Golden Tag Resources Ltd. (“

Golden Tag” or the

"

Company") (TSX.V: GOG) is pleased to provide the

following update regarding its proposed acquisition of the La

Parrilla Silver Mine Complex (“

La Parrilla”) in

Durango, Mexico (the “

Transaction”) from First

Majestic Silver Corp (“

First Majestic”) pursuant

to an asset purchase agreement entered into between First Majestic,

First Majestic Plata, S.A. DE C.V., and Golden Tag, dated December

7, 2022 (the “

Asset Purchase Agreement”) and as

previously announced in the Company’s news release dated December

7, 2022. Upon dissemination of this news release, the Company

anticipates trading will resume in the Golden Tag Shares (as

defined herein) on or about April 19, 2023.

Pursuant to Policy 5.3 – Acquisitions and

Dispositions of Non-Cash Assets of the TSX Venture Exchange’s

(“TSXV”) Corporate Finance Manual (“Policy

5.3”), the Transaction will be classified as a Reviewable

Transaction (as such terms is defined under Policy 5.3); in

connection with being classified as a Reviewable Transaction, the

Company:

- Will not issue more than an

aggregate of 45,068,581 common shares in the capital of Golden Tag

(the “Golden Tag Shares”) in satisfaction of the

First Deferred Payment (as such terms is defined under the Asset

Purchase Agreement); and

- Will file an application pursuant

Policy 4.3 – Shares for Debt of the TSXV’s Corporate Finance

Manual, prior to the issuance of any Golden Tag Shares in

satisfaction of the Second Deferred Payment (as such terms is

defined under the Asset Purchase Agreement) (the “Shares

for Debt Application”). Approval of the TSXV of the

issuance of the Golden Tag Shares in satisfaction of the Second

Deferred Payment Shares is subject to: (i) the approval of the

Shares for Debt Application by the TSXV, and (ii) First Majestic

effecting a share distribution on a pro rata basis to its

shareholders, such that First Majestic holds no more than 19.9% of

the issue and outstanding Golden Tag Shares (on a non-diluted

basis) after payment of the Second Deferred Payment.

The completion of the proposed Transaction is

subject to a number of conditions including, but not limited to:

(i) the approval by the Golden Tag shareholders of the creation of

a new Control Person (as such term is defined under the policies of

the TSXV) as a result of the Transaction; (ii) the completion by

the Company of the private placement for minimum gross proceeds of

C$9,000,000 (inclusive of the subscription of First Majestic in the

amount of US$2,700,000); (iii) the receipt of all necessary

consents, approvals and authorizations (including the TSXV and the

Mexican Antitrust Commission) for the Transaction; and (iv) other

conditions which are customary for a transaction of this type.

For further details of the Asset Purchase

Agreement, please refer to a copy of the Asset Purchase Agreement,

which can be found on the Company’s SEDAR profile.

Voting Support Agreement

As previously announced in the Company’s press

release dated December 7, 2022, concurrent with the completion of

the Transaction, First Majestic and the Company will enter into a

customary voting supporting agreement effective for the duration of

the period that is the longer of: (i) May 31, 2024 and (ii) First

Majestic’s ownership percentage of the total issued and outstanding

Golden Tag Shares being greater than 19.9% (the “Support

Agreement”).

For the duration of the Support Agreement, other

than in respect of a change of control transaction, First Majestic

shall either abstain or vote any Golden Tag Shares owned by First

Majestic in favor of any recommendation of the board of directors

of the Company.

Trading of the Company’s

Shares

In accordance with the policies of the TSXV,

trading in the Golden Tag Shares has remained halted in connection

with the proposed Transaction announced on December 7, 2023. The

Company expects that trading will resume on or about April 19,

2023, following the dissemination of this press release and subject

to approval from the TSXV.

Financing

On April 14, 2023, Golden Tag closed a further

tranche of its previously announced non-brokered private placement

of subscription receipts (the “Offering”). The

gross proceeds received under this tranche of the Offering combined

with those to be received pursuant to subscription commitments

secured by the Company will result in aggregate gross proceeds of

$1,188,000. The terms of this tranche of the Offering are identical

to those described in the Company’s news release dated March 30,

2023 available at www.SEDAR.com. Subsequent tranches are expected

to close within the next month.

Amended and Restated Option

Plan

The Company is pleased to provide further

details with respect to its amended and restated stock option plan

(the “Amended Option Plan”), which was approved

and adopted by the shareholders of the Company at the most recent

annual general and special meeting of the Company held on October

25, 2022.

The Amended Option Plan allows the board of

directors of the Company (the “Board”) to grant

such number of stock options of the Company up to 10% of the issued

and outstanding common shares of the Company at the time of grant.

The following amendments to the Amended Option Plan were made in

order to comply with recent amendments made to the polices of the

TSXV governing security-based compensation, and include, among

other items:

- Subject to receipt of necessary

shareholder approval, the Board may amend the Amended Option Plan

to change the termination provisions of a security which does not

entail an extension beyond the original expiry date; and

- Subject to receipt of disinterested

shareholder approval, the Board may extend the term of a stock

option granted pursuant to the Amended Option Plan where such

grantee is an Insider (as such term is defined under the policies

of the TSXV) of the Company at the time of such proposed

extension.

A copy of the Amended Option Plan was attached

to the Notice of Meeting and Information Circular of the Company

dated September 26, 2022, a copy of which was filed on SEDAR on

October 5, 2022.

About Golden Tag Resources

Golden Tag Resources Ltd. is a Toronto based

mineral resource exploration company. The Company holds a 100%

interest, subject to a 2% NSR, in the San Diego Project, in

Durango, Mexico. The San Diego property is among the largest

undeveloped silver assets in Mexico and is located within the

prolific Velardeña Mining District. Velardeña hosts several mines

having produced silver, zinc, lead and gold for over 100 years. For

more information regarding the San Diego property please visit our

website at www.goldentag.ca.

For additional information, please

contact: Greg McKenzie, President & CEO Ph:

416-504-2024 greg.mckenzie@goldentag.ca

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this news

release.

TSX Venture Exchange Inc. has in no way passed

upon the merits of the Transaction and has neither approved nor

disapproved the contents of this press release.

Cautionary Note Regarding Forward

Looking Statements:

Certain statements in this news release are

forward-looking and involve a number of risks and uncertainties.

Such forward-looking statements are within the meaning of the

phrase ‘forward-looking information’ in the Canadian Securities

Administrators’ National Instrument 51-102 – Continuous Disclosure

Obligations. Forward-looking statements are not comprised of

historical facts. Forward-looking statements include estimates and

statements that describe the Company’s future plans, objectives or

goals, including words to the effect that the Company or management

expects a stated condition or result to occur. Forward-looking

statements may be identified by such terms as “believes”,

“anticipates”, “expects”, “estimates”, “may”, “could”, “would”,

“will”, or “plan”. Since forward-looking statements are based on

assumptions and address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Although

these statements are based on information currently available to

the Company, the Company provides no assurance that actual results

will meet management’s expectations. Risks, uncertainties and other

factors involved with forward-looking information could cause

actual events, results, performance, prospects and opportunities to

differ materially from those expressed or implied by such

forward-looking information. Forward-looking information in this

news release includes, but is not limited to, the completion of

Transaction and the Offering on the terms described herein (or if

at all), the ability to obtain requisite corporate and regulatory

approvals, including, but not limited to, the approval from the

TSXV for the Transaction and the Offering, the completion of

subscription of subscription commitments under the Offering, the

Company’s use of the net proceeds of the Offering, and the payment

of a finders’ fee in connection with the Offering.

In making the forward-looking statements

included in this news release, the Company has applied several

material assumptions, including that the Company´s financial

condition and development plans do not change because of unforeseen

events, that future metal prices and the demand and market outlook

for metals will remain stable or improve, management’s ability to

execute its business strategy, the receipt of all necessary

approvals, the satisfaction of all closing conditions of the

Transaction, the closing of the Offering, and no unexpected or

adverse regulatory changes with respect to La Parrilla.

Forward-looking statements and information are subject to various

known and unknown risks and uncertainties, many of which are beyond

the ability of the Company to control or predict, that may cause

the Company´s actual results, performance or achievements to be

materially different from those expressed or implied thereby, and

are developed based on assumptions about such risks, uncertainties

and other factors set out herein, including, but not limited to,

the risk that the Company is not able to complete the Transaction

or the Offering on the terms anticipated by the Company (or at

all), the risk that the Company is unable to obtain requisite

corporate and regulatory approvals, including but not limited to

the approval of the TSXV, the Mexican government, and shareholder

approval, the risk that the assumptions referred to above prove not

to be valid or reliable, market conditions and volatility and

global economic conditions including increased volatility and

potentially negative capital raising conditions resulting from the

continued or escalation of the COVID-19 pandemic, risk of delay

and/or cessation in planned work or changes in the Company´s

financial condition and development plans; risks associated with

the interpretation of data (including in respect of third party

mineralized material) regarding the geology, grade and continuity

of mineral deposits, the uncertainty of the geology, grade and

continuity of mineral deposits and the risk of unexpected

variations in mineral resources, grade and/or recovery rates; risks

related to gold, silver and other commodity price fluctuations;

employee relations; relationships with and claims by local

communities and indigenous populations; availability and increasing

costs associated with mining inputs and labour, the speculative

nature of mineral exploration and development, including the risks

of obtaining necessary licenses and permits and the presence of

laws and regulations that may impose restrictions on mining; risks

relating to environmental regulation and liability; the possibility

that results will not be consistent with the Company´s

expectations.

Such forward-looking information represents

management´s best judgment based on information currently

available. No forward-looking statement can be guaranteed, and

actual future results may vary materially. Accordingly, readers are

advised not to place undue reliance on forward-looking statements

or information.

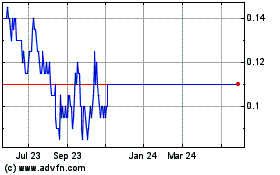

Golden Tag Resources (TSXV:GOG)

Historical Stock Chart

From Oct 2024 to Nov 2024

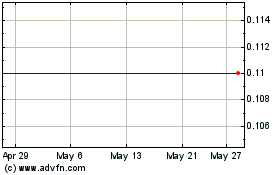

Golden Tag Resources (TSXV:GOG)

Historical Stock Chart

From Nov 2023 to Nov 2024