Route1 Inc. (TSX VENTURE:ROI), a digital security and identity management

company whose customers include the U.S. Department of Defense, the Department

of Homeland Security, the Department of Energy, and the Government of Canada,

today announced its financial results for the three and nine month period ended

September 30, 2013.

Statement of

Operations For the Three Months Ended For the Nine Months Ended

Sep 30 Sep 30

2012 2012

(in 000s of CAD Sep 30 Sep 30 before Sep 30 Sep 30 before

dollars) 2013 2012 award 2013 2012 award

----------------------------------------------------------------------------

Revenue 1,485 1,933 1,342 3,907 6,773 3,928

Cost of revenue 379 236 235 793 1,108 547

Gross profit 1,106 1,696 1,107 3,114 5,665 3,381

Operating

expenses 1,153 1,237 1,238 3,281 3,526 3,526

Stock based

compensation

expense 11 145 145 206 377 377

Operating profit

(loss) (58) 315 (276) (373) 1,762 (523)

Net profit

(loss) (63) 160 (431) (282) 1,643 (642)

----------------------------------------------------------------------------

Operating results for the three and nine month period ended September 30, 2012

were positively affected by the proceeds of an arbitration award which was

received in January 2012. For additional information, please see Route1's

September 30, 2013 Financial Statements and Management's Discussion & Analysis.

Q3 2013 Financial Results Summary

For the three month period ended September 30, 2013, total revenue decreased to

$1.5 million from $1.9 million in the third quarter of 2012. The decrease was a

result of recognizing $0.6 million of services revenue from the arbitration

award during the third quarter of 2012.

Services revenue by

quarter Sep 30 Jun 30 Mar 31 Dec 31 Sep 30

(in 000s of CAD dollars) 2013 2013 2013 2012 2012

----------------------------------------------------------------------------

MobiKEY application

software revenue 1,139 1,158 853 964 954

Other services revenue 174 175 174 792 856

Total 1,313 1,333 1,027 1,756 1,810

----------------------------------------------------------------------------

Gross profit decreased during the third quarter to $1.1 million compared from

$1.7 million during the same period in the prior year. The decrease in gross

profit is attributable to $0.6 million recognized from the arbitration award in

the prior year and a $0.1 million write down of MobiKEY Classic devices in the

current quarter.

Operating expenses for the three months ended September 30, 2013 were $1.15

million compared to $1.24 million for the same period in 2012. The decrease was

primarily a result of a decrease in general administration expense. Professional

fees decreased by approximately $0.1 million for the three months ended

September 30, 2013 as compared to the same period in 2012, as a result of

reducing outsourced human resource and investor relations activities.

As a result, Route1's third quarter 2013 total comprehensive net loss was $0.06

million compared to total comprehensive net income of $0.16 million during the

same period in the prior year. Adjusted earnings before interest, income taxes,

depreciation and amortization, stock-based compensation, restructuring and other

costs (Adjusted EBITDA) during the three-month period amounted to $22,000

compared to an Adjusted EBITDA of $0.5 million in the third quarter of 2012.

As at September 30, 2013, Route1 had no bank debt and a cash balance of $1.4

million.

Sep 30 Jun 30 Mar 31 Dec 31 Sep 30

in 000s of CAD dollars 2013 2013 2013 2012 2012

----------------------------------------------------------------------------

Revenue 1,485 1,366 1,057 2,277 1,933

Adjusted EBITDA 22 (7) 9 645 514

Amortization 69 72 50 47 54

Operating profit (loss)

before stock based

compensation (47) (79) (41) 598 460

----------------------------------------------------------------------------

Year-to-date 2013 Financial Results Summary

For the nine month period ended September 30, 2013, total revenue decreased to

$3.9 million from $6.8 million in the first nine months of 2012. Gross profit

also decreased for the nine month period ended September 30, 2013 to $3.1

million from $5.7 million during the same period in the prior year. The decrease

in total revenue and gross profit is primarily a result of the arbitration

award.

Operating expenses for the nine month ended September 30, 2013 were $3.3 million

compared to $3.5 million for the same period in 2012. The reduction in operating

expenses was driven by lower professional fees, an increase in the SR&ED tax

credit amount, and lower salaries and benefits costs.

As a result, Route1's year-to-date 2013 total comprehensive net loss was $0.3

million compared to total comprehensive net income of $1.6 million during the

same period in the prior year.

Route1 Receives Order for 7,000 MobiKEY Fusion Devices

As announced on September 23, 2013, a component of the U.S. Department of

Homeland Security ordered 7,000 MobiKEY Fusion devices through the U.S.

Department of Homeland Security FirstSource II contract vehicle. This client

will be replacing their allotment of MobiKEY Classic devices with Route1's

MobiKEY Fusion devices. Route1 expects to ship the 7,000 devices between

September 2013 and February 2014. The award has a sales value of approximately

US $0.7 million.

During the quarter ended September 30, 2013, Route1 shipped 1,000 devices with

sales value of approximately $0.1 million.

Paid, Active Subscribers

As at September 30, 2013, Route1 had 14,642 paying, active subscribers.

MobiKEY Subscribers

(in 000s of CAD dollars Sep 30 Jun 30 Mar 31 Dec 31 Sep 30

for Revenue) 2013 2013 2013 2012 2012

----------------------------------------------------------------------------

Closing Number 14,642 14,784 13,989 15,913 14,615

Revenue per Subscriber $ 310 $ 306 $ 245 $ 259 $ 258

Revenue $ 1,139 $ 1,158 $ 853 $ 964 $ 954

----------------------------------------------------------------------------

Business Development Update

On April 11, 2013 during its fiscal year 2012 investor conference call and

webcast, Route1 laid out to shareholders its business development plan. Route1

provided a further update to its plan on August 29, 2013.

Over the last 90 days the Canadian Government component of the business

development plan has materially advanced, specifically Shared Services Canada

(SSC), the program manager for Workplace Technology Devices (WTD), prior termed

Workplace Technology Services program, issued a Letter of Interest on November

4, 2013. Route1 responded on November 20, 2013 per the document requirements.

Specifics of the WTD program are as follows:

-- The WTD initiative will standardize, consolidate and re-engineer the

delivery of end user device hardware, software and associated support

services in the Government of Canada to reduce costs and increase

security for 95 organizations - http://www.ssc-spc.gc.ca/pages/devices-

appareils-eng.html.

Product Development Progress

Recent Releases

-- On October 15, 2013, the Company announced the unveiling of the MobiKEY

Fusion A2T device. The MobiKEY Fusion A2T is an advanced tool for ID-1

smart card users (CAC, PIV and FRAC) who want to use an iPad, iPad mini,

iPhone or iPod touch to access data remotely. With this announcement,

Route1 has expanded the number of mobile devices that ID-1 smart card

users can utilize to securely access data via the MobiKEY technology.

Upcoming Releases (over the next 60 days):

-- MobiKEY for iOS - Integrate third party smart card reader technology

with MobiKEY technology to offer unique hardware based multifactor

authentication for tablets.

-- MAP 2.0 - Integrate administration and provisioning tool with reports

module, feature enhancements and bug fixes.

2014 Target Releases:

-- MobiKEY technology feature addition - Audio support.

-- MobiKEY for Android.

-- Derived Credentials as per FIPS 201-2 - Level 2 to 4 credentials for

mobile devices. Leveraging TPM or SIM enabled devices. Credential

lifecycle management. Policies and authentication/authorization

assertions.

-- MAP 3.0 (Enhanced policy management) - Allow organizations to establish

and implement MobiKEY policy management with real-time implementation of

changes and group policy support.

-- EnterpriseLIVE Virtualization Orchestrator (ELVO) 3.0. Enhanced

functionality and improved integration with features available from the

virtualization provider.

-- MobiLINK 2 (TCP Protocol Suite Support) - Support for native mobile

applications.

There are also a number of additional product development projects being considered.

Product development plans are subject to change without notice, based on market

factors and/or client demands.

Forward Looking Statements

This news release contains statements that are not current or historical factual

statements that may constitute forward-looking statements. These statements are

based on certain factors and assumptions, including, expected financial

performance, business prospects, technological developments, and development

activities and like matters. While Route1 considers these factors and

assumptions to be reasonable, based on information currently available, they may

prove to be incorrect. These statements involve risks and uncertainties,

including but not limited to the risk factors described in reporting documents

filed by Route1. Actual results could differ materially from those projected as

a result of these risks and should not be relied upon as a prediction of future

events. Route1 undertakes no obligation to update any forward-looking statement

to reflect events or circumstances after the date on which such statement is

made, or to reflect the occurrence of unanticipated events, except as required

by law. Estimates used in this presentation are from Route1 sources.

About Route1 Inc.

Route1 delivers industry-leading security and identity management technologies

to corporations and government agencies that require universal, secure access to

digital resources and sensitive data. These customers depend on The Power of

MobiNET - Route1's universal identity management and service delivery platform.

MobiNET provides identity assurance and individualized access to applications,

data and networks. Headquartered in Toronto, Canada, Route1 is listed on the TSX

Venture Exchange.

For more information, visit our website at: www.route1.com

This news release, required by applicable Canadian laws, does not constitute an

offer to sell or a solicitation of an offer to buy any of the securities in the

United States. The securities have not been and will not be registered under the

United States Securities Act of 1933, as amended (the "U.S. Securities Act") or

any state securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such registration is

available.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

(C) Route1 Inc., 2013. All rights reserved. Route1, the Route1 and shield design

Logo, SECURING THE DIGITAL WORLD, Mobi, MobiSecure, MobiLINK, Route1 MobiKEY,

Route1 MobiVDI, MobiKEY, MobiKEY IBAD, DEFIMNET, MobiNET, Route1 MobiNET,

TruOFFICE, TruFLASH, TruOFFICE VDI, MobiKEY Fusion, MobiNET Aggregation Gateway,

MobiNET Switching Array, MobiNET Secure Gateway, EnterpriseLIVE, EnterpriseLIVE

Virtualization Orchestrator, MobiNET Agent, MobiKEY Classic and MobiKEY Classic

2, are either registered trademarks or trademarks of Route1 Inc. in the United

States and or Canada. All other trademarks and trade names are the property of

their respective owners. The DEFIMNET and MobiNET platforms, the MobiKEY,

MobiKEY Classic, MobiKEY Classic 2 and MobiKEY Fusion devices, and MobiLINK are

protected by U.S. Patents 7,814,216 and 7,739,726, Canadian Patent 2,578,053,

and other patents pending.

Other product and company names mentioned herein may be trademarks of their

respective companies.

FOR FURTHER INFORMATION PLEASE CONTACT:

Route1 Inc.

Tony Busseri

CEO

+1 416 814-2635

tony.busseri@route1.com

www.route1.com

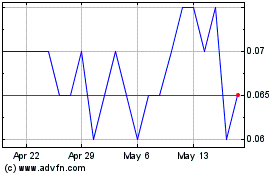

Route 1 (TSXV:ROI)

Historical Stock Chart

From Apr 2024 to May 2024

Route 1 (TSXV:ROI)

Historical Stock Chart

From May 2023 to May 2024