LEADING EDGE

MATERIALS REPORTS FISCAL 2023 RESULTS

Vancouver, January 24, 2024 – Leading Edge Materials

Corp. (“Leading Edge Materials” or the

“Company”) (TSXV: LEM)

(Nasdaq First North: LEMSE) (OTCQB:

LEMIF) (FRA: 7FL) announces results for

the fiscal year ending October 31, 2023. All references to dollar

amounts in this release are in Canadian dollars.

Highlights During and After Fiscal 2023

During the fiscal year ended October

31, 2023, the Company:

- On January 23, 2023, the Company announced that it is ahead of

schedule in exploration of its exclusive and 100% owned Bihor Sud

license in the Apuseni Mountains of central-western Romania.

Furthermore, extensive Nickel and Cobalt mineralisation has been

visually identified over 100 m in the first of the recently opened

historic galleries on the property.

- On March 1, 2023, the Company announced it identified extensive

Co-Ni-mineralization 50 metres above

the previously reported Gallery 7 at

its Bihor Sud project in Romania.

- On April 26, 2023, the Company granted stock options to

directors, officers and consultants of the Company to purchase an

aggregate of 4,700,000 common shares of the Company, at exercise

price of C$0.195 per Optioned Share, expiring on the date that is 5

years from the date of grant for directors and officers and three

years from the date of grant for consultants. The Options will vest

33% on the date of the grant, 33% one year after the date of grant

and 34% two years after the date of grant. The Options were issued

pursuant to the terms of the Company’s Option Plan.

- On June 1, 2023, the Company announced in-situ assay results at

over 30% Nickel and 4.7% Cobal at Bihor Sud. Additionally, surface

trench assay results indicate a zone of Pb-Zn-Ag

mineralisation.

- On August 23, 2023, the Company completed a private placement

financing of 21,739,130 units at a price of $0.115 per unit for

gross proceeds of $2,500,000. Each unit consisted of one

common share and one common share purchase warrant. Each

warrant is exercisable by the holder to acquire one additional

common share at an exercise price of $0.225 per share, expiring

August 23, 2027. The Company paid finders’ fees of $20,930

cash and issued 7,000 finder’s warrants.

- On October 25, 2023, the company announced receiving high grade

Cobalt-Nickel results from systematic gallery chip sampling at its

Bihor Sud Project, Romania. Results confirm in-situ high grade

Co-Ni-Au and Cu-Zn-Pb-Ag mineralization within +150 m and 350 m

gallery segments in G7 and G4 respectively. G7 highlights

include 3.5% Cobalt , 29.7% Nickel and 15.65 g/t Au. G4 highlights

include 11.7% Copper, 11.7% Lead and 18.7% Zinc.

After the fiscal year ended October

31, 2023, the Company:

- On December 14, 2023, the company announced it has received

further positive assay results for Co-Ni-Au from Gallery 7.

This second batch of 104 samples prolongate the zone of

Co-Ni-Au-occurrences by about 250 m to a total length of roughly

400 m NNW-SSE, and constitute the central-southern part of G7 at

the Bihor Sud project in Romania. Highlights include 6.7% Co, 13.0%

Ni, 7.5 g/t Au.

Results of Operations

Three Months Ended

October 31, 2023, Compared to Three Months Ended July 31, 2023

During the three

months ended October 31, 2023 (“Q4 2023”) the Company reported a

net loss of $387,343 compared to a reported net loss of $322,392

for the three months ended July 31, 2023 (“Q3 2023”), an increase

in loss of $64,951, Major movements are in Shares based

compensation booked during Q4 2023 of $46,683 compared to $Nil in

Q3 2023 , Accretion of provision for site restoration booked during

Q4 2023 of $74,428 compared to $10,200 in Q3 2023, which is offset

by foreign exchange gain booked during Q4 2023 of $125,700 compared

to loss of $51,554 in Q3 2023 and interest booked during Q4 2023 of

$26,959 compared to $9,047 in Q3 2023 .

Year Ended October 31,

2023, Compared to Year Ended October 31, 2022 (Restated)

During the year ended

October 31, 2023 (“fiscal year 2023”) the Company reported a net

loss of $2,582,473compared to a net loss of $3,163,557 for the year

ended October 31, 2022 (“fiscal year 2022”), a decrease in loss of

$581,084. The decrease in loss was primarily attributed to

Directors and officer's compensation of $182,341 in fiscal year

2023 compared to $443,700 in fiscal year 2022, Shares based

compensation during fiscal year 2023 of $854,275 compared to

$974,462 in fiscal year 2022 and foreign exchange loss of $137,529

in fiscal year 2023 compared to gain of $151,206 in fiscal year

2022.

Selected Financial Data

The following selected

financial information is derived from the unaudited condensed

consolidated interim financial statements of the Company prepared

in accordance with IFRS.

|

|

|

Fiscal 2023 |

Fiscal 2022 |

|

Three Months Ended |

October 31,2023$ |

July 31,2023$ |

April 30,2023$ |

January 31,2023$ |

October 31,2022(Restated)$ |

July 31,2022(Restated)$ |

April 30,2022(Restated)$ |

January 31,2022 (Restated) $ |

|

Operations |

|

|

|

|

|

|

|

|

|

Expenses |

(582,552) |

(313,950) |

(1,048,182) |

(489,432) |

(860,062) |

(685,569) |

(700,413) |

(459,407) |

|

Other items |

195,209 |

(8,442) |

(187,421) |

(147,703) |

308,721 |

(190,659) |

(356,226) |

(219,942) |

|

Comprehensive profit/(loss) |

(387,343) |

(322,392) |

(1,235,603) |

(637,135) |

(551,341) |

(876,228) |

(1,056,639) |

(679,349) |

|

Basic Profit/(loss) per share |

(0.00) |

(0.00) |

(0.01) |

(0.00) |

(0.00) |

(0.00) |

(0.01) |

(0.01) |

|

Diluted profit/(loss) per share |

(0.00) |

(0.00) |

(0.01) |

(0.00) |

(0.00) |

(0.00) |

(0.01) |

(0.01) |

|

Financial Position |

|

|

|

|

|

|

|

|

|

Working capital |

2,713,098 |

848,952 |

1,344,044 |

2,124,643 |

1,365,657 |

1,686,095 |

2,396,484 |

3,236,870 |

|

Total assets |

25,387,449 |

23,584,544 |

24,181,654 |

24,845,430 |

23,832,418 |

24,827,062 |

25,000,847 |

30,597,341 |

|

Total non-current liabilities |

(4,670,790) |

(5,109,575) |

(5,404,808) |

(5,556,603) |

(5,292,618) |

(6,159,922) |

(6,045,964) |

(10,812,012) |

Financial Condition/Capital Resources

During the year ended

October 31, 2023, the Company recorded a net loss of $2,582,473

and, as of October 31, 2023, the Company had an accumulated deficit

of $46,850,300 and working capital of $2,713,098. The Company is

maintaining its Woxna Graphite Mine on a “production-ready” basis

to minimize costs and is conducting ongoing research and

development to produce higher value specialty products. The Company

is also evaluating a potential restart of production at the Woxna

Graphite Mine. The Company anticipates that it has sufficient

funding to meet anticipated levels of corporate administration and

overheads for the ensuing twelve months however, it will need

additional capital to provide working capital and recommence

operations at the Woxna Graphite Mine, establish a production

facility for the Anode Project, to fund future development of the

Norra Karr Property or to complete exploration activities in

Romania. There is no assurance such additional capital will be

available to the Company on acceptable terms or at all. In the

longer term the recoverability of the carrying value of the

Company’s long-lived assets is dependent upon the Company’s ability

to preserve its interest in the underlying mineral property

interests, the discovery of economically recoverable reserves, the

achievement of profitable operations and the ability of the Company

to obtain financing to support its ongoing exploration programs and

mining operations.

Outlook

The past twelve months

have been characterized by two major trends which directly impact

our business. Firstly, the increasing adoption and sales volumes of

EV’s. And secondly, the more urgently accommodating legislative

environment in the EU to support local extractive industries.

The latter actually

taking shape as industrial policy, hardly seen in the western world

since WW2. We have in previous quarterly notes followed how this

has developed via the Critical Raw Materials Act and the Net-Zero

Industry Act, and keep getting continuously encouraged by speed and

magnitude of actions from Brussels and member states.

European Commission

President Ursula von der Leyen, in her recent annual State of the

Union address offers many highlights1. “Next phase of European

Green Deal” is in fact broad industrial policy using climate agenda

to improve competitiveness. Concerns are voiced at Asian supply

chains outcompeting as well as US green subsidy schemes

undercutting European businesses. It all starts with access to raw

materials and process technologies of these.

We remain convinced

that we are in the right place with the right assets to play our

part in combatting the threat of a European

de-industrialization.Woxna Graphite Mine

In terms of our assets

and the underlying materials needed for the green transition,

natural graphite remains a particularly interesting commodity

according to many analysts2. This is because graphite is a core

component in almost all lithium-ion chemistries, with extreme

dependance on Asian supply chains and importance to help

decarbonize battery anodes. Many analysts predict a six- to

sevenfold increase in graphite demand by 20303, amongst the most

severe of any commodity.

We maintain our built

and permitted Woxna graphite mine and plant on care and

maintenance, while monitoring market signals to consider a restart

of graphite concentrate production, as the first step to developing

a downstream anode business. Despite the looming

demand-supply deficit flake graphite prices have remained weak to

date this year.4 Increased capacity in Chinese synthetic graphite

production has been an important factor5. It is estimated that

China accounts for 92% of global anode production6. This is

important as it leads to constraints and impairs competitiveness

for European auto industry. Additionally, Chinese initiatives in

December to restrict exports7 of graphite have stimulated western

cell manufacturers to reconsider resilience of their supply

chains.

Of course, this offers

Sweden a great opportunity as a producer, and Woxna a first mover

advantage to help address this.

Norra Kärr Heavy Rare

Earth Project

At our Norra Kärr

development project, we have during the past year been progressing

work with a Natura 2000 permit application. To our benefit, the

Swedish government signal legislative changes which positively

impact us, as we believe that the requirement for a Natura 2000

permit will be shifted further along the process. To that end we

are pleased to now proceed with full focus on our mining lease

application. The Natura 2000 permit being deferred, to be resumed

later on when we apply for the environmental permit without losing

benefit of work having been done to date.

This is a direct

consequence of the government initiative to ensure more pragmatic

permitting process.

As this is done based

on the new 2021 design of this project, we are benefitting from

authorities and other stakeholders evaluating the merits of the

project based on recent plans that substantially reduce the

potential for environmental risk. In parallel, we have

started working towards a new mining lease application as well as

evaluating the most appropriate next stages of feasibility

development.

In the meantime, we

are pleased to follow beneficial developments in the rare earth and

permanent magnet space. Prices for the magnet metals have

increased8 because of supply concerns in Asia. We are told that

China, being the dominant processor of concentrate and magnet

producer, is actively trying to tie up supply around the world. In

particular, it is the heavy rare earths which are a challenge to

secure, with prices squeezing higher9. Dysprosium is turning out to

be a crucial bottleneck10, noteworthy is that of REE projects

globally, Norra Kärr is one of the absolute best in terms

Dysprosium potential.

Last year, the

Canadian company Neo Performance Materials have broken ground on

building a rare earth permanent magnet factory in Estonia11. This

is important as it demonstrates, as we have said, the emergence of

new Western producers of these critical products. Norra Kärr, as

one of the largest HREE deposits globally, and the only one in the

EU, has the potential to be a cornerstone supplier to Western

magnet producers12.

Bihor Sud

Nickel-Cobalt Exploration Project

Since having obtained

permission to enter our underground galleries last year, this

project has been advancing rapidly. As communicated, in situ

samples from G7 gallery walls have assayed up to 30% Ni

and 4.7% Co while surface trench assay results indicate a

zone of Pb-Zn-Ag mineralization.

In October we reported

receiving high grade Cobalt-Nickel results from systematic gallery

chip sampling. Results confirm in-situ high grade Co-Ni-Au and

Cu-Zn-Pb-Ag mineralization within +150 m and 350 m gallery segments

in G7 and G4 respectively. G7 highlights include 3.5% Cobalt

, 29.7% Nickel and 15.65 g/t Au. G4 highlights include 11.7%

Copper, 11.7% Lead and 18.7% Zinc.

In December we

announced further positive assay results for Co-Ni-Au from Gallery

7. This second batch of 104 samples prolongate the zone of

Co-Ni-Au-occurrences by about 250 m to a total length of roughly

400 m NNW-SSE, and constitute the central-southern part of G7 at

the Bihor Sud project in Romania. Highlights include 6.7% Co, 13.0%

Ni, 7.5 g/t Au.

Further extensive

Co-Ni mineralization has been identified 50 m above G7 in a cross

cut coming from the higher level gallery G4. These

results confirm our belief that this is a high prospective

exploration project with potential for both scale and

high-grade mineralization.

We are working towards

doing a surface drill program on 50-100 m deep geophysical

anomalies and to explore the depth extent of G7

Co-Ni-mineralization, as well as an underground drill program from

inside G4 and G7.

Additionally, we have

recently entered our next target, Gallery 2, which we have started

mapping and for which we have high expectations.

Financial Information

The report for three months ending January 31, 2024, is expected

to be published on or about March 22, 2024.

On behalf of the Board of

Directors,Leading Edge Materials

Corp.

Eric Krafft, Interim CEO

For further information, please contact the Company

at:info@leadingedgematerials.com

www.leadingedgematerials.com

Follow usTwitter:

https://twitter.com/LeadingEdgeMtlsLinkedin:

https://www.linkedin.com/company/leading-edge-materials-corp/

About Leading Edge Materials

Leading Edge Materials is a Canadian public company focused on

developing a portfolio of critical raw material projects located in

the European Union. Critical raw materials are determined as such

by the European Union based on their economic importance and supply

risk. They are directly linked to high growth technologies such as

batteries for electromobility and energy storage and permanent

magnets for electric motors and wind power that underpin the clean

energy transition towards climate neutrality. The portfolio of

projects includes the 100% owned Woxna Graphite mine (Sweden),

Norra Karr HREE project (Sweden) and the 51% owned Bihor Sud Nickel

Cobalt exploration alliance (Romania).

Additional Information

The Company’s audited consolidated financial statements for the

year ended October 31, 2023 and related management’s discussion and

analysis are available on the Company’s website at

www.leadingedgematerials.com or under its profile on SEDAR at

www.sedarplus.com.

The information was submitted for publication through the agency

of the contact person set out above, on January 24, 2024 at 11:00

am Vancouver time.

Leading Edge Materials is listed on the TSXV under the symbol

“LEM”, OTCQB under the symbol “LEMIF” and Nasdaq First North

Stockholm under the symbol "LEMSE". Mangold Fondkommission AB is

the Company’s Certified Adviser on Nasdaq First North and may be

contacted via email CA@mangold.se or by phone +46 (0) 8 5030

1550.

Reader

Advisory Certain information in this news release may

constitute forward-looking statements or forward-looking

information within the meaning of applicable Canadian securities

laws (collectively, “Forward-Looking Statements”). All

statements, other than statements of historical fact, addressing

activities, events or developments that the Company believes,

expects or anticipates will or may occur in the future are

Forward-Looking Statements. Forward-Looking Statements are

often, but not always, identified by the use of words such as

“seek,” “anticipate,” “believe,” “plan,” “estimate,” “expect,” and

“intend” and statements that an event or result “may,” “will,”

“can,” “should,” “could,” or “might” occur or be achieved and other

similar expressions. Forward-Looking Statements are based

upon the opinions and expectations of the Company based on

information currently available to the Company.

Forward-Looking Statements are subject to a number of factors,

risks and uncertainties that may cause the actual results of the

Company to differ materially from those discussed in the

Forward-Looking Statements including, among other things, the

Company has yet to generate a profit from its activities; there can

be no guarantee that the estimates of quantities or qualities of

minerals disclosed in the Company’s public record will be

economically recoverable; uncertainties relating to the

availability and costs of financing needed in the future;

competition with other companies within the mining industry; the

success of the Company is largely dependent upon the performance of

its directors and officers and the Company’s ability to attract and

train key personnel; changes in world metal markets and equity

markets beyond the Company’s control; the possibility of

write-downs and impairments; the risks associated with uninsurable

risks arising during the course of exploration; development and

production; the risks associated with changes in the mining

regulatory regime governing the Company; the risks associated with

tenure to the Norra Karr property; the risks associated with

the various environmental regulations the Company is subject

to; rehabilitation and restitution costs; the Woxna project

has never defined a mineral reserve. The Woxna project has never

defined a mineral reserve. On June 9, 2021, Leading Edge announced

the results of an independent preliminary economic assessment for

the development of Woxna (the "2021 Woxna PEA"), the full details

of which are included in a technical report entitled "NI 43-101

Technical Report – Woxna Graphite" prepared for Woxna Graphite AB

with effective date June 9, 2021 and issue date July 23, 2021,

available on Leading Edge's website www.leadingedgematerials.com

and under its SEDAR profile www.sedar.ca. The 2021 Woxna PEA is

preliminary in nature, it includes inferred mineral resources that

are considered too speculative geologically to have the economic

considerations applied to them that would enable them to be

categorized as mineral reserves, and there is no certainty that the

preliminary economic assessment will be realized. Mineral resources

that are not mineral reserves do not have demonstrated economic

viability. On July 22, 2021, Leading Edge announced the results of

an independent preliminary economic assessment for the development

of Norra Karr (the "2021 Norra Karr PEA"), the full details of

which are included in a technical report titled “PRELIMINARY

ECONOMIC ASSESSMENT OF NORRA KARR RARE EARTH DEPOSIT AND POTENTIAL

BY-PRODUCTS, SWEDEN" prepared for Leading Edge Materials Corp. with

effective date August 18, 2021 and issue date August 19, 2021,

available on Leading Edge's website www.leadingedgematerials.com

and under its SEDAR profile www.sedar.ca. The 2021 Norra Karr PEA

is preliminary in nature, it includes inferred mineral resources

that are considered too speculative geologically to have the

economic considerations applied to them that would enable them to

be categorized as mineral reserves, and there is no certainty that

the preliminary economic assessment will be realized. Mineral

resources that are not mineral reserves do not have demonstrated

economic viability. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in the Forward-Looking

Statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no

assurance that such Forward-Looking Statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such Forward-Looking

Statements. Such Forward-Looking Statements has been provided

for the purpose of assisting investors in understanding the

Company’s business, operations and exploration plans and may not be

appropriate for other purposes. Accordingly, readers should

not place undue reliance on Forward-Looking Statements.

Forward-Looking Statements are made as of the date hereof, and the

Company does not undertake to update such Forward-Looking

Statements except in accordance with applicable securities

laws. On March 11, 2020, the World Health Organization (“WHO”)

declared the novel coronavirus outbreak identified as “COVID-19”,

as a global pandemic. In order to combat the spread of

COVID-19 governments worldwide have enacted emergency measures

including travel bans, legally enforced or self-imposed quarantine

periods, social distancing and business and organization

closures. These measures have caused material disruptions to

businesses, governments and other organizations resulting in an

economic slowdown and increased volatility in national and global

equity and commodity markets. The Company has implemented

safety and physical distancing procedures, including working from

home where possible and ceased all travel, as recommended by the

various governments. The Company will continue to monitor the

impact of the COVID-19 outbreak, the duration and impact which is

unknown at this time, as is the efficacy of any intervention.

It is not possible to reliably estimate the length and severity of

these developments and the impact on the financial results and

condition of the Company and its operations in future

periods.

1

https://www.euractiv.com/section/energy-environment/news/von-der-leyen-outlines-next-phase-of-european-green-deal-with-heavy

industry-focus/2

https://www.fastmarkets.com/insights/graphite-market-outlook-five-key-factors-to-watch3

https://www.economist.com/finance-and-economics/2023/09/11/how-to-avoid-a-green-metals-crunch4

https://source.benchmarkminerals.com/article/why-battery-material-prices-slumped-under-pressure-in-the-first-half-of

2023?mc_cid=1c25ba3e5d&mc_eid=33b15273445

https://source.benchmarkminerals.com/article/natural-graphite-market-dominated-by-oversupply-2023-in-review?mc_cid=2a16054797&mc_eid=33b15273446

https://source.benchmarkminerals.com/article/in-charts-why-decoupling-from-chinas-anode-market-could-be-difficult-for-the-west?mc_cid=b3fbca6cc2&mc_eid=33b15273447

https://asia.nikkei.com/Spotlight/Supply-Chain/China-s-graphite-export-curbs-take-effect-with-uncertainty-for-EVs#:~:text=BEIJING%20%2D%2D%20China%20on%20Friday,curbs%20targeting%20China's%20tech%20sector.

8

https://www.reuters.com/markets/commodities/chinese-rare-earth-prices-hit-20-month-high-myanmar-supply-worry-2023-09-07/

9

http://news.chinatungsten.com/en/component/content/article/14-tungsten-news-en/tungsten-product-news/158697-tpn-12740.html10

https://pubs.acs.org/doi/full/10.1021/acs.est.3c0132711

https://energydigital.com/articles/neo-produces-specialised-magnets-for-clean-energy-tech12

https://www.fastmarkets.com/insights/rare-earth-magnet-production-outside-asia-gearing-up-2024-preview/

- LEM-Financial Results

- Financial report

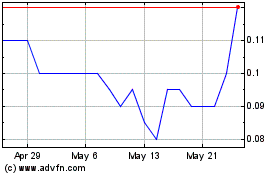

Leading Edge Materials (TSXV:LEM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Leading Edge Materials (TSXV:LEM)

Historical Stock Chart

From Mar 2024 to Mar 2025