Magna Terra Minerals Inc. (the “Company” or “Magna Terra”) (TSX-V:

MTT) is pleased to announce the results of its Annual and Special

Meeting (the “Meeting”) of Shareholders (the “Shareholders”) held

on February 27, 2020. At the Meeting, the Company obtained its

standard annual approvals, as well as a number of special items

including, notably, a share consolidation on the basis of one (1)

new share of Magna Terra for every seven (7) common shares of Magna

Terra presently issued and outstanding (the “Share Consolidation”)

and the acquisition by Magna Terra (the “Acquisition”) of all of

the issued and outstanding common shares of 2647102 Ontario Inc.

(“ExploreCo”) from Anaconda Mining Inc. (“Anaconda”) (see news

releases dated October 15 and December 3, 2019).

As previously disclosed by the Company,

ExploreCo owns a 100% interest in the Cape Spencer Project situated

in New Brunswick and the Great Northern and Viking Projects

situated in Newfoundland and Labrador (the “ExploreCo Assets”). The

Acquisition constitutes a “Reverse Take-Over” and “Non-Arms’

Length” transaction within the meaning of the policies of the TSX

Venture Exchange (the “Exchange”) as (i) Anaconda will become a

“Control Person” (within the meaning of the policies of the

Exchange) of Magna Terra following the closing of the Acquisition

and (ii) Mr. Lew Lawrick and Mr. Michael Byron, respectively

President & Chief Executive Officer and Directors of the

Company, are also Directors of Anaconda. The Acquisition is

therefore subject to Magna Terra obtaining the approval of its

disinterested Shareholders at the Meeting.

Details of the Annual and Special

Meeting

42,993,806 shares representing 49.16% of shares

outstanding were voted at the Meeting as follows:

Election of Directors:

Lew Lawrick – 42,460,056 votes FOR representing

98.76% of votes cast

Dennis Logan – 42,776,556 votes FOR representing

99.49% of votes cast.

Denis Hall – 42,960,806 votes FOR representing

99.92% of votes cast.

Michael Byron – 42,960,806 votes FOR

representing 99.92% of votes cast.

Richard Bedell – 42,969,806 votes FOR

representing 99.92% 0f votes cast.

Appointment of Auditors:

42,993,806 votes FOR representing 100% of votes

cast, approving MNP LLP as the Company’s auditors for the upcoming

fiscal year.

Stock Option Plan:

42,910,806 votes FOR representing 99.81% of

votes cast, approving the stock option plan for the upcoming fiscal

year.

Consolidation of the Common Shares of the

Corporation:

42,958,806 votes FOR representing 99.92% of

votes cast, approving the consolidation of the common shares of the

Company on a 1 for 7 basis.

Acquisition of all of the issued and outstanding

shares of 2647102 Ontario Inc. from Anaconda Mining Inc. (Reverse

Takeover):

42,958,806 votes FOR representing 99.92% of

votes cast, approving the acquisition of ExploreCo.

Anaconda Mining Inc. as new Control Person:

42,958,806 votes FOR representing 99.92% of

votes cast, approving Anaconda Mining Inc. as a new Control Person

of the Company.

President & CEO, Lew Lawrick commented: “We

are very pleased that our shareholders have overwhelmingly embraced

and approved all of the business items presented to them at the

Meeting. Significantly, the acquisition of the ExploreCo assets

gives Magna Terra two exciting new district scale exploration

opportunities in Atlantic Canada that are drill ready with existing

in situ resource ounces, providing a strong value foundation. The

final step to closing the Acquisition will be meeting our minimum

financing condition and final approvals of the Exchange. We will

now move actively to complete these remaining conditions, and look

forward to an active exploration program including drill programs

on each project, that will commence in late Q2 2020.”

Update on Concurrent Private

Placement

As previously disclosed (see news releases dated

December 3, 2019 and February 3, 2020), the Company originally

anticipated proceeding with a non-brokered private placement of

unit subscription receipts and flow-through subscription receipts

(collectively, the “Subscription Receipts”) for minimum gross

proceeds of $3.1 million and maximum gross proceeds of $3.5 million

(the “Offering”). Following receipt by the Company of the required

shareholder approvals as disclosed above and given that the closing

of the Acquisition is scheduled to occur on or before March 31,

2020, the Company has elected to proceed with a non-brokered

private placement of units and flow-through shares rather than by

way of Subscription Receipts, with the other terms of the Offering

remaining unchanged.

As such, the Offering will consist of, on a

post-consolidation basis, (i) flow-through common shares (the “FT

Shares”) at a price of $0.25 per share for minimum of gross

proceeds of $1.3 million (5.2 million FT Shares) and maximum gross

proceeds of $1.7 million (6.8 million FT Shares) and (i) units of

the Company (the “Units”) at a price of $0.20 per Unit for gross

proceeds of $1.8 million (9 million units). Each Unit is comprised

of one common share and one-half of one share purchase warrant

(each whole warrant being a “Warrant”), each Warrant entitling the

holder thereof to purchase one additional common share of the

Company at a price of $0.30 per share for a period of 24 months

following the closing. The Warrants will also be subject to an

accelerated expiry provision whereby should the common shares of

the Company trade on the Exchange at a price of $0.50 or more for a

period of 10 consecutive trading days, the Warrants will expire 30

days following the receipt of a written notice to that effect from

the Company.

The closing of the Offering is conditional upon

(i) the Company having received subscriptions for FT Shares and

Units for minimum proceeds of $3.1 million (5.2 million FT Shares

and 9 million Units); (ii) the closing of the Acquisition; and (v)

the receipt of all required regulatory approvals including, without

limitation, the approval of the Exchange for the Acquisition,

Reverse- Take-Over and the Offering.

About Magna Terra

Magna Terra Minerals Inc. is a precious metals

focused exploration company, headquartered in Toronto, Canada. With

the closing of the ExploreCo Acquisition, Magna Terra will have 2

district-scale, advanced gold exploration projects in the world

class mining jurisdictions of New Brunswick and Newfoundland and

Labrador. The Company maintains a significant exploration portfolio

in the province of Santa Cruz, Argentina which includes its

precious metals discovery on its Luna Roja Project, as well as an

extensive portfolio of district scale drill ready projects

available for option or joint venture.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Magna Terra Minerals

Inc.Lewis Lawrick, President &

CEO647-478-5307Email: info@magnaterraminerals.comWebsite:

www.magnaterraminerals.com

Completion of the transaction is subject to a

number of conditions, including but not limited to, TSX Venture

Exchange acceptance and disinterested shareholder approval by the

shareholders of Magna Terra. The transaction cannot close until the

required shareholder approval is obtained. There can be no

assurance that the transaction will be completed as proposed or at

all.

Investors are cautioned that, except as

disclosed in the management information circular dated January 27,

2020, any information released or received with respect to the

transaction may not be accurate or complete and should not be

relied upon. Trading in the securities of Magna Terra should be

considered highly speculative.

The TSX Venture Exchange has in no way passed

upon the merits of the proposed transaction and has neither

approved nor disapproved the contents of this news release.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statements Regarding Forward Looking

Information

Some statements in this release may contain

forward-looking information. All statements, other than of

historical fact, that address activities, events or developments

that the Company believes, expects or anticipates will or may occur

in the future (including, without limitation, statements regarding

potential mineralization) are forward-looking statements.

Forward-looking statements are generally identifiable by use of the

words “may”, “will”, “should”, “continue”, “expect”, “anticipate”,

“estimate”, “believe”, “intend”, “plan” or “project” or the

negative of these words or other variations on these words or

comparable terminology. Forward-looking statements are subject to a

number of risks and uncertainties, many of which are beyond the

Company’s ability to control or predict, that may cause the actual

results of the Company to differ materially from those discussed in

the forward-looking statements. Factors that could cause actual

results or events to differ materially from current expectations

include, among other things, without limitation, failure by the

parties to complete the Acquisition, the possibility that future

exploration results will not be consistent with the Company's

expectations, changes in world gold markets or markets for other

commodities, and other risks disclosed in the Circular and the

Company’s public disclosure record on file with the relevant

securities regulatory authorities. Any forward-looking statement

speaks only as of the date on which it is made and except as may be

required by applicable securities laws, the Company disclaims any

intent or obligation to update any forward-looking statement.

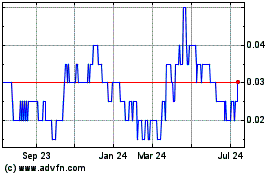

Magna Terra Minerals (TSXV:MTT)

Historical Stock Chart

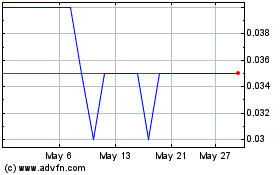

From Nov 2024 to Dec 2024

Magna Terra Minerals (TSXV:MTT)

Historical Stock Chart

From Dec 2023 to Dec 2024