Mint Announces Business Update

12 October 2013 - 4:50AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE U.S.

The Mint Corporation (TSX VENTURE:MIT) ("Mint") announced today that it would

like to release the following business updates:

-- New Management and Board Positions

Randy Koroll has been appointed a Director of Mint. Mr.Koroll has over

25 years of high level experience in the accounting sector. He is

currently serving as a Chief Financial Officer of Star Navigation

Systems Group Ltd. (TSX:SNA) and has served as a Chief Financial Officer

for various publicly traded companies since 2005 as well as private

companies since 2001. He has served on the Board and Audit committee of

a publicly traded mining company and has participated in the launching

of 9 companies on the TSX-V through its CPC program since January 2006.

In addition, he has also been a speaker for the TSX-V in their seminar

series "How to Manage a Public Company" as a public company CFO.

Pierre Gagnon has been appointed Chief Restructuring Officer ("CRO") of

Mint based in Dubai, UAE. As CRO, Pierre will have the authority to

negotiate with all stakeholders including employees, partners, investors

and creditors. Pierre, will also have authority over any expenses

incurred by the company and will identify and implement cost savings

opportunities in the organization. Pierre will prepare a business plan

and a funding plan to position the company for future growth and seek

board approval and support from investors. Mr. Gagnon studied Commerce

at the University of Toronto and is an Associate of the Institute of

Canadian Bankers. In 1988, he joined Brukar Inc., a manufacturer of

industrial components for the food equipment industry as president. Mr.

Gagnon is currently managing director of Chancery Investments Inc., an

investment company. He is a director of publicly listed Altitude

Resources Inc., Baymount Incorporated, DealNet Capital Corp., Spruce

Ridge Resources Limited and Triumph Ventures II Inc., as well as a

number of private companies. He is an advisor to The Succession Fund and

Shotgun Fund, two private equity funds.

Mint welcomes both gentlemen to the Mint team and looks forward to

working with them towards the growth of Mint's future successes.

-- Financing Update

Between August 28, 2013 and September 20, 2013, Mint closed on the

financing of CAD$168,495 and USD$72,180.04 in the form of multiple

secured bridge loans due on November 30, 2013. The bridge loans bear an

interest rate of 24% per annum compounded monthly. Funds were used for

specific third-party vendor payments. On October 9, 2013, the

Company received further bridge financing in the amount of CAD$650,000

with identical terms to the above loans. The lender was a related party

of Mint because Vishy Karamadam is a director of that lender and a

director of Mint. As a consequence, the loans are related party

transactions under Mulitlateral Instrument 61-101. A material change

report was filed less than 21 days before the loans because of the

pressing need for funding by Mint.

The Company continues to operate at a loss. Currently, no long term

funding sources have been secured but Mint is continuing to work on

finding investors for both equity and debt offerings. With the

appointment of Mr. Gagnon as CRO, the Company will spend the next 3 - 6

months heavily focused on reducing operational costs and increasing

revenue in the core business. This process has already begun with the

closing of the US office. The landlord for the US office space has filed

a judgment for non-payment of rent and the Company is currently in

discussions to rectify this situation.

The Company is currently in arrears on various debenture interest

payments. The specific arrears are Series V in the amount of

CAD$83,089.57 which was due on August 8, 2013, Series IV in the amount

of $52,469.11 which was due on August 13, 2013, Series VI in the amount

of US$9,163.47 which was due on September 30, 2013 and Series VII in the

amount of CAD$186,469.97.

Mint is currently 3 months behind in payments for some of its employees.

Funds from the last bridge loan will be used to pay some of these

overdue payments.

GENERAL DISCLOSURE STATEMENT

Investors are encouraged to read the Management Discussion and Analysis

Documents filed on SEDAR for a description of additional risks associated with

investing in The Mint Corporation. The following statement is only intended to

inform investors on certain of the many risks associated with investing in The

Mint Corporation (the "Company"). The Company operates predominantly in the

Middle East and North Africa ("MENA"). It is accordingly exposed to significant

political, legal and regulatory risks associated with operating in these

emerging and volatile markets. The key management personnel and operations of

the Company are based in countries which do not have strong and reliable

judicial enforcement. This results directly in additional risk with respect to

the enforcement of legal and contractual rights, including, for example but

without limitation, the enforcement of the rights of creditors, the protection

of intellectual property rights, the enforcement of joint venture arrangements,

and binding key employees with non-compete agreements. Since inception, the

Company has not reached profitability. The Company relies heavily on high-cost,

debt financing to fund its business plan. This has exposed the Company to unique

financial risks associated with significantly higher than normal debt levels.

Investors in the company are strongly encouraged to be aware of the significant

risks of the company, to conduct additional due diligence and to seek the help

of a licensed investment advisor before considering to invest in securities of

the Company. Moreover, investors must be aware that the purchase of the

Company's securities involves a number of additional significant risks and

uncertainties, as disclosed in the Management Discussion and Analysis reports

filed on SEDAR by the Company. Investors considering purchasing securities of

the Company should be able to bear the economic risk of total loss of such

investment.

ABOUT MINT TECHNOLOGY CORP

Established in 2004, Mint is the world's first vertically integrated prepaid

card and payroll services provider with its own ATM network, payment processing

platform and proprietary branded card product delivered to workers in the United

Arab Emirates and expanding to other parts of the Middle East. Mint operates

through 4 subsidiaries, Mint Middle East LLC, a payroll card services provider;

Mint Capital LLC, a financial products distribution company; Mint Global

Processing Inc., a fully integrated third party processing platform; and MEPS, a

mobile airtime POS and Merchant network solutions business.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM

IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY

FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

For additional information please visit www.mintinc.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

The Mint Corporation

Nabil Bader

President & CEO

+971 506457719

nbader@mintinc.com

The Mint Corporation

Nicole Souadda

Head of Compliance and Investor Relations

610-995-2655

nsouadda@mintinc.com

www.mintinc.com

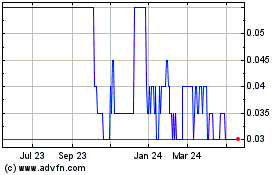

The Mint (TSXV:MIT)

Historical Stock Chart

From Feb 2025 to Mar 2025

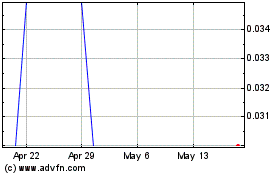

The Mint (TSXV:MIT)

Historical Stock Chart

From Mar 2024 to Mar 2025