NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

Iteration Energy Ltd. ("Iteration") (TSX:ITX) and Storm Ventures International

Inc. ("SVI"), a private Alberta-based oil and gas exploration and production

company, are pleased to announce that they have entered into a definitive

arrangement agreement (the "Arrangement Agreement") pursuant to which Iteration

and SVI have agreed to complete a strategic business combination pursuant to a

statutory plan of arrangement (the "Arrangement"). The combination will create a

new, growth oriented company named Chinook Energy Inc. ("Chinook") with current

production in excess of 20,000 boe/d and a deep inventory of repeatable drilling

opportunities in both Western Canada and Tunisia.

Chinook will be led by SVI's current executive team, with Matthew Brister as

President and Chief Executive Officer. The SVI management team has demonstrated

a successful track record of corporate and project initiation, growth and value

creation in Western Canada over the last 25 years. Staff and management of

Chinook is expected to be comprised of current employees of SVI and Iteration.

Transaction Consideration

Under the terms of the Arrangement, Iteration shareholders may elect to receive:

(a) $1.83 cash for each Iteration share held, subject to a minimum aggregate

cash payment of $50 million and a maximum aggregate cash payment of $225

million, or

(b) 0.5631 of a common share of SVI for each Iteration share held, subject to

pro ration, if required, based on cash elections described above; or

(c) any combination of the foregoing, subject to the cash restrictions set out

above.

If the maximum cash is elected, Iteration shareholders will receive

approximately $1.05 of cash and 0.2400 of a common share of SVI for each

Iteration share held. If the minimum cash is elected, Iteration shareholders

will receive approximately $0.23 of cash and 0.4923 of a SVI share for each

Iteration share held. The Arrangement contemplates a $3.25 per share value for

SVI.

Based on $1.83 per Iteration share, the consideration received by Iteration

shareholders represents an 18% premium to Iteration's 30-day weighted average

trading price on the Toronto Stock Exchange and an 8% premium to the closing

trading price on April 30, 2010.

Matthew Brister, President and Chief Executive Officer of SVI, commented, "We

are very pleased to be able to expand our Western Canadian operations through

the integration of Iteration into our business. The Iteration assets, along with

our existing West Central Alberta properties have high quality gas resource play

opportunities in the Montney, Nikanassin and Notikewin with scale to support

growth from our initial 20,700 boe/d production base for several years. The

application of new technologies in these plays is quickly becoming proven in the

areas we operate and their exploitation on Iteration's lands have been hampered

by capital availability and more recently, gas prices. In addition, I am very

confident that our Tunisia light oil assets will add a material growth component

to Chinook."

Brian Illing, President and Chief Executive Officer of Iteration, added, "We are

pleased that Iteration's comprehensive strategic review has produced a very

positive outcome in the form of the transaction with SVI. Chinook will have an

attractive asset base in Western Canada and high impact exploration upside in

Tunisia. With strong leadership, a highly-skilled combination of executives and

staff, and substantial access to capital with solid institutional investor

support, Chinook is an exciting opportunity for our shareholders".

Transaction Financing and Institutional Sponsorship

SVI has entered into a $75 million fully committed subscription receipt

financing with a group of its existing investors, led by Alberta Investment

Management Corporation, on behalf of certain of its clients ("AIMCo"), at a

price of $3.25 per share.

SVI also intends to raise a minimum of $50 million by way of a marketed

subscription receipt private placement through a syndicate co-led by TD

Securities Inc. and FirstEnergy Capital Corp. AIMCo has agreed to subscribe for

$11.5 million of this offering and fully backstop the remaining $38.5 million,

if required. Each subscription receipt will be converted, for no additional cost

or action by the holder, into one common share of Chinook in accordance with the

Arrangement. If the full net proceeds from the subscription receipt financings

exceed the amount required to satisfy cash elections by Iteration shareholders

pursuant to the Arrangement, the remaining net proceeds are expected be used for

debt reduction and general corporate purposes. SVI plans to market this offering

to investors in North America and Europe and it is expected that the offering

will be priced in mid-May.

Lastly, SVI has entered into a fully committed bridge financing with AIMCo for

up to $125 million to fund the balance of the cash requirements of the

Arrangement, if any, to the extent that cash elections by Iteration shareholders

exceed the net proceeds from the subscription receipt financings. At its option,

Chinook may reduce the amounts outstanding under the bridge facility by way of

asset sales to AIMCo at prevailing market metrics.

"We are very appreciative of AIMCo's support of SVI as a private company and the

confidence they have shown in this transaction", said Matthew Brister. "We view

AIMCo as a long-term partner and a catalyst to expanding our institutional and

long-term investor base." AIMCo currently owns approximately 36% of SVI's shares

and pro-forma the Arrangement is expected to own between 22% and 26% of

Chinook's shares.

Key Attributes of Chinook (before any potential dispositions):

Chinook will combine high quality gas-weighted assets in Western Canada with an

exciting high growth oil business in North Africa which includes high impact

exploration, field development opportunities and production in Tunisia. Chinook

will have an extensive inventory of drilling and field development opportunities

in both Western Canada and North Africa with more than 775,000 net undeveloped

acres in Canada and more than 1.4 million net acres in Tunisia. Chinook will

also have the following key attributes:

- Initial total company production of approximately 20,700 boe/d consisting of

19,900 boe/d in Canada (30% liquids) and 800 bbl/d of light oil in Tunisia.

- Chinook's business plan will be to target a minimum 10% annual growth in the

assets and production levels in Canada initially relying on the footprint and

scale of the existing opportunities and asset base as a competitive edge.

- Chinook's international business will target 25% plus annual growth and will

initially be focused on oil assets in Tunisia. SVI currently expects the

Tunisian business to be self-funding within 18 months.

- Given the good visibility to activity and potential for meaningful production

growth management's initial production forecast for 2011 is 23,500 boe/d.

- 83.4 mmboe of National Instrument 51-101 ("NI 51-101") Proved plus Probable

reserves (83% in Canada) with significant future reserve growth potential

identified through increased recoveries, field extensions and

exploration.(1)(2)(3)(4)

- Proved plus Probable reserve life index of approximately 10 years.

- Canadian tax pools in excess of $715 million.

Notes:

(1) Before any potential dispositions.

(2) Iteration reserves evaluated as at December 31, 2009 by GLJ Petroleum

Consultants Ltd. and McDaniel & Associates Consultants Ltd. in accordance with

NI 51-101.

(3) SVI reserves evaluated as at December 31, 2009 by Paddock Lindstrom &

Associates Ltd. and Sproule International Limited in accordance with NI 51-101.

(4) Includes pro-forma interim period asset acquisition by SVI. Reserves for

acquired assets evaluated as at December 31, 2009 by McDaniel & Associates

Consultants Ltd. in accordance with NI 51-101.

Upon completion of the Arrangement, management anticipates that it will have the

following domestic and international opportunities:

2010 Focus on Western Canadian Oil Opportunities

- An initial focus on waterflood performance at Manyberries (Sunburst) and

Spirit River/Grovedale (Doe Creek) and follow-up to a potentially prolific Doig

oil discovery in northeast British Columbia.

- Evaluation and exploitation of the Cardium land position in west central Alberta.

- An active 2011 winter program in the Keg River at Rainbow Lake.

Big Play Light Oil Exposure in Tunisia

- Q2 2010 exploration activity including the drilling of a 4,400 metre

Ordovician test at Jenein, Tunisia (65% working interest) and operatorship of a

2,900 metre offshore well at Fushia, Tunisia (35% working interest) in 90 metres

of water.

- Plan of Development approval and appraisal of the onshore oil discovery on the

Remada Sud permit (85% working interest) onshore in the Ghadames Basin.

- In excess of 15 drillable exploratory prospects and three undeveloped

discoveries on 7 blocks.

Priority Development of Gas Resource Opportunities

- Confirm the extent of high quality resource opportunities in the Montney at

Knopcik, Gordondale and Monias.

- Prove up the potential of the large scale exposure to resource opportunities

to the Nikanassin and Notikewin at Gold Creek, Knopcik, Gilby and Brazeau.

- Maintain a development bias towards projects with liquid yield in excess of 25

bbls/mmcf.

Financial Capacity

Prior to closing, SVI expects to finalize an approximate $300 million borrowing

base facility for Chinook, currently being arranged by Societe Generale Canada

Branch and TD Securities, with an expected draw of between $190 - $225 million

dependent upon cash elections made by the Iteration shareholders.

Chinook Management Team

Upon completion of the Arrangement, the executive management team and initial

directors of Chinook will be led by the current SVI management team. Many of the

key individuals have worked together successfully in previous public companies

focused in Western Canada and internationally.

Matthew Brister P. Geol., President and Chief Executive Officer

Mr. Brister has served as President and CEO of Pinnacle Resources, Storm Energy

Ltd. and Storm Energy Inc.

L. Geoffrey Barlow CA, Vice President, Finance and Chief Financial Officer

Prior to joining SVI in November 2007, Mr. Barlow most recently served as Vice

President and Chief Financial Officer of Husky Energy and held senior management

positions at Renaissance Energy before its sale to Husky.

P. Grant Wierzba P Eng. Vice President, Operations

Mr. Wierzba will continue in the senior operations management role of the

Canadian business. Grant's experience includes senior officer positions with

Renaissance Energy, Pinnacle Resources, Storm Energy Inc. and Storm Energy Ltd.

Roy Smitshoek P Eng., Chief Operating Officer SVI, Tunisia

Mr. Smitshoek will continue in the senior operational management role of the

International business. His experience includes senior officer positions with

Renaissance Energy and Moneta.

Walter Vrataric, Vice President Business Development and Land

Mr. Vrataric will have business development and contract responsibilities in

both the domestic and international business units and brings experience from

his time at One Exploration, Rock Creek, Advantage Energy Trust and Search

Energy.

Tim Halpen P Eng. Vice President, Exploitation

Mr Halpen has 13 years experience and has responsibilities for the reservoir

engineering and acquisition and divestiture role in Chinook. His previous

experience includes positions with Cometra Energy, Vintage Petroleum and

Wilderness Energy Corp.

Tom Lindskog P Geol, Vice President, Exploration

Mr. Lindskog is a registered Professional Geologist with 29 years experience in

Western Canada, the United Kingdom continental shelf and North Africa. Mr.

Lindskog's experience includes senior officer positions with Pinnacle Resources,

Storm Energy Ltd. and Storm Energy Inc.

Chinook Board of Directors

Matthew Brister - President and CEO of SVI

John A. Brussa - Partner of Burnet, Duckworth & Palmer LLP

Stuart G. Clark - Independent Businessman

Robert Cook - Senior Vice President of ARC Financial Corp.

Simon Munro - Managing Director of Lime Rock Partners

P. Grant Wierzba - Vice President, Operations and Director of SVI

Donald Archibald - Chairman of Iteration

The Arrangement

The Arrangement is subject to customary TSX, court and regulatory approvals and

the requisite approval of 66 2/3% of votes cast by the securityholders of

Iteration, voting together as a single class, at a securityholder meeting. The

information circular for the Iteration securityholder meeting is expected to be

mailed to Iteration securityholders on or about May 31, 2010 and it is

anticipated that the special meeting of Iteration's securityholders will be held

on or about June 28, 2010 with closing of the Arrangement to occur shortly

thereafter.

Iteration's Board of Directors has unanimously determined that the Arrangement

is in the best interests of Iteration and its securityholders, and has, based

upon, among other things, the opinions of its financial advisors, unanimously

determined that the Arrangement is fair to the Iteration securityholders, has

unanimously approved the Arrangement and the entering into of the Arrangement

Agreement and has resolved unanimously to recommend that Iteration

securityholders vote in favour of the Arrangement. All of the directors and

senior officers of Iteration have entered into lock-up agreements with SVI to

vote their Iteration shares and options in favour of the Arrangement,

representing approximately 16% of the aggregate issued and outstanding Iteration

shares and options.

The Arrangement Agreement prohibits Iteration from soliciting or initiating any

discussion regarding any other business combination or sale of material assets,

contains provisions enabling SVI to match competing, unsolicited proposals and,

subject to certain conditions, provides for Iteration to pay a termination fee

of $20 million to SVI in certain circumstances.

Advisors

TD Securities Inc. acted as sole financial advisor to SVI for the Arrangement.

FirstEnergy Capital Corp. ("FirstEnergy") and Scotia Waterous Inc. ("Scotia")

acted as financial advisors to Iteration. FirstEnergy and Scotia have advised

the Iteration Board of Directors that they are of the opinion that the

consideration to be received by Iteration shareholders pursuant to the

Arrangement is fair from a financial point of view, subject to review of final

documentation. A copy of the fairness opinions will be included in the Iteration

information circular to be sent to securityholders for the special meeting to be

called to consider the Arrangement.

Chinook Statistical Summary - Unaudited Information (1)

-------------------------------------------------------

SVI (5) Iteration Pro Forma

------------------------------

Production - Current

Western Canada (boe/d) 6,100 13,800 19,900

Tunisia (bbls/d) 800 - 800

------------------------------

Total Company (boe/d) 6,900 13,800 20,700

------------------------------

------------------------------

% Gas 66 69 68

2009 Proved Reserves (NI 51-101) (3)(4)

Western Canada (mmboe) 13.9 33.0 46.9

Tunisia (mmboe) 4.9 - 4.9

------------------------------

Total (mmboe) 18.8 33.0 51.8

------------------------------

------------------------------

% Gas 54 63 60

2009 P+P Reserves (NI 51-101) (3)(4)

Western Canadian (mmboe) 18.8 50.4 69.2

Tunisian (mmboe) 14.2 - 14.2

------------------------------

Total (mmboe) 33.0 50.4 83.4

------------------------------

------------------------------

% Gas 42 63 55

Financial Summary - May 1, 2010

Estimated Net Debt ($mm) 27.0(6) 186.5

Basic Shares Outstanding (mm) 122.9 211.1

Fully Diluted Shares Outstanding (mm) (2) 128.1 215.6

Canadian Tax Pools ($mm) 242.0 520.0

Notes:

(1) Before any potential dispositions.

(2) Based on in-the-money options at $1.83 for Iteration and $3.25 for SVI.

(3) Before any potential dispositions.

(4) Based on independent December 31, 2009 reserve evaluations net of 2010

dispositions.

(5) Includes pro-forma interim period asset acquisition by SVI.

(6) Excludes approximately $41 million of the purchase price of SVI's

interim period asset acquisition.

Forward-Looking Statements

In the interest of providing SVI's shareholders, Iteration's shareholders and

potential investors with information regarding SVI, Iteration and Chinook,

including management's assessment of the future plans and operations of Chinook,

certain statements contained in this document constitute forward-looking

statements or information (collectively "forward-looking statements") within the

meaning of applicable securities legislation. Forward-looking statements are

typically identified by words such as "anticipate", "continue", "estimate",

"expect", "forecast", "may", "will", "project", "could", "plan", "intend",

"should", "believe", "outlook", "potential", "target" and similar words

suggesting future events or future performance. In addition, statements relating

to "reserves" are deemed to be forward-looking statements as they involve the

implied assessment, based on certain estimates and assumptions, that the

reserves described exist in the quantities predicted or estimated and can be

profitably produced in the future. In particular, this document contains,

without limitation, forward-looking statements pertaining to the following:

expectations of management regarding the proposed Arrangement, including the

timing of completion of the Arrangement, financing activities to be conducted by

SVI in connection with the Arrangement, including the subscription receipt

offerings, bridge financing and the use of proceeds thereof; mailing of an

information circular approving the Arrangement, holding of a securityholder

meeting approving the Arrangement, operating and financial metrics of the

Arrangement, potential synergies resulting from the Arrangement; operational and

business plans subsequent to the Arrangement; debt levels and the pro-forma

effect of the Arrangement on Chinook's production, cash flow, reserves,

undeveloped land position and tax pools.

With respect to forward-looking statements contained in this document, each of

SVI and Iteration have made assumptions regarding, among other things: future

capital expenditure levels; future oil and natural gas prices and differentials

between light, medium and heavy oil prices; future oil and natural gas

production levels; future exchange rates and interest rates; ability to obtain

equipment in a timely manner to carry out development activities; ability to

market oil and natural gas successfully to current and new customers; the impact

of increasing competition; the ability to obtain financing on acceptable terms;

and ability to add production and reserves through development and exploitation

activities. Although SVI and Iteration believe that the expectations reflected

in the forward looking statements contained in this document, and the

assumptions on which such forward-looking statements are made, are reasonable,

there can be no assurance that such expectations will prove to be correct.

Readers are cautioned not to place undue reliance on forward-looking statements

included in this document, as there can be no assurance that the plans,

intentions or expectations upon which the forward-looking statements are based

will occur. By their nature, forward-looking statements involve numerous

assumptions, known and unknown risks and uncertainties that contribute to the

possibility that the predictions, forecasts, projections and other

forward-looking statements will not occur, which may cause SVI's, Iteration's or

Chinook's actual performance and financial results in future periods to differ

materially from any estimates or projections of future performance or results

expressed or implied by such forward-looking statements. These risks and

uncertainties include, among other things, the following: that the Arrangement

may not close when planned or at all or on the terms and conditions set forth

herein; the failure of SVI and Iteration to obtain the necessary securityholder,

Court, regulatory and other third party approvals required in order to proceed

with the Arrangement; volatility in market prices for oil and natural gas;

failure to complete planned financing activities; incorrect assessment of the

value of the Arrangement; failure to realize the anticipated benefits and

synergies of the Arrangement; general economic conditions in Canada, the U.S.

and globally; and the other factors described under "Risk Factors" in

Iteration's most recently filed Annual Information Form available in Canada at

www.sedar.com. Readers are cautioned that this list of risk factors should not

be construed as exhaustive.

The forward-looking statements contained in this document speak only as of the

date of this document. Except as expressly required by applicable securities

laws, SVI and Iteration do not undertake any obligation to publicly update or

revise any forward looking statements, whether as a result of new information,

future events or otherwise. The forward-looking statements contained in this

document are expressly qualified by this cautionary statement.

Barrels of Oil Equivalent

Barrels of oil equivalent (boe) is calculated using the conversion factor of 6

Mcf (thousand cubic feet) of natural gas being equivalent to one barrel of oil.

Boes may be misleading, particularly if used in isolation. A boe conversion

ratio of 6 Mcf:1 bbl (barrel) is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead.

This joint news release does not constitute an offer to sell or the solicitation

of an offer to buy any securities within the United States. The securities to be

offered have not been and will not be registered under the U.S. Securities Act

of 1933, as amended, or any state securities laws, and may not be offered or

sold in the United States absent registration or an applicable exemption from

the registration requirements of such Act or other laws.

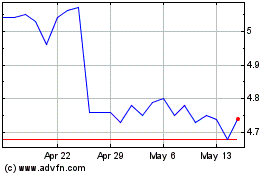

StorageVault Canada (TSX:SVI)

Historical Stock Chart

From May 2024 to May 2024

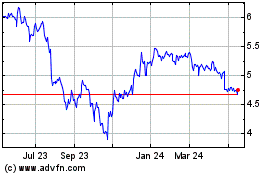

StorageVault Canada (TSX:SVI)

Historical Stock Chart

From May 2023 to May 2024