Andean American Appoints SRK Consulting to Update Invicta Resource Estimate

14 February 2012 - 12:59AM

Marketwired Canada

Andean American Gold Corp. ("Andean American" or the "Company") (TSX

VENTURE:AAG)(FRANKFURT:AQN) announces that it has appointed SRK Consulting (US)

Inc. to update the Invicta Project resource estimate.

Following the independent review of the July 2010 Feasibility Study, which the

Company commissioned SRK Consulting (US) Inc. to conduct in September 2010, and

the subsequent work they undertook towards updating that study, management and

the Board of Directors of the Company have concluded that the July 2010

Feasibility Study can no longer be relied upon.

In its October 28, 2011 press release, the Company announced that, although the

updated Feasibility Study was not yet complete, early indications were that the

initial capital cost to build an underground mine at Invicta would be

considerably higher than was forecast in the July 2010 Feasibility Study, and

may exceed US$150 million, partly due to increases in the estimates for

infrastructure, such as roads and water supply. Indications, based on the work

done up to that stage, were that the mine plan would only support an ore

production rate of 4,000 tonnes per day and not 5,000 tonnes per day as per the

July 2010 Feasibility Study, and management estimated that project operating

costs could be between US$30 to US$40 per ore tonne (not finalized by SRK and

other Feasibility Study consultants), compared to the US$28 per ore tonne

indicated in the July 2010 Feasibility Study. Under National Instrument 43-101,

the Company was required to file, within 45 days of the October 28, 2011 news

release, a new technical report setting forth the revisions to the resource

estimate on the Invicta Project. The Company has not yet filed the required

technical report and is in default of its filing requirements. The contents of

the Company's October 28, 2011 press release constituted a material change for

the Company for which it did not file a material change report as required under

applicable securities laws.

The issue with the prior technical report was brought to the Company's attention

by the Ontario Securities Commission as part of its review of the Company's

disclosure record which review was being conducted in connection with the

Company's application to become a reporting issuer in Ontario.

In view of the fact that the Company believes that the July 2010 Feasibility

Study can no longer be relied upon, and that the work to update the Feasibility

Study is on hold, shareholders are advised that the Invicta Project can no

longer be considered to host mineral reserves and it necessary to re-classify

the Invicta Project Probable Reserves as mineral resources. It is anticipated

that the revised resource estimate will be completed by mid-April. Until the

revised resource estimate is filed, shareholders are referred to the mineral

resource estimates included in the Invicta Property Updated Technical Report

dated November 20, 2009 which are summarised in the tables below:

---------------------------------------------------------------------------

MEASURED AND INDICATED RESOURCE SUMMARY - ALL STRUCTURES - NOVEMBER 20,

2009

---------------------------------------------------------------------------

GOLD SILVER COPPER LEAD ZINC GOLD

STRUCTURE TONNES DENSITY g/t g/t % % % OUNCES

---------------------------------------------------------------------------

Atenea (M) 868 000 2.77 2.71 31.26 0.69 0.73 0.61 76 000

---------------------------------------------------------------------------

Atenea (In) 4 747 000 2.81 1.96 16.52 0.40 0.40 0.38 300 000

---------------------------------------------------------------------------

Pucamina 2 028 000 2.54 1.70 5.71 0.11 0.18 0.25 111 000

---------------------------------------------------------------------------

Dany 1 063 000 2.74 0.75 10.39 0.41 0.10 0.11 26 000

---------------------------------------------------------------------------

Ydalia 1 592 000 2.69 1.63 28.85 1.00 0.22 0.16 31 000

---------------------------------------------------------------------------

Ydalia 2 396 000 2.72 2.92 13.83 0.27 0.22 0.09 37 000

---------------------------------------------------------------------------

Zona 4 1 041 000 2.72 3.83 20.96 0.70 0.15 0.12 128 000

---------------------------------------------------------------------------

TOTAL 10 735 000 2.73 2.05 16.08 0.43 0.32 0.30 709 000

---------------------------------------------------------------------------

---------------------------------------------------------------------------

INFERRED RESOURCE SUMMARY - ALL STRUCTURES - NOVEMBER 20, 2009

---------------------------------------------------------------------------

GOLD SILVER COPPER LEAD ZINC GOLD

STRUCTURE TONNES DENSITY g/t g/t % % % OUNCES

---------------------------------------------------------------------------

Atenea 9 700 000 2.77 0.74 9.16 0.32 0.17 0.17 2 32 000

---------------------------------------------------------------------------

Pucamina 704 000 2.54 0.80 8.10 0.13 0.13 0.15 18 000

---------------------------------------------------------------------------

Dany 1 654 000 2.74 0.17 12.42 0.46 0.80 0.13 9 000

---------------------------------------------------------------------------

Ydalia 1 597 000 2.72 0.25 16.02 0.54 0.09 0.27 5 000

---------------------------------------------------------------------------

Ydalia 2 590 000 2.72 0.76 10.53 0.44 0.36 0.07 15 000

---------------------------------------------------------------------------

Zona 4 981 000 2.69 0.91 29.05 0.59 0.07 0.05 29 000

---------------------------------------------------------------------------

TOTAL 14 226 000 2.75 0.67 11.20 0.36 0.24 0.15 308 000

---------------------------------------------------------------------------

The November 20, 2009 updated resource estimate, comprised of sulphide

mineralization only, is based on 12,400 metres of diamond drilling completed by

Pangea Peru SA during 1997 and 1998, as well as 16,401 metres of diamond

drilling and approximately 1,200 metres of underground development completed by

Andean American during 2007 and 2008. The full Invicta Property Updated

Technical Report is available on the Company's website at www.aaggold.com or at

www.sedar.com.

"In the interests of clarity and transparency we have engaged SRK to update our

mineral resource estimate to reflect the current stage of the Invicta Project.

We continue to believe in the mineral potential at Invicta and are actively

reviewing a number of opportunities to unlock the value of this project," said

David Rae, President and CEO of Andean American.

Qualified Person:

Victor A. Jaramillo, M Sc. A., P.Geo, a geologist with Discover Geological

Consultants Inc., and a qualified person for the purposes of National Instrument

43-101 prepared the Invicta Project Updated Technical Report dated November 20,

2009 and has reviewed and approved the scientific and technical disclosure

contained in this release. For detailed information on the key assumptions,

parameters and methods used to estimate the mineral resources, along with other

information about the properties, please refer to the Technical Report which is

filed on SEDAR and is available on the Company's website at www.aaggold.com.

About Andean American

Andean American is an international mining and exploration company focused on

value growth through the development of gold and copper projects in Peru and

currently has two key assets: the 31,600 hectare Invicta gold-silver-copper

advanced exploration stage project and 64.95% of Sinchao Metals Corp., owner of

the Sinchao gold-silver-copper exploration project.

For further information about Andean American, please visit the Company's

website at www.AAGgold.com or call 416 368 9500.

On behalf of Andean American Gold Corp.,

David Rae, President and Chief Executive Officer

Forward Looking Information

This news release may contain forward-looking information within the meaning of

the Securities Act (Ontario) ("forward-looking statements"). Such

forward-looking statements may include the Company's plans for its mineral

projects, the overall economic potential of its properties, the availability of

adequate financing and involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or achievements

expressed or implied by such forward-looking statements to be materially

different. Such factors include, among others, risks and uncertainties relating

to potential political risks involving the Company's operations in a foreign

jurisdiction, uncertainty of production and costs estimates and the potential

for unexpected costs and expenses, physical risks inherent in mining operations,

currency fluctuations, fluctuations in the price of gold and other metals,

completion of economic evaluations, changes in project parameters as plans

continue to be refined, the inability or failure to obtain adequate financing on

a timely basis, and other risks and uncertainties, including those described in

the Company's Financial Statements, Management Discussion and Analysis and

Material Change Reports filed with the Canadian Securities Administrators and

available at www.sedar.com.

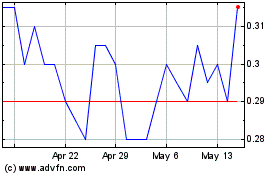

Aftermath Silver (TSXV:AAG)

Historical Stock Chart

From Apr 2024 to May 2024

Aftermath Silver (TSXV:AAG)

Historical Stock Chart

From May 2023 to May 2024