IsoEnergy Ltd. (“

IsoEnergy”) (TSXV: ISO;

OTCQX: ISENF) and Consolidated Uranium Inc. (“Consolidated Uranium”

or “CUR”) (TSXV: CUR; OTCQX: CURUF) are pleased to

announce the successful completion of the previously announced

arrangement (the “

Arrangement” or the

“

Merger”) whereby IsoEnergy has acquired all of

the issued and outstanding common shares of Consolidated Uranium

(the “

CUR Shares”).

The Arrangement results in IsoEnergy acquiring

100% of the CUR Shares not already held by IsoEnergy or its

affiliates and Consolidated Uranium becoming a wholly owned

subsidiary of IsoEnergy. Pursuant to the Arrangement, Consolidated

Uranium shareholders (the “CUR Shareholders”)

received 0.500 common shares of IsoEnergy (each whole share, an

“IsoEnergy Share”) for each CUR Share held. In

aggregate, IsoEnergy issued approximately 52,164,727 million

IsoEnergy Shares under the Arrangement.

In addition, each of the escrow release

conditions in relation to IsoEnergy’s previously announced marketed

private placement offering of 8,134,500 subscription receipts (the

“Subscription Receipts”) for aggregate gross

proceeds of $36,605,250 have been met. As a result, each

outstanding Subscription Receipt has been converted into one common

share of IsoEnergy and the net proceeds from the offering has been

released from escrow. This investment was led by cornerstone

investors including, NexGen Energy Ltd., Mega Uranium Ltd., Energy

Fuels Inc., and Sachem Cove Partners LLC. For additional

information on the offering of Subscription Receipts, please refer

to the news release of IsoEnergy dated October 19, 2023.

Philip Williams, CEO and Director of IsoEnergy,

commented, “The closing of the Merger between IsoEnergy and

Consolidated Uranium marks a significant milestone for IsoEnergy in

cementing its position as a well-funded, globally significant,

multi-asset, multi-jurisdiction uranium developer and explorer. The

company now ranks among the largest publicly traded uranium

companies in the world allowing for greater access to capital and

trading liquidity, broader attractiveness among investors and

utilities as well as positioning the company strongly for continued

growth through further M&A. With significant opportunities for

advancement within the combined company’s portfolio of assets, we

look forward to unlocking value through exploration, particularly

at Hurricane, progressing our U.S. assets toward a production ready

state, and advancing our Australian projects, all with uranium

prices surpassing 16-year highs. Moreover, I extend my gratitude to

the departing directors of CUR for their invaluable support and

guidance during the past three years. We wish them well as they

pursue further endeavours.”

Tim Gabruch, President of IsoEnergy, commented,

“At a time when sentiment and support for the nuclear sector is

increasingly positive and the industry is poised for significant

growth, the need for near-term uranium production and high-quality

uranium discoveries is growing in importance each day. More than

ever, these projects will be needed in stable geopolitical

jurisdictions. This aligns with IsoEnergy as it combines assets

with Consolidated Uranium, for a portfolio focused on Canada, the

U.S. and Australia. Backstopped by its exceptional Hurricane

deposit, bringing together the complementary assets of these two

companies will position IsoEnergy to contribute to the world’s

growing uranium needs in a meaningful way. Additionally, we extend

our appreciation to Trevor Thiele, outgoing director of IsoEnergy,

for his years of service and impactful contributions to our

company’s success. We look forward to continuing to benefit from

his support as a board member of our major shareholder,

NexGen.”

The CUR Shares are expected to be delisted from

the TSX Venture Exchange at market close on December 8, 2023.

IsoEnergy will cause Consolidated Uranium to apply to the relevant

Canadian securities regulatory authorities to cease to be a

reporting issuer under applicable Canadian securities

laws.

Board of Directors and

Management

As previously announced, IsoEnergy’s board of

directors (the “Company Board”) now consists of

six directors, including Richard Patricio as Chair, Leigh Curyer as

Vice Chair, Chris McFadden, Peter Netupsky, Philip Williams, and

Mark Raguz.

The senior management team of IsoEnergy now

includes Philip Williams as Chief Executive Officer, Tim Gabruch as

President, Graham du Preez as Chief Financial Officer, Marty Tunney

as Chief Operating Officer, Darryl Clark as Executive Vice

President Exploration and Development, Dan Brisbin as Vice

President, Exploration and Jason Atkinson as Vice President,

Business Development.

Full details of the Merger and certain other

matters are set out in the management information circular of

Consolidated Uranium and can be found under Consolidated Uranium’s

issuer profile on SEDAR+ at www.sedarplus.ca. A copy of the early

warning report of IsoEnergy in connection with its acquisition of

the CUR Shares will be filed under IsoEnergy’s issuer profile on

SEDAR+ and can be obtained by contacting IsoEnergy as set out

below.

Additional Information for Former CUR

Shareholders

Pursuant to the Merger, former CUR Shareholders

are entitled to receive 0.500 of an IsoEnergy Share for each CUR

Share held. In order to receive IsoEnergy Shares in exchange for

CUR Shares, former registered CUR Shareholders must complete, sign,

date and return (together with the certificate or DRS statement

representing their CUR shares) the letter of transmittal that was

mailed to them prior to closing of the Merger. The letter of

transmittal is also available under CUR’s issuer profile on SEDAR+

at www.sedarplus.ca and by contacting Computershare Investor

Services Inc., the depositary for the transaction, by telephone

toll-free in North America at 1-800-564-6253 or by email at:

corporateactions@computershare.com.

For those former CUR Shareholders whose CUR

Shares are registered in the name of a broker, investment dealer,

bank, trust company, trust or other intermediary or nominee, they

should contact such nominee for assistance in depositing their CUR

Shares and should follow the instructions of such intermediary or

nominee.

IsoEnergy Grants Options

IsoEnergy Ltd. has granted, subject to the

approval of the TSX Venture Exchange, 2,175,000 incentive stock

options to certain directors, officers, employees, and consultants

of IsoEneregy. The options were granted on December 5, 2023, have a

term of five years, vest in three annual installments commencing on

the grant date, and are exercisable at a price of $4.13 per

IsoEnergy Share.

About IsoEnergy

IsoEnergy Ltd. (TSXV: ISO) (OTCQX: ISENF) is a

leading, globally diversified uranium company with substantial

current and historical mineral resources in top uranium mining

jurisdictions of Canada, the U.S., Australia, and Argentina at

varying stages of development, providing near, medium, and

long-term leverage to rising uranium prices.

IsoEnergy is currently advancing its Larocque

East Project in Canada’s Athabasca Basin, which is home to the

Hurricane deposit, boasting the world’s highest grade Indicated

uranium Mineral Resource.

IsoEnergy also holds a portfolio of permitted,

past-producing conventional uranium and vanadium mines in Utah with

a toll milling arrangement in place with Energy Fuels Inc. These

mines are currently on stand-by, ready for rapid restart as market

conditions permit, positioning IsoEnergy as a near-term uranium

producer.

Further Information & Investor

Relations Inquiries

|

IsoEnergy Ltd. |

|

Philip Williams |

|

CEO and Director |

|

Email: info@isoenergy.ca |

|

Phone: 1-833-572-2333 |

|

Website: www.isoenergy.ca |

|

|

Neither TSX Venture Exchange nor its Regulations

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

“plans”, “expects” or “does not expect”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate”, or “believes”, or variations of such words

and phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved”. These forward-looking statements or information may

relate to IsoEnergy’s ongoing business plan, exploration and work

program.

Forward-looking statements are necessarily based

upon a number of assumptions that, while considered reasonable by

management at the time, are inherently subject to business, market

and economic risks, uncertainties and contingencies that may cause

actual results, performance or achievements to be materially

different from those expressed or implied by forward-looking

statements. Such assumptions include, but are not limited to,

assumptions regarding expectations and assumptions concerning the

Arrangement, and that general business and economic conditions will

not change in a material adverse manner. Although Consolidated

Uranium and IsoEnergy have attempted to identify important factors

that could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking information.

Such statements represent the current views of

Consolidated Uranium and IsoEnergy with respect to future events

and are necessarily based upon a number of assumptions and

estimates that, while considered reasonable by Consolidated Uranium

and IsoEnergy, are inherently subject to significant business,

economic, competitive, political and social risks, contingencies

and uncertainties. Risks and uncertainties include, but are not

limited to the following: the TSX Venture Exchange not providing

final approval to the Arrangement and all required matters related

thereto; changes to Consolidated Uranium’s and/or IsoEnergy’s

current and future business plans and the strategic alternatives

available thereto; regulatory determinations and delays. Other

factors which could materially affect such forward-looking

information are described in the risk factors in Consolidated

Uranium’s most recent annual information form, Consolidated

Uranium’s management information circular in connection with the

Meeting, in IsoEnergy’s most recent financial statements and

management discussion and analysis, and in Consolidated Uranium’s

other filings with the Canadian securities regulators which are

available on the Consolidated Uranium’s profile on SEDAR+ at

www.sedarplus.ca. Consolidated Uranium and IsoEnergy do not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Jan 2025 to Feb 2025

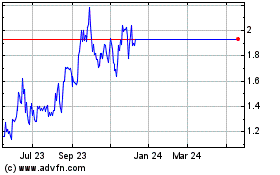

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Feb 2024 to Feb 2025