/NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES

OR FOR DISSEMINATION IN THE U.S./

Individual metre intervals assayed up to 8.00%

Copper and 24.7g/t Gold

LONDON, April 26, 2021 /CNW/ - Meridian Mining UK S

(TSXV: MNO) (Frankfurt: 2MM)

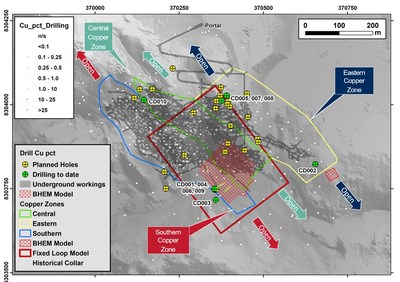

("Meridian" or the "Company") is pleased to report its first assay

results from its Cabaçal Copper-Gold camp scale VMS project

("Cabaçal") in Mato Grosso,

Brazil. These high grade results reported are from the first

four holes (Figure 1) of its ongoing 10,000m program with further results to be

released in the future. The holes targeted the high grade zones of

unmined mineralisation adjacent to the historical Cabaçal

underground mine and are open to the south-east and targeted for

follow up drilling. These initial results are the first steps in

the re-emergence of the Cabaçal Copper-Gold-Camp by Meridian.

Drilling highlights from Southern Copper Zone ("SCZ"):

- CD-004 returned 15.9m @

4.0% CuEq1 from 148.55m (3.3% Cu, 0.7g/t Au, 15.7g/t Ag &

0.6% Zn), including a higher grade zone of:

-

- 10.2m @ 5.9% CuEq from

151.97m (4.9% Cu, 1.0g/t Au, 23.9g/t

Ag & 0.7% Zn)

- CD-003 returned 48.6m @

1.4% CuEq from 120.00m (0.7% Cu,

1.0g/t Au, 2.0g/t Ag & 0.3% Zn), including a higher grade zone

of:

-

- 17.2m @ 3.2% CuEq from

151.40m (1.5% Cu, 2.5g/t Au, 4.7g/t

Ag, & 0.4% Zn)

- CD-001 returned 23.7m @

0.8% CuEq from 128.00m (0.6% Cu,

0.3g/t Au, 0.7g/t Ag, 0.1% Zn), including a higher grade zone

of:

-

- 11.4m @ 1.2% CuEq from

140.26m (0.9% Cu, 0.4g/t Au, 1.2g/t

Ag, & 0.2% Zn)

Drilling Highlights from Eastern Copper Zone ("ECZ"):

- CD-002 returned 22.7m @

0.8% CuEq from 39.70m (0.5% Cu,

0.4g/t Au, 0.7g/t Ag & 0.1% Zn) including a higher grade zone

of:

-

- 2.7m @ 2.8% CuEq from

59.74 (1.6% Cu, 1.7 g/t Au, 5.3g/t Ag & 0.4% Zn)

|

1 Note: True widths are approximately

90% of downhole lengths and assay figures and intervals rounded to

1 decimal place. Copper Equivalents ("CuEq") have been calculated

using the formula CuEq = ((Cu%*Cu price 1% per tonne) + (Au ppm*Au

price per g/t) + (Ag ppm*Ag price per g/t) + (Zn%*Zn price 1% per

tonne)) / (Cu price 1 % per tonne). Commodity Prices: Copper ("Cu")

and Zinc ("Zn") prices from LME Official Settlement Price dated

April 23, 2021 USD per Tonne: Cu = USD 9,545.50 and Zn = USD

2,802.50. Gold ("Au") & Silver ("Ag") prices from LBMA Precious

Metal Prices USD per Troy ounce: Au = USD 1781.80 (PM) and Ag = USD

26.125 (Daily). The CuEq values are for exploration purposes only

and include no assumptions for metallurgical recovery.

|

"Today's drill results have launched the re-emergence of Cabaçal

as a significant camp scale VMS Copper-Gold project. Our results,

showing zones of high grade Copper-Gold mineralisation within a

broad package of discrete layers of Copper-dominant sulphides, that

closely replicates the geological model." commented Dr Adrian McArthur, CEO and President. "These

stacked shallow dipping mineralized lenses reported today

re-confirm Cabaçal's ideal geometry for potential open pit

development. The program of drilling around the Cabaçal mine is

expanding rapidly with the third rig arriving on site shortly, and

with more results pending. Today, with multiple rigs turning, open

mineralization, and an initial focus on the 11km mine corridor belt

with multiple EM conductors to test, Meridian has entered an

exciting time of discovery and growth."

Ongoing Exploration and Resource delineation Programs.

Drilling is continuing across the three Copper-Gold zones, with

a combination of twin and infill drilling along these open trends.

The third rig has arrived and will be testing a combination of the

up-dip extensions, and shortly additional bedrock conductors. The

Company will soon have on site its modern surface and downhole

Electromagnetic ("EM") survey tools where their priority focus will

be the Cabaçal West late channel bedrock conductors. Once it is

surfaced surveyed, the Cabaçal West conductors will be gridded with

focused diamond drilling, as the Company sees potential for this

target area to host the Cabaçal mine's (VMS) massive sulphide pile.

The Company has also recovered more BP Minerals historical drill

data from surface and underground diamond drill holes, and it will

now start the process of incorporating this into the Cabaçal

database. Fieldwork is also evaluating the shallow-up dip

projection of the Cabaçal mine's mineralized trend which received

historically little evaluation given the focus on the underground

operations.

Southern Copper Zone.

Drilling in the SCZ is targeting a corridor identified in the

1990 Mason and Kerr near-mine target review, which considered the

area to form a major NW-SE trending alteration pipe of

copper-gold-silver mineralization.

CD-004 was drilled to target a position projecting ~

20m south of the limit of historical

workings. The hole was collared from the historical drill pad of

JUSPD 596 and drilled as part of a fan (Dip -64°; Az 331°),

intersecting the "CTB" mine sequence unit - a foliated

meta-volcaniclastic horizon, with disseminated sulphides starting

from 46.0m, and continued to the acid

volcanic footwall ("TAC") from 169.0m, with stringer and breccia mineralization

above the contact. Further assays are pending for the interval 77.0

– 120.0m. Results reported

comprise:

- 6.5m @ 0.6% Cu, 0.2g/t Au, 3.0g/t

Ag, & 0.1% Zn, from 114.90m;

-

- including 0.3m @ 11.5% Cu, 2.2g/t

Au, 55.0g/t Ag, & 0.7% Zn from 119.40m; and

- 15.9m @ 3.3% Cu, 0.7g/t Au,

15.7g/t Ag & 0.6% Zn from 148.55m;

-

- including 10.2m @ 4.9% Cu,

1.0g/t Au, 23.9g/t Ag & 0.7% Zn from 151.97m

Complete results are pending for the upper section of the hole,

including results above 113.00m

depth. High grade copper was intercepted with metre interval

sample ID CBDDS00310 & 312 assaying 8.0% Cu (156.63 -

157.63m).

CD-003 was drilled to test a position ~ 100m southeast of the limit of historical

workings, between CD-001 (drilled from the pad of historical hole

JUSPD596) and adjacent holes to the south which intersected broad

packages of mineralization in JUSPD031, AMCD15-0052.

CD-003 (Dip -75°; Az 045°) intersected the "CTB" mine sequence unit

- a foliated meta-volcaniclastic horizon, with disseminated

sulphides starting from 52.4m, and

continued to the acid volcanic footwall ("TAC") at 174.6m, with stringer and breccia mineralization

located above the contact. Further assays are pending for the

interval 77.0 – 120.0m. Results

reported comprise:

- 48.6m @ 0.7% Cu, 1.0g/t

Au, 2.0g/t Ag, & 0.3% Zn from 120.00m;

-

- Including 17.2m @ 1.5% Cu,

2.5g/t Au, 5.0g/t Ag & 0.4% Zn from 151.40m;

-

- 2.0m @ 1.9% Cu, 13.1g/t

Au, 7.5g/t Ag & 0.3% Zn from 156.70m; and

- 4.4m @ 3.8% Cu, 3.5g/t Au,

12.7g/t Ag & 0.7% Zn from 161.27m.

Complete results are pending for the upper section of the hole,

including results above 120m depth

where mineralization commences in the composite above. The presence

of gold mineralization above the historical mine cut-off grades

indicates potential to define both copper and gold mineralization

at appreciable grades in extensional positions to the historical

mine workings. High grade gold was intercepted with metre interval

sample ID CBDDS00448 assaying 24.7g/t Au (156.7 - 157.7m).

CD-001 was drilled to target the SCZ ~75m SE of the

limit of historical workings. The hole (Dip -80°; Az 060°)

intersecting the "CTB" mine sequence unit and continued to the acid

volcanic footwall ("TAC") at 151.65m,

with stringer and breccia mineralization above the contact. Results

reported comprise:

- 14.5m @ 0.3% Cu from 50.50m;

- 0.9m @ 0.6% Cu, 0.1g/t Au &

5.0g/t Ag from 76.65m;

- 3.0m @ 0.2% Cu & 0.1g/t Au

from 92.00m;

- 3.7m @ 0.3% Cu & 0.1g/t Au

from 103.00m;

- 0.9m @ 0.9% Cu & 0.4 g/t Au

from 108.32m;

- 1.0m @ 0.1% Cu & 0.1 g/t Au

from 110.18m; and

- 23.7m @ 0.6% Cu, 0.3g/t Au,

0.7g/t Ag & 0.1% Zn from 128.00m;

-

- Including 8.6m @ 0.5% Cu,

0.2g/t Au & 0.2g/t Ag from 128.00m; and

- 11.4m @ 0.9% Cu, 0.4g/t Au,

1.2g/t Ag & 0.2% Zn from 140.26m.

The hole deviated compared to the historical trajectory of JUSPD

596, accounting for some difference in the assay results. The

combined data of all BHEM results in the area will be reviewed to

provide targeting vectors towards zones of higher sulphide

concentrations (surveys of CD-007-009 pending).

Bore-hole electromagnetic surveys ("BHEM") on holes CD-001,

CD-003, CD-004 and historical hole AMCD-15-005 has defined a

conductivity response coincident with the mineralized intersections

and extending off-hole, with conductive plates modelled over an

extent of ~155m x 120m. The

conductor's extent was limited due to the range of the BHEM tool.

Follow up drilling into the conductor's southern edge will give a

platform for further extension. CD-001 is interpreted to have

deviated from its target zone into a lower grade section within the

conductor.

|

_______________

|

|

2 Meridian News release of September

03, 2020

|

Eastern Copper Zone.

The eastern projection of the ECZ has had limited historical

mine development and is comparatively sparsely drilled and is open.

The ECZ trends, in part, below a gabbroic sill, and potential

extensions below this and beyond its current limits which are

highlighted as a high priority exploration target, with potential

for repeat high-grade Au-Cu centres.

CD-002 (Dip-90 / Az: 000) was drilled as a single

hole to test adjacent to an historical hole JUSPD 228. The new

drill hole intersected:

- 22.7m @ 0.5% Cu, 0.4g/t Au,

0.7g/t Ag & 0.1% Zn from 39.70m;

-

- including 2.68m @ 1.6% Cu,

1.7g/t Au, 5.3g/t Ag & 0.4% Zn from 59.74m.

The pattern of mineralization compared well to the historical

hole JUSPD 228; with an upper disseminated zone returning

19.1m @ 0.4% Cu, 0.1g/t Au from

42.07m, compared to the CD-002

(20.0m @ 0.4% Cu, 0.2g/t Au from

39.7m). Hole JUSPD 228 had a slightly

wider lower basal stringer zone that is interpreted to be

associated with the nearby off-hole BHEM conductor. CD-002 may not

be an exact twin, with the historical drill pad surveyed but JUSPD

228's specific collar not located - the minor offset in the contact

positions and the BHEM conductor suggests CD-002 is slightly up-dip

of the JUSPD 228's position.

BHEM was undertaken on CD-002, although being a vertical hole is

not optimally orientated to provide directional vectors to

conductors. The survey detected a strong conductivity response

modelled as a plate 30.0 x 30.0m

plate, ~ 40m off-hole. The plate is

nominally modelled to the SE but required additional survey

constraint to verify with angled holes. Additional work will be

conducted to test beneath and south-east of the sill to test for

repeat mineralization.

Dr. Adrian McArthur, B.Sc. Hons,

PhD. FAusIMM., CEO and President of Meridian Mining as well as a

Qualified Person as defined by National Instrument 43-101, has

supervised the preparation of the technical information in this

news release.

On behalf of the Board of Directors of Meridian Mining UK S

Dr. Adrian McArthur

CEO, President and Director

Meridian Mining UK S

Email: info@meridianmining.net.br

Ph: +1 (778) 715-6410 (PST)

Stay up to date by subscribing for news alerts here:

https://meridianmining.co/subscribe/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at www.meridianmining.co

Notes

Holes have been drilled HQ through the saprolite and upper

bedrock and reduced to NQ – mineralized intervals represent half NQ

drill core. Samples have been analysed at the accredited SGS

laboratory in Belo Horizonte. Gold

analyses have been conducted by FAA505 (fire assay of a 50g

charge), and base metal analysis by methods ICP40B and ICP40B_S

(four acid digest with ICP-OES finish). Samples are held in the

company's secure facilities until dispatch, and delivered by staff

and commercial couriers to the laboratory. Pulps are retained for

umpire testwork. And ultimately returned to the Company for

storage. The company submits a range of quality controls samples,

including blanks and gold and polymetallic standards supplied by

ITAK, supplementing laboratory quality control procedures. True

widths are interpreted to be ~90% of intersection widths.

Electromagnetic surveys over Cabaçal have been conducted by

Geomag S/A Prospecções Geofísicas, a company of the Wellfield

Services Group, using a TEM57-MK2 Transmitter and PROTEM receiver

for surface surveys and BH43-3 borehole three-dimensional time

domain (TDEM) probe for subsurface work. Quality control is

performed daily by the geophysical representative of the Wellfield

Group, before and data sent to the Company's independent

consultant, Core Geophysics. Modelling of conductivity responses is

undertaken using industry-standard Maxwell software. Geophysical

targets are preliminary in nature and not conclusive evidence of

the likelihood of a mineral deposit.

ABOUT MERIDIAN

Meridian Mining UK S is focused on the acquisition, exploration

and development activities in Brazil. The Company is currently focused on

resource development of the Cabaçal VMS Copper-Gold project,

exploration in the Jaurú & Araputanga Greenstone belts located

in the state of Mato Grosso;

exploring the Espigão polymetallic project and the Mirante da Serra

manganese project in the State of Rondônia Brazil.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking

information or forward-looking statements for the purposes of

applicable securities laws. These statements include, among others,

statements with respect to the Company's plans for exploration,

development and exploitation of its properties and potential

mineralisation. These statements address future events and

conditions and, as such, involve known and unknown risks,

uncertainties and other factors, which may cause the actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the statements. Such risk factors include, among others,

failure to obtain regulatory approvals, failure to complete

anticipated transactions, the timing and success of future

exploration and development activities, exploration and development

risks, title matters, inability to obtain any required third party

consents, operating risks and hazards, metal prices, political and

economic factors, competitive factors, general economic conditions,

relationships with strategic partners, governmental regulation and

supervision, seasonality, technological change, industry practices

and one-time events. In making the forward-looking statements, the

Company has applied several material assumptions including, but not

limited to, the assumptions that: (1) the proposed exploration,

development and exploitation of mineral projects will proceed as

planned; (2) market fundamentals will result in sustained metals

and minerals prices and (3) any additional financing needed will be

available on reasonable terms. The Company expressly disclaims any

intention or obligation to update or revise any forward-looking

statements whether as a result of new information, future events or

otherwise except as otherwise required by applicable securities

legislation.

The Company cautions that it has not completed any feasibility

studies on any of its mineral properties, and no mineral reserve

estimate or mineral resource estimate has been established.

Geophysical exploration targets are preliminary in nature and not

conclusive evidence of the likelihood of a mineral deposit.

The TSX Venture Exchange has neither approved nor disapproved

the contents of this news release. Neither TSX Venture Exchange nor

its Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

SOURCE Meridian Mining S.E.