Crowflight Finalizes Metals Price Protection Requirements for Debt Facility

30 July 2008 - 10:07PM

Marketwired

TORONTO, ONTARIO (TSX VENTURE: CML) today announced that it has

begun drawing down on the $45 million Final Tranche Loan of its

debt facility being used to fund development of the Bucko Lake

Nickel Project near Wabowden, Manitoba.

Of the $45 million, $15.3 million will be used to pay the $15

million bridge facility plus interest, with the remainder to be

applied to completing construction and ramp up of the Bucko Lake

Mine. This credit facility requires a price protection strategy be

put in place to limit the risk against falling nickel prices. On

July 28, 2008, the Company entered into a forward sales contract

agreements with the lender to implement a risk management strategy

to manage commodity price exposure on nickel sales. Forward sale

contracts were entered into from the fourth quarter of 2008 to the

fourth quarter of 2012 for a total of 20.5 million pounds of nickel

at a price of $8.49/pound.

Details are as follows:

- 2008 - 0.40 million pounds Nickel

- 2009 - 3.88 million pounds Nickel

- 2010 - 5.73 million pounds Nickel

- 2011 - 5.54 million pounds Nickel

- 2012 - 4.94 million pounds Nickel

This represents approximately 21% of the current NI 43-101

compliant proven and probable reserve base of 97.2 million pounds

of contained nickel at Bucko. Further increases in the mineable

reserve base will result in lower overall hedge percentages.

The forward sales contracts are considered derivative financial

instruments and are used for risk management purposes and not for

generating trading profits.

Crowflight Minerals - Canada's Next Nickel Producer

Crowflight Minerals Inc. (TSX VENTURE: CML) is a Canadian junior

mining exploration and development company focused on nickel,

copper and Platinum Group Mineral (PGM) projects in the Thompson

Nickel Belt and Sudbury Basin. The Company currently owns and/or

has under option approximately 800 square kilometres of exploration

and development properties in Manitoba and Ontario.

Crowflight's priority is to bring the fully-funded Bucko Lake

Nickel Project located near Wabowden, Manitoba into production by

the third quarter of 2008.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the

information in this press release constitutes "forward-looking

information" within the meaning of Canadian securities law. Such

forward-looking information may be identified by words such as

"plans", "proposes", "estimates", "intends", "expects", "believes",

"may", "will". There can be no assurance that such statements will

prove to be accurate; actual results and future events could differ

materially from such statements. Investors are cautioned not to put

undue reliance on forward-looking information. Except as otherwise

required by applicable securities statutes or regulation, the

Company expressly disclaims any intent or obligation to update

publicly forward-looking information, whether as a result of new

information, future events or otherwise.

Total Shares Outstanding: 269.6MM

Fully Diluted: 308.3MM

52-Week Trading Range: C$0.32 - $0.93

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy of this release.

Contacts: Crowflight Minerals Inc. Mike Hoffman President and

CEO (416) 861-2964 Crowflight Minerals Inc. Heather Colpitts

Manager, Investor and Public Relations (416) 861-5803 Email:

info@crowflight.com Website: www.crowflight.com

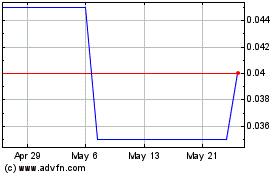

Canickel Mining (TSXV:CML)

Historical Stock Chart

From May 2024 to Jun 2024

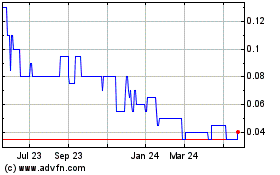

Canickel Mining (TSXV:CML)

Historical Stock Chart

From Jun 2023 to Jun 2024