THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED

STATES.

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today its financial and operating results for the year ended December 31, 2010.

The Company reported net income of $425,897 ($0.018 per basic share) for the

year ended December 31, 2010 compared to a net loss of $101,963 ($0.004 per

basic share) for the year ended December 31, 2009. The net income increase of

$527,860 is primarily attributable to higher incinerator sales and rental

revenues, lower foreign exchange losses and amortization expense. These impacts

are partially offset by higher income tax expense and lower other revenue.

"Questor delivered profitable results in 2010 despite the continuing uncertain

economic environment. Our total revenue for the year was $5.8 million, the

second highest achieved in the Company's history," said Audrey Mascarenhas,

President and Chief Executive Officer. "We are gaining momentum in the

marketplace as more and more customers recognize the operational flexibility,

reliability, exceptional performance and economic benefits of our technology.

Where historically much of the interest in the Company's products and services

was due to global attitudes toward the need for air quality improvements,

minimization of carbon emissions, greater energy efficiency and corporate

responsibility for sustainability, we are observing a growing understanding in

the marketplace of the business value drivers underlying the use of

incineration."

Ms. Mascarenhas added, "In the last year, we have demonstrated that when applied

to an oilsands play, Questor's incineration equipment provided a dependable,

cost effective solution that met stringent regulatory requirements. We are

currently working with a number of major producers who wish to leverage the

financial benefits of incineration solutions in both onshore and offshore field

applications. And the impending start-up of the waste heat capture pilot project

in Colorado has attracted significant attention and will lead to additional

opportunities for Questor. In this application, we are utilizing the waste heat

from our combustion incineration process to vaporize water that would otherwise

have been disposed at considerable cost."

"We remain focused on positioning Questor for success and are optimistic about

the Company's future in view of the economic and social benefits associated with

our existing incineration equipment and products under development," concluded

Ms. Mascarenhas.

2010 OPERATIONAL HIGHLIGHTS

Relative to the strategic priorities, the following selected events and

achievements demonstrate Questor's progression in 2010:

-- Generated the second highest total annual revenue in the Company's

history, $5,841,438, which is 48 percent higher than total revenue

attained in 2009.

-- Completed a substantial international incinerator sales contract with a

global, diversified, upstream oil and gas company for a large gas plant

complex located in Indonesia. This project is the first time the

Company's technology has been deployed to a low heat content tail gas

application. The incinerator equipment was successfully commissioned in

first quarter 2011. The revenue associated with the incinerator sale was

recorded in 2010 whereas the commissioning revenue will be reflected in

2011.

-- Completed a waste gas incineration equipment sales contract with a

Calgary-based oil and natural gas exploration and production company for

an oilsands in-situ combustion development in Saskatchewan. This sales

order was the direct result of having deployed Questor's rental

incinerator equipment to handle low heat content sour waste gases with

high flow rates at a heavy oil operation located in southwest

Saskatchewan. That application established the prospective use of

Questor's products in oilsands development and demonstrated the

considerable energy savings possible while providing an effective and

efficient means to destroy high nitrogen and carbon dioxide content sour

gas.

-- Established a dedicated test facility at the Company's Grande Prairie

location to advance the development of a process to convert waste gas to

heat and/or power which would operate in tandem with Questor's

incinerator products. The Company continued to progress this technology

by testing different heat recovery module prototypes. The purpose of

these tests was, and continues to be, to advance and optimize the design

which will then enable Questor to properly size commercial applications

for heat redistribution as well as provide accurate data in designing

for power generation projects.

-- Awarded its first commercial sales order to supply incineration and heat

recovery equipment to a carbon emissions reduction and energy efficiency

demonstration project in Colorado. The Company, in partnership with a

large oilfield compression company in the United States, is progressing

the use of waste heat generated from combustion of waste gases to

vaporize produced water thereby eliminating the current, expensive

practice of trucking the produced water to a disposal facility. The

application is targeted to commence in second quarter 2011 at which time

the associated revenue will be recognized.

-- Built market awareness and recognition for Questor's expertise in

matters relating to air quality as demonstrated by invitations to

present at several events worldwide:

-- The Texas Commission on Environmental Quality ("TCEQ"), the lead

environmental agency for the state of Texas, on March 26, 2010

regarding Questor's incineration technology as an alternative

solution to flaring.

-- 2010 EnviroArabia Conference held in the Kingdom of Bahrain on April

19, 2010 on the topic of "Clearing the Air - Safely and

Efficiently".

-- Society of Petroleum Engineers Offshore Technology Conference in

Houston, Texas, USA on May 6, 2010, on the topic of "Platform Waste

Gas Combustion: Efficiently, Safely, Reliably and Economically".

-- The Mechanical and Industrial Engineering Department at the

University of Toronto on September 10, 2010 in Toronto, Ontario,

Canada. on the topic of "Air Pollution: The Daily Spills That We

Ignore".

-- Canada-Russia Energy Forum in Montreal, Quebec, Canada on September

11, 2010 on the topic of "Clearing the Air! Safely, Economically and

Efficiently".

-- Achieved recognition of Questor's growth when the Company was selected

for Alberta Venture's 2011 Fast Growth 50 list, an annual ranking

honoring fifty of the fastest growing companies in Alberta. This is the

third year in succession that Questor has been selected for the Fast

Growth 50 list.

-- Questor's President and Chief Executive Officer, Audrey Mascarenhas,

served as a distinguished lecturer for the Society of Petroleum

Engineering ("SPE") during the 2010-2011 lecture season. In that

capacity she presented on the importance of clean air and the

technologies available to address the impacts to air quality from

flaring and venting.

SUBSEQUENT TO DECEMBER 31, 2010

Ms. Mascarenhas presented at the 11th China International Petroleum and

Petrochemical Technology and Equipment Exhibition (CIPPE 2011) held March 22 -

24, 2011 in Beijing, China on the topic of "Clearing the Air! Effective,

Efficient, Safe and Sustainable". A copy of this presentation is available on

the Company's website. More recently, Ms. Mascarenhas participated in a mission

to Yamal, Russia, a project supported by the National Research Council's

Industrial Research Assistance program. The purpose of the mission was to

identify solutions to eliminate gas flaring in the region. She will also join a

business-focused mission to Beijing and Shanghai, China from May 26- 31, 2011,

led by Calgary Economic Development, in conjunction with the Mayor of Calgary,

Naheed Nenshi, Tourism Calgary and the Calgary Airport Authority. On May 10,

2011, Ms. Mascarenhas will present at the Canadian Oilsands Network for Research

and Development ("CONRAD") Annual General Meeting to be held in Calgary,

Alberta, Canada. And on June 9, 2011, Ms. Mascarenhas will present a paper

entitled "Emission Reduction: Effective, Efficient, Safe and Sustainable" at the

2011 North America Gas and Oil Expo and Conference to be held in Calgary,

Alberta, Canada.

The Company also announced today that effective April 26, 2011, subject to

regulatory approval, the grant of share options to select officers entitling the

purchase of up to 200,000 common shares at $0.225 per share, exercisable for a

period of five years and vesting in accordance with the provisions of the

Company's share option plan.

Shareholders are invited to attend the Company's Annual General Meeting to be

held on Thursday, June 2, 2011 at 3:00 p.m. (local time) in the Trophy Room of

the Calgary Petroleum Club, located at 319 - 5th Avenue S.W., Calgary, Alberta.

In addition to the formal business items, management will be presenting an

overview of Questor's results for the financial year ended December 31, 2010 and

discussing the Company's strategic initiatives for 2011.

Questor's audited financial statements and Management's Discussion and Analysis

for the years ended December 31, 2010 and 2009 will be available shortly on the

Company's website at www.questortech.com and through SEDAR at www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield service company founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta, Canada. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases which ensures regulatory compliance, environmental

protection, public confidence and reduced operating costs for customers. Questor

is recognized for its particular expertise in the combustion of sour gas (H2S).

While the Company's current customer base is primarily in the oil and gas

industry, this technology is applicable to other industries such as landfills,

water and sewage treatment, tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

QUESTOR TECHNOLOGY INC.

BALANCE SHEETS

As at December 31 2010 2009

----------------------------------------------------------------------------

ASSETS

Current assets

Cash $ 3,995,669 $ 3,080,997

Accounts receivable 1,872,509 864,260

Income and other taxes receivable 362 306,850

Inventory 313,567 433,145

Prepaid expenses and deposits 107,467 101,072

Deferred expenses - 2,356

Future income tax asset - 50,113

----------------------------------------------------------------------------

6,289,574 4,838,793

Property and equipment 1,316,858 1,418,524

Intangible assets 10,759 15,682

----------------------------------------------------------------------------

$ 7,617,191 $ 6,272,999

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable and accrued liabilities $ 852,821 $ 348,150

Current portion of long-term debt - 15,232

Income and other taxes payable 230,431 19,034

Deferred revenue and deposits 146,485 198,641

Future income tax liability 18,706 2,281

----------------------------------------------------------------------------

1,248,443 583,338

Future income tax liability 110,222 74,057

----------------------------------------------------------------------------

1,358,665 657,395

----------------------------------------------------------------------------

Shareholders' equity

Share capital 5,404,966 5,265,736

Contributed surplus 525,446 447,651

Retained earnings 328,114 (97,783)

----------------------------------------------------------------------------

6,258,526 5,615,604

----------------------------------------------------------------------------

$ 7,617,191 $ 6,272,999

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF INCOME (LOSS), COMPREHENSIVE INCOME (LOSS)

AND RETAINED EARNINGS (DEFICIT)

For the years ended December 31 2010 2009

----------------------------------------------------------------------------

Revenue

Incinerator sales and services $ 4,127,358 $ 2,277,762

Incinerator rentals and services 1,245,060 1,098,385

Combustion services 413,984 478,419

----------------------------------------------------------------------------

5,786,402 3,854,566

Direct costs 3,739,824 2,537,337

----------------------------------------------------------------------------

2,046,578 1,317,229

----------------------------------------------------------------------------

Other revenue 55,036 102,608

Expenses

General and administrative 1,376,256 1,374,672

Foreign exchange loss 50,551 100,205

Depreciation and amortization 16,564 41,090

----------------------------------------------------------------------------

1,443,371 1,515,967

----------------------------------------------------------------------------

Income (loss) before interest expense and

income tax expense 658,243 (96,130)

Interest expense 1,012 3,472

----------------------------------------------------------------------------

Income (loss) before income tax expense 657,231 (99,602)

Income tax expense 231,334 2,361

----------------------------------------------------------------------------

Net income (loss) and comprehensive income

(loss) 425,897 (101,963)

Retained earnings (deficit), beginning of

year (97,783) 4,180

----------------------------------------------------------------------------

Retained earnings (deficit), end of year $ 328,114 $ (97,783)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (loss) per share

Basic $ 0.018 $ (0.004)

Diluted $ 0.017 $ (0.004)

Weighted average number of shares

outstanding

Basic 24,275,589 24,007,370

Diluted 24,387,275 24,007,370

QUESTOR TECHNOLOGY INC.

STATEMENTS OF CASH FLOWS

For the years ended December 31 2010 2009

----------------------------------------------------------------------------

Operating activities

Net income (loss) $ 425,897 $ (101,963)

Items not involving cash:

Depreciation 138,105 133,174

Amortization 4,923 28,998

Unrealized foreign exchange loss (gain) (61,316) 178,974

Future income tax 102,703 (9,766)

Share-based compensation 147,025 164,099

Write-down of inventory 16,006 12,660

----------------------------------------------------------------------------

773,343 406,176

Net change in non-cash working capital 53,921 (21,022)

----------------------------------------------------------------------------

827,264 385,154

----------------------------------------------------------------------------

Investing activities

Additions of property and equipment (38,520) (372,373)

----------------------------------------------------------------------------

(38,520) (372,373)

----------------------------------------------------------------------------

Financing activities

Repayment of long-term debt (15,232) (37,498)

Exercise of share options 70,000 -

----------------------------------------------------------------------------

54,768 (37,498)

----------------------------------------------------------------------------

Effect of foreign exchange rate changes on

cash 71,160 (153,323)

----------------------------------------------------------------------------

Increase (decrease) in cash 914,672 (178,040)

Cash, beginning of year 3,080,997 3,259,037

----------------------------------------------------------------------------

Cash, end of year $ 3,995,669 $ 3,080,997

----------------------------------------------------------------------------

----------------------------------------------------------------------------

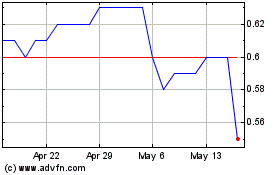

Questor Technology (TSXV:QST)

Historical Stock Chart

From Apr 2024 to May 2024

Questor Technology (TSXV:QST)

Historical Stock Chart

From May 2023 to May 2024