ----------- -----------

Foreign currency

adjustments -- 609,475 -- 609,475

Loss for the period -- -- (1,359,226) (1,359,226)

----------- ----------- ----------- -----------

Total comprehensive

income for the period -- 609,475 (1,359,226) (749,751)

Issue of new ordinary

shares for cash 88,800 -- -- 25,628,400

Costs associated with

issue of new ordinary

shares for cash -- -- -- (281,659)

Warrants lapsed in period (441,213) -- 441,213 --

Share option expense -- -- -- 49,407

----------- ----------- ----------- -----------

Equity shareholders'

funds at 31 March 2013 427,615 (3,996,836) (41,450,128) 63,907,398

----------- ----------- ----------- -----------

SERABI GOLD PLC

Condensed Consolidated Cash Flow Statements

For the three months

ended

31 March

2013 2012

(expressed in US$) (unaudited) (unaudited)

------------ ------------

Operating activities

Operating loss (1,064,266) (1,384,267)

Depreciation - plant, equipment and mining

properties 107,667 426,637

Option costs 47,846 29,150

Interest paid (107,605) (5,301)

Foreign exchange (305,314) 55,616

Changes in working capital

Increase in inventories (61,587) (6,379)

Increase in receivables, prepayments and

accrued income (166,936) (42,208)

Increase/(decrease) in payables, accruals and

provisions 423,347 (480,318)

------------ ------------

Net cash outflow from operations (1,126,848) (1,309,896)

------------ ------------

Investing activities

Purchase of property, plant and equipment and

projects in construction (2,079,391) (51,910)

Exploration and development expenditure (111,137) (931,607)

Interest received 2,757 1,179

------------ ------------

Net cash outflow on investing activities (2,187,771) (982,338)

------------ ------------

Financing activities

Issue of ordinary share capital 25,628,400 4,250,883

Repayment of short-term loan (4,500,000) --

Payment of share issue costs (281,659) (32,645)

------------ ------------

Net cash inflow from financing activities 20,846,741 4,218,238

------------ ------------

Net increase in cash and cash equivalents 17,532,122 1,926,004

Cash and cash equivalents at beginning of period 2,582,046 1,406,458

Exchange difference on cash 108,218 49,736

------------ ------------

Cash and cash equivalents at end of period 20,222,386 3,382,198

------------ ------------

1. Basis of preparation These interim

accounts are for the three month period ended 31 March 2013.

Comparative information has been provided for the unaudited three

month period ended 31 March 2012 and, where applicable, the audited

twelve month period from 1 January 2012 to 31 December 2012.

The accounts for the periods have been prepared in accordance

with International Accounting Standard 34 "Interim Financial

Reporting" and the accounting policies are consistent with those of

the annual financial statements for the year ended 31 December 2012

and those envisaged for the financial statements for the year

ending 31 December 2013. The Group has not adopted any standards or

interpretation in advance of the required implementation dates. It

is not anticipated that the adoption in the future of the new or

revised standards or interpretations that have been issued by the

International Accounting Standards Board will have a material

impact on the Group's earnings or shareholders' funds.

The condensed set of financial statements for the three month

period ended 31 March 2013 has been reviewed by the auditors as set

out in their report.

(i) Going concern and availability of project

finance In common with many companies in the exploration and

development stages, the Company raises its finance for exploration

and development programmes in discrete tranches. During the early

part of 2012 the Company commissioned a Preliminary Economic

Assessment ("PEA") of the viability of re-commencing mining

operations at the Palito Mine. The report which was completed and

published in June 2012 was positive and the Company entered into a

conditional subscription agreement with Fratelli Investments

Limited ("Fratelli") on 2 October 2012 to subscribe for and

underwrite a placement of new shares to finance the development and

start-up of underground mining activities at the Palito gold mine.

In addition Fratelli agreed to provide an interim secured loan

facility of US$6 million to provide additional working capital to

the Company and to enable it to commence the initial works at

Palito. The placing of 270 million new Ordinary Shares with

Fratelli and other subscribers was completed on 17 January 2013,

raising gross proceeds of UK£ 16.2 million. The Company has repaid

out of the proceeds the amount of the loan facility that had been

drawn down, which at that time was US$4.5 million plus accrued

interest. Management considers that the Company has adequate access

to capital to be able to complete the necessary mine development

and process plant and infrastructure rehabilitation works that are

required in order to be able to commence gold production before the

end of 2013. From that time management anticipate that the Company

will have sufficient cash flow to be able to meet all its

obligations as and when they fall due and to, at least in part,

finance the exploration and development activities that it would

like to undertake on its other exploration projects.

There are, however, risks associated with the commencement of

any new mining and processing operation whereby unforeseen

technical and logistical events result in additional time being

required for commissioning or additional costs needing to be

incurred, giving rise to the possibility that additional working

capital may be required to fund these delays or additional capital

requirements. Should additional working capital be required the

Directors consider that further sources of finance could be secured

within the required timescale. On this basis the Directors have

therefore concluded that it is appropriate to prepare the financial

statements on a going concern basis. However there is no certainty

that such additional funds will be forthcoming. These conditions

indicate the existence of a material uncertainty which may cast

doubt over the Group's and the Company's ability to continue as a

going concern and therefore that it may be unable to realise its

assets and discharge its liabilities in the normal course of

business.

These financial statements do not reflect the adjustments to

carrying values of assets and liabilities and the reported expenses

and balance sheet classifications that would be necessary should

the going concern assumption be inappropriate. These adjustments

could be material.

(ii) Impairment The Directors have

undertaken a review of the carrying value of the mining and

exploration assets of the Group and given particular consideration

to the results of the PEA, the current operational status of Palito

and the potential risks and implications of starting up a past

producing gold mine. As part of this review they have assessed the

value of the existing Palito Mine asset on the basis of the

projected value in use that could be expected should the Company

follow the re-development, start-up and future mining plans

proposed in the PEA. The carrying values of assets have not been

adjusted to reflect a failure to raise sufficient funds, not

achieving the projected levels of operation or that, if a sale

transaction were undertaken, the proceeds may not realise the value

as stated in the accounts.

(iii) Inventories Inventories are valued

at the lower of cost and net realisable value.

(iv) Property, plant and equipment

Property, plant and equipment are depreciated over their estimated

useful lives.

(v) Mining property and assets in

construction The Group commenced commercial production at the

Palito mine effective 1 October 2006. Prior to this date all

revenues and operating costs were capitalised as part of the

development costs of the mine. Effective from 1 October 2006 the

accumulated development costs of the mine were re-classified as

Mining Property costs and such cost will be amortised over the

anticipated life of the mine on a unit of production basis. As the

underground mine is currently on care and maintenance and there is

no depletion of the reserves and resources attributable to the

mine, no amortization charge has been recorded in the period.

Costs related to work on the remediation, rehabilitation and

development of the Palito mine, the process plant and other site

infrastructure are being capitalised together with a portion of

general administration costs incurred in Brazil as Assets in

Construction. Upon the successful commencement of commercial

production, these costs will be transferred to Mining Assets and

amortised on a unit of production basis.

(vi) Revenue Revenue represents amounts

receivable in respect of sales of gold and by-products. Revenue

represents only sales for which contracts have been agreed and for

which the product has been delivered to the purchaser in the manner

set out in the contract. Revenue is stated net of any applicable

sales taxes. Any unsold production and in particular concentrate is

held as inventory and valued at production cost until sold.

(vii) Currencies The condensed financial

statements are presented in United States dollars (US$ or "$").

Other currencies referred to in these condensed financial

statements are GB pounds ("GB£ "), Canadian dollars ("C$") and

Brazilian Reais ("BrR$").

Transactions in currencies other than the functional currency of

a company are recorded at a rate of exchange approximating to that

prevailing at the date of the transaction. At each balance sheet

date, monetary assets and liabilities that are denominated in

currencies other than the functional currency are translated at the

amounts prevailing at the balance sheet date and any gains or

losses arising are recognised in profit or loss.

On consolidation, the assets and liabilities of the Group's

overseas operations that do not have a US Dollar functional

currency are translated at exchange rates prevailing at the balance

sheet date. Income and expense items are translated at the average

exchange rate for the period. Exchange differences arising on the

net investment in subsidiaries are recognised in other

comprehensive income.

(viii) Cash and cash equivalents Cash and

cash equivalents include cash in hand, deposits held at call with

banks, other short-term highly liquid investments with original

maturities of three months or less and bank overdrafts. Bank

overdrafts are shown within interest bearing liabilities in current

liabilities on the balance sheet.

Enquiries: Serabi Gold plc Michael Hodgson Chief

Executive Tel: +44 (0)20 7246 6830 Mobile: +44 (0)7799

473621

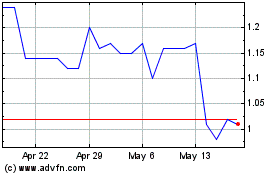

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Jan 2024 to Jan 2025