Route1 Inc. (TSX VENTURE:ROI), a leading provider of mobile workspace

technologies that unlocks the productivity gains of mobile access without

exposing the organization to the risks of data spillage or malware propagation

and whose customers include the U.S. Department of Defense, the Department of

Homeland Security, the Department of Energy and the Government of Canada, today

the Company announced its financial results for the fourth quarter and year

ended December 31, 2013.

"I'm pleased we were able to continue to grow our fourth quarter, compared to

our third quarter, EBITDA on improved revenue and gross margin," said Tony

Busseri, Route1's chief executive officer. "An even more positive development

was the progress we made with supporting ID-1 smart card users (CAC, PIV and

FRAC) who want to use an iPad, iPad mini, iPhone or iPod touch to securely

access enterprise data remotely. Our expanded MobiKEY offering has created

deeper and expanded interest within the U.S. Department of Defense to address

their mobile workspace requirements."

Business Highlights

Notable developments and achievements during the fourth quarter of 2013 included

the following:

-- Brought to market the MobiKEY Fusion A2T device, a patented identity

validation device that integrates with ID-1 smart cards or government

issued identity cards such as CAC, PIV and FRAC. The multi-factor

authentication technology combines physical possession of the MobiKEY

Fusion A2T device and an identity card, with computer and network

access, allowing for remote use of an iPad, iPad mini, iPhone or iPod

touch running iOS 6 or higher.

-- As announced on September 23, 2013, a component of the U.S. Department

of Homeland Security ordered 7,000 MobiKEY Fusion devices through the

U.S. Department of Homeland Security FirstSource II contract vehicle.

During the fourth quarter of 2013, Route1 shipped a further 2,000

devices with sales value of approximately $0.2 million. The remaining

4,000 devices were shipped during the first quarter of 2014.

Financial Highlights

Quarter Comparative

For the quarter ended December 31, 2013, total revenue decreased to $1.5 million

from $2.3 million ($1.7 million before the arbitration award) in 2012. Gross

profit also decreased during the fourth quarter of 2013 to $1.2 million or 78%

of revenue compared to gross profit of $1.8 million ($1.2 million before the

arbitration award) or 80% of revenue during the fourth quarter of 2012. The

decrease in revenue and gross profit is attributable to the 2012 arbitration

award. Route1's fourth quarter 2013 total comprehensive net loss was $0.1

million compared to net income of $0.5 million (net loss of $0.1 million before

the arbitration award) in the fourth quarter of 2012.

Fiscal Year Comparative

For the year ended December 31, 2013, total revenue decreased to $5.4 million

from $9.1 million in 2012. Gross profit also decreased during the year to $4.3

million or 79% of revenue, compared to gross profit of $7.5 million or 83% of

revenue during the previous year. The reduction in revenue and gross profit is

attributable to the 2012 arbitration award. Route1's 2013 total comprehensive

net loss was $0.3 million from net income of $2.2 million in 2012.

The Company's operating results in fiscal year 2013 with 2012 comparatives are

as follows:

FY 2012

FY 2012 without

In 000s of CAD dollars FY 2013 with Award Award

-------------------------------------

Revenue 5,433 9,050 5,614

Cost of revenue 1,137 1,562 1,031

-------------------------------------

Gross profit 4,296 7,488 4,583

Operating expenses 4,485 4,751 4,751

-------------------------------------

Operating profit (loss) for the year (189) 2,737 (168)

Total other expenses (154) (579) (579)

-------------------------------------

Income (loss) from operations (343) 2,158 (747)

-------------------------------------

Earnings before interest, tax, depreciation, and amortization (Adjusted EBITDA)

during the year amounted to $72,000 compared to $2.9 million ($43,000 without

award) in 2012.

Dec 31 Sept 30 June 30 Mar 31 Dec 31

in 000s of CAD dollars 2013 2013 2013 2013 2012

--------------------------------------------

Revenue 1,525 1,485 1,366 1,057 2,277

Adjusted EBITDA 48 22 (7) 9 645

Amortization 70 69 72 50 47

Operating profit (loss) before

stock based compensation (22) (47) (79) (41) 598

--------------------------------------------

During the 2013 year Route1 generated cash flow from operations of $0.4 million.

As at December 31, 2013, the Company had no bank debt and a cash balance of

$699,944.

Dec 31 Dec 31 Dec 31

in 000s of CAD dollars 2013 2012 2011

------------------------------

Cash 700 755 87

Total current assets 1,588 1,928 5,723

Total current liabilities 1,715 1,739 7,430

Net working capital (127) 189 (1,707)

Total assets 2,387 2,503 5,999

Bank debt 0 0 0

Total liabilities 1,854 1,886 7,539

------------------------------

Paid, Active Subscribers

As at December 31, 2013, Route1 had 14,602 paying, active subscribers.

in 000s of Canadian dollars for Dec 31 Sept 30 June 30 Mar 31 Dec 31

Revenue from subscribers 2013 2013 2013 2013 2012

---------------------------------------------

Closing number 14,602 14,642 14,784 13,989 15,913

Average number 14,600 14,697 15,159 13,853 14,870

Revenue per subscriber $ 301 $ 310 $ 306 $ 245 $ 259

Revenue $ 1,100 $ 1,139 $ 1,158 $ 853 $ 964

---------------------------------------------

During the fourth quarter of 2013 Route1's average revenue per subscriber was

$301, an increase of $42 per subscriber or 16.2%, from the same period in 2012.

Investor Conference Call and Webcast

The Company will also hold a conference call and web cast to discuss the

financial results on Thursday, April 10, 2014 at 4:15 pm eastern.

Participants should dial 1-888-287-5563 or 1-719-325-2354 at least 10 minutes

prior to the conference time of 4:15 pm eastern. For those unable to attend the

call, a replay will be available after 7:15 p.m. at 1-877-870-5176 or

1-858-384-5517, pass code 9010761 until midnight on April 24, 2014. The webcast

will be presented live at http://public.viavid.com/index.php?id=108570.

ABOUT ROUTE1, INC.

Route1 enables the mobile workspace without compromising on security. Its

flagship technology MobiKEY uniquely combines secure mobile access, with high

assurance identity validation and plug-and-play usability. Remote and mobile

workers are able to securely and cost affectively access their workspace from

any device without exposing the organization to the risk of data spillage or

malware propagation. MobiKEY customers include Fortune 500 enterprises as well

as the U.S. Department of Defense, the Department of Homeland Security, the

Department of Energy and the Government of Canada. Headquartered in Toronto,

Canada, Route1 is listed on the TSX Venture Exchange.

For more information, visit our website at: www.route1.com.

This news release, required by applicable Canadian laws, does not constitute an

offer to sell or a solicitation of an offer to buy any of the securities in the

United States. The securities have not been and will not be registered under the

United States Securities Act of 1933, as amended (the "U.S. Securities Act") or

any state securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such registration is

available.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

(C) Route1 Inc., 2014. All rights reserved. Route1, the Route1 and shield design

Logo, SECURING THE DIGITAL WORLD, Mobi, MobiSecure, MobiLINK, Route1 MobiKEY,

Route1 MobiVDI, MobiKEY, MobiKEY IBAD, DEFIMNET, MobiNET, Route1 MobiNET,

TruOFFICE, TruFLASH, TruOFFICE VDI, MobiKEY Fusion, MobiNET Aggregation Gateway,

MobiNET Switching Array, MobiNET Secure Gateway, EnterpriseLIVE, EnterpriseLIVE

Virtualization Orchestrator, MobiNET Agent, MobiKEY Classic and MobiKEY Classic

2, are either registered trademarks or trademarks of Route1 Inc. in the United

States and or Canada. All other trademarks and trade names are the property of

their respective owners. The DEFIMNET and MobiNET platforms, the MobiKEY,

MobiKEY Classic, MobiKEY Classic 2 and MobiKEY Fusion devices, and MobiLINK are

protected by U.S. Patents 7,814,216 and 7,739,726, Canadian Patent 2,578,053,

and other patents pending.

Other product and company names mentioned herein may be trademarks of their

respective companies.

FOR FURTHER INFORMATION PLEASE CONTACT:

Route1 Inc.

Tony Busseri

CEO

+1 416 814-2635

tony.busseri@route1.com

www.route1.com

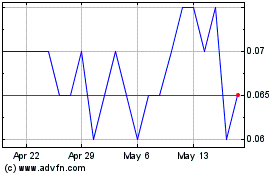

Route 1 (TSXV:ROI)

Historical Stock Chart

From Apr 2024 to May 2024

Route 1 (TSXV:ROI)

Historical Stock Chart

From May 2023 to May 2024