Sprott Inc. Announces 2012 First Quarter Results

09 May 2012 - 9:00PM

PR Newswire (Canada)

TORONTO, May 9, 2012 /CNW/ -Sprott Inc. ("Sprott" or the "Company")

today announced its financial results for the three months ended

March 31, 2012. Q1 2012 Highlights -- Assets Under Management

("AUM") were $9.7 billion as at March 31, 2012, compared to $9.7

billion as at March 31, 2011 and $9.1 billion as at December 31,

2011 -- Assets Under Administration ("AUA") were $4.6 billion as at

March 31, 2012, compared to $5.9 billion as of March 31, 2011 --

Management Fees were $33.0 million, a decrease of 7.2% compared

with the three months ended March 31, 2011 -- Base EBITDA was $16.1

million ($0.10 per share), compared with $16.9 million ($0.10 per

share) in 2011, a decrease of 4.7% -- EBITDA was $20.4 million

($0.12 per share), compared with $17.4 million ($0.11 per share) in

2011, an increase of 17.2% -- Net income was $16.9 million ($0.10

per share), an increase of 60.4% from $10.6 million ($0.07 per

share) in the first quarter of 2011 -- Named John Wilson, Senior

Portfolio Manager of Sprott Asset Management and appointed lead

manager of Sprott Opportunities Funds -- Added Neil Adshead as

Investment Strategist at Resource Capital Investment Corp. --

Sprott Physical Gold Trust completed follow-on offering of Trust

Units for gross proceeds of US$349 million -- Sprott Physical

Silver Trust completed follow-on offering of Trust Units for gross

proceeds of US$349 million -- Launched Sprott Silver Equities Class

-- Announced Letter of Intent to acquire Toscana Capital Corp. and

Toscana Energy Corp. Subsequent events: -- Launched Sprott Enhanced

Equity Class and Sprott Enhanced Balanced Fund -- Nominated Paul

Stephens as Director "The ongoing climate of economic uncertainty

impacted our results during the first quarter as the markets

struggled to price in the potential for further central bank

intervention," said Peter Grosskopf, CEO of Sprott Inc. "In our

view, the strength of the recovery in the U.S. has been overblown

and the European debt crisis is far from resolved. As such, we

believe the outlook for precious metals and their related equities

remains compelling." "We continue to add new products and managers

to help us diversify and grow our business," continued Mr.

Grosskopf. "The pending acquisition of the Toscana Companies

will enhance our position in the energy sector and we continue to

look for new opportunities to grow through further acquisitions of

complementary products and managers." For the three months ended

March 31, ($ in millions) 2012 2011 AUM, beginning of period 9,137

8,545 Net sales 540 260 Business acquisition — 695 Market value

appreciation of portfolios 6 178 AUM, end of period 9,683 9,678

Assets Under Management At March 31, 2012, AUM was $9.7

billion, virtually unchanged from $9.7 billion at March 31,

2011. Net sales for the three months ended March 31, 2012 were

$0.5 billion. During the quarter, the launches of the Sprott 2012

Flow-Through Limited Partnership and the Sprott Silver Equities

Class, combined with the follow-on offerings of the Sprott Physical

Gold Trust and Sprott Physical Silver Trust added approximately

$0.7 billion to AUM. This was offset by approximately $171 million

in net redemptions experienced by the mutual funds, hedge funds,

managed accounts and offshore funds. Average AUM for the three

months ended March 31, 2012 was $10.1 billion compared with

$8.8 billion for the three months ended March 31, 2011, an

increase of 15.1%. Income Statement Total revenue for the three

months ended March 31, 2012 increased by 12.3% to $44.4

million, from $39.5 million in 2011. Management fees decreased by

7.2% during the quarter to $33.0 million, from $35.5 million for

the three months ended March 31, 2011, even though average AUM

increased over the prior year period. Management fee margins fell

during the first quarter of 2012 to 1.4% from 1.5% during the

comparable period in 2011. The decrease is mainly due to the

significant growth in bullion funds and fixed income funds, which

have lower management fees than the majority of the other Sprott

Funds. Gains from proprietary investments, which include

investments in funds that Sprott manages, an investment in Sprott

Resource Lending Corp., certain other resource-related stocks and

warrants, and bullion, totaled $4.2 million for the three months

ended March 31, 2012, compared with a gain of $0.4 million in

the three months ended March 31, 2011. Commission revenue for

the three months ended March 31, 2012, was $5.7 million

compared to $3.0 million during the three months ended

March 31, 2011. In the three months ended March 31, 2012,

commission revenue was generated by Global Resource Investments

Ltd. and Sprott Private Wealth. Other income increased by

$1.0 million in the three months ended March 31, 2012 to $1.4

million from $0.4 million in the first quarter of 2011. Total

expenses for the three months ended March 31, 2012 were $23.2

million, a decrease of $1.4 million or 5.6%, from $24.6 million

during the same period last year. Base EBITDA, which excludes the

impact of income taxes and certain non-cash expenses and gains or

losses on proprietary investments, decreased by 4.7% to $16.1

million ($0.10 per share) for the three months ended March 31,

2012, compared with $16.9 million ($0.10 per share) in the first

quarter of 2011. Net income for the three months ended

March 31, 2012 increased by 60.4% to $16.9 million ($0.10 per

share) from $10.6 million ($0.07 per share) in the first quarter

2011. Dividends On March 20, 2012, a dividend of $0.03 per common

share was declared for the quarter ended December 31, 2011. This

dividend was paid on April 20, 2012 to shareholders of record at

the close of business on April 5, 2012. In May 2012, a dividend of

$0.03 per common share was declared for the quarter ended March 31,

2012. Conference Call and Webcast A conference call and webcast

will be held today, Wednesday, May 9, 2012, at 10:00am ET to

discuss the Company's financial results. To access the call, please

dial 647-427-7450 or 1-888-231-8191 ten minutes prior to the

scheduled start of the call. A taped replay of the conference call

will be available until Thursday, May 17, 2012 by calling

416-849-0833 or 1-855-859-2056, reference number 76237551. The

conference call will also be webcast live at www.sprottinc.com and

www.newswire.ca. An archived replay of the webcast will be

available for 365 days. *Non-IFRS Financial Measures This press

release includes financial terms (including AUM, EBITDA, Base

EBITDA, Cash Flow from Operations and net sales) that the Company

utilizes to assess the financial performance of its business that

are not measures recognized under International Financial Reporting

Standards ("IFRS"). These non-IFRS measures should not be

considered alternatives to performance measures determined in

accordance with IFRS and may not be comparable to similar measures

presented by other issuers. For additional information regarding

the Company's use of non-IFRS measures, including the calculation

of these measures, please refer to the "Non-IFRS Financial

Measures" section of the Company's Management's Discussion and

Analysis and its financial statements available on the Company's

website at www.sprottinc.com and on SEDAR at www.sedar.com.

Forward-Looking Statements This release contains "forward-looking

statements" which reflect the current expectations of the Company.

These statements reflect management's current beliefs with respect

to future events and are based on information currently available

to management. Forward-looking statements involve significant known

and unknown risks, uncertainties and assumptions. Many factors

could cause actual results, performance or achievements to be

materially different from any future results, performance or

achievements that may be expressed or implied by such

forward-looking statements including, without limitation, those

listed under the heading "Risk Factors" in the Company's annual

information form dated March 27, 2012. Should one or more of these

risks or uncertainties materialize, or should assumptions

underlying the forward-looking statements prove incorrect, actual

results, performance or achievements could vary materially from

those expressed or implied by the forward-looking statements

contained in this release. Although the forward-looking statements

contained in this release are based upon what the Company believes

to be reasonable assumptions, the Company cannot assure investors

that actual results, performance or achievements will be consistent

with these forward-looking statements. These forward-looking

statements are made as of the date of this release and the Company

does not assume any obligation to update or revise them to reflect

new events or circumstances. About Sprott Inc. Sprott Inc. is a

leading independent asset manager dedicated to achieving superior

returns for its clients over the long term. The Company currently

operates through four business units: Sprott Asset Management LP,

Sprott Private Wealth LP, Sprott Consulting LP, and Sprott U.S.

Holdings Inc. Sprott Asset Management is the investment

manager of the Sprott family of mutual funds and hedge funds and

discretionary managed accounts; Sprott Private Wealth provides

wealth management services to high net worth individuals; and

Sprott Consulting provides management, administrative and

consulting services to other companies, including Sprott Resource

Corp. , Sprott Resource Lending Corp. and Sprott Power Corp. .

Sprott U.S. Holdings Inc. includes Global Resource Investments Ltd,

Sprott Asset Management USA Inc., and Resource Capital Investments

Corporation. Sprott Inc. is headquartered in Toronto, Canada, and

is listed on the Toronto Stock Exchange under the symbol "SII". For

more information on Sprott Inc., please visit www.sprottinc.com.

Sprott Inc. CONTACT: Investor contact information: (416)

203-2310 or 1 (877) 403-2310or ir@sprott.com

Copyright

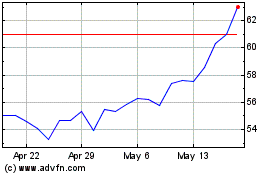

Sprott (TSX:SII)

Historical Stock Chart

From Jun 2024 to Jul 2024

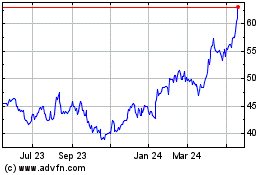

Sprott (TSX:SII)

Historical Stock Chart

From Jul 2023 to Jul 2024