Full Metal and Antofagasta Minerals Drill 195 meters Averaging 0.63% Cu, 0.018% Mo, 0.141 g/t Au or 0.823% Cu Equivalent at Pyra

21 October 2010 - 3:23AM

Marketwired

Full Metal Minerals Ltd. (TSX VENTURE: FMM) ("Full Metal") is

pleased to announce that additional assay results have been

received from the 2010 drill program completed at the Pyramid

Porphyry target, located in southwest Alaska. All holes encountered

chalcocite, chalcopyrite and molybdenite mineralization over long

intervals, starting at surface. The 2010 drill program covered a

900 meter (east-west) by 750 meters (north-south) area. Copper

mineralization has been traced on surface, coupled with current and

historic drilling over an approximate 2,000 meter by 1,000 meter

area, and is open in all directions and to depth. Results are as

follows:

Hole-ID From (m) To (m) Length (m) Cu % Au (g/t) Mo % Cu Eq. %

PY10-01 32.30 499.87 467.57 0.272 0.058 0.019 0.409

including 36.00 424.00 388.00 0.320 0.067 0.018 0.459

including 68.10 290.00 221.90 0.403 0.088 0.014 0.538

including 180.30 238.00 57.70 0.479 0.112 0.018 0.653

PY10-02 4.57 356.62 352.05 0.343 0.078 0.008 0.440

including 96.0 152.0 56.0 0.503 0.112 0.01 0.635

including 186.0 252.0 66.0 0.397 0.083 0.007 0.493

including 272.0 324.0 52.0 0.424 0.112 0.007 0.541

PY10-03 8.7 306.0 297.3 0.197 0.049 0.004 0.253

including 50.0 124.0 74.0 0.429 0.062 0.004 0.494

PY10-04 9.7 298.7 289.0 0.299 0.082 0.032 0.519

including 9.7 166 156.3 0.402 0.108 0.039 0.676

including 30.0 78.0 48.0 0.501 0.104 0.045 0.802

PY10-05 6.39 201.17 194.78 0.63 0.141 0.018 0.823

including 20.0 92.0 72.0 0.754 0.162 0.017 0.957

(i) Copper equivalent calculations use metal prices of US$2.00/lb for

copper, US$1000/oz for gold, and US$10/lb for molybdenum. The contained

copper represents estimated contained metal in the ground and has not

been adjusted for metallurgical recoveries. Adjustment factors to

account for differences in relative metallurgical recoveries for gold,

copper and molybdenum will depend upon the completion of definitive

metallurgical testing.

CuEQ % = ((Cu% x 22.04lbs x $2.00) + (Au g/t x 32.15($/g)) + (Mo % x 22.04

lbs x $10.00))/( 22.04 lbs x $2.00)

Drilling during 2010 tested a wide area of the Pyramid porphyry

system totaling 1,668 meters in five HQ core holes. Holes PY10-04

and 05 were collared approximately 230 meters east of hole PY10-01

(see FMM 2010 NR #18, September 27, 2010), and were both terminated

in copper-gold-molybdenum mineralization (greater than 0.4% Cu

equiv.). Holes 4 and 5 were collared from the same set up, and

drilled north-south in opposing directions. Results from these

holes suggest a near-surface higher grade vector in the

mineralization system, where PY10-05 encountered 72.0 meters

averaging 0.75% Cu, 0.162 g/t Au and 0.017% Mo (0.957% Cu. Equiv),

starting at 20.0 meters. PY10-04 encountered strong molydenite

mineralization, in addition to chalcocite-chalcopyrite,

intersecting 156.3 meters averaging 0.40% Cu, 0.108 g/t Au and

0.039% Mo (0.676% Cu equiv.).

PY10-02 was collared 700 meters south of PY10-01, and

encountered copper sulphide mineralization (greater than 0.15% Cu)

over the entire length of the hole. A higher grade zone of 56.0

meters averaging 0.50% Cu, 0.112 g/t Au and 0.01% Mo, with the

entire length of hole from bedrock to the end of the hole, totaling

352.05 meters averaging of 0.34% Cu, 0.078 g/t Au and 0.008% Mo.

PY10-03 was drilled to the south, 650 meters west of PY10-02,

1,050m southwest of PY10-05 and was the westernmost hole completed

during 2010. Py10-03 encountered a higher-grade zone with 74.0

meters averaging 0.43% Cu, 0.062 g/t Au and 0.004% Mo.

Drilling results from 2010, coupled with historic drilling and

surface mapping has outlined an extensive porphyry system at

Pyramid, with the potential to host higher base and precious metal

grades. Full Metal and Antofagasta are currently planning an

aggressive follow-up program for the 2011 season.

Multiple hydrothermal centers have been identified at Pyramid,

within an oval-shaped 2,300 meter by 1,400 meter mapped extent of

phyllic and potassic alteration zones. Classic vein styles are

identified in the core with EDM, A, B, and D veins hosting

mineralization. Copper mineralization with variable molybdenum

occurs within multiple phases of porphyritic intrusive rocks and

surrounding hornfelsed sediments. Quartz diorite porphyry and

quartz feldspar porphyry intrusives make up the bulk of the igneous

rock types and hosts; diorites are known for their gold bearing

affinity. Drilled mineralization is open for expansion in all

directions and at depth.

The 37,296 hectare Pyramid Porphyry Project lies along the

southern margin of the Alaska Peninsula approximately eight

kilometers from tidewater. The area was initially explored in 1974

by the Aleut-Quintana-Duval Joint Venture, who drilled 19 shallow

holes (maximum 168 meters depth) in late 1975 (1,695 meters total).

Gold content was not an exploration target in the initial

exploration effort. More recent exploration by Battle Mountain Gold

in the late 1980's identified associated gold values that have

enhanced the potential of Pyramid.

The 2010 exploration program at Pyramid was funded by

Antofagasta Minerals S.A.("Antofagasta Minerals"), who are

currently earning a 51% interest in the Property. Full Metal has an

exploration agreement with Option to Lease a 100% interest in

mineral rights from the Aleut Corporation, an Alaska Native

Regional Corporation, and has been granted the surface rights from

Shumagin and TDX Corporations, Alaska Native Village Corporations

(see FMM News Release #8, July 9, 2010).

The 2010 exploration program at Pyramid was supervised by John

T. Galey, Jr, C.P.G., Consulting Geologist, and Robert McLeod,

P.Geo., Vice-President Exploration of Full Metal Minerals. Both are

Qualified Persons as defined by NI 43-101. Drill cores were cut in

half using a diamond saw, with one half placed in sealed bags, and

delivered to ALS-Chemex facilities in Fairbanks, Alaska. A sample

quality control/quality assurance program utilizing standards and

blanks, as well as third-party check labs has been implemented.

Contents of this release were prepared by and approved for release

by Mr. McLeod.

Full Metal is a generative exploration company with multiple

precious and base metal projects in Alaska and the Yukon.

Additional results will be announced shortly from three drilling

programs completed during 2010, including 100%-owned Fortymile

zinc-silver-lead Property, the Grizzly Butte copper-gold-molybdenum

porphyry Property.

Antofagasta Minerals is a wholly-owned subsidiary and the mining

division of Antofagasta plc ("Antofagasta") (ANTO.L). Antofagasta

has three business divisions: Mining, Transport and Water.

Antofagasta is one of the world's largest copper producers. Its

activities are mainly concentrated in Chile where it owns and

operates three copper mines with a total production of 442,500

thousand tonnes of copper and 7,800 tonnes of molybdenum in 2009.

Antofagasta has recently commissioned a brownfield expansion at its

Los Pelambres mine and a new mine development, Esperanza, is

expected to enter into production at the end of 2010. Together,

these are expected to increase group copper production to over

700,000 tonnes from 2011. A feasibility study is also in progress

at Antucoya in Northern Chile. In Pakistan, a feasibility study has

been completed at the Reko Diq joint venture. In the United States,

the group recently signed a joint venture agreement to complete the

exploration and begin a feasibility study for Nokomis, a copper and

nickel project located in Minnesota. Antofagasta also has

exploration programs in Africa, Europe, Australia, and the

Americas.

ON BEHALF OF THE BOARD OF DIRECTORS

Michael Williams, President and Director

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy of this release.

Contacts: Full Metal Minerals Ltd. Jeff Sundar Vice President,

Investor Relations 604-484-7855 604-484-7155 (FAX)

info@fullmetalminerals.com www.fullmetalminerals.com

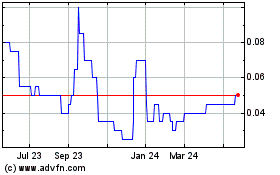

Full Metal Minerals (TSXV:FMM)

Historical Stock Chart

From Jan 2025 to Feb 2025

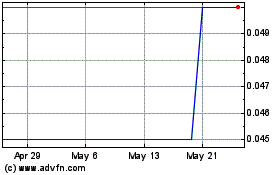

Full Metal Minerals (TSXV:FMM)

Historical Stock Chart

From Feb 2024 to Feb 2025