AIP Realty Trust (the “

Trust” or

“

AIP”) (TSXV: AIP.U) today announced that its

exclusive development and property management partner, Dallas-based

AllTrades Industrial Properties, Inc.

(“

AllTrades”), has completed construction of a new

facility located in Lewisville, TX (the “

Lewisville Main

Property”) in the northern area of the Dallas-Fort Worth

market. All dollar figures are stated in U.S dollars.

The Lewisville Main Property is a light

industrial flex facility comprised of approximately 69,500 rentable

square feet across 22 WorkSpace Shops™, 6 WorkSpace Studios™, and

27 WorkSpace Secured Parking™ spaces. The facility is ready for

occupancy by tenants, is 68% leased, and is tracking similarly to

the other AllTrades facilities such that upon substantial

completion and delivery, the velocity of leasing significantly

increases to become fully occupied shortly after delivery. As

confirmed by AllTrades, the rental rates in the executed leases

have exceeded the projected underwritten rental rate by seven

percent (7%) with a blended NNN rental rate of $15.43 per square

foot.

|

|

| AllTrades Lewisville Main WorkSpace Shops™ |

AllTrades Lewisville Main Aerial |

“We are pleased to see another high-quality facility

completed in the Lewisville Main Property and added to the AIP

acquisition pipeline,” said Les Wulf, Executive Chairman. “Once

again, AllTrades has executed effectively on both the development

and marketing of a new facility. The strong initial occupancy,

coupled with this being the second “AllTrades branded” facility in

the Lewisville, TX market, further validates the growth strategy of

locating new AllTrades facilities on infill locations in

established communities. It also substantiates our thesis on the

unmet need for light industrial flex properties in the Texas real

estate market.”

The Lewisville Main Property is the third

facility to be completed among a group of five properties the Trust

agreed to acquire last year. As announced on May 24, 2022, AIP

entered into membership interest purchase agreements (the

“Agreements”) with AllTrades Five Properties, LLC

(“AT5P”) providing the Trust with the exclusive

option to acquire up to five properties in final stages of

development in the Dallas-Fort Worth (“DFW”) area

of Texas, including the Lewisville Main Property. The first two

properties of this group previously completed, located in Mesquite

and Plano TX, respectively, are now 100% leased and generate NNN

rents averaging $15.37 per square foot, also exceeding the

underwriting rental rates. The remaining two properties from this

group are expected to be completed by the fourth quarter of

2023.

On September 26, 2022, the Trust announced

similar forward purchase agreements to acquire up to seven

additional AllTrades-branded properties in the DFW area. To date,

AIP has now entered into forward purchase agreements to acquire a

total of 12 light industrial flex properties totaling 841,109

square feet of leasable space, comprised of 191 WorkSpace Shops TM,

136 WorkSpace Studios TM and 339 WorkSpace Secured Parking TM

spaces. The aggregate projected purchase price assuming that all of

the properties are acquired by AIP would be $205,500,000.

The facilities are intended to address the

underserved needs for new generation, high-quality light industrial

flex space in established communities targeting the large, diverse,

and growing market of trades, services, and businesses that require

smaller space across the US seeking locations close to their

customer and employee base, following the growing trend of last

mile service. The facilities offer turnkey modern, appealing spaces

that can be readily adapted to multiple uses.

The Trust’s governance committee will begin the

process of evaluating whether to exercise the option based on its

review of the audited financial statements and the appraisal of the

Lewisville Main Property. The Trust will only move forward with the

acquisition of the Lewisville Main Property if the Trust’s

governance committee and independent trustees make a favorable

recommendation, and the Trust has secured the funds necessary to do

so.

About AIP Realty Trust

AIP Realty Trust is a real estate investment

trust with a growing portfolio of light industrial flex facilities

focused on businesses that require smaller space and the trades and

services sectors in the U.S. These properties appeal to a diverse

range of small space users, such as contractors, skilled trades,

suppliers, repair services, last-mile providers, small businesses

and assembly and distribution firms. They typically offer

attractive fundamentals including low tenant turnover, stable cash

flow and low capex intensity, as well as significant growth

opportunities. With an initial focus on the Dallas-Fort Worth

market, AIP plans to roll out this innovative property offering

nationally. AIP holds the exclusive rights to finance the

development of and to purchase all the completed and leased

properties built across North America by its development and

property management partner, AllTrades Industrial Properties, Inc.

For more information, please visit www.aiprealtytrust.com.

For further information from the Trust,

contact:Leslie WulfExecutive Chairman(214)

679-5263les.wulf@aiprealtytrust.com

Or

Greg VorwallerChief Executive Officer(778)

918-8262Greg.vorwaller@aiprealtytrust.com

Cautionary Statement on

Forward-Looking Information

This press release contains statements which

constitute “forward-looking information” within the meaning of

applicable securities laws, including statements regarding the

plans, intentions, beliefs and current expectations of AIP Realty

Trust with respect to future business activities and operating

performance. Forward-looking information is often identified by the

words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “expect” or similar

expressions and includes information regarding, the expected timing

and completion of the acquisition of the LLCs, the effect of the

acquisitions of the LLCs on AIP’s financial performance, the

ability to secure the funding required to complete the acquisition

of the LLCs, the satisfaction of the conditions precedent to

consummation of the acquisition of the LLCs, including the ability

to obtain required regulatory approvals, the ability of AIP to

execute its business and growth strategies, future acquisitions by

the Trust, the ability to obtain regulatory and unitholder

approvals and other factors. When or if used in this news release,

the words “anticipate”, “believe”, “estimate”, “expect”, “target”,

“plan”, “forecast”, “may”, “schedule” and similar words or

expressions identify forward-looking statements or information.

These forward-looking statements or information may relate to

proposed financing activity, proposed acquisitions, regulatory or

government requirements or approvals, the reliability of

third-party information and other factors or information. Such

statements represent the Trust’s current views with respect to

future events and are necessarily based upon a number of

assumptions and estimates that, while considered reasonable by the

Trust, are inherently subject to significant business, economic,

competitive, political and social risks, contingencies and

uncertainties. Many factors, both known and unknown, could cause

results, performance or achievements to be materially different

from the results, performance or achievements that are or may be

expressed or implied by such forward- looking statements. Such

factors include, but are not limited to, the following: (i) AIP

will receive financing on favourable terms; (ii) the future level

of indebtedness of AIP and its future growth potential will remain

consistent with AIP’s current expectations; (iii) there will be no

changes to tax laws adversely affecting AIP’s financing capacity or

operations; (iv) the impact of the current economic climate and the

current global financial conditions on AIP’s operations, including

its financing capacity and asset value, will remain consistent with

AIP’s current expectations; (v) the performance of AIP’s

investments in Texas will proceed on a basis consistent with AIP’s

current expectations; and (vi) capital markets will provide AIP

with readily available access to equity and/or debt. The Trust does

not intend, and do not assume any obligation, to update these

forward-looking statements or information to reflect changes in

assumptions or changes in circumstances or any other events

affecting such statements and information other than as required by

applicable laws, rules and regulations.

The forward-looking statements contained in this

news release are expressly qualified in their entirety by this

cautionary statement. All forward-looking statements in this press

release are made as of the date of this press release. AIP does not

undertake to update any such forward- looking information whether

as a result of new information, future events or otherwise, except

as required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release is not an offer of securities

for sale in the United States. The securities may not be offered or

sold in the United States absent registration or an exemption from

registration under U.S. Securities Act of 1933, as amended (the

“U.S. Securities Act”). The Trust has not registered and will not

register the securities under the U.S. Securities Act. The Trust

does not intend to engage in a public offering of their securities

in the United States.

Source: AIP Realty Trust

Photos accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/59767f8d-fc34-48e3-b5af-35c4ff12f705

https://www.globenewswire.com/NewsRoom/AttachmentNg/e6e00a65-e5b9-410c-97cd-4f4ac143f7df

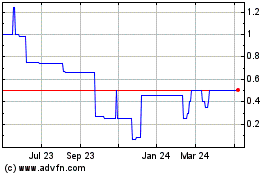

AIP Realty (TSXV:AIP.U)

Historical Stock Chart

From Jun 2024 to Jul 2024

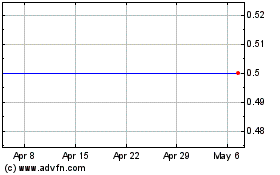

AIP Realty (TSXV:AIP.U)

Historical Stock Chart

From Jul 2023 to Jul 2024