ProntoForms Corporation Announces Annual and Q4 2013 Results

OTTAWA, ONTARIO--(Marketwired - Mar 18, 2014) - ProntoForms®

Corporation (TSX-VENTURE:PFM) -

Highlights:

- FY13 total revenue of $4,363,027, an increase of 75% over

2012

- FY13 recurring revenue of $3,418,819, an increase of 78% over

2012

- Q413 total revenue of $1,365,851, an increase of 94% over

comparable fourth quarter in 2012

- Q413 recurring revenue of $1,005,754, an increase of 67% over

comparable fourth quarter in 2012

ProntoForms® Corporation ("ProntoForms" or "the Company"), a

mobile data solutions company, today announced results for its

fourth quarter and its fiscal year ended 2013. All amounts are

stated in Canadian dollars unless otherwise noted.

Alvaro Pombo, Chief Executive Officer, ProntoForms, said, "As

expected, we had rapid growth of the company and the subscriber

base. The company acquired a growing number of Fortune 100

customers. I am pleased with the ongoing confidence of our

partners, who continue to expand their investment into our product

and company. Also, for the past two years, we have established a

trend of strong revenue growth combined with steadily decreasing

operating losses. ProntoForms has been recognized by industry

analysts like Frost & Sullivan as the leader in the Mobile

Forms product category - a market they measure at 22M subscribers

for North America."

Operating Results for the Three Months Ended December 31,

2013

Total revenue for the fourth quarter of 2013 of $1,365,851

represented an increase of approximately 18.9% over the 2013 third

quarter and 93.9% growth over the comparable fourth quarter of

2012. Revenue details are as follows:

|

|

Three months ended |

Increase |

Increase |

|

|

December 31, 2013 |

September 30, 2013 |

December 31, 2012 |

Over Q313 |

Over Q412 |

|

Recurring revenue |

|

|

|

|

|

|

|

|

|

Subscription |

|

986,342 |

|

874,990 |

|

585,490 |

12.7% |

68.5% |

|

Maintenance |

|

19,412 |

|

17,350 |

|

17,547 |

11.9% |

10.6% |

|

|

|

1,005,754 |

|

892,340 |

|

603,037 |

12.7% |

66.8% |

|

Professional and other services |

|

360,097 |

|

256,771 |

|

101,467 |

40.2% |

254.9% |

|

Total revenue |

$ |

1,365,851 |

$ |

1,149,111 |

$ |

704,504 |

18.9% |

93.9% |

Recurring revenue of $1,005,754 grew by 12.7% from the third

quarter of 2013 and by 66.8% from the comparable fourth quarter of

2012. Within recurring revenue, subscription revenue grew by 12.7%

from the third quarter of 2013 and by 68.5% from the comparable

fourth quarter of 2012. Subscription revenue from operator channels

increased from $542,934 in the third quarter of 2013 to $632,732 in

the fourth quarter of 2013, representing growth of 16.5% and 72.2%

growth over the 2012 fourth quarter operator subscription revenue

of $367,413.

Professional and other services revenue of $360,097 grew by

40.2% from the third quarter of 2013 and by 254.9% from the

comparable fourth quarter of 2012. The 2013 fourth quarter

professional services revenue included approximately $280,000 from

large contracts with major operators and smartphone vendors

compared to approximately $201,000 in the 2013 third quarter and

$90,000 in the fourth quarter of 2012. Revenue from these larger

contracts is recognized as the services are performed and is

subject to variability due to the availability of contracts from

customers and resources to perform the work.

Loss from operations for the fourth quarter of 2013 was $64,392

compared to $142,667 in the third quarter of 2013, representing an

improvement of $78,275 or 55% and an improvement of $311,472 or 83%

over the operating loss of $375,864 in the fourth quarter of

2012.

The Company had a Q4 2013 net loss of $303,112 compared to a Q3

2013 net loss of $237,208 and a comparable Q4 2012 net loss of

$378,051. In the fourth quarter of 2013, the Company incurred

interest and accretion of $38,986 and changes in the fair value of

a derivative liability of $236,265 all relating to the BDC loan

that was secured in November 2012. The large increase in the fair

value of the derivative liability relates primarily to the increase

in valuation for the bonus obligation in the event of a sale of the

Company.

As at December 31, 2013, the Company had cash and cash

equivalents of $896,234 and net working capital of $808,160.

Operating Results for the Year Ended December 31, 2013

Revenue for the year ended December 31, 2013 was $4,363,027

compared to $2,487,898 for the year ended December 31, 2012,

representing an increase of 75%. Revenue details are as

follows:

|

|

|

|

|

|

|

|

|

|

|

|

Year ended |

|

|

|

December 31, 2013 |

December 31, 2012 |

Incrase Over Previous Year |

|

Recurring revenue |

|

|

|

|

|

|

Subscription |

|

3,347,310 |

|

1,856,400 |

80.3% |

|

Maintenance |

|

71,509 |

|

69,842 |

2.4% |

|

|

|

3,418,819 |

|

1,926,242 |

77.5% |

|

Other services revenue |

|

944,208 |

|

561,656 |

68.1% |

|

Total revenue |

$ |

4,363,027 |

$ |

2,487,898 |

75.4% |

Recurring revenue for the year ended December 31, 2013, was

$3,418,819 compared to $1,926,242 in 2012, representing an increase

of 78%. Within recurring revenue, subscription revenue grew by

80.3% from 2012. Other services revenue was $944,208 in 2013

compared to $561,656 in 2012, representing an increase of 68%. The

Company had a loss from operations of $859,882 compared to a loss

from operations in 2012 of $1,944,301. The improvement in loss from

operations relates to an increase in revenue of 75% combined with

only an 18% increase in operating expenses.

The Company had a net loss of $361,288 compared to a net loss in

2012 of $1,981,107. In 2013, the Company had other income of

approximately $875,000 related to the sale of certain patents and a

reduction in deferred revenue due to the reversal of the underlying

obligation. The other income items are one-time events and will not

impact future period. The Company also had interest and accretion

of $143,948 and changes in the fair value of a derivative liability

of $303,825 all relating to the BDC loan that was secured in

November 2012.

Mr. Pombo added: "We're optimistic about 2014; we have a

seasoned management team and strong business partnerships with

global device brands and tier one carriers. Additionally, we have a

proven product and a demonstrated growth strategy. This year is all

about building on this solid foundation."

About ProntoForms® and ProntoForms Corporation

ProntoForms is a mobile workflow solution used by over 2,500

business customers to collect, receive and submit data in the

field. Available for smartphones and tablets, the ProntoForms

solution incorporates a mobile device App, a Web portal to manage

teams and data flow, and provides the ability to export or connect

data to the back office, popular cloud services or other data

destinations. ProntoForms is the Frost & Sullivan winner of the

North American Customer Value Leadership Award for Mobile

Forms.

ProntoForms Corporation has a powerful and proprietary patent

portfolio, from which the ProntoForms mobile App and Web reporting

portal have been developed. The company trades on the TSXV under

the symbol PFM. ProntoForms is the registered trademark of

ProntoForms Inc., a wholly-owned subsidiary of ProntoForms

Corporation. www.prontoforms.com

Certain information in this press release may constitute

forward-looking information. For example, statements about the

Company's future growth or value are forward-looking information.

This information is based on current expectations that are subject

to significant risks and uncertainties that are difficult to

predict. Actual results might differ materially from results

suggested in any forward-looking statements. The Company assumes no

obligation to update the forward-looking statements, or to update

the reasons why actual results could differ from those reflected in

the forward looking-statements unless and until required by

securities laws applicable to the Company. Neither the TSXV nor its

Regulation Services Provider (as that term is defined in the

policies of the TSXV) accepts responsibility for the adequacy or

accuracy of this release.

There are a number of risk factors that could cause future

results to differ materially from those described herein, including

but not limited to the following: (i) there can be no assurance

that the Company will earn any profits in the future or that

profitability, if achieved, will be sustained; (ii) if the Company

is not able to achieve profitability, it will require additional

equity or debt financing, and there can be no assurances that the

Company will be able to obtain additional financial resources on

favourable commercial terms or at all; (iii) the Company's

quarterly revenues and operating results may fluctuate, which may

harm its results of operations; (iv) the loss of business from a

major customer, operator or other reseller could reduce the

Company's sales and harm its business and prospects; (v) a portion

of the Company's sales are through operators and other resellers,

and an adverse change in the Company's relationship with any of

such operators or other resellers may result in decreased sales;

(vi) the market for software as a service is at a relatively early

stage of development, and if it does not develop or develops more

slowly than expected, the Company's business will be harmed; (vii)

the Company faces competition from other software solution

providers, which may reduce its market share or limit the prices it

can charge for its software solutions; (viii) a global economic

downturn or market volatility may adversely affect our business

and/or our ability to complete new financings; (ix) the business of

the Company may be harmed if it does not continue to penetrate

markets; (x) the success of the business depends on the Company's

ability to develop new products and enhance its existing products;

(xi) the Company's growth depends in part on the success of its

strategic relationships with third parties; (xii) the financial

condition of third parties may adversely affect the Company; (xiii)

the US dollar may fluctuate significantly compared to the Canadian

dollar, causing reduced revenue and cash flow as most of our

revenues are received in US dollars while most of our expenses are

payable in Canadian dollars; (xiv) subscription services which

produce the majority of the Company's revenue are hosted by a third

party service for the Company and any interruption in service could

harm its results of operations; (xv) the Company may be liable to

its customers or third parties if it is unable to collect data or

it otherwise loses data; (xvi) the Company may be liable for the

handling of personal information; (xvii) intellectual property

claims against the Company may be time consuming, costly to defend,

and disruptive to the business; (xviii) the Company uses open

source software in connection with its products which exposes it to

uncertainty and potential liability; (xix) economic uncertainty and

downturns in the software market may lead to decreases in the

Company's revenue and margins; (xx) any significant changes in the

technological paradigm utilized for building or delivering

applications in Smartphone devices could harm the Company's

business and prospects; and (xxi) if the Company loses any of its

key personnel, its operations and business may suffer. Please see

"Risk Factors Affecting Future Results" in the Company's annual

management discussion and analysis dated March 12, 2014 found at

www.sedar.com for a more complete discussion of these and other

risks. Readers are cautioned not to place undue reliance on

forward-looking statements. We undertake no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable law.

ProntoForms CorporationAlvaro PomboChief Executive

Officer613.599.8288 ext.

1111apombo@truecontext.comwww.prontoforms.com

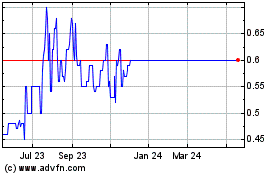

ProntoForms (TSXV:PFM)

Historical Stock Chart

From Nov 2024 to Dec 2024

ProntoForms (TSXV:PFM)

Historical Stock Chart

From Dec 2023 to Dec 2024