Santa Fe Metals Signs LOI for Iron Range: SEDEX and IOCG Potential

18 March 2014 - 11:30PM

Marketwired Canada

Santa Fe Metals Corp. (TSX VENTURE:SFM) ("SFM" or the "Company") announces it

has signed a binding Letter of Intent (LOI) with Eagle Plains Resources Ltd.

("EPL") outlining the terms for an earn-In option (the "Option") to acquire a

60% interest in EPL's Iron Range Project ("Iron Range"). Iron Range hosts the

same stratigraphic rock assemblage as the historic Sullivan Mine, one of the

largest sedimentary exhalative (SEDEX) silver-lead-zinc deposits in the world,

located approximately 60km north east of Iron Range.

With abundant exploration success and many defined targets, SFM and EPL plan to

focus on Sullivan-time stratigraphy and the regional-scale fault complex at Iron

Range for two significant target types on the property;

-- Sullivan-style SEDEX Ag-Pb-Zn mineralization - The Sullivan Mine

produced almost 300 million ounces of silver, 17.5 billion pounds of

zinc and 18.5 billion pounds of lead, over its 100-year lifetime

collectively worth over $45-billion at current metal prices (The Company

cautions that past results or discoveries on proximate land are not

necessarily indicative of results that may be achieved on the Iron Range

property), and

-- Iron-oxide-Cu-Au (IOCG) mineralization - Iron Range also hosts bonanza-

grade gold (2008 drilling intersected 51.52 g/t Au over 7m) in proximity

to felsic granitoid intrusives. This type of contact with a major iron

oxide fault zone (such as the Iron Range fault) are known to generate

significant copper-gold silver deposits, such as the Candelaria deposit

of Chile.

The 630 km2 Iron Range project, located near Creston, BC, is owned 100% by EPL

subject to a 1% NSR on a portion of the claim group. A complete description of

past drill and other exploration results can be viewed at

http://www.eagleplains.com/projects/bc/ironrange/.

The Option comprises a commitment by SFM over a 5-year period to earn a 60%

interest by incurring exploration expenditures on the Property, issuing SFM

shares and making cash payments to EPL, conditional on regulatory approval

including without limitation that of the TSX Venture Exchange (the "Exchange"):

-- On Exchange approval: issuing 1 million SFM shares

-- On or before December 31st, 2014: incurring $150K in exploration

expenditures, and issuing an additional 1 million SFM shares and an

additional $25K in cash;

-- On or before December 31st, 2015: incurring an additional $350K in

exploration expenditures, and issuing an additional 1 million SFM shares

and an additional $50K in cash;

-- On or before December 31st, 2016: incurring an additional $1.5 million

in exploration expenditures, and issuing an additional 1 million SFM

shares and an additional $75K in cash;

-- On or before December 31st, 2017: incurring an additional $3.0 million

in exploration expenditures, and issuing an additional 1 million SFM

shares and an additional $150K in cash; and,

-- On or before December 31st, 2018: incurring an additional $5.0 million

in exploration expenditures, and issuing an additional 1 million SFM

shares and an additional $200K in cash.

SFM and EPL agree to execute a definitive agreement for the Property on or

before April 17, 2014. When all of the conditions of the definitive agreement

have been met and SFM has exercised the Option, a 60/40 joint venture ("JV")

will be formed to advance the Property. EPL will be the operator during the term

of the Option.

Update on Sully Project

SFM plans to re-commence drilling shortly at its Sully Project located near Fort

Steele and 30 km east of the Sullivan Mine at Kimberley, BC. Sully hosts twin,

large-scale, parallel geophysical targets that do not outcrop on surface. The

'blind' targets are well defined by detailed gravity surveys completed over much

of the property. Both targets are made more compelling by coincident parallel

magnetic anomalies. Drilling to date has tested neither of these targets.

Management is excited about the Iron Range project's potential to host Sullivan

type massive sulphides or IOCG deposits and is anxious to be advancing

exploration at both the Iron Range and Sully. Scott Broughton, President and CEO

commented; "The agreement with EPL for Iron Range demonstrably expands on the

project and discovery potential for SFM in this prolific base metal region of

the world."

Technical contents of the Iron Range Project disclosure in this news release

have been reviewed and approved by Charles Downie, P.Geo., a qualified person as

defined by National Instrument 43-101. Technical contents of the Sully Project

disclosure in this news release have been reviewed and approved by Paul Ransom,

P.Geo., a qualified person as defined by National Instrument 43-101.

The TSX Venture Exchange has in no way passed upon the merits of the proposed

transaction and has neither approved nor disapproved the contents of this news

release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this news release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Santa Fe Metals Corp.

Scott E. Broughton, P.Eng.

President and CEO

604.684.2900

www.santafemetals.com

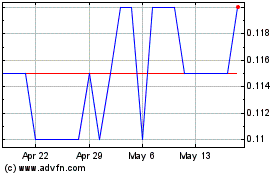

Common Stock (TSXV:EPL)

Historical Stock Chart

From May 2024 to Jun 2024

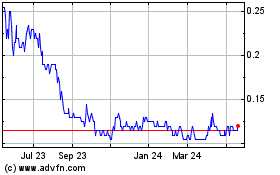

Common Stock (TSXV:EPL)

Historical Stock Chart

From Jun 2023 to Jun 2024