DREAM to Create New "DREAM Alternatives Fund" to Acquire Funds Managed by Return On Innovation Advisors

03 April 2014 - 9:22AM

Marketwired Canada

DREAM Unlimited Corp. (TSX:DRM) ("DREAM") announced today that it has entered

into an agreement with Return On Innovation Advisors Ltd. ("ROI") to acquire the

right to manage the: ROI Canadian High Income Mortgage Fund (TSX:RIH.UN); ROI

Canadian Mortgage Income Fund (TSX:RIL.UN); ROI Canadian Real Estate Fund

(TSX:RIR.UN), and ROI Institutional Private Placement Fund, collectively "ROI

Funds".

DREAM and ROI have agreed to complete a reorganization of the ROI Funds,

pursuant to which all of the assets will be transferred to a newly-formed,

open-ended investment trust called DREAM Alternatives Fund ("DREAM

Alternatives"). Upon successful completion of the transaction, the outstanding

units of the ROI Funds will be redeemed in consideration for units in DREAM

Alternatives, which will be managed by a subsidiary of DREAM.

It is management's expectation that DREAM Alternatives will provide its

unitholders with exposure to real estate, real estate lending, and

infrastructure, including renewable power and accordingly leverage DREAM's asset

management platform, track record and expertise in these areas. Management

expects that upon closing, DREAM Alternatives will comprise an equity value of

approximately $700 million.

The transaction is subject to the approval by the unitholders of each of the ROI

Funds that are listed on the TSX at meetings of the unitholders expected to take

place in June 2014. In addition to such unitholder approval, the transaction is

subject to applicable regulatory approvals and the satisfaction of certain other

closing conditions customary for transactions of this nature. Subject to these

approvals, the transaction is expected to close in July 2014.

Further information regarding the transaction will be contained in an

information circular that ROI will prepare, file and mail to unitholders of the

ROI Funds in connection with the meetings of unitholders and an accompanying

prospectus of DREAM Alternatives to be filed in each of the provinces and

territories of Canada, each of which is expected to be available in mid-May

2014.

About DREAM:

DREAM is an innovative real estate manager and developer primarily focused on

the commercial and residential sectors in Canada and Germany and renewable power

in Canada. From its creation, DREAM has successfully identified and executed on

opportunities for the benefit of the business, shareholders and clients.

DREAM provides asset management for over $13.4 billion of assets. DREAM is the

asset manager for three publicly listed REIT funds in Canada including: Dundee

REIT, Canada's largest office REIT, Dundee International, Canada's largest REIT

that invests only outside of Canada and Dundee Industrial REIT, one of Canada's

largest dedicated industrial REITs.

DREAM is also the co-manager of a $345 million infrastructure fund with a focus

on wind and solar Canadian renewable power projects. The total value of these

projects is about $1.3 billion including debt.

Its asset management team consists of 178 real estate professionals with

backgrounds in property management, architecture, engineering, construction,

finance, accounting, sales and marketing and law. The team brings experience

from virtually all the major real estate organizations in Canada and has

expertise in capital markets, structured finance, real estate investments and

management across a broad spectrum of property types in diverse geographic

markets. It carries out its own research and analysis, financial modeling, due

diligence and financial planning. DREAM has an established track record for

being innovative and for its ability to source, structure and execute on

compelling investment opportunities. DREAM has completed over $17 billion of

commercial real estate transactions over the last 20 years. Website:

www.dream.ca

Forward-Looking Information

This press release may contain forward-looking information within the meaning of

applicable securities legislation. Forward-looking information is based on a

number of assumptions and is subject to a number of risks and uncertainties,

many of which are beyond DREAM's control, which could cause actual results to

differ materially from those that are disclosed in or implied by such

forward-looking information. These risks and uncertainties include, but are not

limited to general and local economic and business conditions, employment

levels, regulatory risks, mortgage rates and regulations, environmental risks,

consumer confidence, seasonality, adverse weather conditions, reliance on key

clients and personnel and competition. All forward looking information in this

press release speaks as of April 2, 2014. DREAM does not undertake to update any

such forward looking information whether as a result of new information, future

events or otherwise. Additional information about these assumptions and risks

and uncertainties is disclosed in filings with securities regulators filed on

SEDAR (www.sedar.com).

FOR FURTHER INFORMATION PLEASE CONTACT:

DREAM Unlimited Corp.

Michael J. Cooper

Chief Executive Officer

(416) 365-5145

mcooper@dream.ca

DREAM Unlimited Corp.

Pauline Alimchandani

Chief Financial Officer

(416) 365-5992

palimchandani@dream.ca

www.dream.ca

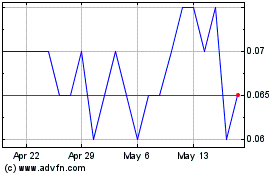

Route 1 (TSXV:ROI)

Historical Stock Chart

From Apr 2024 to May 2024

Route 1 (TSXV:ROI)

Historical Stock Chart

From May 2023 to May 2024

Real-Time news about Route 1 Inc (TSX Venture Exchange): 0 recent articles

More Route1 Inc. News Articles