Full Metal Options Tanacross Copper-Gold-Molydenum Porphyry Targets, Eastern Alaska to Georgetown Capital

09 October 2010 - 5:32AM

Marketwired

Full Metal Minerals Ltd. (TSX VENTURE: FMM) is pleased to announce

that, that it has entered into an agreement (the "Agreement") with

Georgetown Capital Corp. (TSX VENTURE: GET.P), dated October 6,

2010 which grants Georgetown's Alaskan subsidiary an exclusive

right to acquire a 60% undivided beneficial interest in the

Tanacross copper-gold-molydenum porphyry targets, located in

Eastern Alaska (the "Tanacross Property") (the "Proposed

Transaction"). Upon Georgetown earning its 60% interest, the

parties will form a joint venture whereby each party must

proportionately contribute to future programs or be diluted to a

net profits interest.

Georgetown is a "capital pool company" under the policies of the

TSX Venture Exchange (the "Exchange") and the Proposed Transaction

with Full Metal will constitute the Company's "Qualifying

Transaction" in accordance with Exchange Policy 2.4. Upon

completion of the Proposed Transaction, Georgetown expects to be

listed as a Tier 2 Mining Issuer pursuant to the minimum listing

requirements of the Exchange.

The Qualifying Transaction is not considered to be a Non-Arms

Length Transaction under the policies of the Exchange; accordingly,

approval of the Proposed Transaction by Georgetown's shareholders

will not be required.

The Property

The 13,079 hectare Tanacross Property is comprised of multiple

claim groups copper-gold-molybdenum porphyry systems in

east-central Alaska. During 2007 to 2009, Full Metal and BHP

jointly explored these targets using airborne geophysics,

ground-based IP surveys, soil sampling grids and geological

mapping. This work identified multiple drill targets that

Georgetown and Full Metal will drill test during the 2011

season.

Terms of the Proposed Transaction

Pursuant to the Agreement, Full Metal will grant an exclusive

option to earn a 60% undivided beneficial interest ("Interest") in

the Property by incurring cumulative Expenditures of US$4,000,000,

Georgetown issuing the common shares in its capital to Full Metal

and by paying Full Metal the cash amounts as provided in the table

below:

Cumulative Georgetown Share Georgetown

On or Before Expenditures by Issuances Cash Payments

---------------------------------------------------------------------------

On signing $25,000

TSXV Approval 50,000 $25,000

October 1, 2011 US$500,000 150,000 $50,000

October 1, 2012 US$1,000,000 250,000 $50,000

October 1, 2013 US$2,000,000 250,000 $50,000

October 1, 2014 US$4,000,000 $50,000

Georgetown may accelerate the above payments at anytime and

thereby exercise the Option early. If approval is not obtained

within 90 days of signing either party may thereupon terminate this

agreement on 10 days written and unless the Exchange is obtained

within such 10 days this agreement shall lapse and the initial cash

payment of US$25,000 shall be forfeited.

About Full Metal

Full Metal is a generative exploration company with multiple

precious and base metal projects in Alaska and the Yukon.

Additional results will be announced shortly from three drilling

programs completed during 2010, including 100%-owned Fortymile

zinc-silver-lead Property, the Grizzly Butte and Pyramid

copper-gold-molybdenum porphyry Properties.

ON BEHALF OF THE BOARD OF DIRECTORS

Michael Williams, President and Director

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy of this release.

Contacts: Full Metal Minerals Ltd. Jeff Sundar Vice President,

Investor Relations 604-484-7855 604-484-7155 (FAX)

info@fullmetalminerals.com www.fullmetalminerals.com

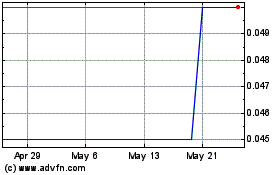

Full Metal Minerals (TSXV:FMM)

Historical Stock Chart

From Jan 2025 to Feb 2025

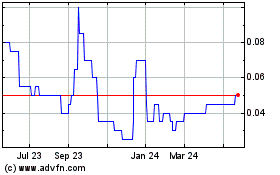

Full Metal Minerals (TSXV:FMM)

Historical Stock Chart

From Feb 2024 to Feb 2025