Ceapro Inc. Reports Financial Results for First Quarter 2024 and Provides Corporate Update

29 May 2024 - 11:00PM

Ceapro Inc. (TSX-V: CZO; OTCQX:

CRPOF) (“Ceapro” or the “Company”), a growth-stage

biotechnology company focused on the development and

commercialization of active ingredients for healthcare and cosmetic

industries, today announced financial results and operational

highlights for the first quarter ended March 31, 2024.

“We are excited by the advancement of several

key milestones related to new product and technology development.

We are making progress on multiple fronts including the team at

Montreal Heart Institute completing the first arm of the Phase 1

clinical study with avenanthramides and the team at Ceapro working

to complete the scale-up of the PGX Technology at the Edmonton

facility using fully defined yeast beta glucan. With the return of

the re-ordering pattern from one major customer and the expected

shared benefits that should result from the upcoming merger of

equals with Aeterna Zentaris, we believe we are poised to

significantly propel the Company into its next phase of growth and

unlock value as a diversified biopharmaceutical company,” stated

Gilles Gagnon, M.Sc., MBA, President and CEO of Ceapro.

Corporate and Operational

Highlights

Pipeline Development

Focus maintained on the development of

avenanthramides and the scale-up of the PGX Technology

Avenanthramides:

Clinical

- Significantly advanced the Phase 1

safety and tolerability study with healthy volunteers at Montreal

Heart Institute (MHI):

- The first arm of the single

ascending dose (SAD) phase of the study has been completed. 6

groups of 8 subjects per group received doses ranging from 30mg to

960mg per group per day. No significant adverse reactions have been

observed during this SAD phase. Based on full report to be

completed shortly, members of the Data Safety Monitoring Board will

decide on conducting the next step of the Phase 1 study consisting

of three additional groups of 8 subjects per group where each

subject will receive multiple ascending dose (MAD). The Company

expects to initiate the MAD arm during the summer 2024. This is the

first-in-human clinical study to assess safety, tolerability, and

pharmacokinetics of single and multiple ascending oral doses of

avenanthramides.

Formulation, Stability Studies and Analytics

- Additional GMP clinical batches of

the selected 30mg and 240mg pills formulation of the drug product

were manufactured by Corealis Inc. GMP Manufacturing Services

(“Corealis”). Stability studies for the pills are ongoing.

- Bioassays for the detection of

avenanthramides in the blood and urine successfully developed and

standardized. Ceapro is the owner of these bioassays currently used

for the pharmacokinetics profile of avenanthramides.

Yeast Beta Glucan (YBG)

Specifications have been standardized and the

product is being used for the PGX scale-up projects in Edmonton and

Austria.

Technology:

Pressurized Gas eXpanded Technology

(PGX):

- Edmonton Main Facility – PGX

Scale-Up 50 Liters Vessel: Construction and installation were

completed during Q1 2024. Several trial runs of yeast beta glucan

have been performed as part of the last commissioning “fine tuning”

phase. Given that the Edmonton site license is for natural

products, yeast beta glucan produced from this facility will be

offered as a nutraceutical. Subject to approval by Health Canada,

this product could be launched by end of 2024.

- Natex Facility, Austria – PGX

Scale-Up 100 Liters Vessel: The project is on schedule.

Commissioning is expected to be completed by end of Q3 2024.

Corporate:

- Announced on March 12, 2024

approval of merger with Aeterna Zentaris by Securityholders at

special meeting.

- Received on March 28, 2024 the

final court approval for merger with AeternaZentaris to create a

diversified biopharmaceutical company; expected to close in the

second quarter of 2024; subject to the closing conditions.

Financial Highlights for the First

Quarter Ended March 31, 2024

- Total sales of $2,800,000 for the

first quarter of 2024 compared to $3,500,000 for the comparative

quarter in 2023. The decrease compared to last year was primarily

due to a significant decrease in product sales of oat oil. One

major customer is gradually resuming ordering pattern with flagship

product, avenanthramides.

- Gross margin of 44% in Q1 2024

compared to 46% in Q1 2023 mostly due to higher costs to produce

avenanthramides which represented most of the sales during Q1

2024.

- Net loss of $1,900,000 in Q1 2024

compared to a net loss of $385,000 in Q1 2023. Loss was incurred

due to lower sales, increased R&D investments as well as

non-recurrent increased G&A expenses mostly due to professional

fees incurred for the expected merger with Aeterna Zentaris.

- Positive working capital balance of

$10,219,022 as of March 31, 2024.

“As we expect renewed growth with our active

ingredients revenue generating base business and subject to the

closing and successful integration of the merger with Aeterna

Zentaris, the Company expects to complete prioritized projects

using cash on hand while continuing to assess different market

initiatives to bring new business and unlock value,” concluded Mr.

Gagnon.

|

|

|

CEAPRO INC. |

|

Condensed Interim Consolidated Balance Sheets |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

|

|

2024 |

|

2023 |

|

|

|

|

$ |

|

$ |

|

|

ASSETS |

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash |

|

4,746,901 |

|

8,843,742 |

|

|

Trade receivables |

|

1,677,934 |

|

167,295 |

|

|

Other receivables |

|

204,911 |

|

216,763 |

|

|

Inventories (note 3) |

|

4,778,701 |

|

5,308,987 |

|

|

Prepaid expenses and deposits |

|

485,826 |

|

310,191 |

|

|

Total Current Assets |

|

11,894,273 |

|

14,846,978 |

|

|

Non-Current Assets |

|

|

|

|

|

|

Restricted cash |

|

10,000 |

|

10,000 |

|

|

Investment tax credits receivable |

|

984,200 |

|

984,200 |

|

|

Deposits |

|

74,369 |

|

74,369 |

|

|

Licences (note 4) |

|

8,884 |

|

9,625 |

|

|

Property and equipment (note 5) |

|

15,783,093 |

|

15,421,884 |

|

|

Deferred tax assets |

|

654,850 |

|

98,778 |

|

|

Total Non-Current Assets |

|

17,515,396 |

|

16,598,856 |

|

|

TOTAL ASSETS |

|

29,409,669 |

|

31,445,834 |

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

1,273,963 |

|

1,342,156 |

|

|

Current portion of lease liabilities (note 6) |

|

401,288 |

|

396,232 |

|

|

Total Current Liabilities |

|

1,675,251 |

|

1,738,388 |

|

|

Non-Current Liabilities |

|

|

|

|

|

|

Long-term lease liabilities (note 6) |

|

1,750,106 |

|

1,852,345 |

|

|

Total Non-Current Liabilities |

|

1,750,106 |

|

1,852,345 |

|

|

TOTAL LIABILITIES |

|

3,425,357 |

|

3,590,733 |

|

|

Equity |

|

|

|

|

|

|

Share capital (note 7 (b)) |

|

16,721,867 |

|

16,721,867 |

|

|

Contributed surplus |

|

4,982,466 |

|

4,963,067 |

|

|

Retained earnings |

|

4,279,979 |

|

6,170,167 |

|

|

Total Equity |

|

25,984,312 |

|

27,855,101 |

|

|

TOTAL LIABILITIES AND EQUITY |

|

29,409,669 |

|

31,445,834 |

|

|

CEAPRO INC. |

|

Condensed Interim Consolidated Statements of Net Loss and

Comprehensive Loss |

|

Unaudited |

|

|

|

|

|

|

|

|

2024 |

|

2023 |

|

|

Three Months Ended March 31, |

|

$ |

|

$ |

|

|

Revenue (note 13) |

|

2,773,788 |

|

3,494,811 |

|

|

Cost of goods sold |

|

1,555,382 |

|

1,888,973 |

|

|

Gross margin |

|

1,218,406 |

|

1,605,838 |

|

|

Research and product development |

|

1,432,824 |

|

573,687 |

|

|

General and administration |

|

2,229,528 |

|

1,521,445 |

|

|

Sales and marketing |

|

4,559 |

|

8,179 |

|

|

Finance costs (note 9) |

|

84,419 |

|

88,800 |

|

|

Loss from operations |

|

(2,532,924 |

) |

(586,273 |

) |

|

Other income (note 10) |

|

(86,664 |

) |

(95,875 |

) |

|

Loss before income taxes |

|

(2,446,260 |

) |

(490,398 |

) |

|

Deferred tax benefit |

|

(556,072 |

) |

(105,348 |

) |

|

Net loss and comprehensive loss for the period |

|

(1,890,188 |

) |

(385,050 |

) |

|

Net loss per common share (note 16): |

|

|

|

|

Basic |

|

(0.02 |

) |

(0.00 |

) |

|

Diluted |

|

(0.02 |

) |

(0.00 |

) |

|

Weighted average number of common shares outstanding (note

16): |

|

|

|

|

Basic |

|

78,293,177 |

|

78,251,844 |

|

|

Diluted |

|

78,293,177 |

|

78,251,844 |

|

|

CEAPRO INC. |

|

Condensed Interim Consolidated Statements of Cash Flows |

|

Unaudited |

|

|

|

|

|

|

|

|

2024 |

|

2023 |

|

|

Three Months Ended March 31, |

|

$ |

|

$ |

|

|

OPERATING ACTIVITIES |

|

|

|

|

Net loss for the period |

|

(1,890,188 |

) |

(385,050 |

) |

|

Adjustments for items not involving cash |

|

|

|

|

Finance costs |

|

29,419 |

|

33,800 |

|

|

Depreciation and amortization |

|

484,351 |

|

485,253 |

|

|

Deferred income tax benefit |

|

(556,072 |

) |

(105,348 |

) |

|

Share-based payments |

|

19,399 |

|

134,083 |

|

|

|

|

(1,913,091 |

) |

162,738 |

|

|

CHANGES IN NON-CASH WORKING CAPITAL ITEMS |

|

|

|

|

Trade receivables |

|

(1,510,639 |

) |

(90,938 |

) |

|

Other receivables |

|

11,852 |

|

10,389 |

|

|

Inventories |

|

530,286 |

|

(488,465 |

) |

|

Prepaid expenses and deposits |

|

(161,825 |

) |

(34,397 |

) |

|

Accounts payable and accrued liabilities relating to operating

activities |

|

(165,513 |

) |

(646,806 |

) |

|

|

|

(1,295,839 |

) |

(1,250,217 |

) |

|

Net loss for the period adjusted for non-cash and working capital

items |

|

(3,208,930 |

) |

(1,087,479 |

) |

|

Interest paid |

|

(29,419 |

) |

(33,800 |

) |

|

CASH USED IN OPERATIONS |

|

(3,238,349 |

) |

(1,121,279 |

) |

|

INVESTING ACTIVITIES |

|

|

|

|

Purchase of property and equipment |

|

(747,499 |

) |

(24,643 |

) |

|

Deposits relating to the purchase of equipment |

|

(13,810 |

) |

(17,419 |

) |

|

CASH USED IN INVESTING ACTIVITIES |

|

(761,309 |

) |

(42,062 |

) |

|

FINANCING ACTIVITIES |

|

|

|

|

Stock options exercised |

|

- |

|

2,000 |

|

|

Repayment of lease liabilities |

|

(97,183 |

) |

(86,188 |

) |

|

CASH USED IN FINANCING ACTIVITIES |

|

(97,183 |

) |

(84,188 |

) |

|

Decrease in cash |

|

(4,096,841 |

) |

(1,247,529 |

) |

|

Cash at beginning of the period |

|

8,843,742 |

|

13,810,998 |

|

|

Cash at end of the period |

|

4,746,901 |

|

12,563,469 |

|

|

|

|

|

|

The complete financial statements are available

for review on SEDAR at https://sedar.com/Ceapro and on the

Company’s website at www.ceapro.com.

About Ceapro Inc.

Ceapro Inc. is a Canadian biotechnology company

involved in the development of proprietary extraction technology

and the application of this technology to the production of

extracts and “active ingredients” from oats and other renewable

plant resources. Ceapro adds further value to its extracts by

supporting their use in cosmeceutical, nutraceutical, and

therapeutics products for humans and animals. The Company has a

broad range of expertise in natural product chemistry,

microbiology, biochemistry, immunology and process engineering.

These skills merge in the fields of active ingredients,

biopharmaceuticals and drug-delivery solutions. For more

information on Ceapro, please visit the Company’s website at

www.ceapro.com.

Forward-looking information

The information in this news release has been

prepared as at May 29, 2024. Certain statements made herein,

including statements relating to matters that are not historical

facts and statements of the Company’s beliefs, intentions and

expectations about developments, results and events which will or

may occur in the future, constitute “forward-looking information”

within the meaning of applicable Canadian securities legislation.

Forward-looking information relates to future events or future

performance, reflect current expectations or beliefs regarding

future events and is typically identified by words such as “aim”,

“anticipate”, “assume”, “believe”, “continue”, “could”, “expect”,

“forecast”, “future”, “intend”, “maintain”, “may”, “outlook”,

“plan”, “potential”, “project”, “synergies”, “will”, and similar

expressions suggesting future outcomes or statements regarding an

outlook.

Forward-looking information is based upon

certain assumptions and other important factors that, if untrue,

could cause the actual results, performance or achievements of the

Company or the combined company to be materially different from

future results, performance or achievements expressed or implied by

such information. There can be no assurance that such information

will prove to be accurate. Such information being based on numerous

assumptions.

Readers are cautioned not to place undue

reliance on forward-looking information, which speak only as of the

date made. For a more detailed discussion of such risks and other

factors that may affect Ceapro’s ability to achieve the

expectations set forth in the forward-looking information contained

in this news release, see Ceapro’s management information circular

dated February 9, 2024, MD&A filed under Ceapro’s profile on

SEDAR+ at www.sedarplus.ca, as well as Ceapro’s other filings with

the Canadian securities regulators. Other than as required by law,

the Company does not intend, and does not assume any obligation to,

update the forward-looking information in this news release.

For more information

contact:

Issuer:Gilles R. Gagnon, M.Sc., MBAPresident

& CEOT: 780-421-4555

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

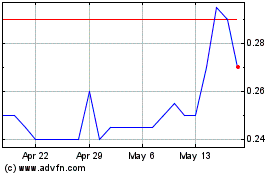

Ceapro (TSXV:CZO)

Historical Stock Chart

From May 2024 to Jun 2024

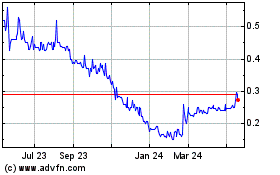

Ceapro (TSXV:CZO)

Historical Stock Chart

From Jun 2023 to Jun 2024