Storm Exploration Inc. (TSX:SEO) ("Storm" or the "Company") is pleased to

provide an operational update for the fourth quarter of 2008, reserve

information as at December 31, 2008 and budget expectations for the year ended

December 31, 2009.

FOURTH QUARTER 2008 UPDATE:

- Average fourth quarter production is estimated to have increased to 8,150 Boe

per day, representing year over year growth of 36% from average production of

5,992 Boe per day in the fourth quarter of 2007. This estimate is based on

actual accounting data for October and November and field estimates for

December. On a per share basis, the increase is 35%, using weighted average

basic shares outstanding for each period.

- All nine wells drilled in the fourth quarter were successful, resulting in

three oil sands evaluation wells (3.0 net) at Surmont, and six (6.0 net) gas

wells, including five horizontal Montney gas wells. For the year, Storm drilled

29 wells (27.8 net) which resulted in 21 gas wells (19.8 net), one dry hole (1.0

net) and seven oil sands evaluation wells at Surmont for a 97% success rate.

- Invested approximately $35.5 million in the fourth quarter resulting in total

capital investment for 2008 of approximately $95.5 million, net of dispositions

which totaled $7.7 million. This excludes equity investments in Storm Gas

Resource Corp. ("SGR") and Storm Ventures International Inc ("SVI") which

totaled $6.2 million in 2008.

- Started construction of the second facility at Parkland in November, 2008

which was completed and operational on January 14, 2009. Initial capacity of

this facility is 12 mmcf per day which increases our total capacity at Parkland

to 45 mmcf per day with current gross raw gas throughput being 36 mmcf per day.

- At December 31, 2008, total proved reserves increased by 109% to 26.4 million

Boe ("Mmboe"): and total proved plus probable reserves grew by 105% to 41.9

Mmboe. Using basic shares outstanding, growth per share amounted to 109% for

total proved reserves and 105% for total proved plus probable reserves.

- The all-in cost to add reserves was $13.02 per Boe for proved reserves and

$11.12 per Boe for proved plus probable reserves (including the change in future

development costs, acquisitions, dispositions and revisions). Using an

estimated cash flow netback of $34.00 per Boe for 2008, Storm generated a

recycle ratio of 2.6 for total proved reserve additions and 3.1 for total proved

plus probable reserve additions.

- Estimated net asset value per fully diluted share at December 31, 2008,

amounted to $16.65, a year-over-year increase of 95% over 2007, using the pre

tax present value of proved and provable reserves discounted at 10% using

forecast prices.

Certain financial and operating information included in this press release for

the quarter and year ended December 31, 2008, such as finding and development

costs, production information, recycle ratios, cash flow netbacks and net asset

value, are based on estimated unaudited financial results for the year then

ended, and are subject to the same limitations as discussed under Forward

Looking Statements set out below. These estimated amounts may change upon the

completion of audited financial statements for the year ended December 31, 2008

and changes could be material.

Boe Presentation - For the purpose of calculating unit revenues and costs,

natural gas is converted to a barrel of oil equivalent ("Boe") using six

thousand cubic feet ("Mcf") of natural gas equal to one barrel of oil unless

otherwise stated. Barrels of oil equivalent ("Boe") may be misleading,

particularly if used in isolation. A Boe conversion ratio of six Mcf to one

barrel ("bbl") is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value equivalency at the

wellhead. All Boe measurements and conversions in this report are derived by

converting natural gas to oil in the ratio of six thousand cubic feet of gas to

one barrel of oil. Mboe means 1,000 Boe.

RESERVES AT DECEMBER 31, 2008:

Storm's year-end reserve evaluation effective December 31, 2008 was prepared by

Paddock Lindstrom & Associates Limited ('Paddock'). Paddock has evaluated all of

Storm's crude oil, NGL and natural gas reserves. The Paddock price forecast at

December 31, 2008 was used to determine all estimates of future net revenue

(also referred to as net present value or NPV). Storm's Reserves Committee,

comprised of independent and appropriately qualified directors, has reviewed and

approved the evaluation prepared by Paddock, and the report of the Reserves

Committee has been accepted by the Company's Board of Directors.

Summary:

- Total proved reserves grew by 109% to 26.4 Mmboe at December 31, 2008, an

increase of 104% per share from the year earlier, using basic shares outstanding

for each year.

- Total proved plus probable reserves grew by 105% to 41.9 Mmboe at December 31,

2008, an increase of 104% per share from the year earlier, using basic shares

outstanding for each year.

- Total proved plus probable reserves increased by 9.4 Boe for each Boe that was

produced during 2008 (840% reserve replacement on a total proved plus probable

basis).

- The total proved finding and development costs, as per NI 51-101 requirements,

was $12.94 per Boe: total proved plus probable finding and development costs, as

per NI 51-101 requirements, was $10.51 per Boe. Changes to future development

costs (FDC) of properties were included in the calculation and the effect of

acquisitions, divestitures, and revisions were excluded. Comparable amounts for

the prior year were $17.41 and $10.77 per Boe.

- The all-in cost for adding proved reserves was $13.02 per Boe, and for adding

proved plus probable reserves was $11.12 per Boe. The all-in calculation

reflects the result of Storm's entire capital investment program as it takes

into account the effect of acquisitions, dispositions, revisions, as well as the

change in future development costs. Comparable amounts for the prior year were

$21.40 and $13.64 per Boe.

- The net present value of total proved plus probable reserves, discounted at

10% before tax, amounted to $755 million, an increase of 105% year-over-year.

The net present value of total proved reserves amounted to $504 million, or 67%

of the net present value of total proved plus probable reserves. Increased net

present value of reserves came from growth in both proved and probable reserves,

as well as a 9% increase in the forecast AECO natural gas price used in the

first three years of the evaluation.

- During 2008 non core properties with proved and probable reserves of 209 Mboe

were sold at an average price of $36.84 per Boe.

- Future development costs were $140 million on a proved basis and $219 million

on a total proved plus probable basis. Included in these amounts are:

----------------------------------------------------------------------------

Total Proved

Total Proved plus Probable

----------------------------------------------------------------------------

Montney horizontal $114 million $182 million

development at Parkland 20 horizontal wells 32 horizontal wells

----------------------------------------------------------------------------

Expansion of 2nd $13 million $15 million

Parkland facility (25 mmcf/d) (40 mmcf/d)

----------------------------------------------------------------------------

Other $13 million $22 million

----------------------------------------------------------------------------

$140 million $219 million

----------------------------------------------------------------------------

Storm plans to drill nine of the proved undeveloped horizontal Montney gas wells

in 2009.

- The Montney discovery at Parkland was assigned 20.8 Mmboe of proved reserves

and 33.8 Mmboe of proved plus probable reserves. This reserve assignment is

based on original gas in place1 in the Montney formation of 312 Bcf for proved

reserves, with a recovery factor of 40%, and 409 Bcf for proved plus probable

reserves, with a 50% recovery factor. Ultimate recoverable raw gas averaging 3.4

Bcf (610 Mboe sales) was assigned to the 20 horizontal wells in the proved

evaluation, while an average of 4.2 Bcf (750 Mboe sales) was assigned to the 32

horizontal wells in the proved plus probable evaluation.

- Total proved reserves assigned to Storm's Parkland property were 22.4 Mmboe,

or 85% of total Company proved reserves, and 36.3 Mmboe on a total proved plus

probable basis, or 87% of total Company proved plus probable reserves. These

amounts include reserves assigned to the Halfway, Doig, and Charlie Lake

formations as well as to the Montney discovery.

- Proved producing reserves ('PDP') represent 44% of total proved reserves,

compared to 73% in 2007, and 28% of total proved plus probable reserves compared

to 45% in 2007. The proportion of PDP reserves declined year-over-year as a

result of assigning 32 proved undeveloped and probable additional horizontal gas

wells in Storm's Montney discovery at Parkland. This is a significant increase

from December 31, 2007, when only eight proved undeveloped and probable

additional horizontal gas wells were recognized in our Montney property.

- The recycle or reinvestment ratio was 2.6 times for proved reserves and 3.1

times for total proved plus probable reserves, using an estimated cash flow

netback of $34.00 per Boe for 2008. This measurement uses the all-in total

proved finding cost of $12.96 per Boe, and proved plus probable finding cost of

$11.08 per Boe (includes the effect of future development capital, acquisitions,

dispositions and revisions).

- Net asset value per fully diluted share of $16.65 at December 31, 2008, is

based on the pre tax net present value of total proved plus probable reserves

discounted at 10% using escalated prices, plus internally generated estimated

values for Storm's undeveloped land inventory, investments, receipts upon

exercise of stock options, less debt at year end.

- Net downward revisions to prior year reserves totaled 6.3% on a total proved

basis and 10.5% on a proved plus probable basis. The Parkland property was the

source of 122% of the proved reserve revision (greater than 100% due to

offsetting positive revisions at other properties) of the proved reserve

revision and 96% of the proved plus probable reserve revision. Poorer than

expected performance at wells producing from the Halfway and Doig formations

accounted for the majority of the revision. Approximately 25% of the reduced

well performance was the result of new, high rate Montney horizontal wells

elevating gathering system pressures, which resulted in the backing out or

reduction of production from Halfway and Doig wells. The remainder was due to a

combination of water encroachment and reservoir size being smaller than

predicted. Reserves lost as a result of higher gathering system pressures are

expected to be recovered as the second Parkland facility is now operational and

part of the gathering system was twinned in late 2008, which has resulted in a

significant decrease in gathering system pressures.

Gross Company Interest Reserves as at December 31, 2008

(Before deduction of royalties payable, not including royalties receivable)

-------------------------------------------

Light Crude Sales 6:1 Oil

Oil Gas NGLs Equivalent

(Mbbls) (mmcf) (Mbbls) (Mboe)

-------------------------------------------

Proved Producing 483 59,525 1,200 11,604

Proved Non-Producing - 5,135 121 977

-------------------------------------------

Total Proved Developed 483 64,660 1,321 12,581

Proved Undeveloped 355 69,798 1,815 13,803

-------------------------------------------

Total Proved 838 134,458 3,136 26,384

Probable Additional 418 79,385 1,869 15,518

-------------------------------------------

Total Proved plus Probable 1,256 213,843 5,005 41,902

-------------------------------------------

-------------------------------------------

Gross Company Reserve Reconciliation for 2008

(Gross company interest reserves before deduction of royalties payable)

6:1 Oil Equivalent (Mboe)

Proved

Total plus

Proved Probable Probable

----------------------------

December 31, 2007 - Opening Balance 12,596 7,880 20,476

Acquisitions - - -

Discoveries 67 (91) 24

Extensions 17,221 9,085 26,306

Dispositions (163) (46) (209)

Technical revisions (789) (1,358) (2,147)

----------------------------

Production (2,548) - (2,548)

----------------------------

December 31, 2008 -- Closing Balance 26,384 15,470 41,902

----------------------------

----------------------------

Total Proved Finding & Development Cost - per NI 3 YEAR

51-101 2008 2007 TOTAL

----------------------------------------------------------------------------

Capital expenditures excluding acquisitions

and dispositions-'000 $102,650 $69,287 $228,209

Net change from previously allocated future

development capital - '000 $121,090 $16,641 $139,788

Total capital including the net change in

future capital - '000 $223,740 $85,928 $367,997

Reserve additions excluding acquisitions,

dispositions and revisions MBoe 17,288 4,935 26,106

Total Proved Finding and Development Costs -

per Boe $12.94 $17.41 $14.10

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total Proved Plus Probable Finding & Development 3 YEAR

Cost - per NI 51-101 2008 2007 TOTAL

----------------------------------------------------------------------------

Capital expenditures excluding acquisitions &

dispositions-'000 $102,650 $69,287 $228,209

Net change from previously allocated future

development capital - '000 $174,036 $35,685 $216,697

Total capital including the net change in

future capital - '000 $276,686 $104,972 $444,906

Reserve additions excluding acquisitions,

dispositions & revisions-MBoe 26,331 9,748 41,206

Total Proved plus Probable Finding and

Development Costs - per Boe $10.51 $10.77 $10.80

----------------------------------------------------------------------------

----------------------------------------------------------------------------

All In Total Proved Finding, Development &

Acquisition Cost

- including FDC, Acquisitions, Dispositions, 3 YEAR

Revisions 2008 2007 TOTAL

----------------------------------------------------------------------------

Capital expenditures including acquisitions &

dispositions -'000 $ 95,500 $ 93,772 $ 273,777

Net change from previously allocated future

development capital - '000 $ 117,206 $ 16,606 $ 136,419

Total capital including the net change in

future capital - '000 $ 212,706 $ 110,378 $ 410,196

Reserve additions including acquisitions,

dispositions & revisions - MBoe 16,336 5,159 25,713

All In Total Proved Finding and Development

Costs - $/Boe $ 13.02 $ 21.40 $ 15.95

----------------------------------------------------------------------------

----------------------------------------------------------------------------

All In Total Proved Plus Probable Finding,

Development & Acquisition Cost

- including FDC, Acquisitions, Dispositions, 3 YEAR

Revisions 2008 2007 TOTAL

----------------------------------------------------------------------------

Capital expenditures including acquisitions

and dispositions -'000 $ 95,500 $ 93,772 $ 273,777

Net change from previously allocated future

development capital - '000 $ 171,177 $ 31,794 $ 213,147

Total capital including the net change in

future capital - '000 $ 266,677 $ 125,566 $ 486,924

Reserve additions including acquisitions,

dispositions and revisions - MBoe 23,974 9,204 39,177

All In Total Proved plus Probable Finding and

Development Costs - $/Boe $ 11.12 $ 13.64 $ 12.43

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total exploration and development costs incurred in the most recent financial

year and the change during that year in estimated future development costs,

generally will not reflect the total cost of reserve additions in that year.

Net Present Value Summary (before tax) as at December 31, 2008

Benchmark oil and NGL prices used are adjusted for quality of oil or NGL

produced and for transportation costs.

The calculated NPVs include a deduction for estimated future well abandonment costs.

----------------------------------------------------------------------------

DISCOUNTED DISCOUNTED DISCOUNTED DISCOUNTED

UNDISCOUNTED AT 5% AT 10% AT 15% AT 20%

$'000 $'000 $'000 $'000 $'000

----------------------------------------------------------------------------

Proved

Producing 437,118 327,876 268,956 231,185 204,471

Proved

Non-Producing 38,433 28,401 22,739 19,108 16,567

----------------------------------------------------------------------------

Total

Proved

Developed 475,551 358,277 291,695 250,293 221,038

Proved

Undeveloped 472,847 303,568 212,638 156,398 118,296

----------------------------------------------------------------------------

Total

Proved 948,398 659,845 504,333 406,691 339,334

Probable

Additional 668,487 378,937 251,139 180,483 135,992

----------------------------------------------------------------------------

Total Proved

plus

Probable 1,616,885 1,038,782 755,472 587,174 475,326

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net Present Value Summary (after tax) as at December 31, 2008

Benchmark oil and NGL prices used are adjusted for quality of oil or NGL

produced and for transportation costs.

The calculated NPVs include a deduction for estimated future well

abandonment costs.

----------------------------------------------------------------------------

DISCOUNTED DISCOUNTED DISCOUNTED DISCOUNTED

UNDISCOUNTED AT 5% AT 10% AT 15% AT 20%

$'000 $'000 $'000 $'000 $'000

----------------------------------------------------------------------------

Proved

Producing 370,929 279,984 230,280 198,172 175,356

Proved

Non-Producing 27,739 20,366 16,207 13,544 11,683

----------------------------------------------------------------------------

Total

Proved

Developed 398,668 300,351 246,488 211,716 187,039

Proved

Undeveloped 344,503 217,123 148,274 105,550 76,585

----------------------------------------------------------------------------

Total

Proved 743,171 517,474 394,761 317,266 263,624

Probable

Additional 488,884 274,866 180,154 127,780 94,861

----------------------------------------------------------------------------

Total

Proved

plus

Probable 1,232,055 792,339 574,915 445,046 358,485

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Paddock Lindstrom & Associates Ltd. Escalating Price Forecast as at December

31, 2008

----------------------------------------------------------------------------

WTI Edmonton Henry Hub AECO

Crude Oil Light Crude Oil Natural Gas Natural Gas Propane Butane

$US/bbl $CDN/bbl $US/mmbtu $CDN/mmbtu $CDN/bbl $CDN/bbl

----------------------------------------------------------------------------

2009 60.00 70.18 6.75 7.24 42.11 56.14

2010 67.50 77.21 7.50 7.90 46.33 61.77

2011 75.00 83.93 8.00 8.26 50.36 67.14

2012 82.50 90.34 8.50 8.60 54.20 72.27

2013 90.00 98.65 9.00 9.13 59.19 78.92

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2008 Actual Price

(excl hedging gains) 2009 Actual

2008 Actual Price and and PLA Price and

PLA Forecast Price Forecast Price PLA Forecast Price

Storm Wellhead Storm Wellhead Storm Wellhead

Oil Price Gas Price NGL Price

$CDN/bbl $CDN/mcf $CDN/bbl

----------------------------------------------------------------------------

2008 Estimated 94.00 8.40 80.00

2009 67.10 7.73 58.42

2010 73.19 8.45 64.46

2011 80.68 8.86 70.20

2012 82.50 9.27 75.70

2013 90.00 9.97 82.80

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Original Gas in Place (OGIP) is the same as discovered Petroleum

Initially in Place which is defined in the COGEH handbook as the

quantity of hydrocarbons that are estimated to be in place within a

known accumulation. OGIP is used here as it is a more commonly used

industry term when referring to gas accumulations. Discovered Petroleum

Initially in Place is divided into recoverable and unrecoverable

portions, with the estimated future recoverable portion classified as

reserves and contingent resources. There is no certainty that it will

be economically viable or technically feasible to produce any portion

of this Discovered Petroleum Initially in Place except for those

portions identified as proved or probable reserves.

NET ASSET VALUE

An estimate of Storm's net asset value at December 31, 2008 is as follows:

----------------------------------------------------------------------------

December 31, December 31,

2008 ('000) 2007 ('000)

----------------------------------------------------------------------------

Reserves discounted at 10% before tax $756,000 $369,000

----------------------------------------------------------------------------

Undeveloped land, excluding Parkland (1) 19,000 16,000

----------------------------------------------------------------------------

Undeveloped land at Parkland (1) 53,000 34,000

----------------------------------------------------------------------------

Surmont Oil sands leases (2) - 19,000

----------------------------------------------------------------------------

Seismic - 9,000

----------------------------------------------------------------------------

Investment - SVI (3) 28,000 22,000

----------------------------------------------------------------------------

Investment - SGR (4) 13,000 -

----------------------------------------------------------------------------

Cash proceeds on exercise of stock options 14,000 15,000

----------------------------------------------------------------------------

Net debt (100,000) (85,000)

----------------------------------------------------------------------------

Net Asset Value $783,000 $399,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Fully diluted common shares outstanding (000s) 47,019 46,698

----------------------------------------------------------------------------

Net Asset Value per Common Share $16.65 $8.54

----------------------------------------------------------------------------

----------------------------------------------------------------------------

1. Based on internal estimates - $1,980 per ha Parkland: $230 per ha other.

2. Current valuation not available.

3. Based on a private placement completed mid 2008 at $6.25 per share.

4. Based in a private placement completed mid 2008 at $6.50 per share.

OUTLOOK FOR 2009:

Storm's Board of Directors has approved a capital budget for 2009. The budget

provides for the following:

- Capital investment totaling $95 million with approximately 45% of this amount

being invested in the first half of 2009. This assumes a natural gas price of

$6.30 per GJ at AECO. Debt will be used to fund $11 million to be invested in

expanding infrastructure at Parkland, while cash flow will be used to fund the

remainder of Storm's 2009 capital budget.

- The drilling of 18.0 gross wells (16.1 net) which includes nine horizontal

development wells in Storm's Montney discovery at Parkland, all at a 100%

working interest. In addition, three horizontal wells drilled in the fourth

quarter of 2008 will be completed and tied in by mid-February.

- Of the total budget, $70 million is allocated to drilling, completion and tie

ins, $11 million to expanding infrastructure at Parkland, $5 million for land

and seismic, and $9 million for miscellaneous projects and contingency items.

- Infrastructure investment in 2009 at Parkland will approximate $11 million.

This includes an amount of $5 million to complete the second facility which will

provide an additional 12.5 Mmcf of capacity. In the third quarter an additional

$6 million will be spent to electrify and increase the capacity of the facility

to 25-30 Mmcf per day. An additional $6 million, not at present included in the

capital budget, may be invested in the second half of the year to install a

liquids extraction plant, which will reduce gas shrinkage and increase NGL

recoveries.

- Exit production for 2009, based on production for the final quarter, is

anticipated to be approximately 10,000 Boe per day, an increase of 23% over 2008

fourth quarter production.

- In the event that natural gas prices are lower than expected, the Company has

developed a contingency budget, which will reduce drilling activity to better

match lower cash flow. At an AECO price of $5.25 per GJ, capital investment will

be reduced to $75 million, with debt being used to fund the investment of $11

million required to expand infrastructure at Parkland. Storm's drilling program

will be reduced to 13 wells (11.4 net), with seven of these being horizontal

Montney development wells at Parkland. Investment in land and seismic will not

change. This reduced level of capital investment is expected to result in final

quarter 2009 exit production of 9,300 Boe per day.

- Operating costs for 2009 will approximate $5.80 per Boe and general and

administrative costs will approximate $1.20 per Boe. The corporate royalty rate,

giving effect to the New Royalty Framework's effect on Alberta production, is

estimated to be 23%.

- Two vertical wells (0.8 net) will be drilled in the Horn River Basin in

northeastern British Columbia, with one being cored, completed and flow tested.

If commercial test rates are obtained, one to three horizontal wells may be

drilled later in 2009 or in 2010 to determine the economic viability of

horizontal development.

Storm's business strategy for the current lower natural gas price environment

will include:

- restricting initial production rates from new Montney horizontal gas wells,

which will flatten out the production profile and level out the price and

netback received over a well's life.

- maximizing netbacks by shutting in higher cost properties and wells.

- emphasizing sustainable increases in production and not trying to maximize

production regardless of price.

- reducing capital investment as much as possible, while still showing steady

increases in production.

- adding to the Company's asset base through underdeveloped land acquisitions,

farm-ins, or asset acquisitions.

Production has grown to a current rate of approximately 8,700 Boe per day as a

result of starting up the second Parkland facility, the tie in of a new

horizontal Montney gas well, and better than expected performance from recently

drilled horizontal Montney gas wells. More than 500 Boe per day is currently

curtailed or shut in, primarily at Parkland, to maximize operating netbacks. We

expect to maintain production at current levels through the first half of 2009

with another three to four Montney horizontal gas wells being completed and tied

in by the end of the first quarter, with two of these being standing wells and

one to two being new wells drilled in the first quarter.

The Company will continue its long standing approach to management and financing

of its operations, and intends to deliver continued and profitable growth per

share from its operations, particularly from its low cost-high netback Montney

property in Parkland. This will be achieved by reinvestment of cash flow and

with a limited amount of debt, consistent with our approach to financial

management.

As always, the support and patience of our shareholders is appreciated.

Respectfully,

Brian Lavergne, President

Forward-Looking Statements - Certain information set forth in this document,

including management's assessment of Storm's future plans and operations,

contains forward-looking statements. By their nature, forward-looking statements

are subject to numerous risks and uncertainties, some of which are beyond the

Company's control, including the effect of general economic conditions, industry

conditions, volatility of commodity prices, currency fluctuations, imprecision

of reserve estimates, environmental risks, competition from other industry

participants, the lack of availability of qualified personnel or management,

stock market volatility and ability to access sufficient capital from internal

and external sources. Readers are advised that the assumptions used in the

preparation of such information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance should not

be placed on forward-looking statements. Storm's actual results, performance or

achievement, could differ materially from those expressed in, or implied by,

these forward-looking statements. Storm disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required under securities

law. References to forward looking information are made in the outlook section

in this press release and are also used in estimates of NPV and asset value per

share and elsewhere.

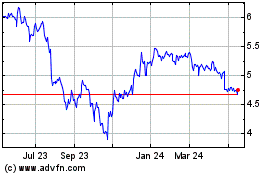

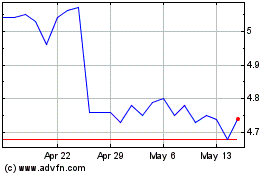

StorageVault Canada (TSX:SVI)

Historical Stock Chart

From Apr 2024 to May 2024

StorageVault Canada (TSX:SVI)

Historical Stock Chart

From May 2023 to May 2024