THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED

STATES.

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today its financial and operating results for the three and six month periods

ended June 30, 2012. The Company reported a profit of $99,440 ($0.004 per basic

share) for the three months ended June 30, 2012 compared to a profit of $209,002

($0.008 per basic share) for the same three-month period last year. Profit for

the six months ended June 30, 2012 was $586,878 ($0.024 per basic share)

compared to a profit of $89,461 ($0.004 per basic share) for the six months

ended June 30, 2011.

FINANCIAL HIGHLIGHTS SUMMARY

(Stated in Canadian dollars except per share amounts)

Three months ended June 30, 2012

----------------------------------------

Increase

2012 2011 (decrease)

----------------------------------------------------------------------------

Revenue 1,188,004 1,206,199 (18,195)

Gross profit(1) 448,598 458,555 (9,957)

EBITDA(1) 199,775 303,411 (103,636)

Profit and total comprehensive

income 99,440 209,002 (109,562)

Cost of sales as a percent of

revenue(1) 62.2% 62.0% 0.2%

Cash generated from operations

before movements in non-cash

working capital(1) 178,490 193,074 (14,584)

Total assets 8,727,857 7,572,410 1,155,447

Non-current liabilities 194,131 85,240 108,891

Shares outstanding(2)

Basic 24,857,370 24,707,370 150,000

Diluted 25,253,889 24,844,360 409,529

Earnings per share - Basic 0.004 0.008 (0.004)

Earnings per share - Diluted 0.004 0.008 (0.004)

----------------------------------------------------------------------------

FINANCIAL HIGHLIGHTS SUMMARY

(Stated in Canadian dollars except per share amounts)

Six months ended June 30, 2012

----------------------------------------

Increase

2012 2011 (decrease)

----------------------------------------------------------------------------

Revenue 3,418,879 2,104,075 1,314,804

Gross profit(1) 1,502,298 756,167 746,131

EBITDA(1) 927,104 202,935 724,169

Profit and total comprehensive

income 586,878 89,461 497,417

Cost of sales as a percent of

revenue(1) 56.1% 64.1% (8.0)%

Cash generated from operations

before movements in non-cash

working capital(1) 953,475 148,509 804,966

Total assets 8,727,857 7,572,410 1,155,447

Non-current liabilities 194,131 85,240 108,891

Shares outstanding(2)

Basic 24,857,370 24,707,370 150,000

Diluted 25,179,460 24,782,243 397,217

Earnings per share - Basic 0.024 0.004 0.020

Earnings per share - Diluted 0.023 0.004 0.019

----------------------------------------------------------------------------

(1) Non-IFRS financial measure. Please see discussion in the Non-IFRS Financial

Measures section of the Company's Management's Discussion and Analysis for the

three and six month periods ended June 30, 2012.

(2) Weighted average.

The Company's operating performance in the second quarter of each year was

reasonably comparable although administration expenses were lower in second

quarter 2012 and net foreign exchange gains were recorded in the period compared

to net foreign exchange losses in the same period of 2011. The variance was the

result of a one-time recovery of fabrication costs for an incinerator order that

was cancelled by the customer in second quarter 2011. In the absence of this

non-recurring revenue, second quarter 2012 results are favourable relative to

2011 results for the same quarter.

The substantial increase to profitability in the first half of 2012 is due to

higher revenues arising from differences in the volume and mix of incinerator

sales in each period and to the stronger margins achieved in 2012. Higher

utilization of the rental incinerator fleet and lower administration expenses in

the first half of 2012 also contributed to the positive profit variance. Profit

further benefited from the net foreign exchange gains recorded compared to the

net foreign exchange losses in the same period of 2011. Partially offsetting

this favourable result was higher income tax expense for the six months ended

June 30, 2012 and the aforementioned non-recurring other income recorded in

second quarter 2011.

"We are continuing to deliver strong, profitable results," said Audrey

Mascarenhas, President and Chief Executive Officer. "Our revenue in the first

six months of 2012 is $1.3 million higher than the same period last year, an

increase of 62.5 per cent. On a comparative basis, gross profit has nearly

doubled and earnings per basic share is six times higher than it was in the

corresponding period of last year. This is particularly noteworthy because

second quarter 2011 earnings reflect a $0.3 million non-recurring revenue

amount. We currently have confirmed incinerator sales orders which, when

combined with incinerator sales revenue achieved to date, are equivalent to the

total incinerator sales revenue reported for 2011.

Tough new emission standards in the United States and Europe is creating demand

for Questor's clean air solutions and we are pursuing expansion of the Company's

presence in those markets. We anticipate the economic and operational benefits

of our technology will lead to greater market penetration of our products and

services," concluded Ms. Mascarenhas.

In relation to the Company's market awareness and brand recognition initiatives,

Ms. Mascarenhas presented on the topic of "Clearing the Air" at the European

Union-Canada Business Forum on Energy held during the Global Petroleum Show in

Calgary, Alberta on June 13, 2012. She also participated in a Calgary Economic

Development led investment mission of Calgary companies to Hong Kong in June

2012. In the coming weeks, Ms. Mascarenhas will make a presentation at the 5th

International Petroleum and Petrochemical Leadership and Innovation Summit to be

held in Dongying, Shandong Province, China from September 17 - 19, 2012 and at

the Canadian Society for Unconventional Resources 14th Annual Unconventional

Resources Conference in Calgary, Alberta on October 4, 2012. A copy of each

presentation is or will be made available on the Company's website.

Questor's unaudited condensed financial statements and notes thereto and

management's discussion and analysis for the three and six month periods ended

June 30, 2012 will be available shortly on the Company's website at

www.questortech.com and through SEDAR at www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield service company founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta, Canada. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases which ensures regulatory compliance, environmental

protection, public confidence and reduced operating costs for customers. Questor

is recognized for its particular expertise in the combustion of sour gas (H2S).

While the Company's current customer base is primarily in the oil and gas

industry, this technology is applicable to other industries such as landfills,

water and sewage treatment, tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF FINANCIAL POSITION

Stated in Canadian dollars

Unaudited

June 30 December 31

As at 2012 2011

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents $ 5,039,438 $ 2,166,301

Short-term investment - 1,007,896

Trade and other receivables 1,075,952 2,852,578

Inventories 454,397 766,028

Prepaid expenses and deposits 52,978 96,296

Current tax assets 18,929 73,341

----------------------------------------------------------------------------

Total current assets 6,641,694 6,962,440

----------------------------------------------------------------------------

Non-current assets

Property and equipment 2,077,231 2,053,972

Intangible assets 8,932 9,541

----------------------------------------------------------------------------

Total non-current assets 2,086,163 2,063,513

----------------------------------------------------------------------------

Total assets $ 8,727,857 $ 9,025,953

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND EQUITY

Current liabilities

Trade payables, accrued liabilities and

provisions $ 577,309 $ 1,070,989

Deferred revenue and deposits - 280,042

Current tax liabilities 16,716 196,572

----------------------------------------------------------------------------

Total current liabilities 594,025 1,547,603

----------------------------------------------------------------------------

Non-current liabilities

Deferred tax liabilities 87,209 94,935

Lease inducement 106,922 61,099

----------------------------------------------------------------------------

Total non-current liabilities 194,131 156,034

----------------------------------------------------------------------------

Total liabilities 788,156 1,703,637

----------------------------------------------------------------------------

Capital and reserves

Issued capital 5,458,215 5,458,215

Reserves 652,733 622,226

Retained earnings 1,828,753 1,241,875

----------------------------------------------------------------------------

Total equity 7,939,701 7,322,316

----------------------------------------------------------------------------

Total liabilities and equity $ 8,727,857 $ 9,025,953

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

Stated in Canadian dollars except per share data

Unaudited

For the three months ended For the six months ended

June 30 June 30

----------------------------------------------------------------------------

2012 2011 2012 2011

----------------------------------------------------------------------------

Revenue $ 1,188,004 $ 1,206,199 $ 3,418,879 $ 2,104,075

Cost of sales (739,406) (747,644) (1,916,581) (1,347,908)

----------------------------------------------------------------------------

Gross profit 448,598 458,555 1,502,298 756,167

Administration

expenses (364,217) (415,578) (717,661) (820,815)

Net foreign exchange

gains (losses) 51,749 (40,745) 17,336 (79,032)

Depreciation of

property and

equipment (10,463) (8,148) (20,785) (11,036)

Amortization of

intangible assets (304) (304) (609) (609)

Write-off of

property and

equipment (6,226) (16,845) (8,994) (18,458)

Other income 7,208 274,644 11,913 278,361

----------------------------------------------------------------------------

Profit before tax 126,345 251,579 783,498 104,578

Income tax (expense)

income

Current (30,389) (4,147) (204,346) (4,147)

Deferred 3,484 (38,430) 7,726 (10,970)

----------------------------------------------------------------------------

Profit and

comprehensive

income $ 99,440 $ 209,002 $ 586,878 $ 89,461

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings per share

Basic $ 0.004 $ 0.008 $ 0.024 $ 0.004

Diluted $ 0.004 $ 0.008 $ 0.023 $ 0.004

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF CHANGES IN EQUITY

Stated in Canadian dollars

Unaudited

Issued Retained

capital Reserves earnings Total equity

----------------------------------------------------------------------------

Balance at January 1,

2012 $ 5,458,215 $ 622,226 $ 1,241,875 $ 7,322,316

Profit and total

comprehensive income - - 586,878 586,878

Recognition of share-

based payments - 30,507 - 30,507

Issue of ordinary

shares under employee

share option plan - - - -

----------------------------------------------------------------------------

Balance at June 30,

2012 $ 5,458,215 $ 652,733 $ 1,828,753 $ 7,939,701

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Balance at January 1,

2011 $ 5,404,966 $ 593,944 $ 51,471 $ 6,050,381

Loss and total

comprehensive loss - - 89,461 89,461

Recognition of share-

based payments - 31,930 - 31,930

Issue of ordinary

shares under employee

share option plan - - - -

----------------------------------------------------------------------------

Balance at June 30,

2011 $ 5,404,966 $ 625,874 $ 140,932 $ 6,171,772

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF CASH FLOWS

Stated in Canadian dollars

Unaudited

For the six months ended June 30 2012 2011

----------------------------------------------------------------------------

Cash flows from (used in) operating activities

Profit and total comprehensive income $ 586,878 $ 89,461

Adjustments for:

Income tax expense 196,620 15,117

Write-off of property and equipment 8,994 18,458

Depreciation of property and equipment 142,997 97,748

Amortization of intangible assets 609 609

Net unrealized foreign exchange gains (13,685) (105,845)

Expense recognized in respect of equity-

settled share-based payments 30,507 31,930

Write-downs of inventories to net realizable

value 555 1,031

----------------------------------------------------------------------------

953,475 148,509

Movements in non-cash working capital 2,688,931 (738,354)

----------------------------------------------------------------------------

Cash generated from (used in) operations 3,642,406 (589,845)

Income taxes paid (371,549) (215,000)

----------------------------------------------------------------------------

Net cash generated from (used in) operating

activities 3,270,857 (804,845)

----------------------------------------------------------------------------

Cash flows (used in) from investing activities

Payments for property and equipment (408,549) (958,786)

Proceeds from disposal of property and

equipment - 3,200

----------------------------------------------------------------------------

Net cash used in investing activities (408,549) (955,586)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash flows from financing activities - -

----------------------------------------------------------------------------

Net increase (decrease) in cash 2,862,308 (1,760,431)

Cash and cash equivalents at beginning of the

period 2,166,301 3,995,669

Effects of exchange rate changes on the balance

of cash held in foreign currencies 10,829 117,141

----------------------------------------------------------------------------

Cash and cash equivalents at end of the period $ 5,039,438 $ 2,352,379

----------------------------------------------------------------------------

----------------------------------------------------------------------------

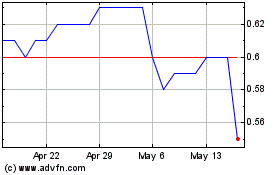

Questor Technology (TSXV:QST)

Historical Stock Chart

From Apr 2024 to May 2024

Questor Technology (TSXV:QST)

Historical Stock Chart

From May 2023 to May 2024