Decklar Resources Inc. (TSX-V: DKL) (OTCQX: DLKRF) (FSE:

A1U1) (

the “Company” or “Decklar”) is

pleased to announce the signing of a Crude Handling Agreement

(“CHA”) between the Company’s wholly-owned subsidiary Decklar

Petroleum Limited (“DPL”), its co-venturer Millenium and UPIL to

deliver oil produced at the Oza Field to the UPIL crude handling

facilities for injection into the Umugini Pipeline for ultimate

delivery to the SPDC JV Forcados Oil Export Terminal for export and

sale of Oza crude oil production.

Oza Field Oil Export Operations –

Trucking and Barging

Decklar has been pursuing logistics and export

activities and made progress on several options, including:

- Completion and signing of the CHA

between DPL, Millenium, and UPIL to deliver oil produced at the Oza

Field to the UPIL crude handling facilities for injection into the

Umugini Pipeline that will transport the crude oil to the SPDC JV

Forcados Oil Terminal for export and sale;

-

A permit from the Nigerian regulatory authority to transport the

crude oil by truck is in the final stages of approval. It is

anticipated that the first shipments of oil to the UPIL export

facilities will commence in early April 2022;

-

The next phase, and the most likely mid- to long-term solution for

an alternate export option is barging oil directly from storage

facilities at the Oza Field along the Imo River to a floating

storage and offloading (“FSO”) facility located offshore in shallow

waters off the Bonny River; and

-

Options and logistics to transport oil by barge from the Oza Field

to an offshore floating storage facility are currently at advanced

stages of negotiations. Shipping and exporting the Oza crude oil

using the barge and FSO system could enable higher crude oil

volumes per shipment and greater transportation and cost

efficiency.

In terms of operations, Decklar has successfully

finalized the re-entry, re-completion, and flow testing of the

Oza-1 well, as detailed in the press release dated November 5,

2021. Crude oil storage tanks on site now hold approximately 22,000

barrels of oil, awaiting export and sale. Once Oza-1 is brought

onto commercial production, the Company expects a stabilized flow

rate of between 1,200 – 1,500 barrels of oil per day

(“bopd”).

As previously described, Decklar and Millenium

had initially planned to utilize the Shell-operated Trans Niger

Pipeline (“TNP”) to the Bonny Export Terminal;

however, the link to the TNP between Isimiri, where Oza crude would

enter the Shell operated pipeline network, and the TNP tie-in at

Owaza, has been down for maintenance with an uncertain timeline to

restart operations.

As previously announced, 2022 development plans

for the Oza Field include:

-

Currently in advanced stages of finalizing arrangements with local

communities and contractors to begin construction of the access

road and associated infrastructure for a new oil well drilling

pad;

-

Drilling the first new development well;

-

Re-entry, re-completion, and flow testing of the other two existing

wells (Oza-2 and Oza-4), including tie-in to existing production

facilities;

-

Installation of a Central Production Facility and infrastructure

tie-ins for new well locations to replace the current Early

Production Facility;

-

Completion of an inter-field evacuation pipeline and all related

infrastructure; and

-

Drilling of up to two additional development wells.

Development plans for the Oza Field beyond 2022

include up to five additional development wells.

Duncan Blount, CEO of Decklar Resources, said,

“We are extremely pleased to announce that we have finalized a

crude handling agreement, securing alternative transportation and

crude export facilities for oil production from the Oza Field. This

will now allow us to achieve a significant milestone of commencing

full-time production, transforming Decklar from a developer into an

oil producer generating positive cash flow. Now, we will work

towards starting new development drilling activities at the Oza

Field, as well as continuing progress on development activities at

the Asaramatoru and Emohua Fields, where we are pursuing similar

re-entry, development, and production strategies. Given the

supportive oil price environment and broader energy market

fundamentals, we look forward to developing this portfolio of

high-quality, proven undeveloped assets.”

For further information:

Duncan T. BlountChief Executive Officer Telephone: +1 305 890

6516Email: dblount@decklarresources.com

David HalpinChief Financial Officer Telephone: +1 403 816

3029Email: david.halpin@decklarresources.com

Investor Relations: info@decklarresources.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Cautionary Language

Certain statements made and information

contained herein constitute "forward-looking information" (within

the meaning of applicable Canadian securities legislation),

including the future commercial production of the Oza-1 well, the

timing for export or sale of barrels of oil being held in storage,

the development plans for 2022. All statements in this news

release, other than statements of historical facts, are

forward-looking statements. Such statements and information

(together, "forward looking statements") relate to future events or

the Company's future performance, business prospects or

opportunities. There is no certainty that definitive agreements in

respect of the Transaction will be entered into, or that any

conditions precedent contained therein will be satisfied on terms

satisfactory to the parties or at all.

All statements other than statements of

historical fact may be forward-looking statements. Any statements

that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, using words

or phrases such as "seek", "anticipate", "plan", "continue",

"estimate", "expect, "may", "will", "project", "predict",

"potential", "targeting", "intend", "could", "might", "should",

"believe" and similar expressions) are not statements of historical

fact and may be "forward-looking statements". Forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. The Company believes that the expectations reflected in

those forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be correct and

such forward-looking statements should not be unduly relied upon.

The Company does not intend, and does not assume any obligation, to

update these forward-looking statements, except as required by

applicable laws. These forward-looking statements involve risks and

uncertainties relating to, among other things, changes in oil

prices, results of exploration and development activities,

uninsured risks, regulatory changes, defects in title, availability

of materials and equipment, timeliness of government or other

regulatory approvals, actual performance of facilities,

availability of financing on reasonable terms, availability of

third party service providers, equipment and processes relative to

specifications and expectations and unanticipated environmental

impacts on operations. Actual results may differ materially from

those expressed or implied by such forward-looking statements.

The Company provides no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements. The Company

does not assume the obligation to revise or update these

forward-looking statements after the date of this document or to

revise them to reflect the occurrence of future unanticipated

events, except as may be required under applicable securities

laws.

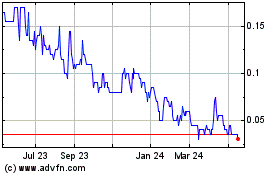

Decklar Resources (TSXV:DKL)

Historical Stock Chart

From Oct 2024 to Nov 2024

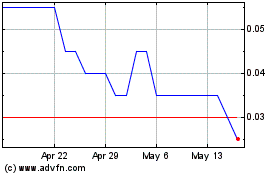

Decklar Resources (TSXV:DKL)

Historical Stock Chart

From Nov 2023 to Nov 2024